My AARP Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Does AARP offer the best Medicare supplemental insurance?

We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesn’t charge more as you grow older. This is especially helpful if you are still covered under your...

Is there such thing as an AARP Medicare supplement?

While Social Security and Supplemental Security Income (SSI) benefits will increase 5.9 percent in 2022, so will Medicare Plan B premiums ... vice president of AARP’s financial resilience programming said. “There are people that might retire, try ...

How much does AARP Medicare supplement cost?

To apply for AARP Medicare Supplement Plan G or any other Medigap plan from AARP, you must be an AARP member. Memberships are $16 per year in 2021 and include a number of savings and discounts on travel, dining, shopping and more. How Do I Apply for Medicare Supplement Plan G?

Is AARP Medicare supplemental the same as all the others?

Because Medicare Supplement insurance is standardized among nearly all U.S. states, these features and benefits of specific AARP Medicare Supplement plans are the same as with any other carrier. You can receive care anywhere in the United States. You can see any provider who accepts Medicare.

See more

What is a AARP Medicare Supplement plan?

AARP Medicare Supplement plans are insured and sold by private insurance companies like UnitedHealthcare to help limit the out-of-pocket costs associated with Medicare Parts A and B. Supplement plans can help pay for some or all of the costs not covered by Original Medicare — things like coinsurance and deductibles.

How much is the AARP Medicare Supplement?

$16 per yearInsurance policyholders must be AARP members, and you can join during your insurance application if you're not already a member. Membership costs are minimal at only $16 per year. Costs for AARP Medigap insurance vary widely, ranging from about $60 to $300 per month.

What is the difference between a Medicare Advantage plan and a Medicare Supplement?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Is AARP A Supplement or Advantage plan?

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare Insurance Company.

Is AARP worth joining?

There can be some great benefits to getting older, including the discounts and promotions that many companies offer to senior citizens. AARP caters to older people who are looking for benefits and a sense of community. The organization offers an annual membership that provides access to senior discounts and offers.

Does AARP Medicare Supplement pay Medicare deductible?

AARP Medicare Supplement Plan B Plan B covers each of the benefits offered under Plan A. Additionally, it covers 100% of your Medicare Part A deductible. In 2020, the Part A deductible is $1,408.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the difference between AARP Medicare Complete and AARP Medicare Advantage?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

What's the difference between advantage and supplement plans?

There are several differences between Medicare Advantage vs. Medicare Supplement plans. A Medicare Advantage plan (Medicare Part C) is structured to be an all-in-one option with low monthly premiums. Medicare Supplement plans offer additional coverage to Original Medicare with low to no out-of-pocket costs.

What is the difference between AARP and UnitedHealthcare?

Although AARP is not an insurance company, it offers healthcare insurance plans through United Healthcare. The plans include Medicare Part D prescription drug coverage and Medigap. United Healthcare is a nationwide health insurance company, with reported 2019 revenue of $242.2 billion.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

How much is Medicare Part A deductible?

Plan A. Hospital Services for Medicare Part A: With Plan A, you are responsible for the Part A deductible of $1,484 for the first 60 days of hospitalization. This plan includes semiprivate room and board and general nursing costs. For days 61 to 90, the plan pays the $371 per day that Medicare does not cover.

How much does Medicare pay for days 61 to 90?

For days 61 to 90, the plan pays the $371 per day that Medicare does not cover. Days 91 and beyond are covered at $742 per day while using your 60 lifetime reserve days. Once the lifetime reserve days are used, Plan A continues to pay for all Medicare-eligible expenses that would not otherwise be covered by Medicare for an additional 365 days.

What is covered by Plan B after day 100?

After day 100, you are responsible for all skilled nursing care costs. Plan B also covers the first three pints of blood and, for hospice care, any co-payment and co-insurance Medicare may require for outpatient drugs and inpatient respite care. 3 .

How much does Medicare pay for hospitalization?

Hospital Services for Medicare Part A: Plan B pays the $1,484 deductible for Part A for the first 60 days of hospitalization. It then acts like Plan A. For days 61 to 90, Plan B pays the $371 per day that Medicare doesn't cover. For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days.

What is Plan K for Medicare?

Plan K. Plan K is similar to Plan C, but it pays only 50% rather than 100% of certain costs. Hospital Services for Medicare Part A: Plan K pays only 50%—or $742—of the $1,484 Part A deductible. Regarding care at a skilled nursing facility, it pays up to $92.75, instead of $185.50, per day for days 21 to 100.

How much does Plan B pay?

For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days. After the lifetime reserve days are used, Plan B continues to pay 100% of Medicare-eligible expenses for an additional 365 days. After that period, you are responsible for all costs. If you have been in the hospital for at least three days ...

Does AARP provide Medicare Supplement?

AARP Medicare Supplement Plans are provided through UnitedHealthcare Insurance Company. For seniors who are concerned that their Medicare plan may not provide all the health insurance coverage they need, these plans are available to supplement their Medicare coverage.

Speak with a Medicare Expert today

Medicare Supplement plans can be complicated, but UnitedHealthcare is here to help make it clear.

Learn about Medicare Supplement plans

Learn how Medicare Supplement plans work with Medicare and review plans in your area.

Get more complete coverage with Medicare Supplement and Part D

Prescription drugs can be expensive, and Medicare Parts A and B ("Original Medicare") may not provide the coverage you need. Pairing an AARP ® MedicareRx Part D Plan from UnitedHealthcare with a Medicare Supplement plan can help protect you from unexpected medical and prescription drug costs now or in the future.

The biggest benefit is peace of mind

Don't worry about finding a new doctor, shopping for a plan each year, or network changes. With a Medicare Supplement insurance plan, you also avoid the hassle of out-of-pocket costs, which puts the control right where it belongs... with you.

Providing coverage and building relationships for over 40 years

In addition to the standard benefits of Medicare Supplement plans, an AARP Medicare Supplement Insurance Plan from UnitedHealthcare has many features that stand out.

Expert advice right at your fingertips

If you have questions about the different plan options, are curious about plan benefits or just don’t know where to start, that’s OK. UnitedHealthcare is here and ready to help.

What is AARP Supplement?

What is an AARP Medicare Supplement. AARP Medicare Supplement Plans are Medicare Supplemental Insurance provided by United Healthcare that are offered under the banner of AARP. The mission of AARP is “empowering people to choose how they live as they age", and through Medigap plans they help fulfill this mission by protecting you from ...

How to contact AARP Medicare Supplement?

Compare pricing and get the details to see if an AARP Medicare Supplement Plan is a good fit for you, or call us at 844-528-8688 for a personal consultation. More...

What is the deductible for AARP?

Here are a few of the out-of-pocket expenses you can prevent with the right AARP plan. Part A deductible: Your Medicare Part A benefits come with a deductible of $1,340 (in 2018). And this isn’t an annual deductible.

Which Medicare Supplement Plan covers everything except the Part B deductible?

You get the best bang for your buck when you compare premiums to benefits. Medicare Supplement Plan G covers everything except the Part B deductible (which really isn’t that expensive). Plan F includes everything, and is available in a high deductible version. It is hands down the most popular Medigap plan available.

What is the maximum amount of Medicare Part B excess charge?

So, for example, imagine you required a service for which the Medicare maximum was $1,000.

Does AARP have the same coverage?

Benefits of AARP Medicare Supplement Plans. Remember that all Medigap plans are going to include the same coverage regardless of your provider. However, not all providers are going to carry the same plans, and they won’t all have the same premiums. That is, Plan F is Plan F regardless of the provider. Therefore, when it comes to selecting the right ...

Does AARP provide medicaid?

This optional addition to your Medicare is always provided by private insurance companies. AARP doesn’t actually provide the insurance, instead partnering with UnitedHealthCare to provide you quality insurance coverage from professionals who have been in the Medigap business for decades.

What is Medicare Supplemental Insurance?

This is health insurance that helps pay for some of your costs in the Original Medicare program and for some care it doesn’t cover. Medigap insurance is sold by private insurance companies.

What does Medigap cover?

None of the standard Medigap plans cover: • long-term care to help you bathe, dress, eat or use the bathroom. • vision or dental care. • hearing aids. • eyeglasses. • private-duty nursing.

What are excess charges for Medicare Part B?

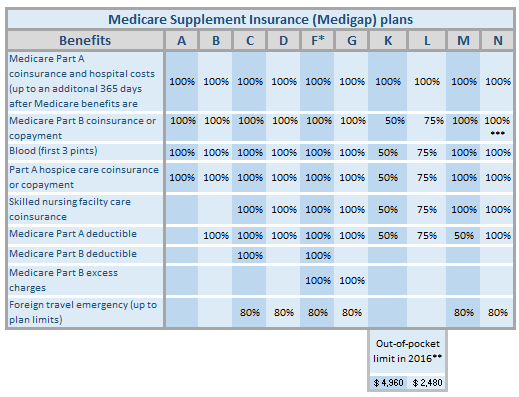

Medicare Part B Excess Charges#N#When you see a doctor who doesn’t “accept assignment,” he or she doesn’t accept Medicare’s approved amount as payment in full. The doctor can charge you up to 15 percent more than Medicare’s approved amount.#N#Medigap Plans F and G pay 100% of these excess charges. You might want this benefit if you don’t know whether the doctors you see accept assignment, such as when you are in the hospital.#N#Foreign Travel Emergency#N#Medicare does not cover any health care you receive outside of the United States. Medigap Plans C, D, F, G, M and N cover some emergency care outside the United States. After you meet the yearly $250 deductible, this benefit pays 80 percent of the cost of your emergency care during the first 60 days of your trip. There is a $50,000 lifetime maximum.#N#Plans K and L#N#Important: Plans K and L offer similar coverage as plans A - G, but the cost-sharing for the benefits are different levels and have annual limits on how much you pay for services. The out-of-pocket limits are different for plans K and L and will increase each year for inflation. In 2010, the out-of-pocket limit was $4,620 for plan K and $2,310 for Plan L.#N#Ongoing Coverage#N#Once you buy a Medigap plan, the insurance company must keep renewing it. The company can’t change what the policy covers and can’t cancel it unless you don’t pay the premium. The company can increase the premium, and should notify you in advance of any increases.

What percentage of Medicare pays for mental health?

It pays 50 percent of mental health services and 100% of some preventive services. Medigap plans cover all or part of your share of these services – 20 percent of the Medicare-approved amount for doctor services and 50 percent for mental health services.

How long does Medicare pay for skilled nursing home?

Skilled Nursing Home Costs. The Original Medicare Plan pays all of your skilled nursing home costs for the first 20 days of each benefit period. If you are in a nursing home for more than 20 days, you pay part of each day’s bill.

How many days does Medicare cover?

All 11 Medigap plans cover (pay) your costs for days 61 through 150. In addition, once you use your 150 days of Medicare hospital benefits, all Medigap plans cover the cost of 365 more hospital days in your lifetime.

Does Medicare cover blood?

Blood. The Original Medicare Plan doesn't cover the first three pints of blood you need each year. Plans A-D, F-G, and M through N pay for these first three pints. Plans K pays 50% and L pays 75% part of the cost.

What is AARP for seniors?

AARP is a nonprofit organization that works to serve the interests of people age 50 and over. AARP was founded in 1958 by Dr. Ethel Percy Andrus on three primary principles: To promote independence, dignity and purpose for older persons. To enhance the quality of life for older persons.

How much is AARP insurance in 2021?

You must be an AARP member and continue to pay your AARP dues. In 2021, the standard yearly price of AARP membership is $16 for your first year.

How many AARP plans are there in 2021?

AARP Medicare Supplement Availability. There are 8 AARP Medicare Supplement plans offered by UnitedHealthcare in 2021. Depending on where you live, you may be able to find one of the following Medigap plans: Plan A.

What is Plan L?

Plan L provides coverage for 75 percent of the costs for the Medicare Part A deductible, Part B coinsurance, hospice care coinsurance, skilled nursing facility coinsurance and the first three pints of blood.

What is a Medigap Plan A?

Medigap Plan A provides full coverage of Medicare Part A and Part B coinsurance costs, hospice care coinsurance and the first three pints of blood needed for a transfusion. Plan B. Plan B provides all of the same coverage as Plan A and also includes coverage of the Medicare Part A deductible. Plan C.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

How does AARP listen to community feedback?

AARP listens to community feedback as part of their decision-making process, using surveys, social media, phone calls, emails and other avenues to find out what means the most to their diverse membership. All of this helps guide AARP’s public policy recommendations.

What is Medicare Supplement Plan?

Medicare Supplement Plan (Medigap) Benefits. Medicare supplement insurance plan (Medigap) benefits are standardized and set by the federal government. That means the basic benefit structure for each plan is exactly the same, no matter which insurance company is selling it to you. Some plan features are:

What to think about when looking at Medicare supplement plans?

There are a number of things to think about when you're looking at Medicare supplement plans. Consider how much you'll pay for services, like hospital stays or doctor visits, and how much you're willing to spend on your monthly plan premium and out-of-pocket costs.

What is the difference between Medicare Supplement Plan A and Plan B?

Plans A and B: Lower Benefits, Higher Out-of-Pocket. Medicare Supplement Plan A offers just the Basic Benefits while Plan B covers Basic Benefits plus a benefit for the Medicare Part A deductible. The Medicare Part A deductible could be one of your largest out-of-pocket expenses if you need to spend time in a hospital.

Why are coinsurance premiums lower?

The premiums are lower because they pay a percentage of the coinsurance instead of the full coinsurance amount . Once the out-of-pocket limit is reached, these plans pay 100% of covered services for the rest of the calendar year.

When can I apply for Medicare Supplement?

When can I apply for a Medicare supplement (Medigap) plan? Once you're enrolled in Medicare Parts A and B, you can apply for a Medicare supplement insurance plan at any time. 2 Your acceptance is guaranteed if you apply during your Medigap Open Enrollment Period.

Does Medicare Supplement Insurance cover out of pocket expenses?

Medicare Supplement Insurance Plans help cover some of your out-of-pocket expenses that Medicare doesn't pay. While Medicare Parts A and B (also called "Original Medicare") cover some health care costs, they don't pay for everything. That's where an AARP Medicare Supplement Insurance Plan, insured by UnitedHealthcare Insurance Company, may help.

Who pays royalty fees to AARP?

UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

What is AARP insurance?

AARP is a nonprofit, membership organization. It offers medical supplement insurance plans through the United Healthcare insurance company. The plans, also known as Medigap, help people pay for out-of-pocket medical expenses that original Medicare does not cover. This article looks at the various AARP medical supplement insurance plans.

How many AARP plans are there?

The eight AARP Medigap plans offered by AARP cover some of the gaps left in original Medicare coverage, including out-of-pocket costs such as copays, coinsurance, and deductibles. The plans vary in coverage and cost. Each state has at least one AARP Medigap plan available, although people may not find all eight plans in their location.

How many Medigap plans does United Healthcare offer?

AARP members can choose from 8 standardized Medigap plans offered through United Healthcare. These plans are A, B, C, F, G, K, L, and N. Although all 50 states have at least one of these plans, people may not find all 8 plans offered in their state. A person can use this online tool to find a plan in their state.

What is the process of underwriting for Medigap?

Insurance companies use a process called medical underwriting to decide if they will accept an application for Medigap and to determine the cost. During open enrollment, a person with health issues can enroll in any Medigap policy in their state for the same price as someone in good health.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Does Medicare cover Medigap?

Medicare standardizes the coverage for each Medigap plan. The table below shows some of the benefits covered through the AARP Medigap plans. A person can check the complete coverage details for all AARP plans online. Benefit. Coverage 100%.

Can Medigap be stopped?

Medigap plans are guaranteed renewable, which means that if someone pays their monthly premium, the insurer cannot stop their plan. This applies even if someone becomes ill after purchasing a plan. Not all plans are available in all states.