- Medicare Supplement Insurance, or Medigap, is a type of health insurance policy sold by private insurance companies to complement Medicare policies.

- It covers common gaps in Medicare’s standard insurance plans.

- Insured individuals pay monthly premiums for Medigap policies directly to the insurance provider.

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

How much does a Medicare supplemental insurance plan cost?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

What do you need to know about Medicare supplement insurance?

- The Medicare Supplement insurance plan premium

- Your Medicare Part B premium (you generally pay this no matter what type of Medicare coverage you have)

- Your stand-alone Medicare Part D Prescription Drug Plan premium, if applicable Premiums for Medicare Supplement insurance plans can vary widely. ...

Should I buy Medicare supplement insurance?

With Medicare Supplement insurance, not only do you get to choose a plan that suits your needs—you also have the option of adding Medicare prescription drug coverage. You can buy any stand-alone Medicare prescription drug plan that serves your area.

What does Medicare Supplement plan I cover?

Plan I includes the Basic Benefits, Pays the Part A deductible and Skilled Nursing Coinsurance. Plan I Includes Foreign Travel Emergency benefits. Plan I includes at home recovery.

What is the difference between Medicare and a supplemental plan?

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles.

What is the difference between Medicare Advantage and supplemental?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

How much is Medicare Supplement monthly?

Medicare Supplement Plans have premiums that cost anywhere from around $70/month to around $270/month. Typically, plans with higher monthly premiums will have lower deductibles.

Does Medicare pay 100 percent of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is Medicare Supplement Insurance Plan?

What Is a Medicare Supplement Insurance Plan? A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits. Use the following guide to compare Medicare ...

Which is the most popular Medicare Supplement?

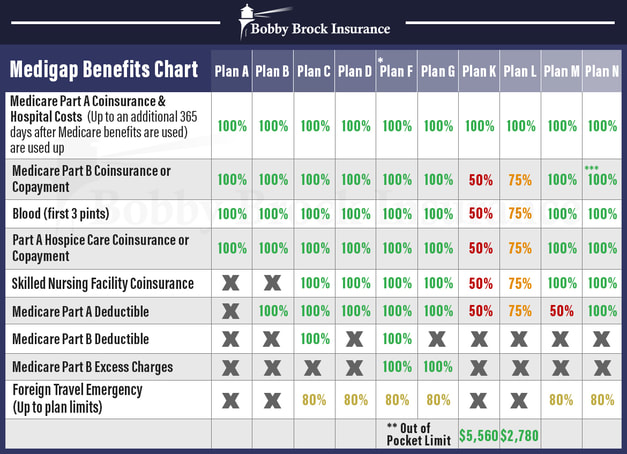

Medigap Plan F Is the Most Popular. Medicare Supplement Insurance Plan F is the most popular Medigap plan, largely because it offers the most comprehensive range of basic benefits. Plan F is the only Medigap plan that covers all nine of the basic Medigap benefits, including the Medicare Part B deductible and Part B excess charges.

How many types of Medigap are there?

Each of the ten types of Medigap plans are different, designed to give beneficiaries multiple options. The rates for different plans will vary. The important thing to remember is that the basic benefits are standardized by Medicare. No matter where you buy Medigap Plan G, the basic benefits have to be the same.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

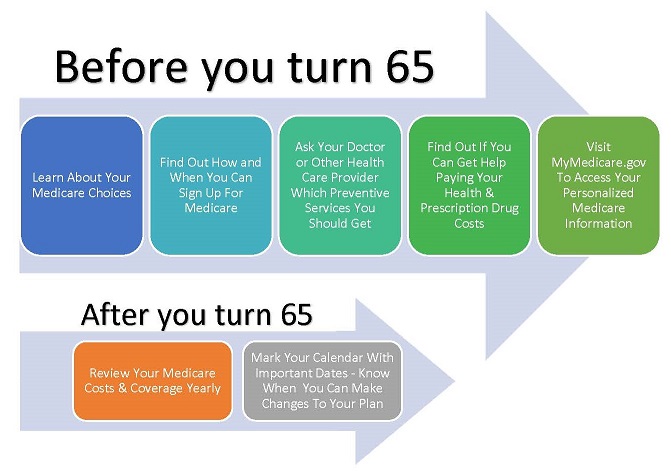

How long does Medicare open enrollment last?

Your Medigap open enrollment period only lasts for six months. It begins as soon as you are at least 65 years old and enrolled to receive Medicare Part B benefits.

When is the best time to buy Medicare Supplement?

The best time to buy a Medicare Supplement Insurance plan is during your Medigap open enrollment period. During your open enrollment period, insurance companies cannot consider any pre-existing conditions when deciding whether or not to offer you a policy. They also cannot charge you more for a Medigap plan based on pre-existing conditions.

What is the deductible for Plan L in 2021?

3 Plan L has an out-of-pocket yearly limit of $3,110 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as a Medigap plan, can help cover these expenses. Medigap insurance plans help people enrolled in Original Medicare pay out-of-pocket health insurance expenses, like copays, coinsurance, and deductibles.

When comparing Medicare Supplement insurance policies, make sure you compare the same Medigap plan types?

For example, compare Plan L from one Medigap insurance company with Plan L from another.

Why do people opt for Medicare Part C?

As such, some Medicare beneficiaries opt for Medicare Part C as a means to boost health coverage and potentially pare back expenses. Medigap plans are also only offered through private health insurers, but they generally don’t offer the extra health coverage like Part C plans do.

Which Medicare supplement is the most robust?

For example, compare Plan L from one Medigap insurance company with Plan L from another. Medigap Plan F is generally considered the most robust Medicare supplement insurance, since it covers the most out-of-pocket costs.

How to decide what Medicare plan is right for you?

To decide what Medicare plans are right for you, you have to assess all of your costs and the amount of health care you expect you’ll need. Because both Advantage plans and Supplement Insurance come from private insurers, there are many plans with a wide range of costs and coverage options.

When will Medicare open enrollment start?

You can read more about Medicare open enrollment here. (Medicare open enrollment started October 15, 2020.) While you can cancel a Medicare supplement plan anytime by calling your insurer, keep in mind you might not be able to get a new Medigap policy if it is outside of Medigap open enrollment.

Is Medicare Supplement Insurance a federal or state insurance?

Medicare is a federal health insurance program aimed at retirement age Americans. It helps make health coverage more affordable and less costly than private health insurance. Many people even get part of it premium-free. However, Medicare beneficiaries still have to pay for some costs of health care — like deductibles and coinsurance — on their own. Medicare Supplement Insurance, also known as a Medigap plan, can help cover these expenses.

What is Medicare Supplement Insurance?

Key Takeaways. Medicare Supplement Insurance, or Medigap, is a type of health insurance policy sold by private insurance companies to complement Medicare policies. It covers common gaps in Medicare’s standard insurance plans. Insured individuals pay monthly premiums for Medigap policies directly to the insurance provider.

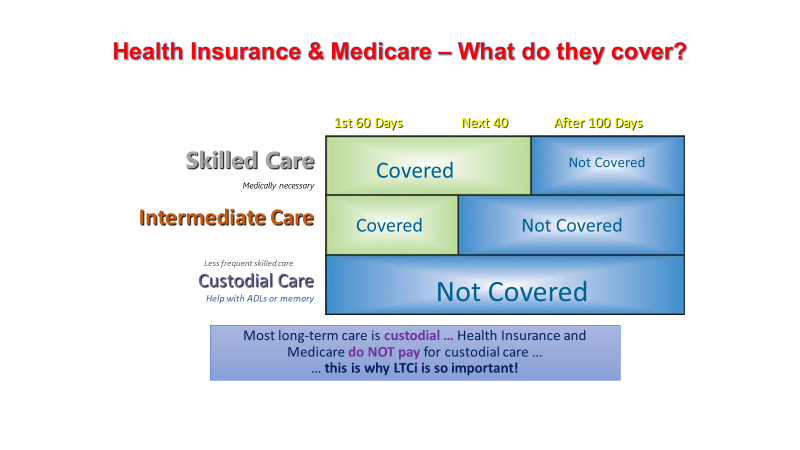

How long does Medicare cover hospital costs?

Hospital costs for up to an additional 365 days after Original Medicare—Parts A and B—coverage is exhausted

What is a scammed medicaid?

Common scams include high-pressure sales tactics, selling duplicate policies, or selling policies when insurers are aware individuals have coverage from an incompatible government program such as Medicaid or Medicare Advantage. 4

How much will Medicare premiums be in 2021?

Monthly premiums are updated annually and range from $259 to $471 in 2021, depending on an individual's quarterly coverage eligibility. 8 Medigap plans will assist with covering these out-of-pocket expenses. Even though premiums may be free for most Medicare enrollees, they must cover certain out-of-pocket expenses.

What is Medicare Part C?

Medicare Part C is also known as a Medicare Advantage plan. As with Medigap plans, Medicare Advantage (MA) plans come from private providers. These plans include and replace Medicare Parts A, B, and usually Part D coverage, but not hospice care. 5 6 Medicare Advantage plans generally include:

What is a MA plan?

MA plans have one of four structures: a health maintenance organization (HMO), a preferred provider organization (PPO) plan, a private fee-for-service (PFFS) plan, or a special needs plan (SNP). The federal government forbids private insurers from selling Medigap policies to individuals enrolled in Medicare Advantage. To be eligible, an individual must live in the plan’s service area and have Medicare Parts A and B. These plans come from private providers who have government approval.

Is Medigap insurance a federal program?

Anyone shopping for supplemental plans should bear in mind that it is illegal for private insurers to misrepresent Medigap policies as federal programs.

How does Medicare Supplement Plan D work?

1 If you have total medical charges are $20,000, for instance, your coinsurance would be $4,000. The higher your total charges, the higher your coinsurance, and there’s no limit to how much you can be charged under Original Medicare. With Medicare Plan D, you pay a monthly premium each month, and the plan covers your Part B coinsurance at 100%. 2

What is Medicare Plan D?

Medicare Plan D is a Medicare Supplement plan, also known as a Medigap plan. Plan D is one of the 10 standardized Medicare Supplement plans available in most states: A, B, C, D, F, G, K, L, M, and N. The names “Medicare Plan D”, “Medicare Supplement Plan D”, and “Medigap Plan D all mean the same thing. But these plans are not the same thing as ...

Does Medicare cover copays?

Helps play some of the costs original Medicare doesn’t cover, which are mostly copays, coinsurance, and deductibles. Only works with Original Medicare. Must have both Parts A and B to enroll. Provides prescription drug coverage to Medicare beneficiaries.

Does Medicare Supplement Plan D cover prescription drugs?

But these plans are not the same thing as Medicare Part D, which is for prescription drug coverage. Medicare Supplement Plan D policies do not cover prescription drugs.

What is a check mark on a Medigap plan?

The chart below shows which benefits are included in each of the standardized Medigap plans. A check mark means the plan covers that benefit. Click here to view enlarged chart.

What does a check mark mean on Medigap?

The chart below shows which benefits are included in each of the standardized Medigap plans. A check mark means the plan covers that benefit.

Do you have to have supplemental health insurance?

Anyone who is unhappy with the extent of their current medical coverage can purchase theses policies; you don’t have to have a specific type of health insurance to get most types of supplement al health insurance.

What is supplement insurance?

Supplemental health insurance helps to pay for healthcare costs that aren't typically covered by traditional health insurance. Some cover specific situations, like hospital or disability insurance, while others cover specific health conditions like cancer. Learn more about these policies and how they work.

Why do you need a supplemental plan?

You might think about a supplemental plan if you know that you couldn't afford the costs of long-term care, or the loss of income if you were diagnosed with something like cancer. Long-term care or critical illness plans may be worth thinking about in these cases.

What is accidental death insurance?

Accidental Death and Dismemberment Insurance. This type of insurance typically reimburses you for medical costs resulting from accidents. Benefits are paid to your beneficiaries if you die. Premiums are usually low, and no medical exam is required.

What is cash benefit insurance?

This type of insurance provides a cash benefit paid directly to you if you require treatment for a specific disease such as cancer. You can typically spend the cash any way you choose, and getting your benefit has nothing to do with how much your insurance pays for your medical costs. 2

Is supplemental health insurance right for me?

Whether a supplemental health plan is right for you depends on your health, the costs of the plan, and the benefits of the policy you're thinking about buying.

Is it worth buying a supplemental health plan?

Would you have enough money to cover your deductible, copays, and coinsurance if you were in the hospital for a few weeks or even more? Do you have money that you can access because you've been saving to an HSA or FSA? Buying a supplemental health plan might not be worth it if you do.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

Which pays first, Medicare or group health insurance?

If you have group health plan coverage through an employer who has 20 or more employees, the group health plan pays first, and Medicare pays second.

What is supplemental insurance?

Supplemental insurance is any policy that you have in addition to your main health insurance coverage.

Cost of supplemental insurance

Supplemental policies are less expensive than regular insurance because they provide supplemental coverage, not comprehensive coverage.

Why should you buy supplemental plans?

Supplemental policies serve a dual purpose of limiting how much you pay for health care while also helping to protect your finances.

Types of supplemental insurance

Below are descriptions of some of the most popular supplemental plans and what to consider when shopping for coverage.

Frequently asked questions

Supplemental insurance is an add-on to your regular insurance that provides an extra level of coverage, helping you to meet out-of-pocket costs and other expenses not covered by your regular insurance.