MEDICARE for Railroad Workers and Their Families RRB.gov The Railroad Retirement Board

Railroad Retirement Board

The U.S. Railroad Retirement Board is an independent agency in the executive branch of the United States government created in 1935 to administer a social insurance program providing retirement benefits to the country's railroad workers.

Unemployment benefits

Unemployment benefits are payments made by back authorized bodies to unemployed people. In the United States, benefits are funded by a compulsory governmental insurance system, not taxes on individual citizens. Depending on the jurisdiction and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

What is the difference between Medicare and Medicare railroad?

You can get Medicare Part A at age 65 without paying any premiums if:

- You receive Railroad Retirement Board benefits; or

- You are eligible to receive Railroad Retirement Board benefits or Social Security benefits but have not yet filed for them; or

- You or your spouse had Medicare-covered government employment.

What does railroad Medicare cover?

Railroad Medicare covers the cost of insulin pumps and the insulin used in the pumps. However, if you inject your insulin with a needle (syringe), Medicare Part B does not cover the cost of the insulin, but your Medicare prescription drug benefit (Part D) covers the insulin and the supplies necessary to inject it.

Does railroad Medicare require authorization?

Prior authorizations requests for Railroad Medicare patients should be submitted to the jurisdictional Medicare Administrative Contractor (MAC) that will process the hospital’s outpatient department facility claim. No PA requests should be submitted to Palmetto GBA Railroad Medicare.

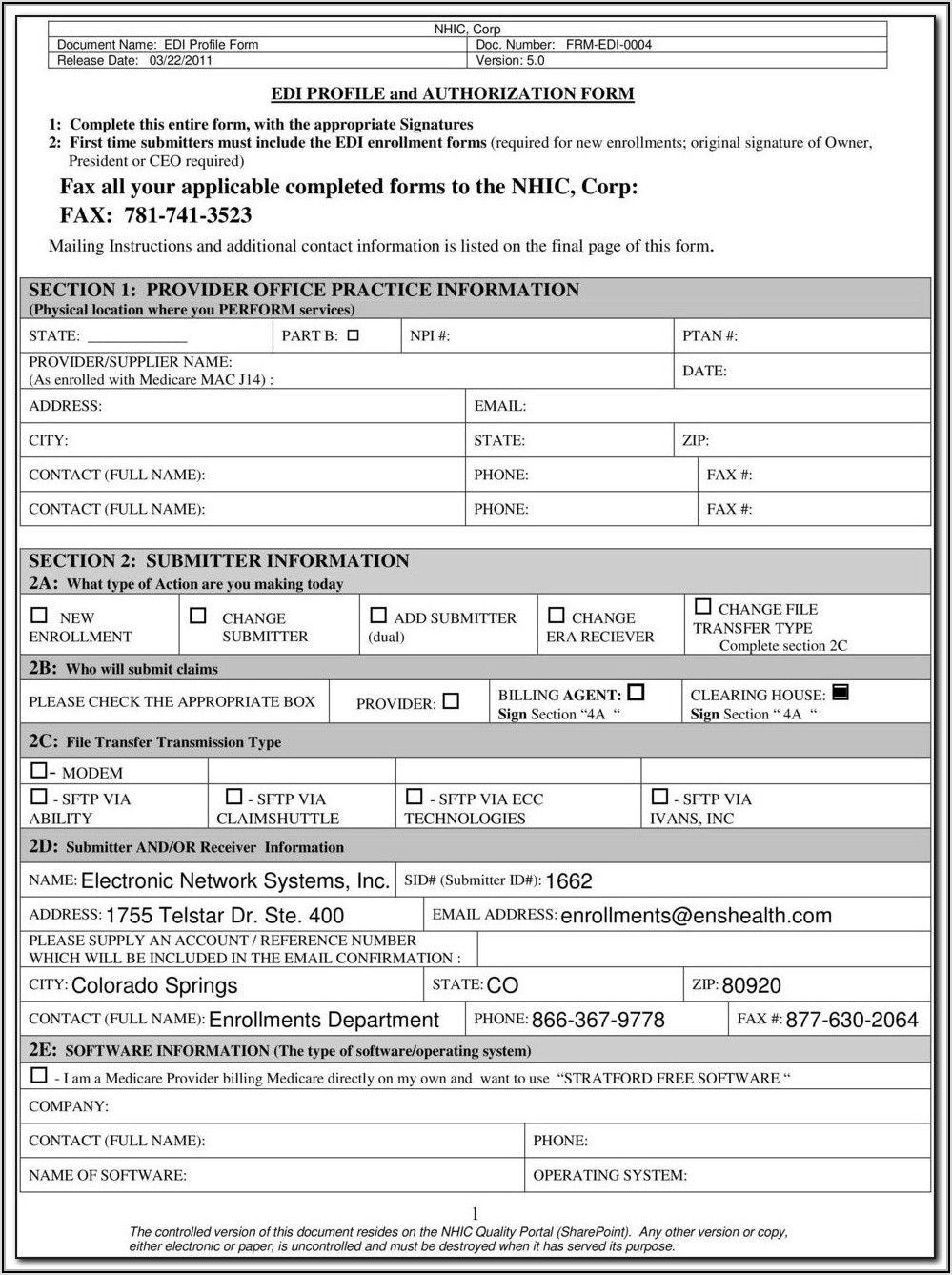

How to bill Medicare Railroad claims?

- Before filing claims electronically to Railroad Medicare, you must have an EDI enrollment packet on file with Palmetto GBA. ...

- View the Electronic Filing Instructions

- Palmetto GBA Interactive CMS-1500 Claim Form Instructions — This resource can also be helpful to providers who submit electronic claims. ...

Whats the difference between Medicare and Medicare railroad?

A: The only difference is that retired railroad beneficiaries have their Part B benefits administered by the Palmetto GBA Railroad Retirement Board Specialty Medicare Administrative Contractor (RRB SMAC) regardless of where they live. Members should be certain to advise providers of this when they receive treatment.

What does railroad mean in Medicare?

The Railroad Retirement Board (RRB) enrolls railroad retirement beneficiaries in the program, deducts Medicare premiums from monthly benefit payments, and assists in certain other ways.

Is Medicare railroad an Advantage plan?

Yes, Railroad Medicare beneficiaries can choose to enroll in Medicare Advantage plans.

Who administers railroad Medicare?

Palmetto GBA is contracted by the independent federal agency Railroad Retirement Board (RRB), which administers comprehensive retirement-survivor and unemployment-sickness benefit programs for railroad workers and their families under the Railroad Retirement and Railroad Unemployment Insurance Acts.

Is railroad retirement the same as social security?

Railroad Retirement Benefits. Both RRB and Social Security offer retirement, disability, spousal, and survivor benefits that are generally calculated in the same manner. However, the benefits provided by each program are not identical.

How do I find railroad Medicare?

The Medicare card of a person with Railroad Medicare is unique, as seen below, with the RRB logo in the upper left corner and “Railroad Retirement Board” at the bottom.

Can you receive social security and railroad retirement at the same time?

Answer: Yes, you can apply for and receive both benefits, but the Tier 1 portion of your Railroad Retirement Annuity will be reduced by the amount of your Social Security benefit, so you may not receive more in total benefits.

How much is the average railroad pension?

The average age annuity being paid by the Railroad Retirement Board (RRB) at the end of fiscal year 2020 to career rail employees was $3,735 a month, and for all retired rail employees the average was $2,985. The average age retirement benefit being paid under social security was approximately $1,505 a month.

At what age can a spouse collect railroad retirement?

age 62Full retirement age for a spouse is gradually rising to age 67, just as for an employee, depending on the year of birth. Reduced benefits are still payable at age 62, but the maximum reduction will be 35 percent rather than 25 percent by the year 2022.

Why is railroad retirement separate from social security?

Workers whose jobs required that they cross State lines sometimes found that they were not eligible for benefits in any of the States in which they worked. It was therefore recommended that railroad workers be covered by a separate plan. Congress enacted the Railroad Unemployment Insurance Act in June 1938.

Can I cash out my railroad retirement?

You aren't allowed to take any early withdrawals or loans against your Railroad Retirement Annuity. The earliest you can start receiving funds is when you are at retirement age. For railroaders this can be as early as 60 years old.

Can you lose your railroad retirement?

Once a current connection is established at the time the railroad retirement annuity begins, an employee never loses it, no matter what kind of work is performed thereafter.

What Medicare Parts are automatically enrolled in if you receive a railroad retirement?

If you receive Railroad Retirement benefits or disability annuity benefits from the railroad at the time of eligibility for Medicare, you are automatically enrolled in Medicare Parts A and B by the RRB.

Where is the railroad retirement board on my Medicare card?

Your Medicare card is similar to the new Medicare cards that all beneficiaries receive, with the exception that “Railroad Retirement Board” is printed in a red banner at the bottom of the card .

Does Medicare cover railroad employees?

Medicare offers coverage to railroad employees just as it does for people who have Social Security. The payroll taxes of railroad employees include railroad retirement and Medicare hospital insurance taxes.

Do you have to go through the Social Security Administration if you are employed by the railroad?

However, if you have end-stage renal disease (ESRD) and qualify for Medicare, you must go through the Social Security Administration even if you are employed by the railroad.

Does Medicare work with railroad retirement?

If you or a loved one is retiring form the U.S. Railroad Retirement Board (RRB), you may be wondering how your benefits will work with Medicare . The RRB administers insurance and retirement benefits to all railroad workers in the country. Instead of getting retirement benefits from the U.S. Social Security Administration as other workers do, the RRB provides railroad workers and their families with retirement benefits, along with unemployment and sickness benefits, Medicare will still be responsible for the individual’s health care benefits.

How is Railroad Medicare financed?

This is financed through the payroll taxes that are paid by the employees as well as the employers when they were still working for the company. Railroad Part B, on the other hand, is financed by monthly premiums from you or the federal government revenue funds.

What is the difference between railroad health insurance and Medicare?

The only difference is that Railroad health insurance plans are usually given to railroad retirement annuitants and their families. Try to think of it as just like getting social security benefits when you retire. With Railroad Medicare, the Part A plan will be able to cover hospitalization.

How old do you have to be to qualify for Railroad Medicare?

Even the eligibility requirements for both are practically the same. You need to be 65 years old or you need to be disabled. These are the things that you have to remember about these program. You will see that there is not much difference between Railroad Medicare and normal Medicare.

What Medicare Parts does RRB automatically enroll you in?

If you are receiving Railroad Retirement benefits or railroad disability annuity checks when you become eligible for Medicare, RRB should automatically enroll you in Medicare Parts A and B . You should receive your red, white, and blue Medicare card and a letter from RRB explaining that you have been enrolled in Medicare.

What to do if you are not collecting Railroad Retirement?

If you are not collecting Railroad Retirement benefits when you turn 65, you should contact your local RRB field office to enroll in Medicare. If you are under 65 and have a disability, you will have to fulfill different eligibility requirements to qualify for Medicare.

Do doctors have to bill Medicare Part B?

Your doctors and other providers should bill a separate contractor for services covered under Part B. Your providers must send Railroad Medicare Part B claims to the Part B contractor selected by RRB. Always make sure your providers know you have Railroad Medicare to ensure that Medicare pays in a timely manner.

Does RRB collect Medicare?

RRB will collect your Medicare premiums. If you receive Railroad Retirement benefits or railroad disability annuity checks, your Medicare Part B premium should be automatically deducted from your check each month. If you do not qualify for premium-free Part A, it will also be deducted from your check.

How do railroad workers enroll in Medicare?

Most railroad workers enroll in Medicare by contacting their local Railroad Retirement Board office. You can find the nearest office using the field office link above. But if you have end-stage renal disease, you must enroll through the Social Security Administration.

What is the number to call a railroad retirement board?

Call a Licensed Agent: 833-271-5571. Due to COVID-19, the Railroad Retirement Board closed offices as of March 16, 2020. We’ll keep you updated on when offices reopen. In the meantime, visit RRB.gov to learn about your online self-serve options.

What is the RRB in 2020?

Licensed Insurance Agent and Medicare Expert Writer. June 15, 2020. Before the Social Security Administration (SSA) was formed, the Railroad Retirement Board (RRB) developed retirement, disability, and unemployment benefits for railroad workers who were hit hard by the Great Depression. Today, the RRB offers railroad workers a similar safety net.

When do you become eligible for Medicare?

Typically, you’ll become eligible when you turn 65 or reach your 25th month of receiving disability benefits. The main difference is that the RRB classifies disability differently than the SSA does, so check with a representative ...

Does Medicare pay through the RRB?

Generally, your Medicare costs through the RRB will be the same as those paid by people who qualify for Medicare via Social Security. Just like workers outside the railroad industry, you’ll see Medicare deductions from your paycheck during your working years.

Does RRB have Medicare?

Today, the RRB offers railroad workers a similar safety net. RRB beneficiaries can tap into Medicare benefits, much like Social Security beneficiaries, with a few differences. If you are a railroad worker, learn what you can expect from Medicare in terms of eligibility, enrollment, costs, and health benefits—and how your RRB benefits differ ...

Do you pay Medicare Part D premiums through RRB?

If you add Medicare Part D, Medigap, or Medicare Advantage, you’ll pay additional premiums for these as well, but not through your RRB income checks. You’ll pay for each of these coverages separately, directly to the insurance company that provides each plan.

RRB Specialty MAC Providers

Effective immediately, the Railroad Medicare COVID-19 hotline can be reached at 888-882-7931 between the hours of 8:30 a.m. to 7 p.m. ET. Representatives can assist with provisional enrollment and information about accelerated payment requests. Learn More

Railroad Medicare COVID-19 Hotline

Effective immediately, the Railroad Medicare COVID-19 hotline can be reached at 888-882-7931 between the hours of 8:30 a.m. to 7 p.m. ET. Representatives can assist with provisional enrollment and information about accelerated payment requests. Learn More

Provider Contact Center: 1-888-355-9165

Call the Provider Contact Center (PCC) to speak with representatives in Customer Service, Provider Enrollment, Electronic Data Interchange, eServices and Telephone Reopenings.

Interactive Voice Response (IVR): 1-877-288-7600

Use the IVR to request routine claim status, beneficiary eligibility, and payment information and to request a duplicate remittance advice.

Email Us

Use our contact form to submit general inquiries or to provide feedback on our website. For security reasons please do not submit requests involving PHI/PII with this form.

Contact Palmetto GBA Departments

For information on contacting a specific department by phone, email, fax, or for instructions on submitting documentation by mail, please select a department:

Feedback to the Railroad Retirement Board (RRB)

If you would like to send any feedback to the RRB regarding your experience with Palmetto GBA, please direct your comments to: [email protected] .