Full Answer

What are the most popular Medicare supplement plans?

Plan B is one notch above the coverage in Plan A. Basic coverage includes Part A coinsurance and hospital costs for up to 365 additional days after Original Medicare benefits have been exhausted. Also, Plan A covers Part B coinsurance or copayments, the first three pints of blood annually, Part A hospice care coinsurance or copayments and skilled nursing facility care …

What is the most popular Medicare supplement insurance?

What Does Medicare Supplement Plan B Cover? Medicare Supplement Plan B offers limited coverage, but it does protect you from the higher costs that you’d be responsible for with just Original Medicare alone. Medicare Supplement Plan B covers the following costs: Medicare Part A coinsurance and hospital costs; Medicare Part B coinsurance or copayment; Blood (first 3 …

What are the benefits of Medicare supplement?

What is Medicare Supplemental Plan B? Medicare includes four main parts: Parts A, B, C, and D. In addition to Original Medicare, many seniors choose to enroll in a Medicare Supplement or Medigap to assist with out-of-pocket expenses not covered by Parts A and B. Medicare Supplement Plan B covers some of the out-of-pocket expenses such as covers copayments, …

Who is the largest Medicare supplement provider?

May 11, 2021 · According to the U.S. government website on Medicare, Medicare Supplement Plan B coverage includes: Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. Part B coinsurance and copayment. The first three pints of transfused blood. Part A hospice care coinsurance or copayment. Part A deductible.

Is Medicare Part B the same as a supplemental plan?

Part B is part of what's called Original Medicare, along with Part A. Plan B refers to Medicare supplement insurance commonly called Medigap. Part A covers hospital bills and Part B, for which a standard premium is paid, covers outpatient care, medical equipment, and other services.

What is the difference between Medicare Plan B and G?

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

Is Medicare Plan B good?

Medigap Plan B may be a good choice for you, but you should carefully review your options for rates for other Medicare Supplement plans before you make your decision. Medigap Plan B isn't offered by all carriers, and it doesn't tend to be a cost-effective choice for most people.

What types of services are covered by Medicare Supplement Plan B?

Part B covers things like:Clinical research.Ambulance services.Durable medical equipment (DME)Mental health. Inpatient. Outpatient. Partial hospitalization.Limited outpatient prescription drugs.

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Does Medicare Plan G have a maximum out of pocket?

No out-of-pocket limit Original Medicare doesn't have an out-of-pocket limit. Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year. If you are interested in an out-of-pocket limit, consider Plan K or Plan L.Dec 12, 2019

Is Medicare Part B worth the cost for federal retirees?

Overall, we see far less expense for retirees in BCBS Basic compared to BCBS Standard, and with Basic there is an additional benefit of a partial Part B premium reimbursement. Medicare Advantage Eligibility—By joining Part B, federal retirees gain access to Medicare Advantage (MA) plans offered by a few FEHB carriers.Nov 14, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Does Medicare Part B pay for prescriptions?

Medicare Part B (Medical Insurance) includes limited drug coverage. It doesn't cover most drugs you get at the pharmacy. You'll need to join a Medicare drug plan or health plan with drug coverage to get Medicare coverage for prescription drugs for most chronic conditions, like high blood pressure.

Which of the following is not covered by Medicare Part B?

does not cover: Routine dental exams, most dental care or dentures. Routine eye exams, eyeglasses or contacts. Hearing aids or related exams or services.

Does Medicare Part B cover dental and vision?

Original Medicare (Medicare Part A and Part B) does not cover routine dental or vision care. There are certain circumstances under which Original Medicare may provide some coverage for dental or vision care in an emergency setting or as part of surgery preparation.Dec 7, 2021

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

How much is Medicare Part B deductible in 2021?

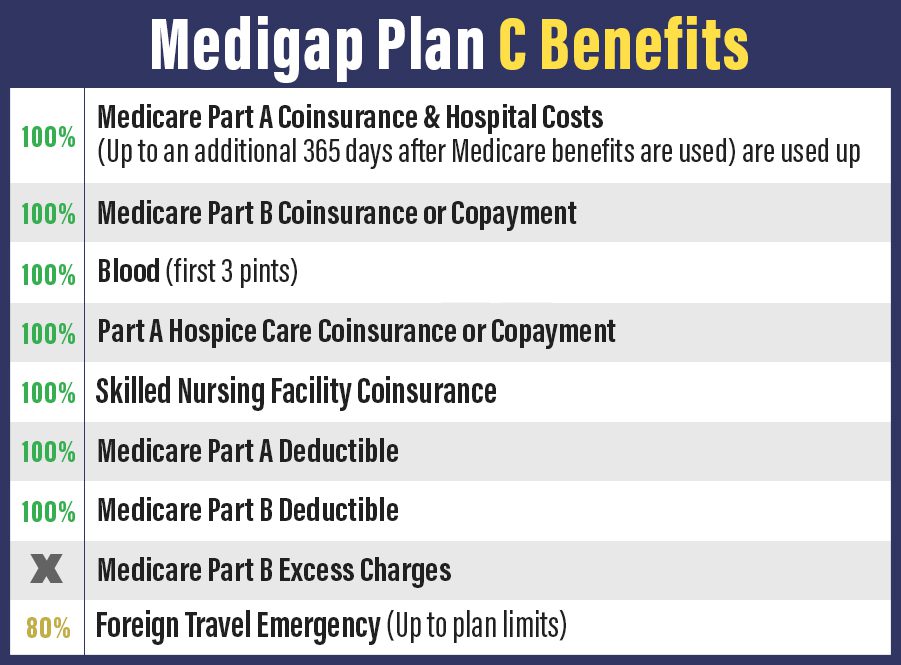

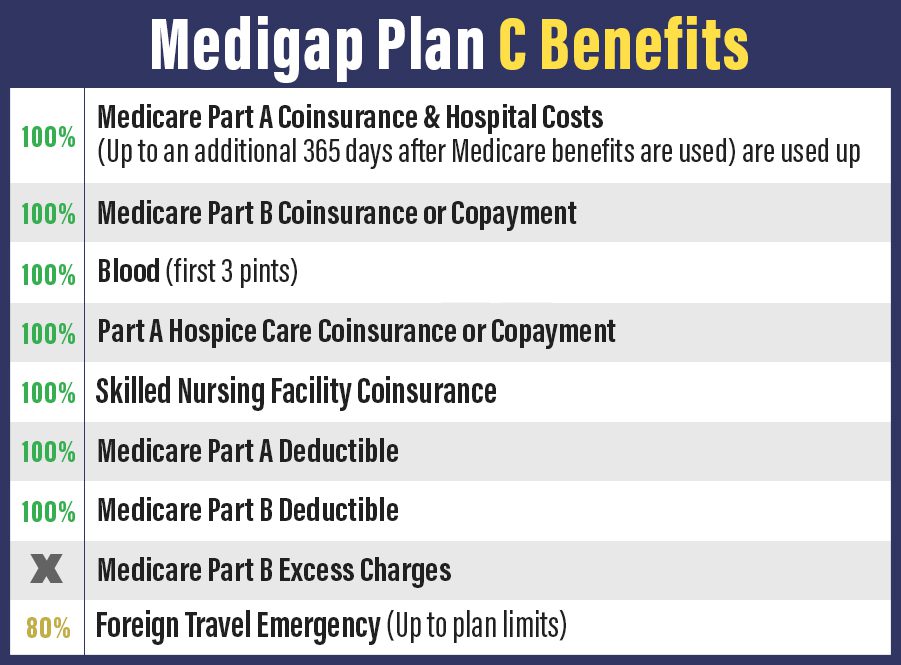

Medicare Part B (outpatient services) deductible, which is $203 per year in 2021. Medicare Part B excess charges. Foreign travel emergency. If you don’t travel outside of the U.S., you may not be concerned with the lack of foreign travel coverage.

How much is Medicare Part A 2021?

Medicare Part A represents your inpatient treatment, and the amount for 2021 is $1,484 per benefit period. A benefit period starts once you haven’t been treated as an inpatient for 60 days in a row. So, if you had no other coverage, you could be responsible for paying for the deductible more than once each year.

Is Medigap Plan B a good plan?

Medigap Plan B may be a good choice for you, but you should carefully review your options for rates for other Medicare Supplement plans before you make your decision. Medigap Plan B isn’t offered by all carriers, and it doesn’t tend to be a cost-effective choice for most people.

What is Medicare Supplement Plan B?

Medicare Supplement Plan B covers some of the out-of-pocket expenses such as covers copayments, deductibles, and coinsurance. Medicare Supplement Plan B may help you pay for expenses accrued from an unexpected procedure or hospitalization.

What is the OEP period for Medicare?

This six-month period is known as the Medigap Open Enrollment Period (OEP). When enrolling in a Medicare Supplement during this period, insurance companies cannot reject enrollment for health reasons. You must also live within the plan’s service area.

What are the parts of Medicare?

Medicare includes four main parts: Parts A, B, C, and D. In addition to Original Medicare, many seniors choose to enroll in a Medicare Supplement or Medigap to assist with out-of-pocket expenses not covered by Parts A and B.

What is Medicare Supplement Plan B?

government website on Medicare, Medicare Supplement Plan B coverage includes: Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. Part B coinsurance and copayment. The first three pints of transfused blood. Part A hospice care coinsurance or copayment.

What is Part B coinsurance?

Part B coinsurance and copayment. The first three pints of transfused blood. Part A hospice care coinsurance or copayment. Part A deductible. Keep in mind that all Medicare Supplement Plan B policies cover the same expenses no matter which company’s plan you choose. The same is true of all the Medigap policies: Those within ...

How long does Medicare pay for skilled nursing?

Original Medicare pays for up to 100 days in such a facility for each benefit period, according to the U.S. government website for Medicare. For the first 20 days you pay no money; for days 21-100, you pay coinsurance of $176 a day. Medigap policies with skilled nursing facility coverage would pay that coinsurance, but Plan B policies will not.

Can you cancel Medigap?

Your coverage can’t be canceled as long as you keep up your premium payments. This is true of all Medigap policies. Companies do not have to offer every Medigap supplement plan, so it might take some shopping around to find a Plan B policy, if that’s what you choose.

Is Medicare Advantage a Medigap?

You also could think about Medicare Advantage plans, which are not Medigap policies. With this coverage, a private provider contracts with the government to cover the usual Part A and Part B services, but also often covers additional services such as prescription drugs and vision care.

Is Medigap Plan B the same as Part B?

Medigap Plan B is just one of the many different Supplements you can purchase to help offset your medical expenses. It is not the same as Part B, which is your outpatient medical coverage that you purchase directly from Social Security. People must have Part B for outpatient coverage, and then they still need a Supplement to help them pay for ...

Does Medicare Supplement Plan B pay for Part A?

Medicare Supplement Plan B, also called Medigap Plan B , offers the same benefits as Plan A. In addition, it will also pay your Part A hospital deductible for you. This is a significant benefit as the Part A deductible is over $1,400, and tends to go up slightly each year.

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

What is Medicare Supplement Plan B?

Plan B offers coverage for the Part A deductible, Part A coinsurance, Part B coinsurance or copayment, and first 3 pints of blood. The coverage chart below lists all the benefits included in Plan B.

What is a Medigap Plan B?

Medigap Plan B is best suited for 1 Those in good health 2 Don’t travel outside the U.S. 3 Looking for lower premiums 4 Are not concerned about out of pocket costs if hospitalized

What is a plan B?

Plan B is a Medicare Supplement policy that helps beneficiaries with healthcare costs. You’ll use the word “plan” when referring to a Medigap plan.

Who is Lindsay Malzone?

Lindsay Malzone. Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What are the benefits of Medicare Supplement?

All Medicare Supplement plans typically cover: 1 Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted 2 Some or all of your Medicare Part B coinsurance 3 Some or all of your Part A hospice coinsurance 4 Some or all of your first three pints of blood

How many Medicare Supplement Plans are there?

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

What is Medicare Part A coinsurance?

Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted. Some or all of your Medicare Part B coinsurance. Some or all of your Part A hospice coinsurance. Some or all of your first three pints of blood. Medicare Supplement Plan A is the most basic of the standardized, ...

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.