Which Medicare supplement plan should I Choose?

Jan 06, 2022 · Medicare Supplement Insurance Plan C is among the more comprehensive Medigap plans available in most states. Medicare Supplement Insurance works alongside Original Medicare (Part A and Part B) to cover some of the program’s out-of-pocket costs, like coinsurance, copayments and deductibles.

How to pick the best Medicare supplement plan?

Aug 03, 2021 · Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, the plan will provide all of your Part A (Hospital Insurance) and Part B (Medical Insurance) coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and …

What is the best and cheapest Medicare supplement insurance?

Jun 23, 2020 · Medicare Supplement Plan C (also known as Medigap Plan C) is an insurance plan you buy to cover the 20% gap in coverage from Original Medicare. Medicare Part C is another label for a Medicare Advantage policy. Medicare Advantage (aka Part C) isn’t a “supplement”, but it another type of insurance policy.

What are the best Medicare plans?

Jan 20, 2020 · Medicare Supplement Insurance, also known as Medigap, is a policy designed to help pay some of the health care costs that Original Medicare doesn’t cover. Medigap Plan C is one such option, and (considering it covers all but one of the available Medicare Supplement benefits) it happens to be one of the most comprehensive.

Is plan C better than plan F?

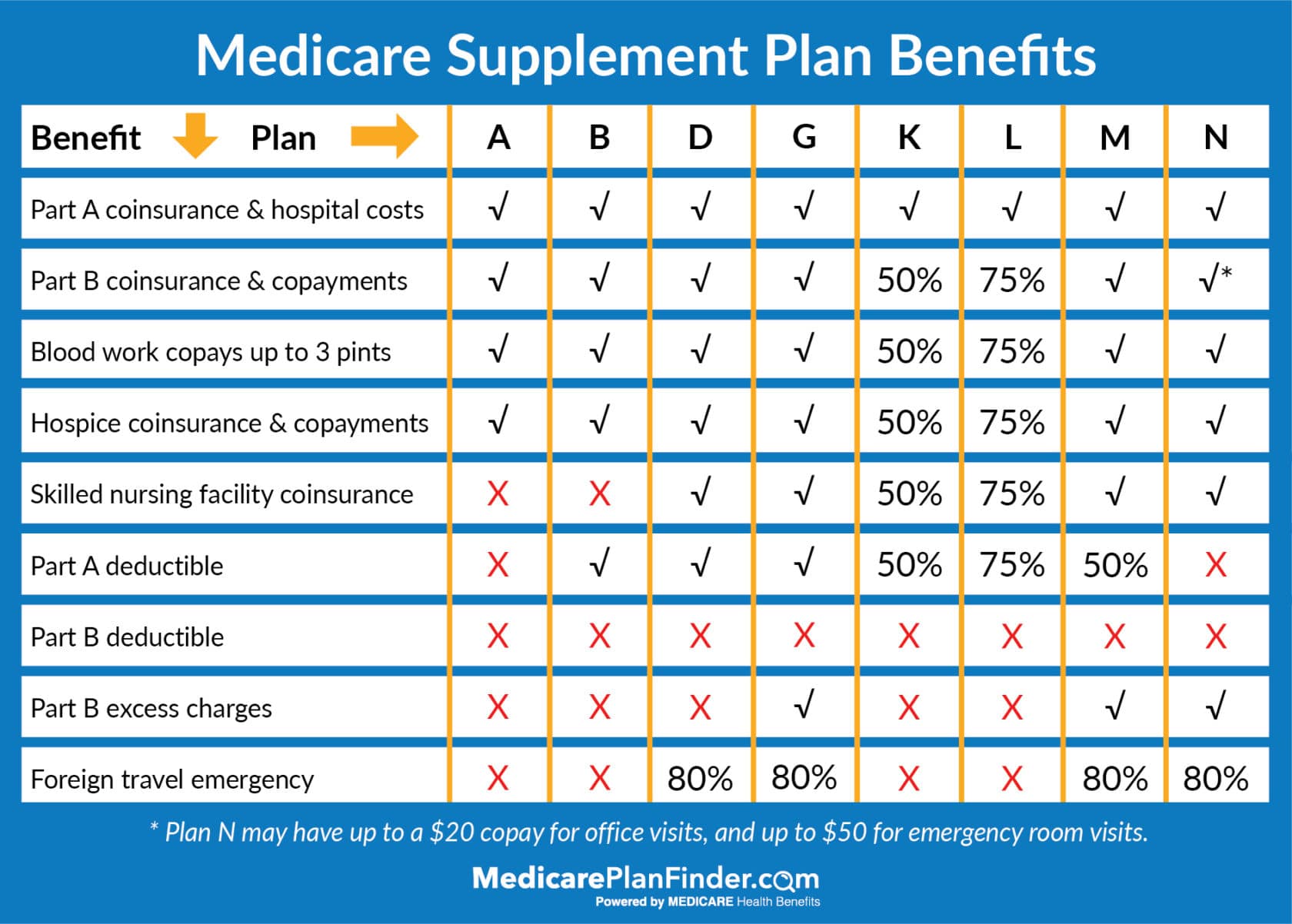

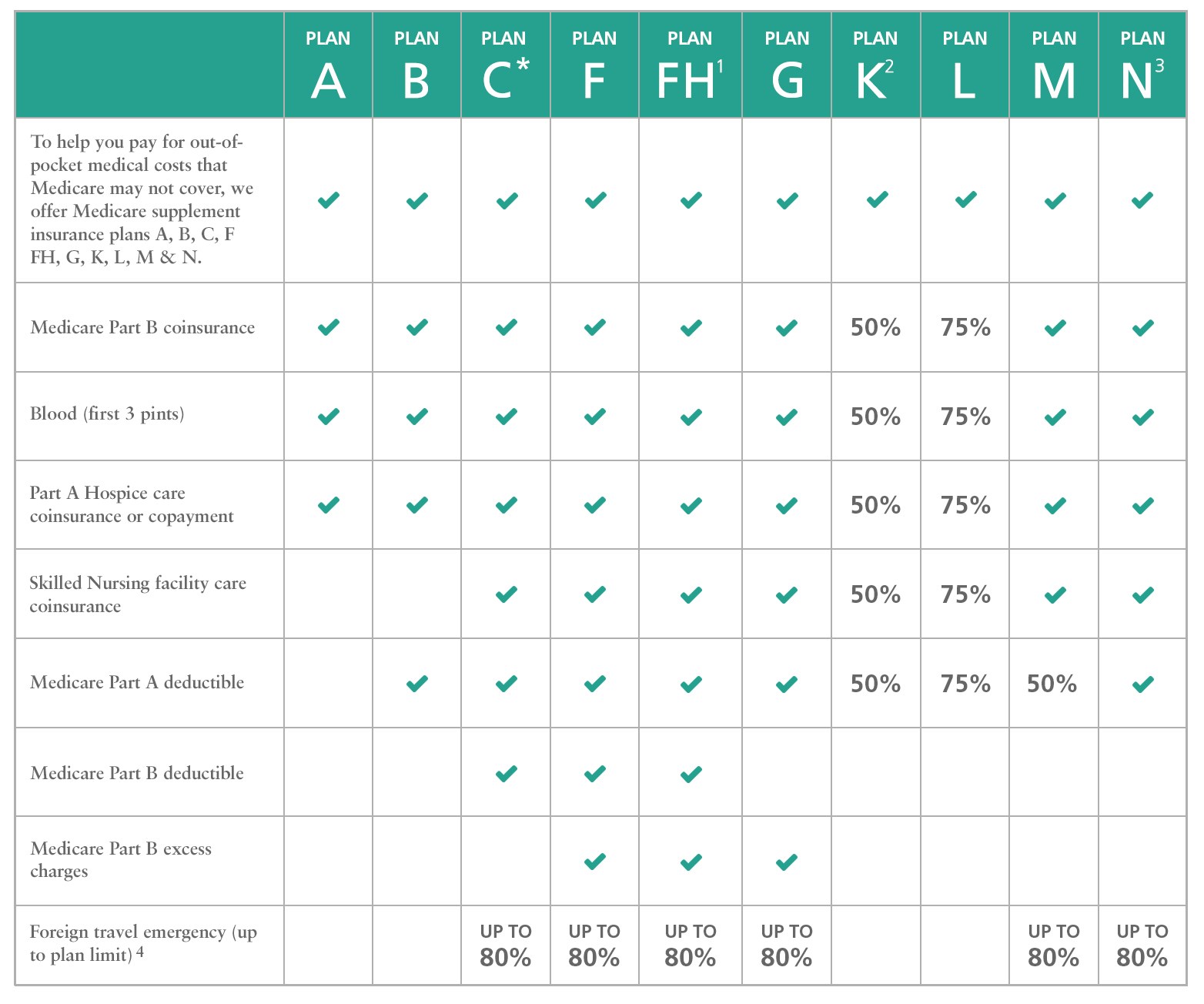

Medicare Supplement (Medigap) insurance Plan C is one of the most comprehensive of the 10 standardized Medigap insurance plans available in most states. Out of the 10, only Medigap Plan F offers more coverage. Medigap Plan C covers most Medicare-approved out-of-pocket expenses.

Is Medicare Part C the same as Medicare supplemental insurance?

These are also called Part C plans. Medicare Supplement insurance policies, also called Medigap, help pay the out-of-pocket expenses not covered by Original Medicare (Part A and B). It is not part of the government's Medicare program, but provides coverage in addition to it.Oct 1, 2021

What does Medicare C provide?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Is plan C better than plan G?

What's the Difference Between Plan C vs. Plan G? If you don't want to enroll in Plan C for one reason or another, then Plan G is the best alternative. The only difference between Plan C and Plan G is coverage for your Part B Deductible.Jan 26, 2022

Does Medicare Part C cover prescriptions?

Unlike Original Medicare, Medicare Part C generally offers coverage for prescription drugs you take at home. The exact prescription drugs that are covered are listed in the plan's formulary. Formularies may vary from plan to plan.

What is the difference between Medicare Part C and Part D?

Medicare part C is called "Medicare Advantage" and gives you additional coverage. Part D gives you prescription drug coverage.

Is Medicare Part C necessary?

Do you need Medicare Part C? These plans are optional, but if you need more than just basic hospital and medical insurance, Medicare Part C might be a good option for you.

How much does Part C Medicare cost?

While the average cost for Medicare Part C is $25 per month, it's possible to get a Medicare Advantage plan with a $0 monthly premium. In fact, according to Kaiser Family Foundation, 60 percent of Medicare Advantage plan enrollees pay no premium for their plan, other than their Medicare Part B premium.Sep 30, 2021

What are some items that Medicare Part C offers that are not covered in Original Medicare?

Some of the items and services Medicare doesn't cover include:Long-Term Care. ... Most dental care.Eye exams related to prescribing glasses.Dentures.Cosmetic surgery.Acupuncture.Hearing aids and exams for fitting them.Routine foot care.

How much does a Plan C cost?

For 2022, the average cost of a Medicare Part C plan with prescription drug coverage is $33 per month....What's the average cost of Medicare Part C?Medicare Part C plan type# of plans offeredAverage monthly costRegional PPO29$805 more rows•Jan 24, 2022

What is the most comprehensive Medicare supplement plan?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

What is Plan C for?

Plan C is a term that refers to an abortion that's performed using medication. It can also be referred to as a medication abortion. The most effective medication abortion is a combination of mifepristone (Mifeprex) and misoprostol (Cytotec) taken over 1 to 2 days.Sep 17, 2021

What is Medicare Supplement Plan C?

Medicare sure makes things confusing don’t they? Let’s break it down into simple terms: 1 Medicare Supplement Plan C (also known as Medigap Plan C) is an insurance plan you buy to cover the 20% gap in coverage from Original Medicare. 2 Medicare Part C is another label for a Medicare Advantage policy. Medicare Advantage (aka Part C) isn’t a “supplement”, but it another type of insurance policy. If fact it’s very different than a Supplement and more like an HMO or PPO with a network of doctors.

Does Medicare Supplemental Insurance Plan C cover everything?

Medicare Supplemental Insurance Plan C is one of the five Medigap policies that offer nearly all of the basic coverage possible. However, it doesn’t cover everything and you will be responsible for some specific types of care. Let’s look closer into Medicare Plan C. When you’re finished, make sure to check out the other Medicare plans available to you below.

Does Medicare Supplement Insurance cover Part B excess?

Medicare Supplement Insurance Plan C does not cover any Medicare Part B excess charges. Your Medicare Part B excess charges are surcharges that your physician may charge above what Original Medicare will reimburse for a procedure. to Original Medicare costs for a procedure. These charges are limited to 15% beyond what Original Medicare will pay.

Can Medicare charge you for an assignment?

You may or may not have heard about “Doctor’s Accepting Assignment.” When Medicare physicians don’t accept assignment rates, they can charge you the excess charge. Be aware that the excess charge is not allowed in some states. For Medicare shoppers who reside in these “no excess charge” states, they’ll notice that their Medigap Plan C works like a Plan F.

What is Medigap Plan C?

Medigap Plan C is designed to provide enrollees with fewer out-of-pocket expenses because it covers a portion of the remaining balance of hospital or doctor bills not covered by Original Medicare (Parts A and B), such as Medicare deductibles, copayments, and coinsurance.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as Medigap, is a policy designed to help pay some of the health care costs that Original Medicare doesn’t cover. Medigap Plan C is one such option, and (considering it covers all but one of the available Medicare Supplement benefits) it happens to be one of the most comprehensive.

What is Medicare Part A deductible?

At its most basic level, this plan specifically covers the following costs and benefits: Medicare Part A deductible. Part A hospital and coinsurance costs (up to an additional 365 days after Medicare benefits are exhausted) Part A hospice care copayment or coinsurance. Part B deductible. Part B copayments and coinsurance.

When to buy Medigap insurance?

The ideal time to purchase any Medigap policy is during your open enrollment period, which is a six-month period that begins the month you turn 65 and enroll in Medicare Part B. During this time period, insurance companies cannot decline coverage, even if you have pre-existing conditions or are in poor health.

What is excess charge in Medicare?

If you have Original Medicare, and the amount a health care provider is legally allowed to charge is greater than the Medicare-approved amount, the difference is called an excess charge. With Plan F, excess charges will be taken care of, while with Plan C they become the beneficiary’s responsibility.

Does Medigap Plan C make a difference?

Medigap Plan C can make a substantial difference in out-of-pocket costs and coverage. If any of the following scenarios apply to you, it’s worth considering Plan C supplemental coverage:

Is Charlie on Medicare?

Charlie has been eligible for Medicare for a few years, but he's just now retiring at age 71 and enrolling in Medicare for the first time. He plans to spend much of his free time traveling the world, so coverage while abroad is at the top of his needs list.

What is Medicare Supplement?

Medicare Supplement (Medigap) plans are offered by private insurance companies and can help you pay for out-of-pocket costs for services covered under Original Medicare (Medicare Part A and Medicare Part B).

What happens if a doctor charges 115% of the amount Medicare allowed?

For example, if a doctor charges 115% of the amount Medicare allowed amount for a procedure, you would be responsible for the remaining 15% left after the Medicare reimbursement amount is subtracted. Because Medicare Supplement Plan C does not offer coverage for the 15% excess charge, you would have to pay for it yourself.

Does Medicare Supplement cover foreign travel?

Foreign travel emergency coverage (up to plan limits) Please note that Medicare Supplement (Medigap) Plan C does not cover Medicare Part B excess charges. Medicare Part B excess charges are provider expenses that exceed Medicare’s allowed payment for the service with the difference being charged to the patient.

Is Medicare Supplement Plan C phased out?

Medicare Supplement Plan C is being phased out. Medicare Supplement Plan C, along with Plan F, is not available to people who qualified for Medicare January 1, 2020 or later. If you already have Plan C or Plan F, you don’t have to give it up. If you qualified for Medicare before the end of 2019, you might be able to buy Plan C (or Plan F).