- Medicare Supplement Insurance, or Medigap, is a type of health insurance policy sold by private insurance companies to complement Medicare policies.

- It covers common gaps in Medicare’s standard insurance plans.

- Insured individuals pay monthly premiums for Medigap policies directly to the insurance provider.

How much does a Medicare supplement insurance plan cost?

Medicare Supplement Insurance Cost Factors

- Plan Coverage. One big factor in the cost of a Medicare Supplement Insurance plan is the level of coverage provided.

- Carrier. Medicare Supplement Insurance is sold by private insurance companies that set their own plan prices.

- Location. ...

- Enrollment Time. ...

- Pricing Structure. ...

- Discounts. ...

- Gender. ...

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

Which Medicare supplement plan should I buy?

One of the most common types of supplemental insurance is Medigap, which is sold by private insurance companies to people enrolled in Original Medicare. (Medigap plans cannot be paired with Medicare Advantage plans).

Which Medicare supplement plan is the most popular?

Medicare supplement Plan G is one of the most popular Medigap plans available today. More people will enroll in Plan G than any other Medigap plan, and for good reason. Medicare Plan G pays 100% of the gaps in Medicare Part A and B after you simply pay a small annual deductible. Keep reading to learn why Plan G might be the best option for you.

What is the purpose of a Medicare supplement policy?

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

What is the difference between Medicare and Medicare supplement?

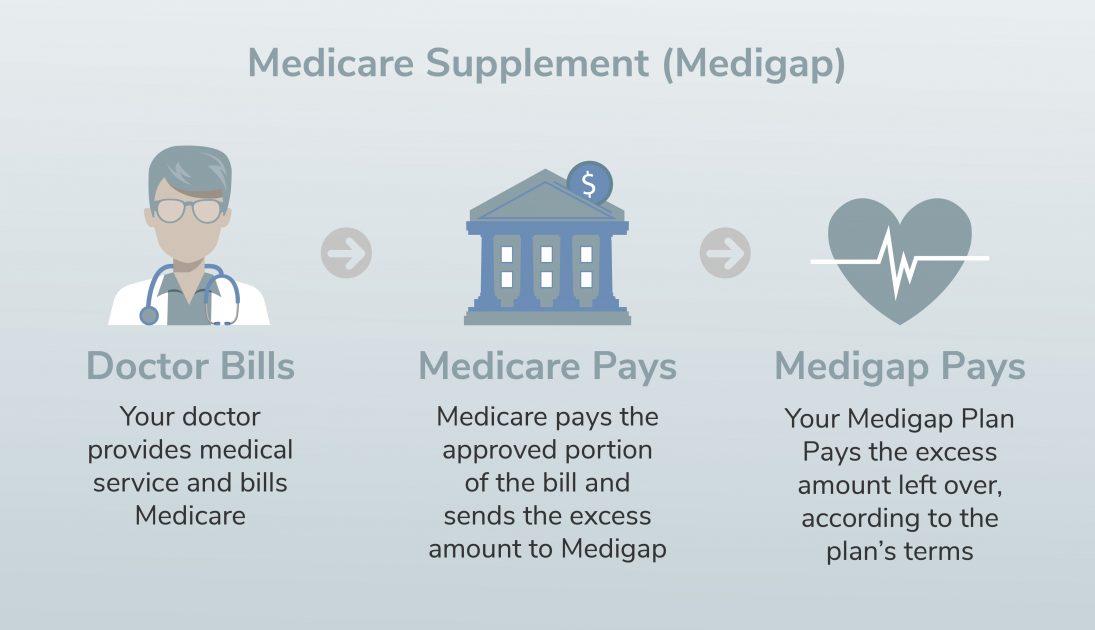

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles.

What does Medicare supplement plan I cover?

Plan I pays the $ 1100.00 Part A Deductible. Plan I includes the Basic Benefits, Pays the Part A deductible and Skilled Nursing Coinsurance. Plan I Includes Foreign Travel Emergency benefits. Plan I includes at home recovery.

What is a supplement policy?

An additional insurance plan that helps pay for healthcare costs that are not covered by a person's regular health insurance plan. These costs include copayments, coinsurance, and deductibles.

What are the advantages and disadvantages of Medicare supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Is there a Medicare supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

What does Medicare supplement cost?

Medicare Supplement Plans have premiums that cost anywhere from around $70/month to around $270/month. Typically, plans with higher monthly premiums will have lower deductibles.

Do Medicare supplement plans have a deductible?

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up.

What are examples of supplemental insurance?

Supplemental insurance includes a variety of policies that can be offered by employers or purchased on their own, including:Life insurance.Short-term disability.Long-term disability.Dental/vision insurance.Accident insurance.Critical illness insurance.

Who might benefit from supplemental insurance and why?

Supplemental health insurance can be an added layer of protection used to cover what a traditional health insurance plan does not. It can also help pay for nonmedical expenses that can go with illness or injury, such as lost income or childcare.

Is it worth it to get supplemental life insurance?

Supplemental life insurance can be a useful add-on, particularly if health conditions make it tough for you to get enough coverage elsewhere. But be sure to compare policies and prices. In some cases, the benefits may not be worth the cost.

How Do Medicare Supplement (Medigap) Plans Work With Medicare?

Medigap plans supplement your Original Medicare benefits, which is why these policies are also called Medicare Supplement plans. You’ll need to be...

What Types of Coverage Are Not Medicare Supplement Plans?

As a Medicare beneficiary, you may also be enrolled in other types of coverage, either through the Medicare program or other sources, such as an em...

What Benefits Do Medicare Supplement Plans Cover?

Currently, there are 10 standardized Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, N; there’s also a high-deductible vers...

What Benefits Are Not Covered by Medicare Supplement Plans?

Medigap policies generally do not cover the following health services and supplies: 1. Long-term care (care in a nursing home) 2. Routine vision or...

Additional Facts About Medicare Supplement Plans

1. You must have Medicare Part A and Part B to get a Medicare Supplement plan. 2. Every Medigap policy must be clearly identified as “Medicare Supp...