Which Medicare supplement plan should I Choose?

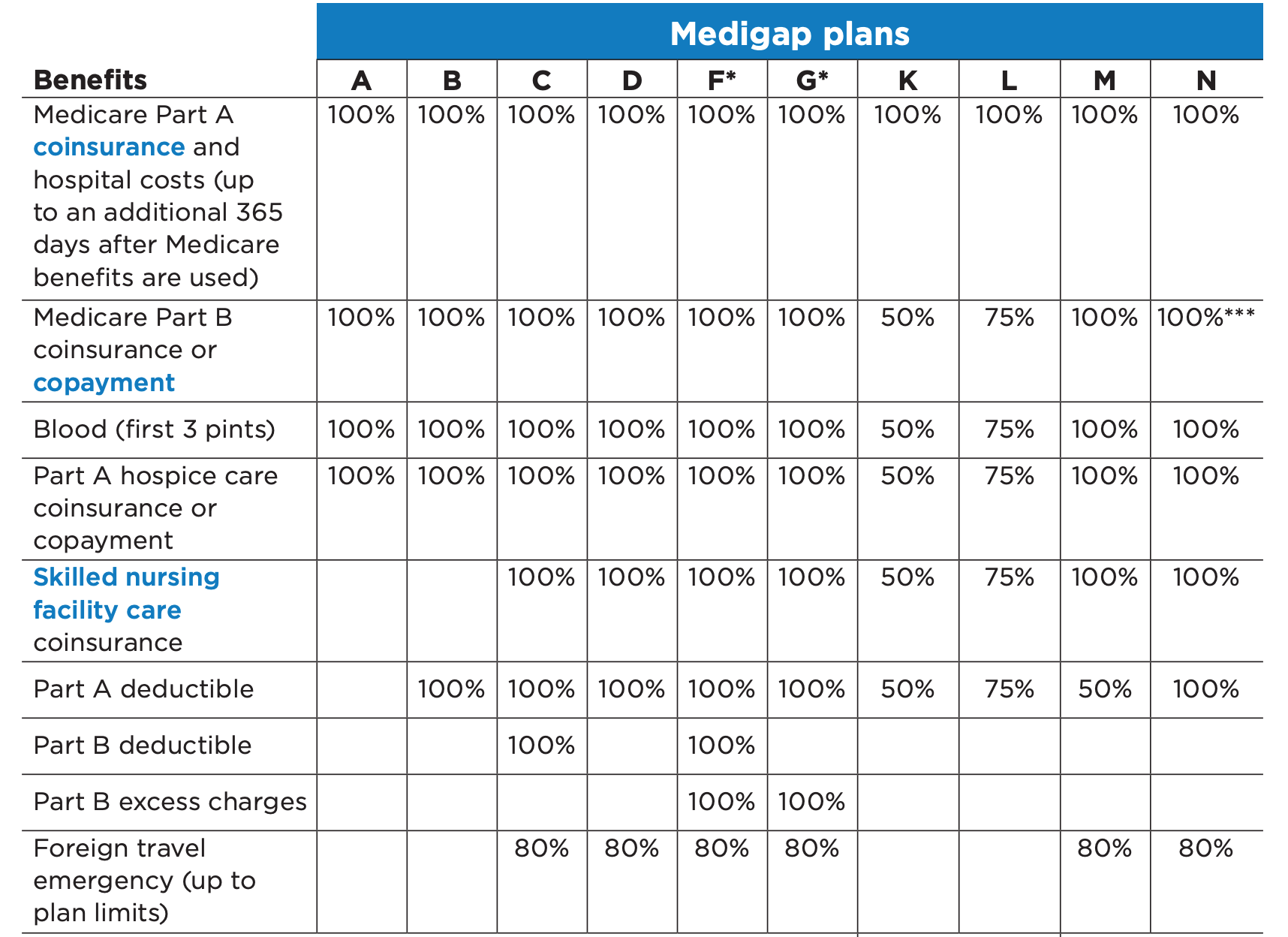

Some people also refer to these plans as Medigap. As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

What is a high deductible F plan Medicare supplement?

What is a high deductible supplemental Medicare plan? A deductible is the amount you pay out of pocket before your insurance plan kicks in. A high deductible plan is a plan that has a higher deductible than most other plans, meaning you pay more out of pocket up front. I know what you are thinking: why on Earth would this be a good thing?

What is the best Medicare supplement?

Medicare.gov, describes a five star plan as "excellent" saying that the rating system "help you compare plans based on quality and performance." The ratings for plans are completed each year and can very as new plans become available. Those who select a ...

What does plan HDF mean?

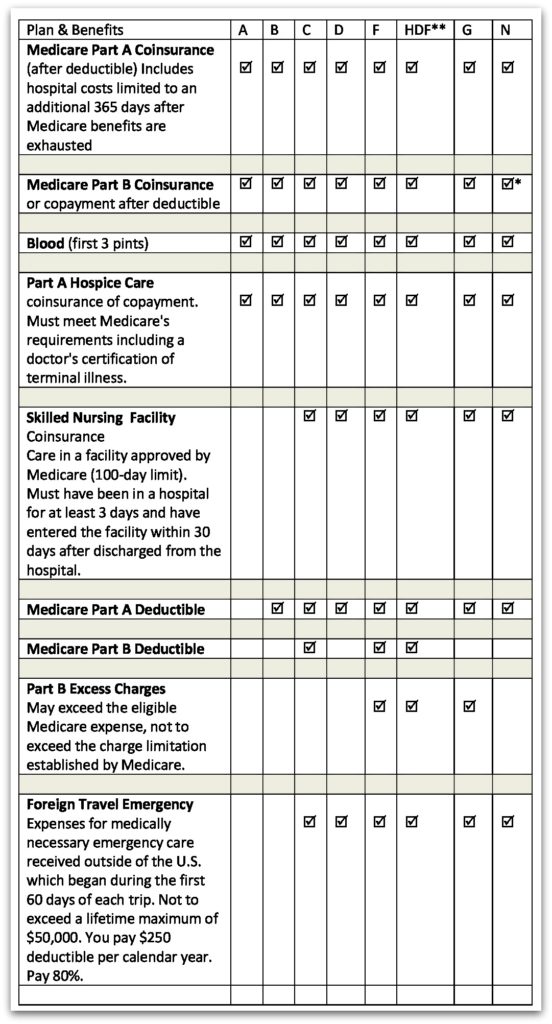

It's a Medicare Supplement Plan F policy that provides all the features and benefits of a standard Plan F, but at a substantially lower premium. A calendar-year deductible, set by the federal government, applies.

What is Medicare Supplement HD plan F?

Plan F provides the most comprehensive coverage of any Medicare Supplement plan. High deductible Plan F offers similar coverage but requires you to pay out-of-pocket before your carrier pays for your healthcare. Plan F is only available if you qualified for Medicare before January 1, 2020.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the difference between plan F and high deductible Plan F?

The only difference in plan details is that High Deductible Plan F requires you to meet a deductible before it begins covering you ($2,490 in 2022), whereas Plan F provides coverage immediately.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Is Medicare Part G better than Part F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Which Medicare Supplement plan has the highest level of coverage?

Plan FPlan F premiums are usually the highest of all Medicare Supplement plans. This makes sense because it offers the highest level of coverage. Medicare Supplement costs vary based on a number of factors, including your age, sex, smoking status, and even your ZIP code.

Who is the largest Medicare Supplement provider?

UnitedHealthCareAARP/United Health Group has the largest number of Medicare Supplement customers in the country, covering 43 million people in all 50 states and most U.S. territories. AARP licenses its name to insurer UnitedHealthCare, which helps make these policies so popular.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

Who is eligible for high deductible plan G?

High deductible G is available to individuals who are new to Medicare on or after 1/1/2020. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020.

Is Medigap plan F high deductible going away?

Medicare Plan F has not been discontinued, but it is only available for people who were eligible for Medicare before Jan 1, 2020. If you are currently enrolled in Plan F, your enrollment remains active unless you choose a different plan or fail to pay your premiums.

What is the advantage of a high deductible Medigap plan?

A high-deductible Medigap plan makes more sense than a standard version if the amount you spend to meet the deductible and premiums are less expensive than the premiums of a standard insurance policy.

What is the lowest cost Medicare Supplement?

Medicare Supplement High Deductible Plan F is the least expensive Medigap plan with regard to monthly premiums. Once the plan's $2,340 (in 2020) deductible is met, the plan is identical to Plan F. This means there are virtually no out-of-pocket medical expenses after the deductible is met.

What happens after a high deductible plan is met?

After the deductible is met, High Deductible Plan F pays for virtually all Medicare-approved expenses. While meeting the plan deductible, Original Medicare continues to pay its share (generally 80% of medical expenses). .

Plan F Recap

We’re back with the Dynamic Duo with me, Allie Shipman, and my partner John Shinn. Now the last couple of videos we talked about Medicare supplements plan F, plan G, and plan N. Today, we’re going to talk about another plan – a very popular plan called the high deductible F plan or HDF.

High Deductible F Plan

Now, when we talk about the high deductible F plan, it is exactly like plan F except for one difference. You’re going to pay what Medicare doesn’t pay until you reach the annual out of pocket of $2200. Once you reach that $2200, the HDF plan will act exactly like plan F. It’s pretty simple actually.

A Popular Medicare Supplement Plan

We want to let everybody know that they should know about the Medicare supplement, high deductible plan F. In previous videos, we talked about the 11 standardized plans – specifically the plan F, the plan G, and the plan N. The natural partner to all of these is the high deductible plan F plan.

High Deductible Plan F Is a Great Value for Any Budget

The high deductible plan F works the same way except for one thing. You pay an annual deductible of $2200. Medicare is going to pay what they pay, and you’re going to pay out-of-pocket until you reach $2200 per year. Then, the high deductible F will kick in like a regular plan F would. The attractive aspect is the premiums.

How Does Medicare Supplement Plan F Work?

Medigap Plan F offers the highest level of coverage out of the Medigap plans available. Essentially, with Plan F, you have no out-of-pocket costs for anything that’s covered under Original Medicare (Medicare Part A and Medicare Part B).

How Does High Deductible Medicare Supplement Plan F Work?

With High Deductible Medigap Plan F, Original Medicare will continue to pay its usual portion (usually about 80% of the bill), but you’ll need to pay $2,370 out-of-pocket before the plan kicks in.

Am I Eligible for Medicare Supplement Plan F and High Deductible Plan F?

Both Medigap Plan F and High Deductible Plan F are available to you if you became eligible for Medicare before January 1 st, 2020. If you’re unsure of when you became eligible, you can check by looking at the Part A start date on your Medicare card.

How Do I Choose Between Medicare Supplement Plan F and High Deductible Plan F?

Medigap Plan F is often recommended over its high deductible counterpart because, for most people, it’s less of a financial risk. While High Deductible Plan F has lower premiums, those savings can easily be offset by the bills you’d receive if you do need treatment, and you could ultimately wind up paying more out-of-pocket overall.

How Can I get Medicare Supplement Plan F or High Deductible Plan F?

Because of its popularity, Medigap Plan F is offered by most carriers. Its high deductible counterpart isn’t as widely available, so you may have fewer options for insurance companies to choose from. You can compare your options and apply with the carrier of your choice quickly and easily by using our online Find Your Plan tool.

What is Medicare Supplement?

Medicare Supplement insurance, also known as Med-Supp or Medigap, was created by the federal government and is regulated by state Insurance Departments. It is offered by private insurance companies to cover some of the out-of-pocket costs not covered by Original Medicare.

How much is a 2021 F and G deductible?

1 Plans F and G also have a high deductible option which requires first paying a plan deductible of $2,370 in 2021 before the plan begins to pay. Once the plan deductible is met, the plan pays 100% of covered services for the rest of the calendar year.

Does high deductible plan G cover Medicare Part B?

High deductible plan G does not cover the Medicare Part B deductible. However, high deductible plan G counts your payment of the Medicare Part B deductible toward meeting the plan deductible. 2 Plans K and L pay 100% of covered services for the rest of the calendar year once you meet the out-of-pocket yearly limit.

Does Medicare cover all of the costs?

Original Medicare covers some of the healthcare costs, but not all. *Denotes plan available from United American Insurance Company. Plan availability varies by state. Only applicants first eligible for Medicare before 2020 may purchase Plans C, F, and high deductible F.