What are the basic benefits in a Medicare supplement plan?

Nov 07, 2019 · Here’s an overview of what Medicare Supplement Plan F may cover and what your costs may be, as well as details on important changes related to this plan. Medicare Supplement Plan F benefits. As mentioned, Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings (Plans A-N; Plans E, H, I, and J are no longer sold). …

Is plan F a viable Medicare supplement option?

Sep 07, 2021 · Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage. However, Medicare Plan F was discontinued as of Jan. 1, 2020.

When should I apply for a Medicare supplement plan?

Apr 08, 2022 · The most comprehensive Medicare Supplement plan is called Plan F. 100% of your Medicare cost-sharing is covered by Medicare Supplement Plan F, so you don’t have to pay out-of-pocket expenses. What plan G does not cover? Dental care and other services that are not covered by Original Medicare are not covered by the Medigap Plan G.

Which Medicare supplement plan should I Choose?

Mar 12, 2021 · Medicare Supplement Plan F is also referred to as Medigap Plan F. It is a supplemental policy that you can buy from a private insurance company. It is only available to Original Medicare beneficiaries who want the additional insurance coverage needed to help pay for their share of the costs.

See more

Dec 16, 2021 · Medicare Supplement Plan F is the most comprehensive private insurance policy available to go with Medicare Part A and Part B. It pays the out-of-pocket costs associated with Parts A and B — including deductibles and the 20% coinsurance after the Part B deductible, and more. In addition to covering your out-of-pocket costs, Plan F travels well.

What is Medicare Plan F coverage?

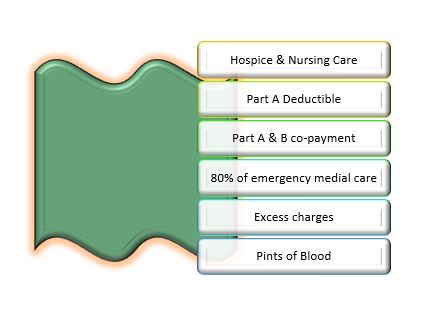

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are exhausted. Part A Hospice care coinsurance or copayment.

What are the benefits of Plan F?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.Aug 26, 2021

Who qualifies for Medicare Part F?

Who Can Enroll in Plan F? Any Medicare beneficiary who was Medicare-eligible prior to January 1, 2020, can enroll in Plan F. If you are within the first six months of having enrolled in Medicare Part B, you are able to enroll in Plan F under the guarantee issue period.

Why are they doing away with Medicare Plan F?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

Does Plan F have a deductible?

You may purchase this plan directly from health insurance providers during the Medicare open enrollment period. Like other health insurance policies, premiums for Plan F are tax-deductible.3 days ago

Has Medicare Plan F been discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.Nov 23, 2021

Does Medicare Part F cover prescriptions?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.Dec 15, 2020

Does Medicare Plan F cover deductible?

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Can you switch from Plan F to Plan G in 2021?

Can't I just move from a Medigap Plan F to a Plan G with the same insurance plan? Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch.Jan 14, 2022

Can I switch from Plan N to Plan F?

Medicare Supplement Plan N's coverage is very similar to Plan F's, and you can use your Plan N anywhere that you can use your Plan F.

Are all Medigap Plan F policies the same?

Remember, all Plan F policies offer the exact same benefits. This is true no matter where you buy the plan. Different insurance companies may charge different premiums, deductibles, copayments or coinsurance for it, but they can't change its coverage.Nov 11, 2020

What is the difference between Plan F and Plan F high deductible?

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium. As a reminder, your...

Does Plan F cover dental?

Original Medicare doesn’t cover routine dental care, like cleanings or extractions, and there are no supplement plans that fill the gap. If you wan...

Is there an alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers,...

Why is Medicare Plan F being discontinued?

Congress passed “The Medicare Access and CHIP Reauthorization Act of 2015”, also known as MACRA, as a way to control Medicare spending. As a result...

Who qualifies for Medicare Part F?

Part F (Medicare Supplement Plan F) is only available to people who became eligible for Medicare before January 1, 2020. If your 65th birthday came...

Is Medicare Plan G Better Than Plan F?

Medicare Supplement Plan F and Plan G are nearly identical. Technically, Plan F is better because it offers first-dollar coverage. However, the one...

What is the Best Medicare Supplement Insurance Plan?

For some, the best means getting the most coverage. Medigap Plan F offers the most coverage possible. It covers ALL the cost gaps in Original Medic...

What is a Medigap Plan F?

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage.

What does Medicare Supplement Insurance Plan F cover?

Medicare Supplement Plan F covers costs that Medicare doesn’t cover, says Laura Decker, co-founder and president of the Employee Benefits Division at SSGI, a Maryland-based employee benefits insurance agency.

What doesn't Medicare Supplement Plan F cover?

Medicare Plan F won't cover any services not covered under Original Medicare.

How much does Medicare Part F cost?

The cost of Medicare Plan F depends on a few factors, including your age.

Medicare supplement plans comparison

Medicare Plan F is no longer available for purchase. However, several other Medigap supplement plans can help cover the out-of-pocket costs associated with Original Medicare.

Frequently Asked Questions

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium.

When will Medicare Supplement Plan F be available?

As a result, anybody who becomes eligible for Medicare on or after 1 January 2020 will not be able to purchase a Medicare Supplement Plan F policy.

Which is better, Medicare Supplement Plan F or G?

Medicare Supplement Plan F and Plan G are nearly identical. Technically, Plan F is better because it offers first-dollar coverage. However, the one cost that Plan G does not cover, the Part B deductible, is often less than the annualized premium difference between the two plans.

What is Medicare Supplement Plan C?

Medicare Supplement Plan C, also called Medigap Plan C, is one of the most comprehensive of the 10 standardized supplemental Medicare plans available in most states. In fact, only Medicare Plan F offers more coverage.... , E, F, H, I, and J are no longer available to new Medicare beneficiaries.

How does Medigap work?

With a Medigap plan, you pay for most of your medical services in advance through your monthly premiums. A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ...

What is Medicare 2021?

March 12, 2021. The federal Medicare program. Medicare is a federal health insurance program for people ages 65 and older and people with certain disabilities.... is a series of lettered (A, B, C, and D) health insurance programs available to people, age 65 and older, and certain adults with qualifying disabilities. Medicare Part A.

How much does Medicare Plan F cost?

The price of a Medicare Plan F policy is determined based on your age, location, gender, and use of tobacco. National averages are around $300 per month, but in many areas, rates start as low as $125 per month. For the high deductible version, you may pay as little as $68.

What is Medicare Part B excess charge?

A Medicare Part B excess charge is the difference between a health care provider’s actual charge and Medicare’s approved amount for payment. ... . These occur when your doctor or specialist does not accept the standard Medicare payment for a service.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F is the most comprehensive private insurance policy available to go with Medicare Part A and Part B. It pays the out-of-pocket costs associated with Parts A and B — including deductibles and the 20% coinsurance after the Part B deductible, and more. In addition to covering your out-of-pocket costs, Plan F travels well.

How much does Plan F pay for Medicare?

Plan F will pay the following benefits (costs are for 2020 and generally increase each year on January 1): Deductible for days 1-60 — $1,408 per benefit period. Coinsurance for days 61-90 — $352 per day of each benefit period.

What is Plan N?

Plan N is another option that has broad coverage. You can expect to pay the Medicare Part B deductible and the excess charges with Plan N, as well as copayments for doctors’ visits and emergency room visits . The plan will pay other covered services like the Part A deductible and daily coinsurance costs as well as the Part B 20% coinsurance.

What is the difference between Plan G and Plan F?

Plan G covers the Medicare Part A deductible and coinsurance days for inpatient hospital stays beyond 60 days.

How much is coinsurance for 61-90?

Coinsurance for days 61-90 — $352 per day of each benefit period. Days 91 and beyond — $704 coinsurance for each “lifetime reserve day.”. Up to an additional 365 days beyond lifetime reserve days. First three pints of blood — Medicare pays for the fourth and beyond.

How much is the 2020 Medicare deductible?

In 2020, the deductible is set at $2,340 and premiums range from $44 to $194, based on a search through medicare.gov, the government’s official Medicare website.

What is Medicare Part B excess?

Medicare Part B excess charges — up to 15% of additional doctor’s charges. This is not an exhaustive list, so be sure to review plan documents and Summary of Benefits to understand all of the coverage you have available under Plan F.

What Is Medicare Supplement Insurance?

Medicare supplement plans are private health insurance plans that supplement Original Medicare.

What Is Medicare Supplement Plan F?

First, the bad news, Plan F has been phased out for new enrollees as of 2020. This is due to new legislation that no longer allows Medicare Supplement Insurance plans to cover your Part B deductible ($203 in 2021).

Frequently Asked Questions

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance (including Part B deductibles), which means you pay nothing out of pocket throughout the year.

Conclusion

We hope you found this overview helpful! If you have a question we did not cover, however, don’t hesitate to leave a comment or send us an email at [email protected]. We’ll be sure to get back to you within 24 hours.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Why is Medicare Plan F so popular?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

What is the most comprehensive Medicare plan?

If you became eligible for Medicare on or after January 1, 2020, you’ll find that Plan G is the most comprehensive Medigap plan available to you. (In recent years, Plan G has been the second most popular Medicare Supplement plan, and you can read more on that below.) A Medigap plan, or Medicare Supplement, pays after Medicare to help cover your ...

What is the best Medigap plan for 2021?

The best Medigap plans in 2021 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no longer available to new enrollees. Get a quote for both and see which ones offer you the best annual savings.

What happens if you don't have a Supplement?

You would also pay 20% of expensive procedures like surgery because Part B only pays 80%.

How much does it cost to have Gracie's surgery?

The total cost for Gracie’s surgery, hospital stay and follow-up care is $70,000.

Is Medicare Supplement Plan F the #1 seller?

This post has been updated for 2021. Medicare Supplement Plan F has also been the #1 seller with Baby Boomers for many years. According to a report from America’s Health Insurance professionals in 2016, about 57% of all Medigap policies in force were a premium Medicare Plan F policy.

What is Plan F for Medicare?

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are exhausted. Part A Hospice care coinsurance or copayment.

What does Plan F cover?

Plan F also covers the Medicare Part B expenses. Part B covers doctor visits and related charges covered under Medicare for providers. Like Part A, Part B only covers 80% of the Medicare-approved expenses. It leaves the remaining 20% on the Part B participant.

What is Plan F?

Plan F covers the Medicare-approved expenses not covered under Medicare Part A (deductibles, coinsurances, and copays). Part A is the hospitalization component of Original Medicare and covers Medicare expenses typically associated with a hospital stay.

How long does Medicare cover skilled nursing?

Medicare limits this benefit to the first 100 days of a stay in a skilled nursing facility.

Why is Plan F standardized?

They did this with the specific goal of making shopping for a plan more manageable. No matter which company provides Plan F, they all must pay for Medicare approved expenses.

What is the 80% travel insurance?

This plan coverage also includes 80% of approved costs associated with foreign travel emergencies, which is vital for the many seniors who enjoy taking cruises or other trips outside the United States. There are plan limits, but this coverage can help offset charges associated with becoming sick or injured while traveling outside of the U.S.

Does Plan F cover Medicare Part B?

It leaves the remaining 20% on the Part B participant. Plan F covers Medicare Part B approved services at the doctor’s office, such as: Plan F is one of only two Medicare Supplement plans that cover the Medicare Part B excess charges (the other being Plan G).