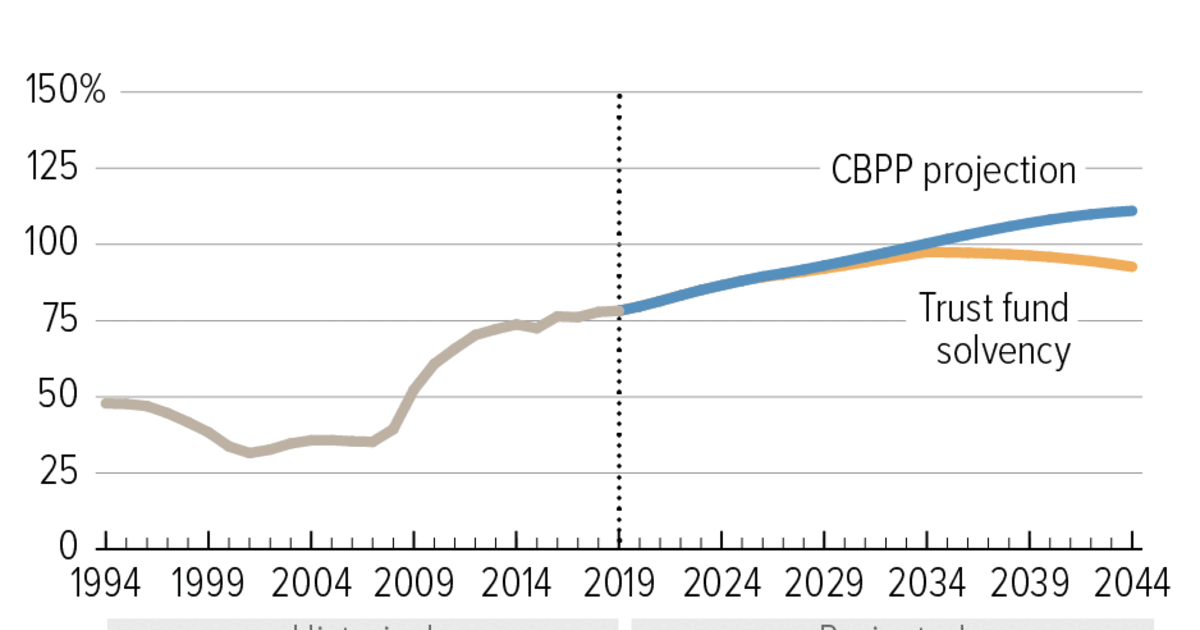

Medicare solvency is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases.

What happens when Medicare runs out of money?

There are multiple scenarios that could play out if the HI trust fund for Medicare were to run out, according to the medical journal Health Affairs. CMS could decide to pay recipient health insurance in full, but late. The agency could also choose to pay a portion — projected to be about 83% of costs — of each covered procedure on time.

When will Medicare become insolvent?

Medicare will become insolvent in 2026, U.S. government says Social Security is expected to become insolvent in 2034 — no change from the projection last year. (Patrick Semansky / Associated Press)

Is Medicare going to run out of money?

Medicare trustees announced on Tuesday that the Medicare hospital insurance trust fund will run out of money by 2026, three years earlier than reported in 2017. This is due to: Spending in 2017 that was higher than estimated; Legislation that increases hospital spending; Higher payments to private Medicare Advantage plans; As for Social Security, it will become insolvent by 2034.

Is Medicare solvent and sustainable?

The 2019 report of Medicare’s trustees finds that Medicare’s Hospital Insurance (HI) trust fund will remain solvent — that is, able to pay 100 percent of the costs of the hospital insurance coverage that Medicare provides — through 2026.

How do you fix Medicare solvency?

By boosting the economy and lowering unemployment, the American Rescue Plan and other economic or job stimuli could help to further increase payroll taxes, thereby improving the solvency of the trust fund. The net impact of the pandemic on health care spending has been a matter of significant debate.

Is Medicare running out of money?

A report from Medicare's trustees in April 2020 estimated that the program's Part A trust fund, which subsidizes hospital and other inpatient care, would begin to run out of money in 2026.

How long is Medicare expected to last?

According to a new report from Medicare's board of trustees, Medicare's insurance trust fund that pays hospitals is expected to run out of money in 2026 (the same projection as last year). The report states that in 2020, Medicare covered 62.6 million people, 54.1 million aged 65 and older, and 8.5 million disabled.

How much is the Medicare deficit?

The Medicare Trustees' report shows that the Part A Hospital Insurance trust fund will be insolvent in just five years, the trust fund faces a shortfall of 0.77 to 1.61 percent of payroll, and Medicare spending will grow significantly over the next few decades.

What happens when Medicare goes broke?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Is Medicare about to collapse?

At its current pace, Medicare will go bankrupt in 2026 (the same as last year's projection) and the Social Security Trust Funds for old-aged benefits and disability benefits will become exhausted by 2034.

What happens when Medicare runs out in 2026?

The trust fund for Medicare Part A will be able to pay full benefits until 2026 before reserves will be depleted. That's the same year as predicted in 2020, according to a summary of the trustees 2021 report, which was released on Tuesday.

Will Medicare be available in the future?

After a 9 percent increase from 2021 to 2022, enrollment in the Medicare Advantage (MA) program is expected to surpass 50 percent of the eligible Medicare population within the next year. At its current rate of growth, MA is on track to reach 69 percent of the Medicare population by the end of 2030.

What is the solvency of Social Security?

Solvency for the Social Security program is defined as the ability of the trust funds at any point in time to pay the full scheduled benefits in the law on a timely basis.

Is Medicare underfunded?

Politicians promised you benefits, but never funded them.

Where does the money come from for Medicare?

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

Why is Social Security running out?

“Social Security's cost has exceeded its non-interest income since 2010.” “The year when the combined trust fund reserves are projected to become depleted, if Congress does not act before then, is 2035 -- one year later than last year's projection,” the SSA added.

How is Medicare solvency measured?

Medicare solvency is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases. This matters because when spending exceeds income and the assets are fully depleted, ...

Where does Medicare get its money from?

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest. The different parts of Medicare are funded in varying ways.

How much would Medicare increase over 75 years?

Over a longer 75-year timeframe, the Medicare Trustees estimated that it would take an increase of 0.76% of taxable payroll over the 75-year period, or a 16% reduction in benefits each year over the next 75 years, to bring the HI trust fund into balance.

How much of Medicare will be covered in 2026?

Based on data from Medicare’s actuaries, in 2026, Medicare will be able to cover 94% of Part A benefits spending with revenues plus the small amount of assets remaining at the beginning of the year, and just under 90% with revenues alone in 2027 through 2029.

How many people are covered by Medicare?

Medicare, the federal health insurance program for more than 60 million people ages 65 and over and younger people with long-term disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. Medicare spending often plays a major role in federal health policy and budget discussions, ...

How much of the federal budget is Medicare?

Medicare spending often plays a major role in federal health policy and budget discussions, since it accounts for 21% of national health care spending and 12% of the federal budget. Recent attention has focused on one specific measure of Medicare’s financial condition – the solvency of the Medicare Hospital Insurance (HI) trust fund, ...

Medicare Financing: The Basics

The traditional Medicare program is made up of three parts: (1) hospital insurance (Part A) for hospital inpatient procedures; (2) supplemental medical insurance (Part B) for doctor’s visits and outpatient procedures; and (3) prescription drug coverage (Part D).

Doing Nothing Is Not an Option

As Congress begins to confront the soaring national debt today and in the years to come, it will become even more obvious that fundamental Medicare reform is an essential part of that process.

What is solvency fix?

A solvency fix also could present an opportunity to improve benefits. For example, a reform package could add a hard cap on out-of-pocket costs for prescription drugs, or add dental, vision and hearing benefits to Original Medicare. It also could include addition of a long-term care benefit, perhaps the most significant uncovered risk ...

When will Medicare become insolvent?

The Medicare trustees projected last year that the Hospital Insurance Trust Fund will become insolvent in 2024 - less than three years from now. Just last week, the Congressional Budget Office (CBO) forecast a somewhat longer insolvency date due to an improving economic outlook - 2026.

What is the most urgent retirement issue facing the new Biden administration and Congress?

CHICAGO (Reuters) - The most urgent retirement issue facing the new Biden administration and Congress is not Social Security reform or figuring out how to boost savings in 401 (k)s and IRA accounts. FILE PHOTO: The sun rises on the U.S. Capitol dome before Joe Biden's presidential inauguration in Washington, U.S., January 20, 2021.

Is there a shortfall in Medicare Part A?

Shortfalls are nothing new for Medicare Part A - they generally are the result of rising healthcare costs. But this is only the second time insolvency has been predicted within five years. The financial cliff has drawn closer due to declining payroll tax receipts during the economic downturn.

How long does it take for Medicare to become insolvent?

But now even those gimmicks have run their course. Estimates suggest the Medicare trust fund will become officially insolvent within five years —and could face a cash flow crunch even sooner.

When did Medicare Part A become a condition of Social Security?

In 1993, an administrative ruling by the Clinton administration—one that did not even go through notice-and-comment rulemaking—forced all individuals to enroll in Medicare Part A as a condition of applying for Social Security. This policy makes little sense, for several reasons.

What does it mean when seniors pay to Medigap?

Every dollar seniors pay to a Medigap insurer allows an organization like AARP to take their share of the cut (a.k.a. “ kickbacks ”) in the process. Fewer dollars running through insurance companies means less overhead and profits for the insurers—and more dollars back in seniors’ pockets.

How much money does Washington spend on Medicare?

According to the Congressional Budget Office, the national debt has roughly tripled since 2007 and is projected to rise such that, by the end of the coming decade, Washington will spend nearly $1 trillion per year just to pay the interest on our bills. Medicare itself has been effectively insolvent for several years.

Does Medicare have a cap on out of pocket costs?

Because the traditional Medicare benefits provided by law do not include a cap on out-of-pocket costs, roughly nine in 10 seniors have some type of “insurance” to provide such a catastrophic cap. Otherwise they could face medical bills totaling tens of thousands of dollars (or more) in the case of a medical emergency.

Can Republicans reform Medicare?

To be clear: Republicans can—and should—explore more comprehensive Medicare reforms, including a premium support program that would place private plans and traditional Medicare on a level playing field to attract and enroll seniors.

Does Medicare subsidize Part B?

That law provided that, beginning in January 2020, Medigap plans could not subsidize the Medicare Part B deductible (currently $203 in 2021 ).

When will Medicare be depleted?

Meanwhile, Medicare’s hospital insurance fund is expected to be depleted in 2026 — the same date that was projected a year ago. At that point, doctors, hospitals and nursing homes would not receive their full compensation from the program and patients could face more of the financial burden.

How much was cut in Social Security?

It also called for $26 billion less on Social Security programs, including a $10 billion cut to Social Security Disability Insurance, which provides benefits to disabled workers. Fiscal watchdog groups said on Monday that the new figures underscored the need for changes to the programs.

Is Medicare and Social Security precarious?

WASHINGTON — The financial outlook for Medicare and Social Security, two of the nation’s most important social safety net programs, remains precarious, threatening to diminish retirement payments and increase health care costs for Americans in old age, the Trump administration said on Monday.