Full Answer

What are the gaps in Medicare coverage?

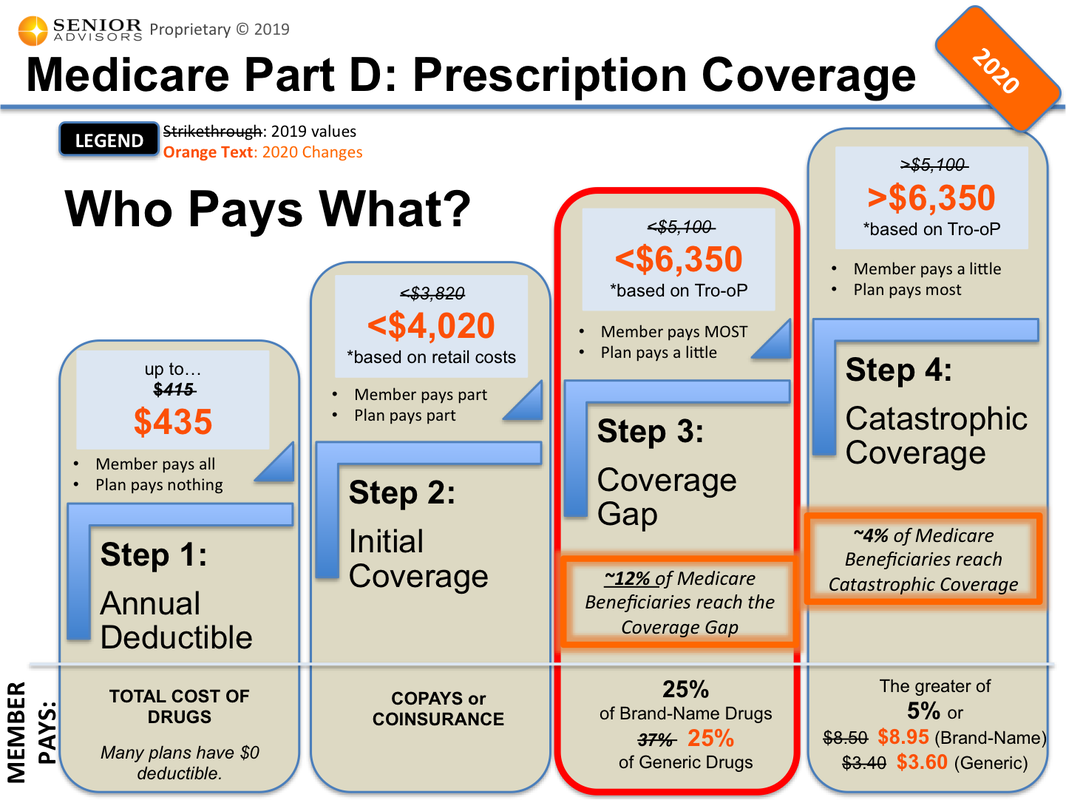

Dec 12, 2019 · The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage Prescription Drug plans pay for prescription drug costs. This gap will officially close in 2020, but you can still reach this out-of-pocket threshold where your medication costs may change.

How much does gap coverage cost?

the coverage gap? When a person gets prescription drugs through a Medicare drug plan during their coverage gap, the plan tracks and calculates the person’s out-of-pocket costs automatically. The person with Medicare should always use their Medicare drug plan card, even during the coverage gap. This will allow them to buy their

Does gap coverage pay if insurance denies the claim?

Mar 07, 2022 · The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs. Once you and your Medicare Part D plan have spent a certain amount on covered prescription drugs during a calendar year ($4,430 in 2022), you reach the coverage gap and are considered in the “donut hole.”.

What is Medicare Part D GAP insurance?

Apr 19, 2020 · The Medicare coverage gap, or “donut hole,” is a temporary limit on what drug plans will pay for eligible medications. Each year, Medicare Part D beneficiaries may enter the prescription drug coverage gap if they and their drug plan have paid a specified amount on covered drugs. Once in the Medicare coverage gap, beneficiaries must pay a percentage of …

What is the Part D donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.Oct 1, 2020

Can I avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

What is prescription drug coverage gap?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs.

What is the donut hole coverage gap for Medicare Part D beneficiaries?

The Medicare Part D donut hole or coverage gap is the phase of Part D coverage after your initial coverage period. You enter the donut hole when your total drug costs—including what you and your plan have paid for your drugs—reaches a certain limit. In 2022, that limit is $4,430.

How do you get around the donut hole in Medicare?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.Jun 5, 2021

Is there insurance to cover the donut hole?

There is no Donut Hole Insurance but there are ways to reduce your overall Part D spending. Insurance to cover the Donut Hole in Medicare Part D does not exist. There is no Donut Hole insurance policy that you can buy just to cover the higher expenses during the coverage gap.Aug 8, 2014

Is Medicare going to do away with the donut hole?

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold. See what your clients, the drug plans, and government will pay in each spending phase of Part D.

What does not count towards the coverage gap?

Here's what doesn't count toward the Medicare donut hole (coverage gap): Your costs for any prescription drugs you buy that your plan doesn't cover. Your monthly Medicare Prescription Drug Plan premium. Pharmacy dispensing fees.

What happens when you reach the donut hole?

You enter the donut hole once your Medicare Part D plan has paid a certain amount toward your prescription drugs in 1 coverage year. Once you fall into the donut hole, you'll pay more out of pocket (OOP) for the cost of your prescriptions until you reach the yearly limit.

How does Medicare Part D calculate donut holes?

3The Donut Hole (Coverage Gap Stage)25%* of the cost of generic (non-brand name) Part D medications. Tufts Health Plan pays the remaining 75% of the cost.25% of the cost of Part D brand name medications.

How does the doughnut hole work?

Most plans with Medicare prescription drug coverage (Part D) have a coverage gap (called a "donut hole"). This means that after you and your drug plan have spent a certain amount of money for covered drugs, you have to pay all costs out-of-pocket for your prescriptions up to a yearly limit.

What Is The Coverage Gap (“Donut Hole”), and When Does It Start?

For those who are new to the coverage gap, or “donut hole,” learning about the different Medicare Part D coverage phases is a good place to start....

What Costs Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Once you’ve entered the coverage gap (“donut hole”), it’s important to understand which out-of-pocket costs count towards helping you reach the cat...

What Costs Don’T Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Not all out-of-pocket costs count towards reaching catastrophic coverage. The following costs don’t count towards getting you out of the coverage g...

How Do I Avoid The Medicare Part D Coverage Gap (“Donut Hole”)?

Now that you know about the coverage gap (“donut hole”), here is some good news: 1. Many Medicare beneficiaries won’t have to pay the increased pri...

What If I Have Questions About The Coverage Gap (“Donut Hole”)?

If you have questions about how the coverage gap works and how to avoid it, I can help. A licensed insurance agent such as myself can help you comp...

When will the Medicare coverage gap end?

This gap will officially close in 2020 , but you can still reach this out-of-pocket threshold where your medication costs may change. Find affordable Medicare plans in your area.

How much is the coverage gap for 2020?

While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020. You’re out of the coverage gap once your yearly out-of-pocket drug costs reach $ 6,350 in 2020. Once you have spent this amount, you’ve entered the catastrophic coverage phase.

How to calculate out of pocket expenses?

The following costs count towards your out-of-pocket spending and getting you out of the coverage gap: 1 Your prescription drug plan’s yearly deductible 2 The amount you pay for your prescription medications 3 The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap

What is the cost of prescription drugs in 2020?

Remember, if your prescription drug spending reaches $6,350 in 2020, you’ll have catastrophic coverage for the rest of the year. The following costs count towards your out-of-pocket spending and getting you out of the coverage gap: The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap.

What is extra help?

Extra Help is a federal program that helps eligible individuals with limited income pay for Medicare Part D costs such as premiums, deductibles, and copayments/coinsurance. If you qualify for this assistance, you won’t enter the coverage gap.

Do manufacturer discounts count towards catastrophic coverage?

Additionally, manufacturer discounts for brand-name drugs count towards reaching the spending limit that begins catastrophic coverage. If your plan requires you to get your prescription drugs from a participating pharmacy, make sure you do so, or else the costs may not apply towards getting out of the coverage gap.

Does Medicare have a gap?

Although most Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans have a coverage gap, some plans offer additional coverage during this phase. Costs for this additional coverage will vary by plan. Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap.

What is a donut hole in Medicare?

What Is the Medicare Part D “Donut Hole”? Most Medicare Part D prescription drug plans have a coverage gap. More commonly, this has been known as the “donut hole.”. The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs. Once you and your Medicare Part D plan have spent a certain amount on ...

How much does Medicare pay for generic drugs?

For generic drugs: You’ll pay 25% of the price. Medicare pays 75% of the price. Only the amount you pay will count towards getting you out of the “donut hole.”. NOTE: Some plans may have coverage in the gap, so if this is true for you, you will get a discount after the plan’s coverage has been applied to the drug’s price. ...

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How to save money on prescriptions?

Here are some ways you may be able to save money on prescription drugs: 1 Ask local pharmacies if they offer drugs you take at a reduced cost. 2 Check with your plan to see if using a mail-order pharmacy for a three-month supply of drugs may lower your copayments. 3 Ask your doctor if your medications have lower-cost generic options. 4 Always use a preferred pharmacy if your prescription drug plan has one. 5 Ask your plan if you can get your prescription filled at GoodRX, Sam’s Club, Walmart, or other discount pharmacies. 6 Get assistance from private, state, or federal programs that help with drug costs. 7 Some drug manufacturers also offer assistance programs for their own drugs.

Is the Medicare coverage gap closed?

Because of provisions in the Affordable Care Act, beneficiaries paid a lower percentage toward their drugs while in the coverage gap each year. As of 2020, the coverage gap is officially closed.

What is phase 3 coverage gap?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap, and it doesn’t apply to members who get Extra Help to pay for their Part D costs. Once in the gap, you’ll pay no more ...

What is a donut hole in Medicare?

When Medicare Part D prescription drug plans first became available , there was a built-in gap in coverage. This coverage gap opened after initial plan coverage limits had been reached and before catastrophic coverage kicked in. While in this gap, plan members had to pay the full cost of their covered drugs until their total costs qualified them for catastrophic coverage. The phrase “donut hole” was commonly used to describe this gap. 1

What is the copayment for a prescription?

For example, if your plan has a 25% copayment for a $200 prescription, you would pay $50 and your plan would cover the $150 balance.

What is phase 4 of Part D?

Phase 4 – catastrophic coverage. In this last phase of Part D plan coverage, you’ll only pay a small coinsurance amount or copayment for covered drugs for the rest of the year. When your new plan year begins, you start over at phase 1.

Is the donut hole closed?

Where members once paid 100% of their costs in the gap, now their share of costs in the donut hole is limited to 25% for both brand-name and generic drugs. The donut hole has essentially closed. 2.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

What is the coverage gap?

In the coverage gap, the plan is temporarily limited in how much it can pay for your drugs. If you do enter the gap, you'll pay 25% of the plan's cost for covered brand-name drugs and 25% of the plan's cost for covered generic drugs.

What is a copayment in Medicare?

You pay the other portion, which is either a copayment (a set dollar amount) or coinsurance ...

What is catastrophic coverage?

After your out-of-pocket cost totals $6,550, you exit the gap and get catastrophic coverage. In the catastrophic stage, you will pay a low coinsurance or copayment amount (which is set by Medicare) for all of your covered prescription drugs.

What does Medigap cover?

A Medigap plan will cover what Medicare leaves for the patient in hospital and outpatient settings. Specifically, it works with your Medicare to ensure one hundred percent of your standard health care costs are handled. Plus, these plans include additional coverage that can save you a great deal of money in the future.

How long does Medicare cover skilled nursing?

Medicare alone only offers up to 20 days of full coverage for this care, after which you’re responsible for coinsurance payments each day until coverage runs out on the hundredth day.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

How many days do you have to be in the hospital for Medicare?

On standard Medicare, each day in the hospital after the first 60 days costs hundreds of dollars in coinsurance. After 90 consecutive days, you’ll need to start using your lifetime reserve days, of which Medicare provides 60.

What is a donut hole?

The donut hole refers to a phase in prescription drug coverage when the beneficiary must pay a certain percentage for drugs. This phase ends when the total amount spent on drugs in the year reaches a specific threshold, and the following stage, catastrophic coverage, begins.

Does Medicare cover gap?

Many people believe they’ll receive coverage for all their health care expenses once they’re on Medicare. The reality is there are several costs that Medicare alone doesn’t cover. Thus, beneficiaries must pay these out-of-pocket.