How do I use the prompt payment interest rate calculator?

To use this calculator you must enter the numbers of days late, the amount of the invoice in which payment was made late, and the Prompt Payment interest rate, which is pre-populated in the box. If a payment is less than 31 days late, use the Simple Daily Interest Calculator.

What is a prompt payment discount?

A vendor may offer the agency a discount if the agency pays within a specified shorter time. To determine the amount to pay with the discount, use the Prompt Payment discount calculator. Accelerated payments. Agencies should pay vendors early in these cases:

What is the prompt payment rule?

Prompt Payment. The Prompt Payment rule makes sure that valid and proper invoices submitted by vendors are paid on time by federal agencies. If a vendor submits a proper and valid invoice, the agency must pay it on time. If not, the payment is late. In most cases when an agency pays a vendor late, it must pay interest.

When is interest not paid on a mortgage?

Interest is not paid on: The interest rate is determined by the applicable rate on the day of payment. This rate is determined by the Treasury Department on a six month basis, effective every January and July 1.

What is the prompt payment interest rate?

The prime rate was 3.25 percent on July 1, 2021....Interest Rates.Fiscal YearRate20206.5020196.0020185.2520174.5015 more rows

How much interest does medicare charge?

The interest rate for January - June 2020 is 2.125%. The year 2020 is a leap year. When interest payments are applied, the amount of interest on each claim will be reported on the remittance advice.

How do you calculate prompt interest?

P(r/360*d)P is the amount of principal or invoice amount;r is the Prompt Payment interest rate; and.d is the number of days for which interest is being calculated.

Does CMS pay interest on claims?

It states the following: Interest is required to be paid for clean claims not paid within 30 days after the day of receipt of a claim. Interest accrues until and including the day of late payment.

Are Medicare premiums tax deductible in 2021?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

Does Medicare take money from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What is meant by prompt payment?

Prompt payment is a commercial discipline which requires businesses to: agree fair and reasonable payment terms with their suppliers. ensure suppliers' invoices are approved and paid within agreed terms. encourage adoption of the same practices throughout their supply chain.

How much interest can you charge on late payments?

Don't charge more than 10% interest per year. Some states restrict the amount you can charge in late fees, but you're likely safe if you cap rates at 10%.

What is daily interest rate?

A daily periodic interest rate generally is used to calculate interest by multiplying the rate by the amount owed at the end of each day. This interest amount is then added to the previous day's balance, which means that interest is compounding on a daily basis.

What is NYS prompt pay?

This article provides an in-depth discussion of New York's Prompt Pay Act, enacted in 2002 to promote business in New York by attempting to avoid undue delays of payment to contractors and subcontractors.

What is the penalty interest rate for delayed payment of claims on the part of the insurance company?

2%Sub-clause (5) states that where a delay is occasioned on the part of the insurer in processing a claim, it shall pay interest at the rate of 2% above bank rate prevalent at the beginning of the year on the claim amount.

How do you post interest payments in medical billing?

If you do not have patient-specific information:Create a patient named Interest Payment (or another name as desired- but designated for Interest Payments)Create a custom code for Interest Payments.Create an appointment for patient Interest Payment (or another name as designated by the office)More items...•

Who reports the amount of interest on each claim on the remittance advice to the provider?

Note: The Medicare contractor reports the amount of interest on each claim on the remittance advice to the provider when interest payments are applicable.

How is interest rate determined?

The interest rate is determined by the applicable rate on the day of payment. This rate is determined by the Treasury Department on a six-month basis, effective every January 1 and July 1. Providers may access the Treasury Department webpage https://www.fiscal.treasury.gov/prompt-payment/rates.html for the correct rate. The interest period begins on the day after payment is due and ends on the day of payment.

How long does Medicare have to pay for clean claims?

Medicare must pay interest on clean claims if payment is not made within the applicable number of calendar days after the date of receipt. The applicable number of days is also known as the payment ceiling. The interest rate is determined by the applicable rate on the day of payment.

Is interest paid on home health claims?

Interest is not paid on: • Claims requesting anticipated payments under the home health prospective payment system. Note: The Medicare contractor reports the amount of interest on each claim on the remittance advice to the provider when interest payments are applicable.

How to calculate daily interest rate?

To determine the amount of interest due, we multiply the amount of reimbursement times the annual interest rate divided by 365 to determine daily interest rates .

When does the interest period end?

The interest period begins on the day after payment is due and ends on the day of payment.

What happens if a payment is late?

In most cases, when an agency pays a vendor late, the agency must pay interest.

May an agency pay early?

Discounts for early payments. A vendor may offer the agency a discount if the agency pays within a specified shorter time.

Stay Up to Date with Prompt Payment

Subscribe to e-mail notifications and get Prompt Payment news and updates delivered right to your inbox!

What is prompt payment provision?

Contracts or other written agreements between MA organizations and providers must contain a prompt payment provision, the terms of which are developed and agreed to by both the MA organization and the relevant provider .

How long does it take for a CMS to pay clean claims?

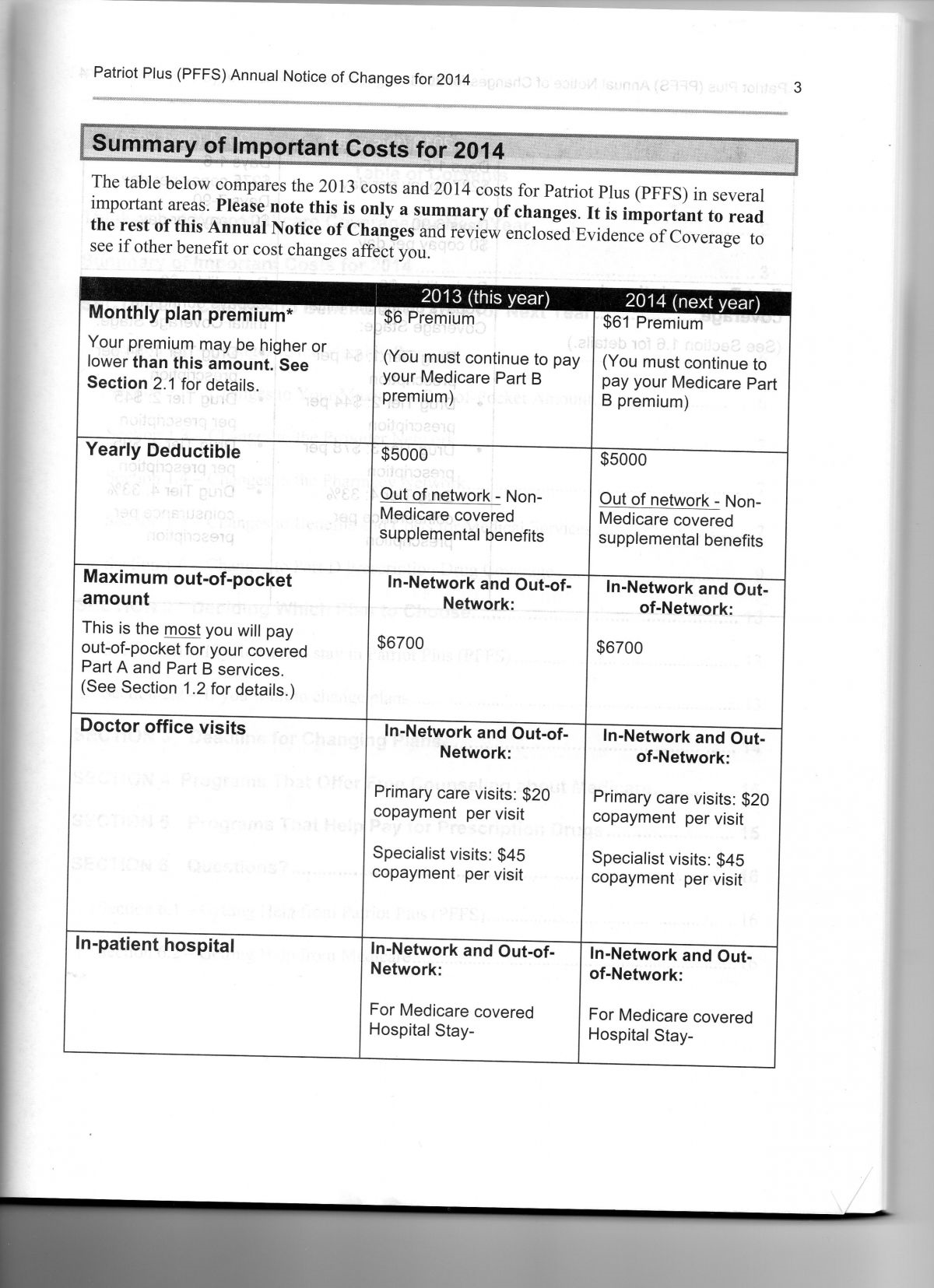

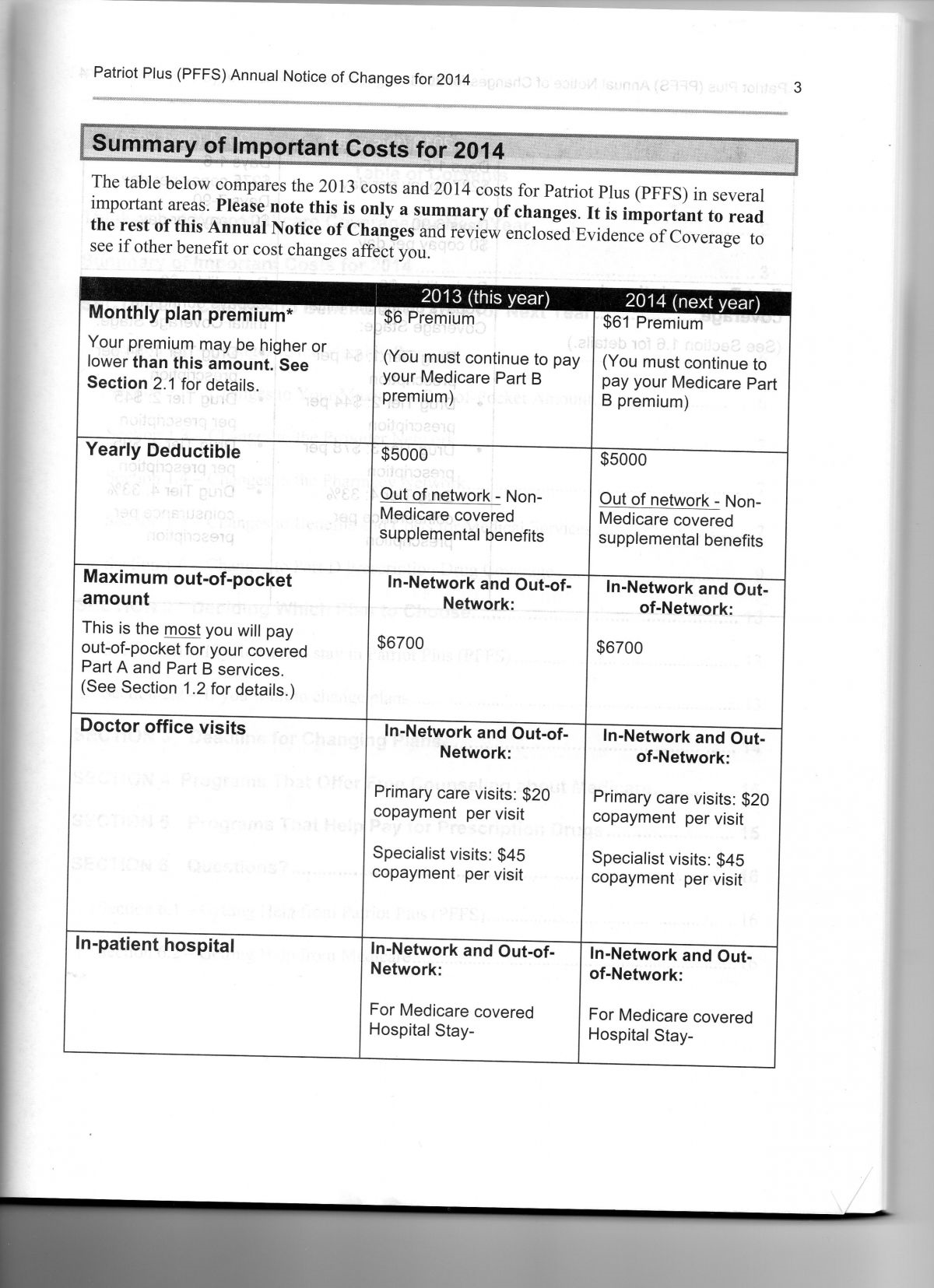

(1) The contract between CMS and the MA organization must provide that the MA organization will pay 95 percent of the “clean claims” within 30 days of receipt if they are submitted by, or on behalf of, an enrollee of an MA private fee-for-service plan or are claims for services that are not furnished under a written agreement between the organization and the provider .

How is interest rate determined?

The interest rate is determined by the applicable rate on the day of payment. This rate is determined by the Treasury Department on a six month basis, effective every January and July 1. The interest period begins on the day after payment is due and ends on the day of payment.

How long does it take to pay interest on a clean claim?

Interest must be paid on clean claims if payment is not made within 30 days (ceiling period) after the date of receipt. The ceiling period is the same for both Electronic Media Claims (EMCs) and paper claims. Interest is not paid on:

Is CMS a government system?

Warning: you are accessing an information system that may be a U.S. Government information system. If this is a U.S. Government information system, CMS maintains ownership and responsibility for its computer systems . Users must adhere to CMS Information Security Policies, Standards, and Procedures.