How do you qualify for Medicare savings program?

There are four Medicare Savings Programs: Qualified Medicare Beneficiary. Specified Low-Income Medicare Beneficiary. Qualifying Individual. Qualified Disabled & Working Individuals.

How does Medicare savings program work?

Feb 11, 2020 · Qualified Medicare Beneficiary (QMB) Program for Part A and/or Part B premiums. Specified Low-Income Medicare Beneficiary (SLMB) Program for Part B premiums. Qualifying Individual (QI) Program for Part B premiums. Qualified Disabled and Working Individuals (QDWI) Program for Part A premiums.

What is the slmb Medicare savings program?

The Medicare Savings Program (MSP) is a Medicaid-administered program that can assist people with limited income in paying for their Medicare premiums. Depending on your income, the MSP may also pay for other cost-sharing expenses.

Who qualifies for Medicare extra help?

Medicare Savings Programs (MSPs) are Medicaid-administered programs for people on Medicare who have limited income and resources. These programs help those qualified to afford Medicare. There are four different Medicare Savings Programs, each with different income and resource eligibility limits.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

How much savings can you have on Medicare?

You may have up to $2,000 in assets as an individual or $3,000 in assets as a couple.

What is a saving program?

The phrase “savings plan” is just a way to describe the process of saving enough money to buy a home — or saving for any other life goal that's important to you. It's a strategic process that allows you to make measurable, sustainable, and consistent progress toward what you want.Jun 13, 2017

What is the income limit for Medicare Savings Program in Texas?

Medicare Savings Program in Texas: 2021 Eligibility and CoverageType of Medicare Savings ProgramMonthly Gross Income EligibilitySpecified Low-Income Medicare Beneficiary (SLMB)Between 100%-120% of Federal Poverty Level, plus $20 income disregard. Single: $1,094- $1,308 Married: $1,472-$1,7623 more rows

Does Medicare check your bank account?

Medicare will usually check your bank accounts, as well as your other assets when you apply for financial assistance with Medicare costs. However, eligibility requirements and verification methods vary depending on what state you live in. Some states don't have asset limits for Medicare savings programs.Feb 10, 2022

Can you get Medicare if you have money in the bank?

Assets are any money you have in the bank, and the value of any investments (i.e., stocks, bonds and real estate). However, the house you live in and up to one car you own are not counted as assets when it comes to qualifying for a Medicare Savings Program.Oct 7, 2021

How does your saving plan work?

You open a savings account at the bank. The bank pays you interest on the money that you deposit and leave in that account. The bank then loans that money out to other people, only they charge a slightly higher interest rate on the loan than what they pay you for your account.

Who can have a medical savings account?

Who can set up a health savings account? Your employer may offer an HSA option, or you can start an account on your own through a bank or other financial institution. To qualify, you must be under age 65 and have a high-deductible health insurance plan.

What does savings plan consist of?

An employee savings plan (ESP) is a pooled investment account provided by an employer that allows employees to set aside a portion of their pre-tax wages for retirement savings or other long-term goals, such as paying for college tuition or purchasing a home.

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

What is the maximum monthly income to qualify for Medicaid in Texas?

Single applying for MedicaidIncome LimitAsset LimitInstitutional / Nursing Home Medicaid$2,349 / month$2,000Medicaid Waivers / Home and Community Based Services$2,349 / month$2,000Regular Medicaid / Aged Blind and Disabled$783 / month$2,000Dec 3, 2021

What is the income limit for Medicaid in Texas?

Who is eligible for Texas Medicaid?Household Size*Maximum Income Level (Per Year)1$26,9092$36,2543$45,6004$54,9454 more rows

What is Social Security Medicare Savings Program?

Medicare Savings Programs (MSP) are federally funded programs administered by each individual state. These programs are for people with limited inc...

Who is eligible for Social Security Medicare Savings Program?

Below are general requirements for the MSP: Reside in a state or the District of Columbia. Are age 65 or older. Receive Social Security Disability...

How do I apply for Social Security Medicare Savings Program?

Once you know which benefits you may be eligible for, go to the Medicare Benefits page to apply online.You may also call your State Medicare Progra...

How can I contact someone?

For more information about Medicare, visit CMS’s Medicare page. Visit SSA's Publications Page for detailed information about SSA programs and polic...

What is Medicare Savings Program?

A Medicare Savings Program (MSP) is designed to cover all or part of Medicare out-of-pocket expenses that encumber Medicare recipients who live within limited financial means.

What is a Medicare summary notice?

You will also receive a Medicare Summary Notice (MSN), which is proof of being in the program and shows the healthcare provider you should not be billed for services, deductibles, coinsurance or copayments. An exception is outpatient prescriptions.

Key Takeaways

Medicaid is a health insurance benefit for people with limited incomes.

What is Medicaid?

Medicaid is a state-run health insurance program that pays for a broad range of medical services for people with low income and resources. Each state runs its own Medicaid program, so eligibility and additional program benefits may vary by state.

Can people with Medicare also have Medicaid?

People who have Medicare can also receive Medicaid, if they meet their state’s eligibility criteria. These people are often called “dual eligibles” or “duals.” Medicaid can cover Medicare co-payments and deductibles and services not covered by Medicare that may be available in your state’s Medicaid program, such as vision, hearing, and dental care.

What are the 4 Medicare Savings Programs?

Medicare Savings Programs (MSPs) are Medicaid-administered programs for people on Medicare who have limited income and resources. These programs help those qualified to afford Medicare. There are four different Medicare Savings Programs, each with different income and resource eligibility limits.

What are the advantages of Medicare Savings Programs?

Seniors and younger adults with disabilities who may not qualify for full Medicaid may still be able to enroll in the Medicare Savings Programs. There are two major advantages to doing so:

Let's keep in touch

Subscribe to receive important updates from NCOA about programs, benefits, and services for people like you.

Introduction

While Medicare helps cover your hospitalization and medical costs, it is not free as you are still required to pay premiums, deductibles, and copayments. Thankfully, for those with limited income and savings, there are programs available, such as the Medicare Savings Program (MSP), that can reduce healthcare costs.

What is Medicare Savings Program (MSP)?

The Medicare Savings Program (MSP) is a Medicaid-administered program where your state will help in paying for your Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) premiums if you are under Original Medicare.

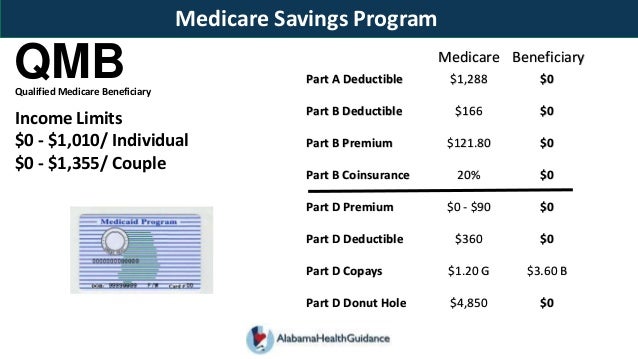

Qualified Medicare Beneficiary (QMB) Program

The Qualified Medicare Beneficiary (QMB) program provides the most benefits. It helps in paying for Medicare Part A premiums, as well as your Medicare Part B premiums and out-of-pocket costs (deductibles, coinsurance, copayments).

Specified Low-Income Medicare Beneficiary (SLMB) Program

If you earn a little more than the QMB income requirement, you may qualify for the Specified Low-Income Medicare Beneficiary (SLMB) program.

Qualifying Income (QI) Program

If you are not eligible under QMB or SLMB, you might qualify for the third MSP program – Qualifying Income Program (QI). This program is for those who have Medicare Part A but have limited income and resources.

Qualified Disabled and Working Individuals (QDWI) Program

The Qualified Disabled and Working Individuals Program (QDWI) program is not for Medicare beneficiaries over 65. Instead, the QDWI program helps disabled workers under 65 eligible for Medicare who cannot pay their Medicare Part A premiums after returning to work.

Medicare Savings Program: Prescription Drug Coverage

While MSPs will help pay for Part A and/or Part B premiums, it does not pay for any costs related to prescription drugs.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs. Below, we explain who is eligible for these programs and how to get the assistance you need to pay for your Medicare.

What are the different types of Medicare savings programs?

Types of Medicare Savings Programs 1 Qualified Medicare Beneficiary (QMB) Programs pay most of your out-of-pocket costs. These costs include deductibles, copays, coinsurance, and Part B premiums. A QMB will also pay the premium for Part A if you haven’t worked 40 quarters. Those who qualify for the QMB program are also automatically eligible for the Extra Help program for prescription drugs. 2 Specified Low-Income Medicare Beneficiary (SLMB) Programs pay your Part B premium. Like QMBs, those who qualify for SLMBs are automatically eligible for Extra Help. 3 Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help. 4 Qualified Disabled and Working Individual (QDWI) Programs cover monthly Part A premiums for qualified individuals under 65 with disabilities who are currently working.

How many types of MSPs are there?

There are four kinds of MSPs. Each type of MSP is tailored to different needs and circumstances. Qualified Medicare Beneficiary (QMB) Programs pay most of your out-of-pocket costs. These costs include deductibles, copays, coinsurance, and Part B premiums. A QMB will also pay the premium for Part A if you haven’t worked 40 quarters.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is QI in Medicare?

Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help.

What is balance billing?

Balance billing refers to the cost for a service that remains after Medicare pays. If you’re a QMB, your providers should not be billing you directly for the balance after Medicare pays them for your service. Yet, if you’re an SLMB or a QI, there is no rule against your doctor’s office sending you a bill for the balance of your service.

What is countable resource?

The term countable resources mean any money in bank accounts (checking or savings), stocks, and bonds. Your home, one car, a burial plot, up to $1,500 already saved for burial expenses, and personal belongings aren’t included when countable resources are considered.

Medicare Savings Programs

Five federally supported programs are designed to help seniors with income and resources that have fallen below specific thresholds. These programs were created because not everyone can handle the expenses of Medicare, such as; copays, coinsurance, deductibles, and prescription costs.

How do I know I qualify for the Medicare savings program?

Medicaid in each state administers these four Medicare cost-cutting measures:

Other facts about Medicare Savings Program

Healthcare providers won’t bill you: You will not be billed for services provided to you in the QMB program; Medicaid will pay the medical providers. Ensure that the doctor is aware you are in the QMB program, so they don’t bill you incorrectly, and also make sure to Inform Medicare of the charge.

How to Apply for Medicare Savings Program

If you are eligible for Medicare, and your income and resources meet or exceed the financial eligibility requirements for a Medicare savings program, see if you can locate your state’s Medicaid office.

Prescription drug coverage

It is an effective treatment, so use it with the care that you would with any other prescription medication.

Savings to cut Medicare costs

Private insurance policies help you cover the costs of Medicare, such as copays, coinsurance, and deductibles. You have ten plans to choose from, all of which provide nationwide coverage.

The Takeaway

Medicare savings programs help low-income people pay Part A and Part B premiums, deductibles, copays, and coinsurance.

What is Medicare Part A?

Original Medicare is comprised of Medicare Part A (hospital insurance) and Medicare Part B (outpatient insurance). MSPs are run at the state level by each individual state’s Medicaid program. That means you need to contact your state’s Medicaid office to apply for an MSP. Even if you already take part in a Medicare Savings Program, ...

What is SLMB in Medicare?

The Specified Low-Income Medicare Beneficiary (SLMB) Program helps pay for Medicare Part B premiums only. You must already have Medicare Part A to qualify. You can take part in the SLMB program and other Medicaid programs at the same time. Some states may refer to this as the SLIMB program.

How old do you have to be to qualify for Medicare?

There are four types of Medicare Savings Programs. Three of them are available only if you have Medicare and are at least 65 years old: The Qualified Medicare Beneficiary (QMB) Program helps pay for Medicare Part A premiums and Medicare Part B premiums, deductibles, coinsurance, and copays.

Is Medicaid a separate program from Medicare?

See if you qualify with our state-by-state guide to Medicaid. Medicaid is a separate program from Medicare. Both programs provide health insurance, but Medicare coverage is primarily for seniors while Medicaid eligibility depends largely on your income. It’s possible to take part in both programs at the same time.

Does MSP cover prescriptions?

MSPs can help pay the out-of-pocket expenses associated with Medicare Part A and Medicare Part B. They do not cover prescription drug costs. However, Medicare recipients who qualify for an MSP are also automatically eligible for Medicare Extra Help, which helps pay for a Medicare Part D prescription drug plan.

What is medicaid?

Medicaid is a federal assistance program that provides health insurance for low-income and vulnerable Americans. The program is partially funded by the states and each state can set its own eligibility requirements. Qualifying for Medicaid benefits depends largely on your income, but also on your age, disability status, pregnancy, household size, and your household role.

Who is Derek from Policygenius?

Derek is a personal finance editor at Policygenius in New York City, and an expert in taxes. He has been writing about estate planning, investing, and other personal finance topics since 2017. He especially loves using data to tell a story. His work has been covered by Yahoo Finance, MSN, Business Insider, and CNBC.