- Medicare Supplement Insurance, or Medigap, is a type of health insurance policy sold by private insurance companies to complement Medicare policies.

- It covers common gaps in Medicare’s standard insurance plans.

- Insured individuals pay monthly premiums for Medigap policies directly to the insurance provider.

Full Answer

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Which Medicare supplement plan should I Choose?

Some people also refer to these plans as Medigap. As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

Which Medicare supplement plan is the most popular?

Medicare supplement Plan G is one of the most popular Medigap plans available today. More people will enroll in Plan G than any other Medigap plan, and for good reason. Medicare Plan G pays 100% of the gaps in Medicare Part A and B after you simply pay a small annual deductible. Keep reading to learn why Plan G might be the best option for you.

Which is the best Medicare supplement?

Medicare Supplement Plan G is identical to Plan F except you pay the Part B deductible once per year on Plan G. It’s definitely one of the best Medicare supplement Plans. Whereas Plan F pays that amount for you (with the extra money you give them in the higher monthly premium for Plan F).

What is meant by Medicare Supplement?

Medicare Supplement Insurance, or Medigap, is a type of health insurance policy sold by private insurance companies to complement Medicare policies. It covers common gaps in Medicare's standard insurance plans. Insured individuals pay monthly premiums for Medigap policies directly to the insurance provider.

What is the purpose of Medicare supplemental insurance?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance.

What is the difference between Medicare and a supplemental plan?

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles.

How much a month is Medicare Supplement?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

How do I choose a Medicare Supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What part of Medicare is free?

Part APart A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What is Medicare Supplement Insurance Plan?

What Is a Medicare Supplement Insurance Plan? A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits. Use the following guide to compare Medicare ...

Which is the most popular Medicare Supplement?

Medigap Plan F Is the Most Popular. Medicare Supplement Insurance Plan F is the most popular Medigap plan, largely because it offers the most comprehensive range of basic benefits. Plan F is the only Medigap plan that covers all nine of the basic Medigap benefits, including the Medicare Part B deductible and Part B excess charges.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When is the best time to buy Medicare Supplement?

The best time to buy a Medicare Supplement Insurance plan is during your Medigap open enrollment period. During your open enrollment period, insurance companies cannot consider any pre-existing conditions when deciding whether or not to offer you a policy. They also cannot charge you more for a Medigap plan based on pre-existing conditions.

Does Medicare Supplement Insurance require coinsurance?

Medicare Supplement Insurance Plans. Medicare Part A and Part B both require deductibles and coinsurance or copays. Medigap plans help beneficiaries fill in these cost "gaps" that can add up to potentially large dollar amounts. The chart below lists the basic benefits offered by each type of Medigap plan. Click here to view enlarged chart.

What is Medicare Supplement Insurance?

Key Takeaways. Medicare Supplement Insurance, or Medigap, is a type of health insurance policy sold by private insurance companies to complement Medicare policies. It covers common gaps in Medicare’s standard insurance plans. Insured individuals pay monthly premiums for Medigap policies directly to the insurance provider.

What is Medicare Part C?

Medicare Part C is also known as a Medicare Advantage plan. As with Medigap plans, Medicare Advantage (MA) plans come from private providers. These plans include and replace Medicare Parts A, B, and usually Part D coverage, but not hospice care. 5 6 Medicare Advantage plans generally include:

How much will Medicare premiums be in 2021?

Monthly premiums are updated annually and range from $259 to $471 in 2021, depending on an individual's quarterly coverage eligibility. 8 Medigap plans will assist with covering these out-of-pocket expenses. Even though premiums may be free for most Medicare enrollees, they must cover certain out-of-pocket expenses.

How long is the Medigap open enrollment period?

The Medigap Open Enrollment Period (OEP) is six months from the first day of an individual's 65th birthday month. These plans may also have open enrollment for six months after signing up for Part B coverage. 3 . Insured individuals pay monthly premiums for private Medigap policies directly to the insurance provider.

Does Medicare Supplement cover gaps?

Medicare Supplement Insurance covers common gaps in Medicare’s standard insurance plans. People who apply for Medigap coverage must take part in Medicare Parts A and B. Medigap plans supplement, but do not replace, primary Medicare coverage. 1 There are 10 Medigap plans, from Plan A to Plan N. 2 .

Does Medigap pay monthly premiums?

Insured individuals pay monthly premiums for Medigap policies directly to the insurance provider . Medigap coverage is different from Medicare Part C, which is also known as a Medicare Advantage plan.

Does Medigap pay directly to the hospital?

The private insurer then remits the difference directly to the healthcare provider. Some plans submit payments to hospitals based upon the Medicare Part A claim information, but this is less common.

What is Medicare Supplement?

A Medicare Supplement (also known as Medigap) plan is a supplemental insurance plan sold by a private company. This kind of insurance helps cover the costs that Original Medicare doesn’t, like deductibles, copayments, or coinsurance.

When is Medicare due for 2019?

December 12, 2019. If you’re around 65, close to retiring, or already retired, chances are you’re researching Medicare. During your research, perhaps you’ve come to like what Original Medicare, or Medicare Part A and Part B, offers.

How much is SNF coinsurance?

Although Original Medicare covers treatment from an SNF for up to 20 days, after day 20, you face daily coinsurance fees (currently $176 per day in 2020). 1 Those fees are completely covered if you purchase a plan with the SNF care coinsurance benefit. 6.

How long does it take to sign up for Medicare Part B?

Besides picking a plan that suits your needs best, timing is everything when purchasing a Medigap plan. For anyone 65 and over, within a six-month window of signing up for Medicare Part B, federal law guarantees the following protections:

How long does Medicare cover hospitalization?

Medicare Part A will cover your first 60 days in a hospital, but only after you meet your not-so-small deductible in your benefit period ($1,408 in 2020). 2 A plan with this benefit covers your Part A deductible completely.

How many pints of blood do you get with Medicare?

Under Original Medicare, you have to pay for every pint of blood you receive until you hit four pints in a calendar year. You’re covered for the first three pints you get in a year with this benefit.

Is Medicare Part A the same as Part D?

Keep in mind, they are not the same. Medicare Part A, Part B, Part C, and Part D are all sections of Medicare. Medicare Supplement Plans A, B, C, D, F, G, K, L, M, and N are Medigap policies that supplement your Original Medicare coverage. The plans supplement coverage for the parts.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance is private insurance that can help cover some of the out-of-pocket costs that Original Medicare (Part A and Part B) does not, such as copayments, coinsurance and deductibles. Comparing Medicare Supplement Insurance plans can help you find the right policy for your health care needs.

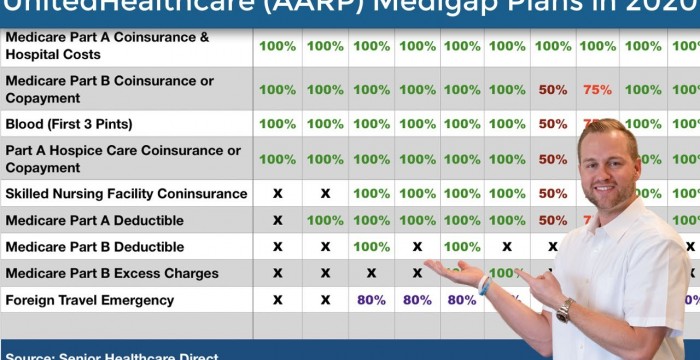

What are the additional benefits of Medicare Supplement?

Each type of plan may also cover one or more of these five additional benefits: Skilled nursing facility care coinsurance. Part A deductible. Part B deductible. Part B excess charge. Foreign travel exchange. The chart below illustrates all possible benefits covered by Medicare Supplement Insurance and which plans cover them.

What are the benefits of Medigap?

Each type of Medigap plan covers four standard benefits: 1 Part A coinsurance and hospital costs 2 Part B coinsurance or copayment 3 Your first three pints of blood 4 Part A hospice care coinsurance or copayment

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

Which is the most comprehensive Medicare plan?

Medigap Plan F is the most comprehensive type of plan, which explains why it's also the most popular type of Medicare Supplement Insurance plan. You may be better served with a less comprehensive plan, however, so it's important to compare each type of basic benefit.

Does every insurance company offer a Medigap plan?

Not every insurer offers each type of Medigap plan. However, if an insurance company sells any Medigap policy, they must offer at least Medigap Plan A and either Medigap Plan C or Plan F. Medicare Supplement Insurance plans only cover one person, so if you and your spouse are both eligible, you’ll each need to purchase a separate policy. ...

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

What is the best alternative to Plan G?

Best alternative to Plan G Medicare supplement: Plan N. Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Does Cigna offer a discount on Medicare?

Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

4 kinds of Medicare Savings Programs

Select a program name below for details about each Medicare Savings Program. If you have income from working, you still may qualify for these 4 programs even if your income is higher than the income limits listed for each program.

How do I apply for Medicare Savings Programs?

If you answer yes to these 3 questions, call your State Medicaid Program to see if you qualify for a Medicare Savings Program in your state:.