How does Medicare set aside work?

What is an MSA Medicare set aside?

How is Medicare Set Aside calculated?

How do I stop Medicare set aside?

What happens to Medicare set aside funds upon death?

What does MSA stand for in workers compensation?

What is a non submit MSA?

What is the largest Workmans Comp settlement?

What is MSA seed money?

What does self administered MSA mean?

Is Medicare set aside taxable?

What are the covered expenses under workers compensation program?

What is WCMSA in workers compensation?

A WCMSA is used when an injured worker: is eligible for Medicare. settles his or her future medical care with a lump sum payment. A lump-sum settlement of future medical care in workers’ compensation cases is done through a form called a Compromise and Release. A WCMSA is calculated by:

What is it called when an injured worker settles his or her future medical care with the insurance company?

When an injured worker settles his or her future medical care with the insurance company, the settlement is called a Compromise and Release.

What is a WCMSA?

A Workers’ Compensation Medicare Set-Aside (WCMSA or MSA) is money set aside from a workers’ compensation settlement to pay future medical benefits. The money goes toward any treatment for the work-related injury that would have been paid by Medicare. A WCMSA is used when an injured worker:

What is the purpose of WCMSA?

The account is used to pay for medical treatment whenever the injured worker gets treatment for the work injury through Medicare. There is nothing to stop an injured worker from using the set-aside funds on something else.

Is there a WCMSA reference guide for workers compensation settlements with Medicare set asides?

There is a WCMSA reference guide for workers’ compensation settlements with Medicare set-asides.

Can an injured worker get medicare?

But the injured worker may still need the care. An injured worker might try to get the treatment through Medicare. Medicare argues that this treatment should be paid for by money from the workers’ compensation insurance company even if there is a settlement agreement of the claim.

Who approves WCMSA?

If the settlement meets either of these review levels, the insurance company will send this report to Medicare. Medicare will approve or deny the WCMSA.

Medicare Set Aside: The Short Version

A “Medicare Set Aside” or “MSA” is essentially a trust fund created as part of a workers’ compensation settlement that allows money for future medical treatment to be set aside for reimbursing Medicare. In this situation, Medicare will only begin paying medical expenses resulting from the workplace injury after the MSA has been fully depleted.

Medicare Set Aside: The Long Version

An MSA is basically an account where some money is set aside to be used for future medical care. There are many varieties of MSA’s. Some Medicare Set Asides are professionally managed and the injured worker is given a card to use like a health insurance card.

What is a workers compensation set aside?

A Workers’ Compensation Medicare Set-aside Arrangement (WCMSA), often called “Medicare set-aside,” involves some of the money from a workers’ compensation settlement being allocated for future costs that Medicare would typically cover. Medicare has strict guidelines about how a person can use the funds in their set-aside account.

When do you have to use set aside funds for Medicare?

Settlement recipients must use the set-aside account funds in their entirety before Medicare starts to cover the costs of care related to the illness, injury, or disease reported in the claim for compensation.

What does Medicare do with medical documentation?

Medicare then reviews medical documentation and estimates future medical expenses related to the injury or illness in the compensation claim.

What does WCMSA go toward?

Money in a WCMSA account must go toward future medical expenses related to the work-related injury or illness. The costs must be among those that Medicare typically covers, including prescription drug expenses. Individuals may not use the funds for any services that Medicare does not cover.

How long does it take for Medicare to enroll in workers compensation?

or reasonably expect Medicare enrollment within 30 months of their workers’ compensation settlement date, with the settlement agreement being greater than $250,000

What is MSA in WCMSA?

When a person has an WCMSA, some money awarded in a workers’ compensation settlement is placed in a separate account, called an MSA, to cover future medical needs related to the illness or injury in the claim. A person needs to use this money for Medicare-approved services.

What does WCMSA cover?

If a person has a WCMSA, the money put away for future healthcare covers medical costs before Medicare, ensuring that the person uses their settlement funds before using Medicare’s federal funds.

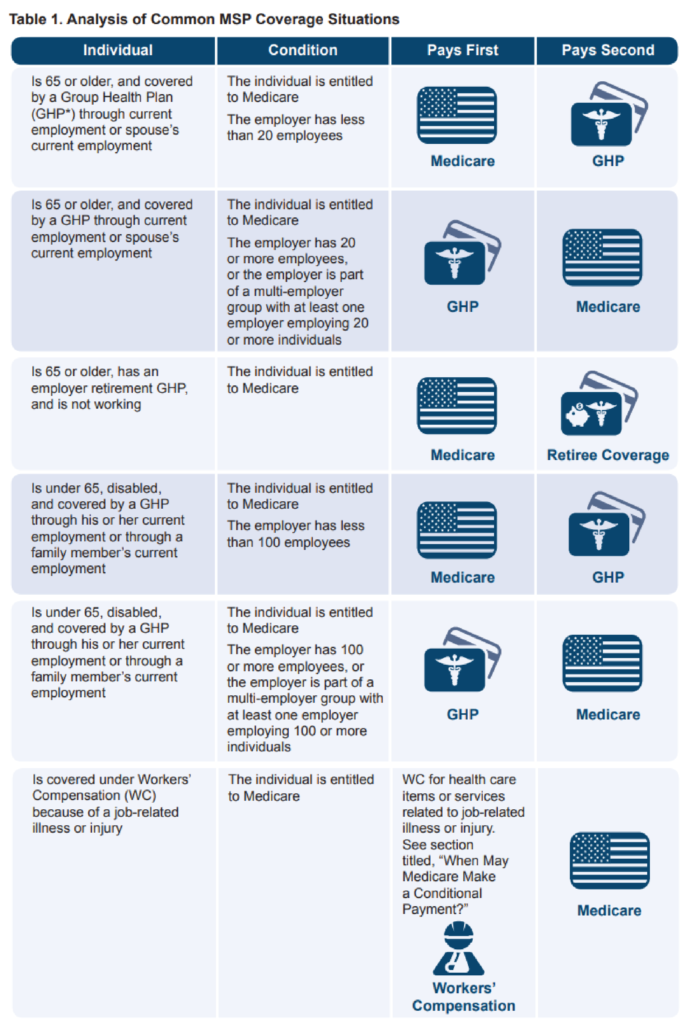

What is WC in Medicare?

WC is a primary payer to the Medicare program for Medicare beneficiaries’ work-related illnesses or injuries. Medicare beneficiaries are required to apply for all applicable WC benefits. If a Medicare beneficiary has WC coverage, providers, physicians, and other suppliers must bill WC first.

Why is WCMSA used prior to becoming a beneficiary?

For claimants who are not yet Medicare beneficiaries and for whom CMS has reviewed a WCMSA, the WCMSA may be used prior to becoming a beneficiary because the accepted amount was priced based on the date of the expected settlement.

What is secondary payer Medicare?

“Medicare Secondary Payer” (MSP) is the term used when the Medicare program does not have primary payment responsibility on behalf of its beneficiaries—that is , when another entity has the responsibility for paying for medical care before Medicare. Until 1980, the Medicare program was the primary payer in all cases except those involving WC (including Black Lung benefits) or for care that is the responsibility of another government entity. With the addition of the MSP provisions in 1980 (and subsequent amendments), Medicare is secondary payer to group health plan insurance in specific circumstances, but is also secondary to liability insurance (including self-insurance), no-fault insurance, and WC. An insurer or WC plan cannot, by contract or otherwise, supersede federal law, for instance by alleging its coverage is “supplemental” to Medicare.

What is WCMSA insurance?

WCMSA is set up to ensure that all future medical and drug or pharmacy expenses for a work-related injury otherwise payable by Medicare are covered by a WC settlement.

When will benzodiazepines be included in WCMSA?

The WCRC will include benzodiazepines and barbiturates in WCMSAs effective June 1, 2013. Benzodiazepines and barbiturates are new to the Part D Benefit since January 1, 2013. For 2013 and future years, all medically accepted indications for benzodiazepines will be covered. For barbiturates, in 2013, only those used in the treatment of epilepsy, cancer, or a chronic mental health disorder will be covered, but in 2014 all medically accepted indications will be covered. Example: a case submitted on June 1, 2013 includes a barbiturate used for the treatment of headache. This will not be covered in 2013, as this is not being used for the treatment of epilepsy, cancer, or a chronic mental health disorder, but will be covered in 2014. Another example: temazepam for the treatment of insomnia would be covered and should be included in a WCMSA effective June 1, 2013. Cases submitted or reopened on or after June 1, 2013, will need to include benzodiazepines or barbiturates when prescribed. The October 2, 2012, CMS memorandum to Part D Sponsors concerning the transition to Part D coverage of benzodiazepines and barbiturates is available on the CMS website.

Who administers WCMSA?

The WCMSA can be administered either by the claimant (i.e., self-administered, if permitted under state law) or by a third-party trustee, such as a guardian or trust company. (See the Administrators section of this guide for more information.) When a claimant designates a representative payee, appointed guardian/conservator, or has otherwise been declared incompetent by a court; the settling parties should include that information in this section. Include any official stand-alone agreement that provides the name and address of the administrator of the WCMSA.

Is WCMSA still recommended?

WCMSA is still recommended when you have coverage through other private health insurance, the Veterans Administration, or Medicare Advantage (Part C). Other coverage could be cancelled or you could elect not to use such a plan. A WCMSA is primary to Medicare Advantage and must be exhausted before using Part C benefits on your WC illness or injury.

What is Medicare set aside agreement?

What are Medicare Set-Aside Agreements? A Workers’ Compensation Medicare Set-Aside Agreement (MSA) is a financial agreement that allocates a portion of a workers’ compensation settlement to pay for future medical services related to the work injury that Medicare would have otherwise paid.

When settling a workers compensation case, it will be necessary that all parties consider Medicare’s interest, regardless of

When settling a workers’ compensation case, it will be necessary that all parties consider Medicare’s interest, regardless of the amount of the settlement . The Centers for Medicare & Medicaid Services (CMS) will review and approve MSAs in the following when the settlements are above certain threshold amounts.

What is the purpose of MSA?

The purpose of the MSA is to protect the Medicare Trust Fund by ensuring that Medicare does not pay for certain medical treatment when other health insurance coverage should apply. MSAs also protect injured workers by ensuring that they get coverage for medical treatment.

What is a MCP in workers comp?

If a Claimant is not Medicare eligible and the workers comp settlement is lower than the threshold amount, in lieu of a formal MSA, the parties can get a medical cost projection (MCP). An MCP, usually prepared by a registered nurse, compiles information from past and present medical records to accurately project future medical costs through a claimant’s lifespan. MCPs are informational and aid in setting reserves for medical and prescription drug costs.

How long does it take to amend MSA?

If the value of future medical care changes drastically, an MSA can be amended. Amendments can be requested as long as the request is submitted within 1 to 4 years after CMS approval and there is a 10% or $10,000 change in the valuation of the claim based on a change in treatment.

Do employers have to set aside Medicare?

Employers do not always have to set aside funds for Medicare. There can be a “zero-dollar set-aside” if: It is a denied claim and no payments have been made by the Employer other than “expenses” (for example, IME fees, mileage); or.

Can Medicare pay for an injured worker?

Once the injured worker exhausts the MSA funds, Medicare will pay for allowable expenses in excess of the properly exhausted MSA funds. If Medicare denies coverage because an MSA was under-funded, then the Claimant can sue the carrier for under-funding the MSA and causing a loss of benefits.

What Is An MSA?

When Is An MSA used?

- A WCMSA will be necessary any time an injured worker: 1. is on Medicare or may be in the near future 2. settles his or her future medical care with a lump sum payment from the insurance company When an injured worker settles his or her future medical care with the insurance company, the settlement is called a Compromise and Release. In this situation, an injured worke…

How Is A WCMSA calculated?

- When an injured worker’s condition has stabilized at the permanent and stationary date, the treating doctor can determine the future medical care an injured worker may require. Medicare wants to make sure that the insurance company pays enough money in the settlement to cover medical care for the injured worker’s work injury for the rest of his or her life. Generally, the insur…

What Happens to The WCMSA Report?

- Medicare will review the WCMSA if the: 1. amount of the settlement money is over $25,000; and 2. injured worker is a Medicare beneficiary Medicare will also review the report if the: 1. settlement is over $250,000; and 2. injured worker has a reasonable expectation of Medicare enrollment for 30 months If the settlement meets either of these review levels, the insurance company will send th…

What Does It Mean If Medicare Approves The Set-Aside?

- If Medicare agrees to the set-aside amount, it will pay benefits once the money in the set-aside is used up. Depending on the type of occupational injury, future medical care, and life expectancy, an MSA may be only a few thousand dollars up to several hundred thousand. An MSA will often be worked out at the mandatory settlement conference.

How Does An MSA Work After A Settlement?

- When there is a Compromise and Release settlement, the amount going to the MSA can be put in a special bank account. The special account should only be used for: 1. medical treatment for the work injury 2. treatment that is with a Medicare provider The money is for treatment that would have been paid by the workers’ compensation insurance company if not for the settlement. In a…

What Is The Effect of An MSA on A Workers’ Compensation Settlement?

- An MSA can protect an injured worker from having to pay for medical costs on his or her own. Because an MSA is a detailed analysis of future medical care over an injured worker’s lifetime, it usually increases the value of a settlement. The downside is that the increased value is directed to future medical expenses. The money is not available to the injured worker for other things. A…

Call Us For Help…

- For help with filing a workers compensation claim in California, completing workers comp forms or appealing a denial of benefits, contact us to discuss your eligibility. Our firm helps police officers, firefighters and other workers to get compensation for their job-related injuries in California.