How much is Medicare supplement plan F?

Medicare Supplement Plan F: changes in 2020 Beginning January 1, 2020, Medicare Supplement plans that cover the Part B deductible are no longer offered to new Medicare enrollees. This applies whether you qualified for Medicare because of age, end-stage renal disease, or disability.

Who is eligible for Medicare Plan F?

Nov 07, 2019 · Changes to Medicare Supplement Plan F. It’s worth noting that Medicare Supplement Plan F may not be available to those new to Medicare. Starting in 2020, Medicare Supplement plans that cover the Part B deductible (Plan F and Plan C) are being gradually discontinued. If you qualify for Medicare before January 1, 2020: You may be able to buy …

How much is plan F?

Sep 07, 2021 · Medicare Supplement Plan F is a Medigap policy that’s no longer available to new Medicare members, but Original Medicare beneficiaries who were eligible before 2020 may be able to get a plan. Medicare is one of the most comprehensive health insurance plans available, but there are costs that you have to pay out-of-pocket.

Is Medicare supplement plan F the best?

Medicare Supplement Plan F 2020. Medicare Supplement F was once a popular health insurance plan from Medicare. It covers supplemental expenses to make it the most beneficial policy for many seniors. But its price tag was discouraging and most seniors could not afford it. For that reason, Medicare ended Supplement Plan F 2020.

What is Medicare Part F supplemental insurance?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but it's no longer available to most new Medicare enrollees.Feb 1, 2022

What is replacing Medicare Plan F?

No plan completely replaces Medicare Part F, but the closest available is Medicare Supplement Plan G. Like Plan F, Plan G covers 100% of many benefits, including: Part A coinsurance and hospital costs.

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

What are the benefits of Plan F?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.Aug 26, 2021

Who is eligible for Plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.Oct 1, 2021

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Will Plan F be grandfathered?

If you enrolled in Plan F before 2020, you will be “grandfathered” into the plan. This gives you the choice to keep the plan past 2020.

What is the most popular Medigap plan for 2021?

Medigap Plans F and G are the most popular Medicare Supplement plans in 2021.Oct 6, 2021

Does Plan F cover drugs?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.Dec 15, 2020

Does Plan F have a deductible?

You may purchase this plan directly from health insurance providers during the Medicare open enrollment period. Like other health insurance policies, premiums for Plan F are tax-deductible.Apr 8, 2022

Has Medicare Plan F been discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.Nov 23, 2021

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

What is Medicare Supplement Plan F?

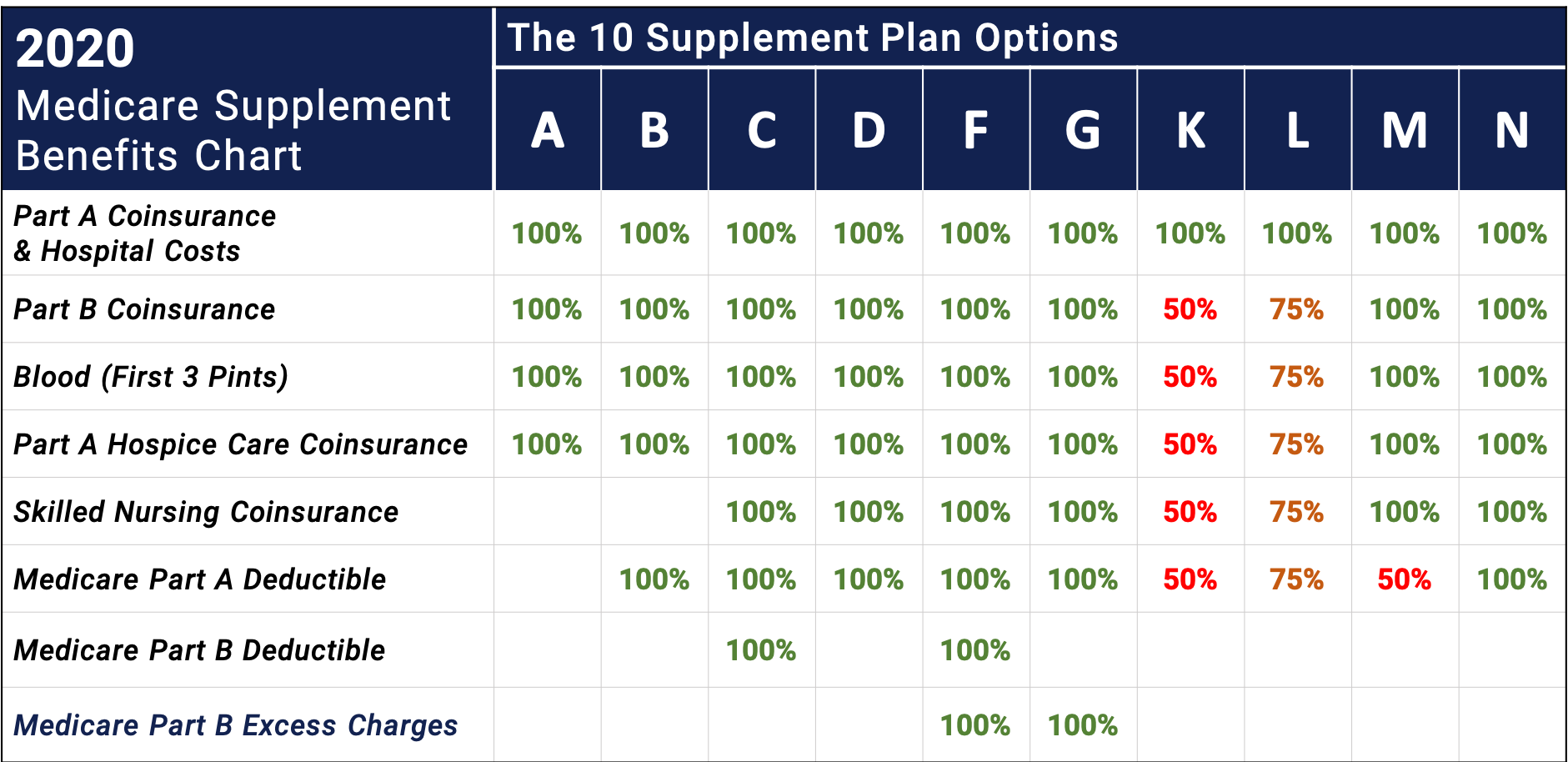

Medicare Supplement (Medigap) plans may help with certain out-of-pocket health-care costs that Original Medicare doesn’t pay for, such as deductibles, copayments, and coinsurance. Of the 10 standardized plans that may be available in most states, Medicare Supplement Plan F offers the most comprehensive coverage.

How much is Medicare deductible for 2017?

In 2017, the deductible is $2,200 (note that this amount may change from year to year).

When will Medicare stop covering Part B?

If you qualify for Medicare before January 1, 2020: You may be able to buy Medicare Supplement Plan F (or Plan C). You can typically keep your existing Plan F or Plan C. You can talk to your insurance company about how ...

Is Medicare Supplement Plan F the most comprehensive?

Because Medicare Supplement Plan F offers the most comprehensive coverage of the standardized lettered plans offered in most states, premium costs tend to be higher than other plans. Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan.

Medicare Supplement Plan F 2020

Medicare Supplement F was once a popular health insurance plan from Medicare. It covers supplemental expenses to make it the most beneficial policy for many seniors. But its price tag was discouraging and most seniors could not afford it.

Where is Plan F Now

This type of supplement is still being offered but only to those who have already registered before Medicare has terminated it. When you visit an insurance company’s website, you will not find any information about this supplement because of its discontinued status. It has been this way for a long time now.

Coverage of Plan F

Most seniors are not aware of how this full-coverage plan works. Plan F works to pay all supplemental expenses, like deductible to Part A, copayment and coinsurance. This policy can also pay for deductible of Part B, copayment and other expenses.

What is the Cost of Plan F

Medicare’s decision to stop selling it was for a good reason. The price tag is higher now than it was before. The reason for this is that insurers are free to charge their clients high fees for this full coverage.

What is the Medicare Supplement Plan F?

First three pints of blood (per calendar year). Medicare Supplement Plan F also provides coverage for foreign travel emergencies. After a $250 deductible, Plan F covers 80% of the cost of medical services up to $50,000.

What to do if you are new to Medicare?

If you are new to Medicare and are wondering what your supplement options are, conducting your own research, having all the facts, and recognizing what your needs are before enrolling can go a long way in determining the type of coverage that is best for you.

How much is Medicare Part A deductible?

Medicare Part A deductible ($1,408). Medicare Part B deductible ($198). Hospital stays for up to 365 days per year after Original Medicare benefits run out. Stays of up to 100 days per year in a skilled nursing facility. Part B coinsurance (the 20% of Part B costs that Original Medicare doesn't cover).

Does Plan G cover Part B?

If your goal is to reduce your overall costs, premiums for Plan G tend to be lower than the premiums for Plan F, so while Plan G won't cover your Part B deductible, you will likely still save money. If you are like most people over the age of 65, Medicare coverage is essential.

Does Medicare cover out of pocket medical bills?

But even if Medicare covers a good portion of your healthcare costs, you are still responsible for out-of-pocket payments like premiums, deductibles, co-pays, and coinsurance. In the event of an emergency — or even routine care — these costs could quickly add up.

Is Medigap Plan F the same as Plan G?

While benefits and costs vary by standardized Medicare Supplement plan, there is one that is nearly identical to Plan F: Plan G. With the information provided below, you will find everything you need to know about Medigap Plan F, alternative options to Plan F, ...

Does Medicare cover Part B deductible?

Congress' rationale for this is that by requiring Medicare beneficiaries to pay their own deductibles, it will curb overuse of services that are not deemed to be medically necessary. Three Medicare Supplement plans currently cover the Part B deductible: Plan C, Plan F, and the high deductible version of Plan F.

What is the most comprehensive Medicare Supplement?

In most states, the most comprehensive Medicare Supplement insurance plan available will be Plan G. Plan G is similar to Medicare Supplement Plan F, except Plan G does not cover the Part B deductible. (In 2021, the Part B deductible is $203 per year.)

What is the Medicare Access and CHIP Reauthorization Act?

In 2015, Congress passed the Medicare Access and CHIP Reauthorization Act. The act was meant to improve provider payments for covered Medicare services. At the same time, however, Congress knew there’s an increasing strain on the Medicare Trust Fund budget, as more and more people age into Medicare.

Is Medicare Supplement Plan F still available?

Yes. Medicare Supplement Plan F may eventually leave the market, starting in 2020 – but not for everyone. If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.