Medicare Supplement Plan F coverage includes:

- Medicare Part A coinsurance and hospital costs

- Medicare Part A deductible (1,408 in 2020)

- Medicare Part B coinsurance and copayment

- The Medicare Part B deductible ($198 in 2020)

- Blood (first three pints)

- Part A hospice care coinsurance or copayment

- Skilled nursing facility coinsurance

- Foreign Travel emergency

- Excess charges

Full Answer

What are the benefits of Medicare Part F?

Nov 07, 2019 · Medicare Supplement Plan F benefits As mentioned, Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings (Plans A-N; Plans E, H, I, and J are no longer sold). Medigap Plan F may cover: Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers

How much does Medicare Part F cost?

Medicare Plan F is a supplemental (Medigap) health insurance plan that is offered to individuals who are disabled or over the age of 65. Known better as simply Plan F, the policy is the most comprehensive of the 10 Medigap plans offered in the U.S. Plan F is a supplemental policy to Original Medicare (Parts A and B) and can fill many of the gaps of Original Medicare and …

Who is eligible for Medicare Plan F?

Sep 07, 2021 · Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage. However, Medicare Plan F was discontinued as of Jan. 1, 2020.

What are the best Medicare supplement plans?

Dec 16, 2021 · Medicare Supplement Plan F is the most comprehensive private insurance policy available to go with Medicare Part A and Part B. It pays the out-of-pocket costs associated with Parts A and B — including deductibles and the 20% coinsurance after the Part B deductible, and more. In addition to covering your out-of-pocket costs, Plan F travels well.

What is the difference between Plan F and Plan F high deductible?

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium. As a reminder, your...

Does Plan F cover dental?

Original Medicare doesn’t cover routine dental care, like cleanings or extractions, and there are no supplement plans that fill the gap. If you wan...

Is there an alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers,...

What is Medicare Plan F?

Medicare Plan F provides the most benefits out of all the supplemental Medicare plans available and can help reduce your out-of-pocket expenses. The policy is designed to address most of the coverage gaps in Medicare parts A and B. For this reason, many people covered by the standard Medicare policies are willing to pay ...

How much does Medicare Part F cost?

Since Medicare Part F is the is the most comprehensive Medigap policy, the premium can be costly. Typically, these range from $120 to $140 per month for a 65-year-old. However, the exact cost will be determined by your location, plan provider, current health condition, and age and gender. For this reason, it is vital to compare rates for ...

Does Medicare cover injectables?

Medicare Plan F does provide coverage for injectable or infusion drugs given in a clinical setting but does not pay for other prescription drugs. The ideal coverage package would include Medicare parts A and B, along with the Part D prescription drug plan and a supplemental Medigap policy such as Plan F.

Is Medicare Plan F deductible?

When filing your federal tax return, Medicare Plan F premiums would be tax-deductible. Additionally, any medical expenses that you pay for out-of-pocket can also be deducted on your taxes. You would need to itemize these medical expenses, but the tax deductions could provide valuable additional returns.

Does Medigap Plan G cover Medicare Part B?

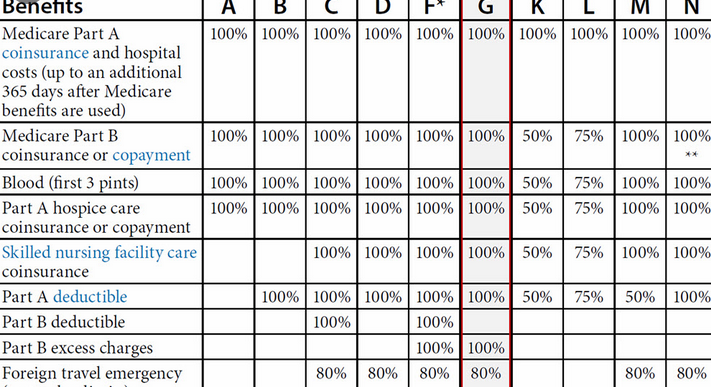

As you can see, Medigap Plan G would not provide coverage for the Medicare Part B deductible. This means if you were to purchase Plan G, you would have to pay the deductible for Part B, which is $185 for 2019, as you receive health services.

What is a plan F?

Plan F is a supplemental policy to the standard Medicare parts A and B plans and can fill many of the gaps of standard Medicare policy and provide broader assistance with out-of-pocket costs. However, not all health insurance gaps will be covered by Plan F.

What is a high deductible Medicare plan?

What is a high-deductible Medicare Plan F? The benefits within the high-deductible Medicare Plan F policy are the same as the standard Part F policy, though you would have to meet the deductible before you can access its health benefits.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F is the most comprehensive private insurance policy available to go with Medicare Part A and Part B. It pays the out-of-pocket costs associated with Parts A and B — including deductibles and the 20% coinsurance after the Part B deductible, and more. In addition to covering your out-of-pocket costs, Plan F travels well.

Is Medicare Plan F available for 65?

In the end, although Medicare Plan F is no longer available for people turning 65, there are options. And you are still able to purchase comprehensive coverage to keep your out-of-pocket costs controlled. Seek the advice of a Medicare specialist in your area to get the best information on plan options. Learn The Basics.

How much is the 2020 Medicare deductible?

In 2020, the deductible is set at $2,340 and premiums range from $44 to $194, based on a search through medicare.gov, the government’s official Medicare website.

Does Medicare cover prescriptions?

It is important to remember that Medicare Supplement or Medigap policies do not cover your prescriptions. You will want to look at a Medicare Part D plan to go along with your Medicare Supplement or Medigap policy to offset the potentially high costs of medications.

What is a plan F?

Plan F is a Medicare Supplement plan, also known as a Medigap policy, that is offered by private insurance companies. It pays Medicare costs for you in exchange for a monthly premium. Plan F will pay the following benefits (costs are for 2020 and generally increase each year on January 1): Medicare Part A hospital inpatient costs: ...

Does Plan F have a high deductible?

That means that by choosing a monthly premium that fits your budget, you should not have to worry about large, unexpected medical bills. Plan F also comes in a “high deductible” option. In exchange for a lower monthly premium, you pay an up-front deductible for medical care.

What is the difference between Plan G and Plan F?

Plan G covers the Medicare Part A deductible and coinsurance days for inpatient hospital stays beyond 60 days.

How to choose a Medicare supplement?

Follow the tips below while shopping for a Medicare supplement plan: 1 Pick a plan. There are several Medicare supplement plans to choose from. The extent of coverage can vary by plan. Review your health-related needs to decide on one that’s right for you. 2 Compare policies. Once you’ve decided on a plan, compare the policies offered by different companies, as costs can vary. Medicare’s website has a helpful tool to compare the policies offered in your area. 3 Consider premiums. Providers can set their premiums in different ways. Some premiums are the same for everyone, while others may increase based on your age. 4 Remember high deductible options. Some plans have a high deductible option. These plans often have lower premiums and may be a good choice for someone who doesn’t anticipate a lot of medical expenses.

How many Medicare Supplement Plans are there?

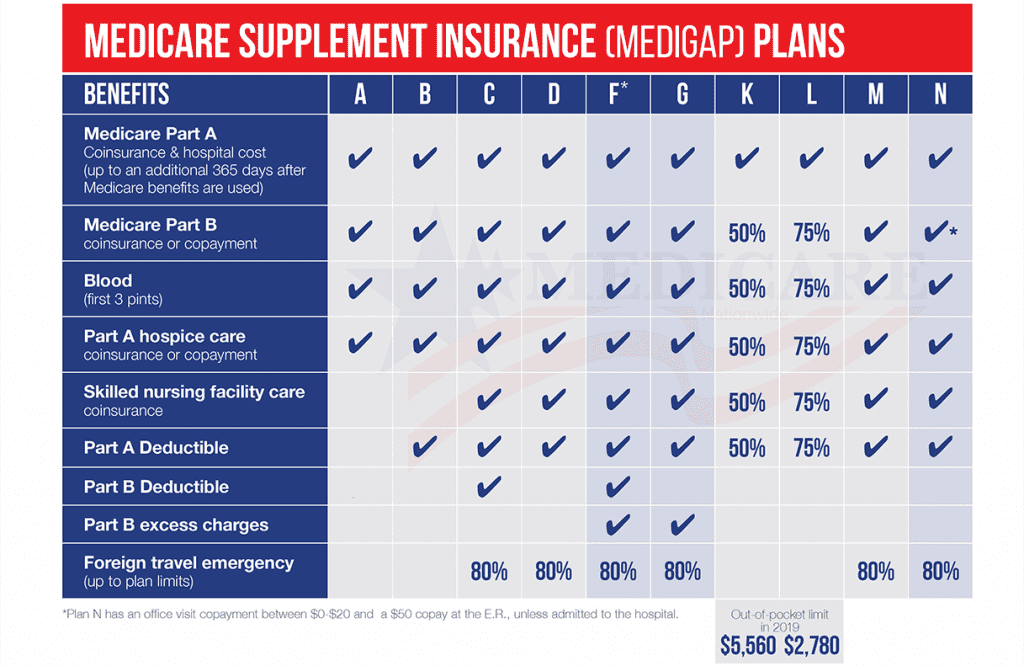

There are 10 different Medicare supplement plans. You’ll see them designated as letters: A through D, F, G, and K through N. Each of these different plans is standardized, meaning the same set of basic benefits needs to be offered.

Is Medigap part of Medicare?

It’s actually one of several Medicare supplement insurance ( Medigap) plans. Medigap comprises several plans you can buy to help pay for things that original Medicare (parts A and B ) doesn’t. Keep reading to find out more about plan F, what it includes, and if it may be a good fit for you.

How much is the deductible for Plan F in 2021?

While monthly premiums for this option may be lower, you must pay a deductible before Plan F begins paying for benefits. For 2021, this deductible is set at $2,370.

What is a plan F?

Plan F is a very comprehensive plan, helping cover expenses that original Medicare doesn’t. This includes your deductibles, coinsurance, and copays when receiving medical care. It even covers a portion of your medical expenses during foreign travel.

Do you have to pay a monthly premium for Medicare?

You’ll have to pay a monthly premium with a Medicare supplement plan. This is in addition to premiums you pay for other parts of Medicare, such as Medicare Part B or Part D. An insurance provider can set their Medicare supplement plan premiums in three different ways: Community rated.

Is Medicare Supplement Plan F still available?

Yes. Medicare Supplement Plan F may eventually leave the market, starting in 2020 – but not for everyone. If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs.

What is the most comprehensive Medicare Supplement?

In most states, the most comprehensive Medicare Supplement insurance plan available will be Plan G. Plan G is similar to Medicare Supplement Plan F, except Plan G does not cover the Part B deductible. (In 2021, the Part B deductible is $203 per year.)

What is the Medicare Access and CHIP Reauthorization Act?

In 2015, Congress passed the Medicare Access and CHIP Reauthorization Act. The act was meant to improve provider payments for covered Medicare services. At the same time, however, Congress knew there’s an increasing strain on the Medicare Trust Fund budget, as more and more people age into Medicare.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F or Part F is the most comprehensive supplemental insurance policy and covers 100% of the major gaps left by Medicare. The reason why many people like Medicare Supplement Plan F is due to the fact that it is hassle-free. There are no claims paperwork to file, and the policy virtually pays everything.

Is Medicare Plan F still available?

Plan F is no longer available to folks who became eligible for Medicare Part A after January 1st, 2020. Those who have Plan F now can keep it forever and they can change to a Plan F with another company if they wish. Although Medicare Plan F is the most comprehensive policy, that means it is also the most expensive as compared with ...

What is Plan F for Medicare?

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are exhausted. Part A Hospice care coinsurance or copayment.

What does Plan F cover?

Plan F also covers the Medicare Part B expenses. Part B covers doctor visits and related charges covered under Medicare for providers. Like Part A, Part B only covers 80% of the Medicare-approved expenses. It leaves the remaining 20% on the Part B participant.

How long does Medicare cover skilled nursing?

Medicare limits this benefit to the first 100 days of a stay in a skilled nursing facility.

What is Plan F?

Plan F covers the Medicare-approved expenses not covered under Medicare Part A (deductibles, coinsurances, and copays). Part A is the hospitalization component of Original Medicare and covers Medicare expenses typically associated with a hospital stay.

What is the 80% travel insurance?

This plan coverage also includes 80% of approved costs associated with foreign travel emergencies, which is vital for the many seniors who enjoy taking cruises or other trips outside the United States. There are plan limits, but this coverage can help offset charges associated with becoming sick or injured while traveling outside of the U.S.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F Coverage is Comprehensive 1 Plan F fully covers both your Part A hospital deductible and your Part B outpatient deductible. 2 It covers all of the 20% that Medicare Part B normally leaves for you to pay. 3 Medicare Plan F covers all Part B excess charges. You will never pay the standard 15% excess charges that doctors under Medicare are allowed to charge for Part B services. 4 Choose any doctor – from over 900,000 physicians in the United States. 5 No referrals required! Medigap plans allow you to see any Medicare specialist whenever you like. You are not required to get a referral from your primary care doctor. 6 Guaranteed renewable. Your coverage can never be canceled due to health conditions or the number of claims you file.

Does Medicare Supplement Plan F replace Part B?

Medigap plans do not replace your Medicare Part B. You must be enrolled in both Part A and Part B first, then you are eligible to enroll in Medicare Supplement Plan F.

What is the most comprehensive Medicare plan?

If you became eligible for Medicare on or after January 1, 2020, you’ll find that Plan G is the most comprehensive Medigap plan available to you. (In recent years, Plan G has been the second most popular Medicare Supplement plan, and you can read more on that below.) A Medigap plan, or Medicare Supplement, pays after Medicare to help cover your ...

Why is Medicare Plan F so popular?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

What happens if you don't have a Supplement?

You would also pay 20% of expensive procedures like surgery because Part B only pays 80%.

What is the best Medigap plan for 2021?

The best Medigap plans in 2021 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no longer available to new enrollees. Get a quote for both and see which ones offer you the best annual savings.

Does Medicare Supplement Insurance cover Part B?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible. Because of this, Plans C and F aren’t available to people newly eligible for Medicare on or after January 1, 2020.

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.