How do you calculate Medicare premium?

- Deductions for what you give to charity 8

- Deductions for adoption expenses 9

- Dependent tax credits 10

- The earned income tax credit (EITC) 11

What income is used to determine Medicare premiums?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

How much will I pay for Medicare premiums?

Keep in mind that:

- Once you hit certain income levels, you’ll need to pay higher premium costs.

- If your income is more than $88,000, you’ll receive an IRMAA and pay additional costs for Part B and Part D coverage.

- You can appeal an IRMAA if your circumstances change.

- If you’re in a lower income bracket, you can get help paying for Medicare.

What are the typical Medicare premiums?

Medicare beneficiaries currently lack that protection. According to the Kaiser Family Foundation, 1.2 million seniors faced out-of-pocket drug costs of more than $2,000 in 2019, meaning they could have saved an average of more than $1,200 per year had a ...

How much will Medicare premiums be in 2021?

There are six income tiers for Medicare premiums in 2021. As stated earlier, the standard Part B premium amount that most people are expected to pay is $148.50 month. But, if your MAGI exceeds an income bracket — even by just $1 — you are moved to the next tier and will have to pay the higher premium.

What is Medicare Advantage?

Essentially: Medicare Advantage – Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A.

Why did Medicare Part B premiums increase in 2021?

That’s because 2021 Medicare Part B premiums increased across the board due to rising healthcare costs. Exactly how much your premiums increased though, isn’t based on your current health or Medicare plan or your income. Rather, it’s the soaring prices of overall healthcare.

How much of Medicare Part B is paid?

But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

Why are Social Security beneficiaries paying less than the full amount?

In 2016, 2017, and 2018, the Social Security COLA amount for most beneficiaries wasn’t enough to cover the full cost of the Part B premium increases, so most enrollees were paying less than the full amount, because they were protected by the hold harmless rule.

How much is Part B 2021?

So most beneficiaries are paying the standard $148.50/month for Part B in 2021. The hold harmless provision does NOT protect you if you are new to Medicare and/or Social Security, not receiving Social Security benefits, or are in a high-income bracket.

Is Medicare Part D tax deductible?

Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A. However, you are charged monthly premiums for Part B and Part D, and can also be charged for Part C, depending on the plan you select. These premiums are tax-deductible but very few ...

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

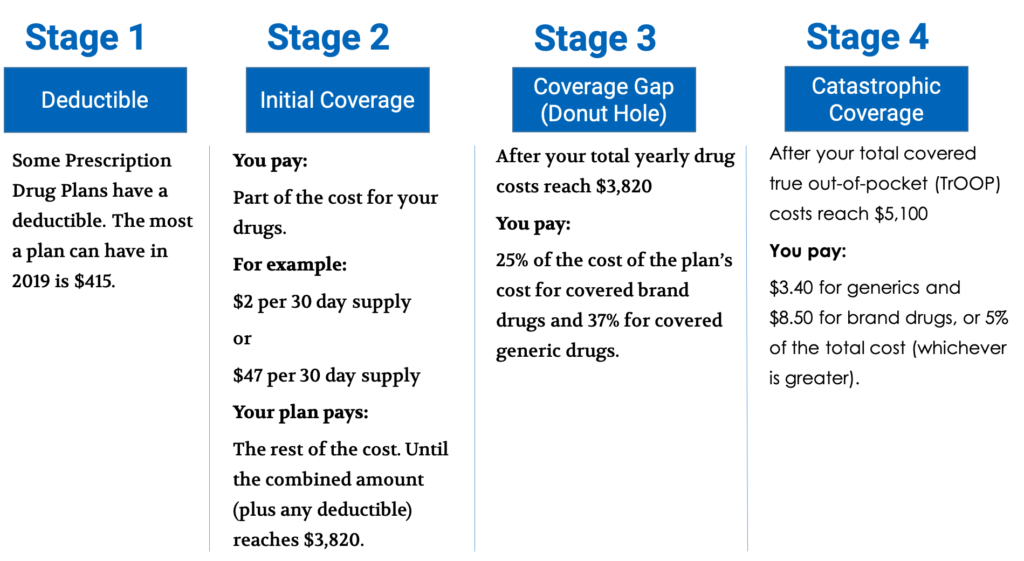

Does Medicare pay for prescription drugs?

Medicare prescription drug coverage helps pay for your prescription drugs. For most beneficiaries, the government pays a major portion of the total costs for this coverage, and the beneficiary pays the rest.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

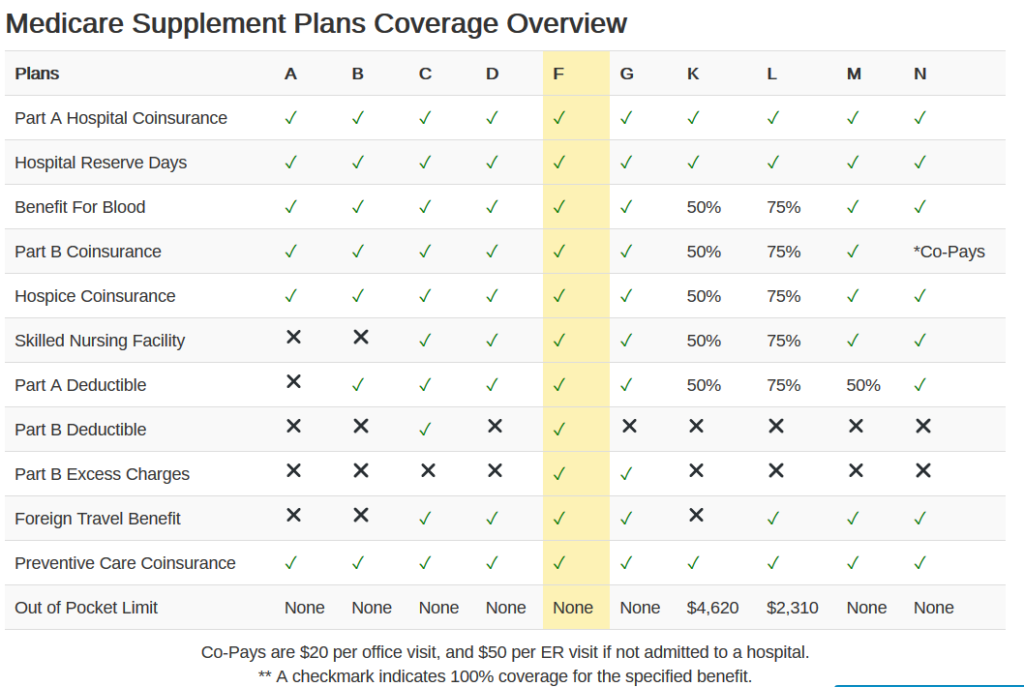

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is the Medicare premium for 2020?

For 2020, the standard monthly rate is $144.60. However, it will be more if you reported above a certain level of modified adjusted gross income on your federal tax return two years ago. Any additional amount charged to you is known as IRMAA, which stands for income-related monthly adjustment amount. Visit Medicare.gov, point to “Your Medicare Costs,” and then click “Part B costs” to see a matrix of premiums corresponding to income ranges across different tax filing statuses.

How long do you have to be on Medicare to receive Part A?

People under age 65 may receive Part A with no liability for premiums under the following circumstances: Have received Social Security or Railroad Retirement Board disability benefits for two years.

How many years of work do you need to be eligible for Medicare?

Four is the maximum number of credits a person can earn per year, so it takes at least 10 years or 40 quarters of employment to be eligible for Medicare.

Is Medicare the same for everyone?

Medicare is a federal program that mandates standardization of services nationwide, so many people may assume the premiums would be the same for everyone. In reality, there are variations in the premiums people pay, if they pay any at all.

Can Medicare be charged at 65?

For Part A, most Medicare recipients are not charged any premium at all. Seniors at age 65 are eligible for premium-free Part A if they meet the following criteria: Currently collect retirement benefits from Social Security or the Railroad Retirement Board. Qualify for Social Security or Railroad benefits not yet claimed.

How Does Medicare Part B Work?

Before getting into the weeds of Medicare Part B premiums, let’s do a quick review of Medicare Part B and its role in federal retirement health insurance.

Medicare Part B Premiums

Medicare Part B premiums are calculated based on a person’s modified adjusted gross income (MAGI). For purposes of Part B premiums, your MAGI is the adjusted gross income you report on line 11 of your federal tax return, plus any tax-exempt interest income, such as municipal bonds (line 2a) earnings.

Who Pays More for Medicare Part B?

Each year the government crunches the numbers to determine total costs for providing Medicare Part B coverage. For most enrollees, the government agrees to cover 75% of the cost and charges enrollees the Medicare Part B premium to cover the other 25%.

How to Apply for Medicare Part B

If you are already receiving Social Security benefits when you turn 65, you will automatically be signed up for Medicare Part A and Medicare Part B by the Social Security program. Your Part B premium will be deducted from your retirement benefit each month.

The Bottom Line

Once you turn 65, the government agrees to cover the majority of your health insurance costs. But Medicare is not free. The Medicare Part B premium alone—irrespective of other Medicare out-of-pocket costs—is an important line-item expense you will want to plan for in retirement.