A Medicare Supplement plan, also known as Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What are the benefits of a Medicare supplement plan?

- Non-emergency medical transportation (to and from scheduled healthcare appointments)

- Meal delivery

- Cooking classes designed to improve beneficiaries’ diets

- Air purifiers for the home

- Home carpet cleanings

- Limited home improvements and fixtures that promote safety (like shower rails)

How much will a Medicare supplement insurance plan Save Me?

What is a Medicare Supplement insurance plan? Medicare Supplement (also known as Medigap) insurance plans are offered by private insurance companies. Whether they may save you money, and how much money they might save you, depends on a number of details. Medicare Supplement insurance plans may help you pay for out-of-pocket costs for services covered under Medicare Part A and Part B.

Do I need to consider a Medicare supplement plan?

The purpose of Medicare Supplement Insurance is to cover the cost left by deductibles and coinsurance in Original Medicare, but as full Medicaid coverage should cover the majority of those costs, a Medicare Supplement Insurance policy isn’t necessary. 3 A number of factors influence your coverage eligibility and decisions.

When should I apply for a Medicare supplement plan?

The best time to enroll in a Medicare Supplement plan may be your Medicare Supplement Open Enrollment Period. This period lasts six months and begins the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. For example, your birthday is August 31, 1953, so you turn 65 in 2018.

What is the difference between Medicare and a supplemental plan?

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles.

What is the purpose of Medicare supplemental insurance?

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

What must be included in a Medicare Supplement plan?

Medicare Supplement insurance Plan A covers 100% of four things: Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up. Medicare Part B copayment or coinsurance expenses. The first 3 pints of blood used in a medical procedure.

How much a month is Medicare Supplement?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

Is there a deductible for Medicare supplemental insurance?

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Is there a Medicare supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

What is the difference between plan G and plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the monthly premium for Plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

What part of Medicare is free?

Part APart A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Is Plan F better than Plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

How many Medicare Supplement Plans are there?

These plans cover more than just out-of-pocket costs from Medicare and may provide additional benefits for some people. Currently, 10 Medicare supplement plans are available. These are:

What is Medicare Advantage Plan?

People use Medicare Advantage plans as an alternative to Medicare parts A and B. Private companies sell and administer them, just as they do Medicare supplement plans. They provide bundled plans that may cover more than separate Medicare plans, such as dental or vision care.

What is Medicare Part A and B?

Medicare parts A and B, which would serve as the primary payer, administer their coverage first . Afterward, Medigap coverage takes over to fund the out-of-pocket costs of treatment and any other agreed costs, such as treatment received outside the United States on some Medigap plans.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What does "no" mean in Medicare Supplement?

“Yes” under a plan letter means that it covers 100% of the benefit. “No” under a plan letter means that it does not cover that benefit.

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs. This article explains how Medicare supplement plans work, how to find one, and how to work out which plan is best.

Does Medicare cover all of the costs?

A person can choose to enroll in Medicare parts A and B. However, these may not cover all healthcare costs. People with Medicare will still have to pay different deductibles and coinsurances based on the type of care they receive. Medicare supplement plans can help a person reduce out-of-pocket costs on Medicare parts A and B. ...

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What are Medicare Supplement Plans?

Medicare Supplement plans, also known as Medigap, are supplement insurance plans that work with Original Medicare Part A and Part B.

Who Regulates Medicare Supplement Plans?

Although Medicare Supplements (Medigap) plans are sold by private insurance companies, the federal government (CMS) regulates each plan’s design in terms of coverages offered.

How Does Medicare Supplement Plans Work?

While there are 10 Medigap plans to choose from in all but three states, each plan, although different from the next, works in the same manner. Medicare would pay its share and then the Medicare Supplement Plan would pay its share.

Which Medicare Supplement Plans Provide the Best Coverage?

Having multiple Medigap plans to choose from enables the policy shopper to select a plan that will best meet their individual needs and their individual budget. It’s also important to keep in mind that the Medigap Plan you select will have a monthly premium charge over and above your Medicare Part B premium.

What are High-Deductible Medicare Supplement Plans?

There are two high-deductible Medicare Supplement Plans available. High deductible Plan F and Plan G both have a regular version and a “high-deductible” version. Since the policyholder is agreeing to accept more out-of-pocket expenses for their annual healthcare expenses, the insurance company offers the plan at a lower monthly premium.

What is Medicare Supplement Insurance Plan?

What Is a Medicare Supplement Insurance Plan? A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits. Use the following guide to compare Medicare ...

Which is the most popular Medicare Supplement?

Medigap Plan F Is the Most Popular. Medicare Supplement Insurance Plan F is the most popular Medigap plan, largely because it offers the most comprehensive range of basic benefits. Plan F is the only Medigap plan that covers all nine of the basic Medigap benefits, including the Medicare Part B deductible and Part B excess charges.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When is the best time to buy Medicare Supplement?

The best time to buy a Medicare Supplement Insurance plan is during your Medigap open enrollment period. During your open enrollment period, insurance companies cannot consider any pre-existing conditions when deciding whether or not to offer you a policy. They also cannot charge you more for a Medigap plan based on pre-existing conditions.

Does Medicare Supplement Insurance require coinsurance?

Medicare Supplement Insurance Plans. Medicare Part A and Part B both require deductibles and coinsurance or copays. Medigap plans help beneficiaries fill in these cost "gaps" that can add up to potentially large dollar amounts. The chart below lists the basic benefits offered by each type of Medigap plan. Click here to view enlarged chart.

What is Medicare Supplement?

Medigap insurance, also known as Medicare Supplement, is special private insurance standardized by the Medicare system. It's sold to people with Original Medicare (Parts A and B). In addition to paying deductibles, copayments, and coinsurance, some Medigap plans also cover additional services, or kick in when your Medicare benefits are maxed out.

Does Medicare Advantage cover traditional insurance?

However, Medicare Advantage plans, which are private alternatives to traditional insurance, often do cover these services. So, it’s important to consider which services you need most and compare the costs not only of each plan but of the services they do not cover.

Does Medicare cover everything?

Original Medicare pays for a wide range of services, but it won’t cover everything. Even when something is included in your Medicare policy, you may have to pay a copay or hit a deductible before getting full coverage. Medigap insurance can help fill these gaps, offering you broader insurance coverage.

Does Medigap cover hearing aids?

It’s also worth noting that Medigap policies do not typically cover services like hearing aids or dental care.

Can I get Medigap if I have Medicare Advantage?

In addition, you can’t buy Medigap insurance if you have a Medicare Advantage plan, according to the Centers for Medicare and Medicaid Services.

How does Original Medicare work?

Original Medicare covers most, but not all of the costs for approved health care services and supplies. After you meet your deductible, you pay your share of costs for services and supplies as you get them.

How does Medicare Advantage work?

Medicare Advantage bundles your Part A, Part B, and usually Part D coverage into one plan. Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

Why is Medicare Supplement important?

If you choose the original Medicare option, Medicare supplement plans are important because these plans add an extra element, or boost, to your main coverage by paying for gaps for stand-alone prescription drug plans, employer group health coverage and other retiree benefits. Original Medicare will pay first, followed by the payment by ...

How many Medicare supplement plans are there?

How Medicare supplement insurance plans work with Medicare plans. There are up to 10 standardized plans available – labeled A, B, C, D, F, G, K, L, M and N – that cover anywhere from four to nine of these benefits:

What are the benefits of Medicare?

There are up to 10 standardized plans available – labeled A, B, C, D, F, G, K, L, M and N – that cover anywhere from four to nine of these benefits: 1 Medicare Part A coinsurance for hospital costs (up to an additional 365 days after Medicare benefits are used) 2 Medicare Part B coinsurance, copayment 3 First three pints of blood for a medical procedure 4 Part A hospice care coinsurance or copayment 5 Skilled nursing facility care coinsurance 6 Part A deductible 7 Part B deductible 8 Part B excess charges 9 Foreign travel emergencies

How much does coinsurance cost for hospitalization?

For example, coinsurance for hospitalization costs $335 per day for days 61-90. Beyond day 90, the cost is $670 until a lifetime reserve is met, in which case you must pay the rest of the costs. Keep in mind you must pay your Medicare Part A deductible ($1,340 for 2018) before receiving these benefits. Medicare supplement plans don’t cover routine ...

How long does Medicare cover hospital coinsurance?

Medicare Part A coinsurance for hospital costs (up to an additional 365 days after Medicare benefits are used) Keep in mind, all 10 Medicare supplement plans cover the coinsurance and 100 percent of hospital costs for Medicare Part A, but after that, plans differ in what they cover. For example, only Medicare supplement plans C and F cover ...

Does Medicare Supplement Insurance require a doctor to be listed?

Every Medigap policy must be clearly identified as “Medicare Supplement Insurance.”. Medicare SELECT plans require you to only use doctors and hospitals in provider networks. This is an important factor if your doctor is not listed and you prefer to remain with that doctor’s service.

Do you have to leave Medicare first?

If you have a Medicare Advantage Plan, you must leave it first before your new Medicare supplement (Medigap) policy begins; apply for the Medigap plan first before you leave your other plan. Buy a Medigap policy from an insurance company licensed in your state to sell them.

How does Medicare billing work?

1. Medicare sets a value for everything it covers. Every product and service covered by Medicare is given a value based on what Medicare decides it’s worth.

What does it mean when a provider accepts a Medicare assignment?

“Accepting assignment” means that a doctor or health care provider has agreed to accept the Medicare-approved amount as full payment for their services.

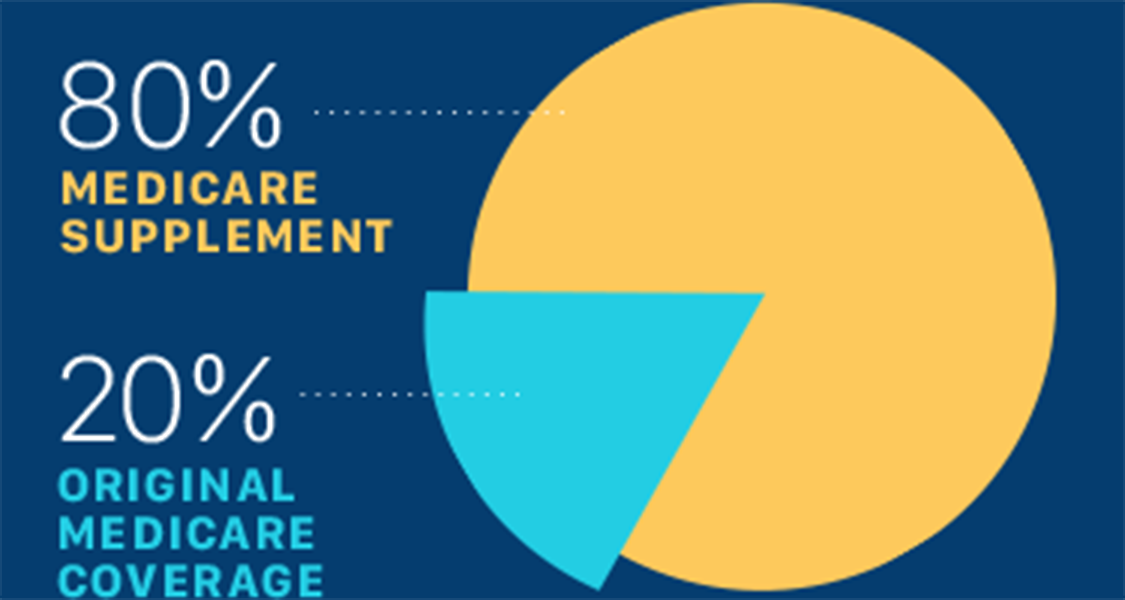

What percentage of Medicare is coinsurance?

For example, the patient is responsible for 20 percent of the Medicare-approved amount while Medicare covers the remaining 80 percent of the cost. A copayment is typically a flat-fee that is charged to the patient.

What happens if a provider doesn't accept Medicare?

If a provider chooses not to accept assignment, they may still treat Medicare patients but will be allowed to charge up to 15 percent more for their product or service. These are known as “excess charges.”. 3.

Does Medicare cover out of pocket expenses?

Some of Medicare’s out-of-pocket expenses are covered partially or in full by Medicare Supplement Insurance. These are optional plans that may be purchased from private insurance companies to help cover some copayments, deductibles, coinsurance and other Medicare out-of-pocket costs.

Is Medicare covered by coinsurance?

Some services are covered in full by Medicare and the patient is left with no financial responsibility. But most products and services require some cost sharing between patient and provider.This cost sharing can come in the form of either coinsurance or copayments. Coinsurance is generally measured in a percentage.