Principal Care Management is also known as PCM and its very similar to Medicare’s Chronic Care Management program (CCM) with a few key differences. Under the new PCM codes, specialists may now be reimbursed for providing their patients with care management services that are more targeted within their own particular area of specialty.

Full Answer

What do you mean by Medicare prepayment?

The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. A request for payment that you submit to Medicare or other health insurance when you get items and services that you think are covered.

Do Medicare Advantage plans provide better care than traditional Medicare?

A JAMA study found that Advantage enrollees often receive more preventive care than those in traditional Medicare. Advantage plans are competing not just on cost but on delivering quality care, says Kenton Johnston, PhD, associate professor of health management and policy at Saint Louis University, co- author of the study.

How do Medicare Advantage plans work?

To keep premiums low, Advantage plans generally require you to get your care from a network of doctors, hospitals, and other providers, and you typically need pre-authorization for specialized care. Original Medicare has no annual out-of-pocket limit, and for Part B services, you’ll have to pay 20 percent of the costs after the deductible.

What are the different parts of Medicare?

The other parts of Medicare—Part C, aka Medicare Advantage, and Part D, prescription drug coverage—are optional and offered by private insurers. Medicare Advantage is an all-in-one managed care plan, typically an HMO or PPO. Advantage plans provide the benefits of Part A and B, and most also include Part D, or prescription drug coverage.

What is Medicare PB?

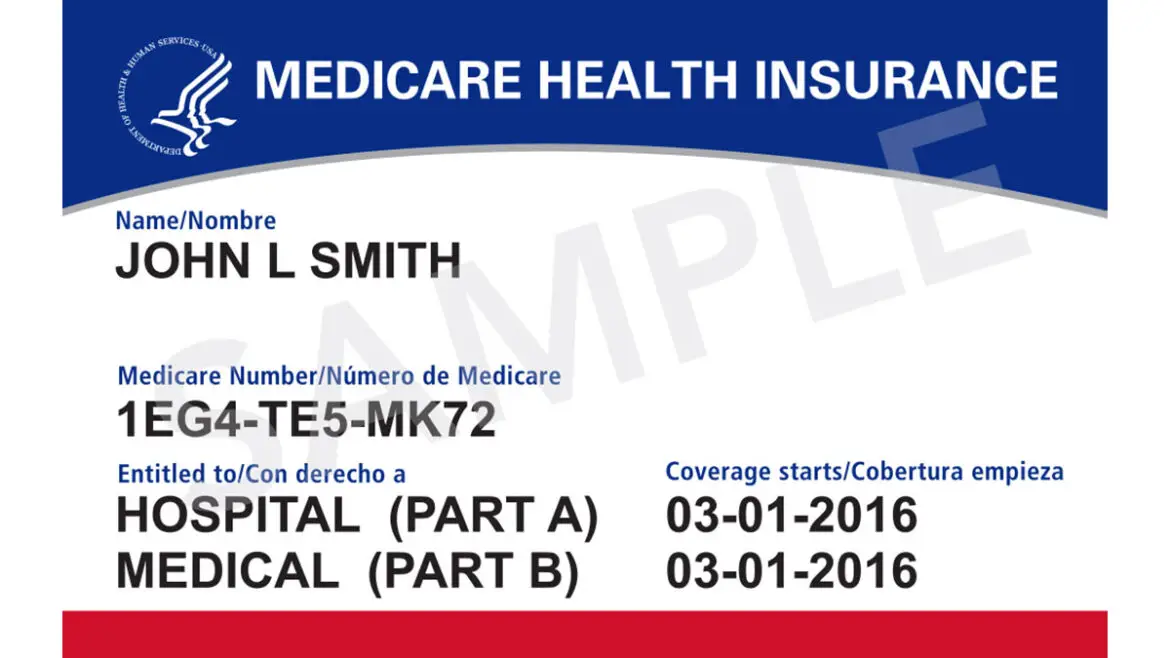

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What does it mean when Medicare is primary?

When Medicare is Primary. Primary insurance means that it pays first for any healthcare services you receive. In most cases, the secondary insurance won't pay unless the primary insurance has first paid its share. There are a number of situations when Medicare is primary.

What is the difference between Medicare prime and Medicare Advantage?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What are the 3 parts of Medicare?

What are the parts of Medicare?Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.Medicare Part B (Medical Insurance) ... Medicare Part D (prescription drug coverage)

What are the two types of Medicare plans?

There are 2 main ways to get Medicare: Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). If you want drug coverage, you can join a separate Medicare drug plan (Part D).

Is it better to have Medicare as primary or secondary?

Medicare is always primary if it's your only form of coverage. When you introduce another form of coverage into the picture, there's predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

Who is primary payer with Medicare?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

How do you determine which insurance is primary and which is secondary?

The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" to pay. The insurance that pays first is called the primary payer. The primary payer pays up to the limits of its coverage. The insurance that pays second is called the secondary payer.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How Medicare Advantage Plans Work

First, it will help to review a few basics. Medicare comes in four parts, with Part A covering inpatient hospital care, and skilled nursing. There’s no premium if you or your spouse have earned at least 40 Social Security credits.

Why Medicare Advantage Plans Can Fall Short

For many older Americans, Medicare Advantage plans can work well. A JAMA study found that Advantage enrollees often receive more preventive care than those in traditional Medicare.

What to Do

Begin researching your options several months before you first sign up for Medicare, or before your open enrollment period, says Julie Carter, senior federal policy associate at the Medicare Rights Center. Start with these steps:

What is the first step to Medicare?

Once eligible for Medicare coverage, the first step is signing up for Original Medicare, which includes Part A, for hospital stays and inpatient care, and Part B, for visits to the doctor’s office and outpatient care.

When did Medicare discontinue Plan J?

Medicare Supplement Plan J. Before Plan J was discontinued in 2010, as a result of the Medicare Prescription Drug, Improvement and Modernization Act, it was highly favored relative to the other plans. Basic supplement plan coverage, which is Plan A, includes Medicare Part A coinsurance, hospital costs up to 365 days after all Medicare benefits have ...

Does Medicare leave a shortfall?

Original Medicare leaves a shortfall that impacts beneficiaries in terms of coinsurance, copayments, blood, deductibles, drugs, foreign travel emergencies and out-of-pocket limits. This is why many people decide to supplement their Medicare coverage with policies from Medicare-approved private insurance carriers.

Do you know?

6 out of 10 Americans are diagnosed with at least one chronic condition while 4 out of 10 suffer from more than one.

When it is required?

When the patient’s condition is severe enough which cannot be handled by a primary care physician, at risk for hospitalization, complications, and in need of special care with a specialist’s intervention then PCM is recommended.

For whom?

PCM should be provided for patients who are suffering from the least of Single and serious chronic disease, which may lead to hospitalization or death or functional decline.

How does PCM differ from CCM?

Principal Care Management is the new care management code for the specialist from CMS which enables extra care for patients with a serious and single chronic condition.

What is a CPL for Medicare?

A CPL provides information on items or services that Medicare paid conditionally and the BCRC has identified as being related to the pending claim. For cases where Medicare is pursuing recovery from the beneficiary, a CPL is automatically sent to the beneficiary within 65 days of issuance of the Rights and Responsibilities letter (a copy of the Rights and Responsibilities letter can be obtained by clicking the Medicare's Recovery Process link). All entities that have a verified Proof of Representation or Consent to Release authorization on file with the BCRC for the case will receive a copy of the CPL. Please refer to the Proof of Representation and Consent to Release page for more information on these topics. The CPL includes a Payment Summary Form that lists all items or services the BCRC has identified as being related to the pending claim. The letter includes the interim total conditional payment amount and explains how to dispute any unrelated claims. The total conditional payment amount is considered interim as Medicare might make additional payments while the beneficiary’s claim is pending.

Can you get Medicare demand amount prior to settlement?

If the beneficiary is settling a liability case, he or she may be eligible to obtain Medicare's demand amount prior to settlement or to pay Medicare a flat percentage of the total settlement. Click the Demand Calculation Options link to determine if the beneficiary's case meets the required guidelines.

Does Medicare require a copy of recovery correspondence?

The beneficiary does not need to take any action on this correspondence.

Does Medicare pay for a secondary plan?

Under Medicare Secondary Payer law (42 U.S.C. § 1395y (b)), Medicare does not pay for items or services to the extent that payment has been, or may reasonably be expected to be, made through a no -fault or liability insurer or through a workers' compensation entity. Medicare may make a conditional payment when there is evidence that the primary plan does not pay promptly conditioned upon reimbursement when the primary plan does pay. The Benefits Coordination & Recovery Center (BCRC) is responsible for recovering conditional payments when there is a settlement, judgment, award, or other payment made to the Medicare beneficiary. When the BCRC has information concerning a potential recovery situation, it will identify the affected claims and begin recovery activities. Beneficiaries and their attorney (s) should recognize the obligation to reimburse Medicare during any settlement negotiations.

Live life confidently with insurance that has your back

Reliable insurance is a key building block to your financial security. Take the next step toward financial freedom and protect what’s most important to you.

Estate planning & irrevocable life insurance trusts

Look for in-network dentists in your area with our provider directory.