What is the income limit for QMB?

Jun 06, 2018 · The Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. In 2017, 7.7 million people (more than one out of eight people with Medicare) were in the QMB program.

What is the difference between QMB and QMB plus?

The Qualified Medicare Beneficiary (QMB) Program is one of the four Medicare Savings Programs that allows you to get help from your state to pay your Medicare premiums. This Program helps pay for Part A premiums, Part B premiums, and …

Is Medicaid QMB traditional Medicaid?

Jul 26, 2019 · Medicaid QMB, which stands for Qualified Medicare Beneficiary, is a program designed specifically for individuals that qualify for both Medicare and Medicaid coverage and that are financially unstable. This program provides these individuals with an alternative way to pay for their medical bills and can allow them to use Medicaid services to help cover the costs …

Do QMB patients have copays?

Dec 08, 2021 · QMB stands for “Qualified Medicare Beneficiary” and is a cost assistance program designed to help individuals who are eligible for both Medicare and Medicaid, a circumstance that is known as “dual eligibility.”. The QMB program helps pay for the full cost of Medicare Part A and Part B premiums along with complete coverage of deductibles, copayments and …

What is Qualified Medicare Beneficiary (QMB) Program?

The Qualified Medicare Beneficiary (QMB) Program is one of the four Medicare Savings Programs that allows you to get help from your state to pay yo...

Who is eligible for Qualified Medicare Beneficiary (QMB) Program?

In order to qualify for QMB benefits you must meet the following income requirements, which can also be found on the Medicare Savings Programs page...

How do I apply for Qualified Medicare Beneficiary (QMB) Program?

To apply call your state Medicare Program.It's important to call or fill out an application if you think you could qualify for savings—even if your...

How can I contact someone?

For more information, please visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048. Visit the Medicare.gov...

What is QMB in Medicare?

The Qualified Medicare Beneficiary (QMB) Program is one of the four Medicare. Savings Programs that allows you to get help from your state to pay your Medicare. premiums. This Program helps pay for Part A premiums, Part B premiums, and. deductibles, coinsurance, and copayments.

What is the income limit for QMB?

Who is eligible for Qualified Medicare Beneficiary (QMB) Program? In order to qualify for QMB benefits you must meet the following income requirements, which can also be found on the Medicare Savings Programs page: Individual monthly income limit $1,060. Married couple monthly income limit $1,430. Individual resource limit $7,730.

What is the number to call for Medicare?

1-800-633-4227. Additional Info. Qualified Medicare Beneficiary. Managing Agency. U.S. Department of Health and Human Services. Check if you may be eligible for this benefit. Check if you may be eligible for this benefit. Expand Quick Info Section. Benefit Categories >.

How to contact Medicare by phone?

For more information, please visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227) . TTY users can call 1-877-486-2048. Visit the Medicare.gov Helpful Contacts page to locate a contact near you. 1-800-633-4227. Receive an email when this benefit page is updated: Subscribe to this Benefit.

What is QMB in medical?

Medicaid QMB, which stands for Qualified Medicare Beneficiary, is a program designed specifically for individuals that qualify for both Medicare and Medicaid coverage and that are financially unstable. This program provides these individuals with an alternative way to pay for their medical bills and can allow them to use Medicaid services ...

What is the difference between Medicare and Medicaid?

Original Medicare is available to individuals 65 years of age or older and individuals with certain disabilities. Medicaid insurance caters to individuals with low income and provides an affordable, government-funded healthcare option for this demographic. The QMB program has specific income requirements that must be met, ...

What is the income limit for 2019?

In 2019, the monthly income limits for individuals is $1,060 and the monthly income limit for a married couple is $1,430. There is also a limit on resources, which is set at $7,730 for individuals and $11,600 for married couples. Additionally, you must also be at or below the annual federal poverty level. The amounts of the QMB requirements and the ...

How does Medicaid QMB work?

In addition to covering Medicare premiums for eligible QMB recipients, one of the benefits of the QMB program is having protection from improper billing. Improper billing refers to when health care providers inappropriately bill a beneficiary for deductibles, copayments or coinsurance.

Who is eligible for QMB?

You must be eligible for both Medicare and Medicaid to be eligible for QMB benefits. While Medicare’s eligibility requirements are federally mandated, each state may set its own qualifying restrictions for Medicaid.

What are other Medicare and Medicaid assistance programs?

QMB is not the only program available to dual-eligible beneficiaries. Others include:

How much does QMB pay for Medicare?

It can pay deductibles that can total more than $1,400 per year for Part A and more than $190 for Part B. The QMB can also pay copays that apply to services used by participants. The overall amount of these payments depends on upon the services used.

What is QMB program?

The QMB Program is the Qualified Medicare Beneficiary program; Medicaid pays premiums for Part A and for Part B. It pays deductibles, coinsurance, and copays for Part B. The program accepts applicants with incomes as high as 100 percent of the federal poverty guideline. The QDWI Program is the qualified disabled and working individuals program;

What is a qualified Medicare beneficiary?

The Qualified Medicare Beneficiary Program can cover premiums, deductibles, copays, and coinsurance. The QMB is a Medicare Savings Program for low-income individuals and families that can save a lot of money. It is one of four Medicare Savings Programs. The QMB helps low-income Medicare beneficiaries pay Medicare Part A premiums, ...

Can disabled people get Medicare again?

The Social Security Administration advises disabled worker that have returned to work of a potential valuable benefit. They may be able to buy-in to Medicare Part A again. Some disabled recipients lose free Medicare Part A coverage when they return to work.

What is the deductible for qualified Medicare?

The annual Medicare cycle includes a deductible which was approximately $1,408.00 in 2020. Coinsurance and copays can build into the thousands very easily given even a short hospital stay and outpatient follow-up.

What is QMB eligibility?

Eligibility for QMB. The keys are participation in Medicare Part A and income in the range of the federal poverty guideline. Applicants must be Medicare beneficiaries. The income must be in the range of the federal poverty guideline as adjusted by the review standards.

Why is it bad to not apply for a state of residence?

This is a bad outcome because the state governments have freedom to adjust the income and assets that they consider.

What are the benefits of QMB?

Benefits of the QMB program include: 1 Medicare Part A & B premiums paid back in your Social Security Check 2 Medicare Part D premium reduced or covered through the Low Income Subsidy (LIS) / Extra Help program 3 Medication costs reduced to $0 – $10 for most medications through the LIS / Extra Help program 4 No Donut Hole / Coverage Gap 5 Medicare deductibles paid by Medicaid 6 Medicare coinsurance and copays within prescribed limits paid

How much does insulin cost in the donut hole?

When in the Donut Hole, Insulin costs $360 per month. With QMB, the cost is reduced to $3.60 per month. When on QMB, you save $149.00* on your monthly Medicare Part B premium, as this is paid back into your social security check. *Average cost for Medicare Pt B premium. May be more or less depending on the individual.

What is QMB in Medicare?

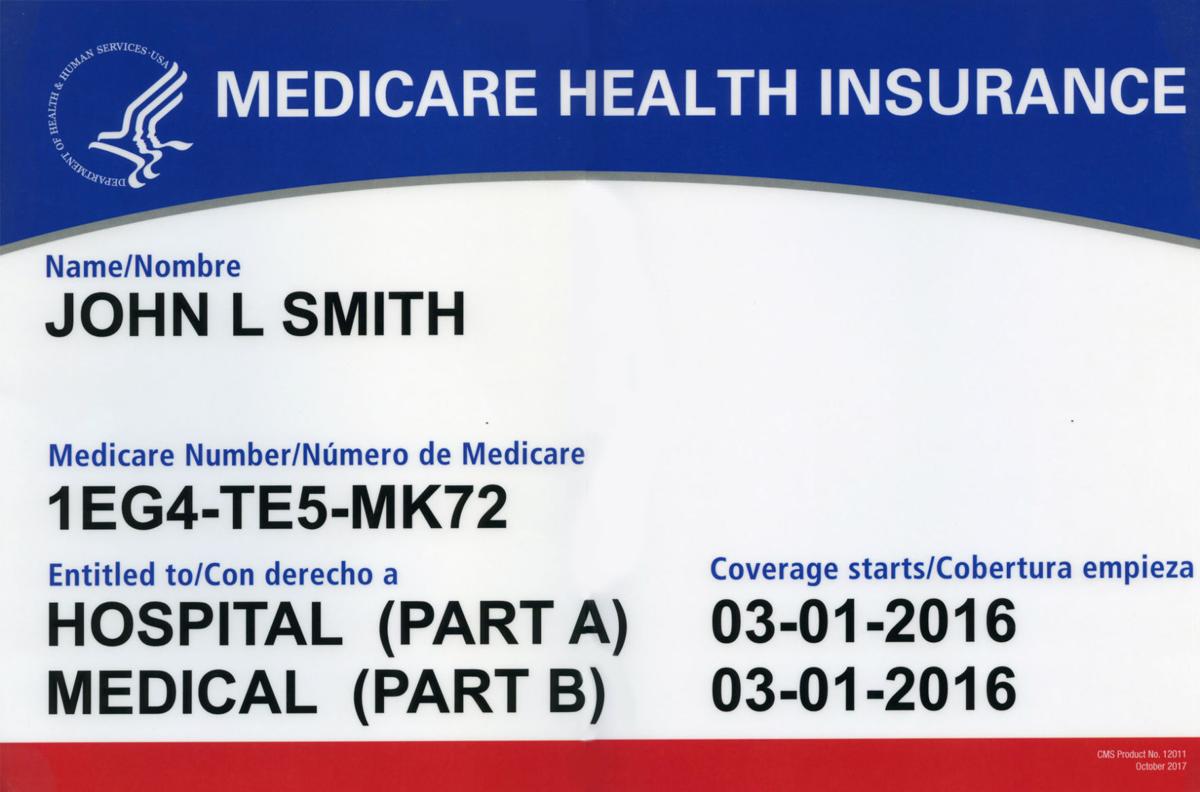

Qualified Medicare Beneficiary (QMB) Program. If you’re a Medicare beneficiary, you know that health care costs can quickly add up. These costs are especially noticeable when you’re on a fixed income. If your monthly income and total assets are under the limit, you might be eligible for a Qualified Medicare Beneficiary program, or QMB.

What is QMB insurance?

The QMB program pays: The Part A monthly premium (if applicable) The Part B monthly premium and annual deductible. Coinsurance and deductibles for health care services through Parts A and B. If you’re in a QMB program, you’re also automatically eligible for the Extra Help program, which helps pay for prescription drugs.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is a qualified Medicare beneficiary?

The Qualified Medicare Beneficiary program is a type of Medicare Savings Program (MSP). The QMB program allows beneficiaries to receive financial help from their state of residence with the costs of Medicare premiums and more. A Qualified Medicare Beneficiary gets government help to cover health care costs like deductibles, premiums, and copays.

Does Medigap cover copays?

This program helps you avoid the need for a Medigap plan by assisting in coverage for copays, premiums, and deductibles. Those that don’t qualify for the QMB program may find that a Medigap plan helps make their health care costs much more predictable.

What is QMB insurance?

The QMB program is just one way to get help paying your premiums, deductibles, and other costs. You must fall below income and asset limits to participate in the QMB program. If you think you make or own too much, try applying anyway. Many assets and income sources aren’t included when calculating your eligibility.

What is QMB program?

Since the QMB program aims to help individuals with low income, it places limits on the monthly income and financial resources available to you. If you exceed these limits, you may not be eligible for the program. Generally, participation is limited to individuals who meet the federal poverty level.

What is the poverty level in 2021?

For 2021, the federal poverty level is $12,880 per year for individuals in Washington, D.C., and 48 states. Limits are higher in Alaska ($16,090) and Hawaii ($14,820). Specific financial requirements for the QMB for individuals are: a monthly income limit of $1,094. an asset limit of $7,970.

Does Medicare cover out of pocket costs?

The takeaway. Medicare is meant to provide affordable healthcare coverage for older adults and other individuals in need. Even so, out-of-pocket costs can add up . A number of programs can help you pay for your share of Medicare costs.