How to calculate Medicare surtax?

Medicare Surtax. THE STANDARD Medicare payroll tax is 2.9%, half of which may be paid by your employer, leaving your share at 1.45%. Add that to the 6.2% Social Security tax and you get the total 7.65% payroll tax. If you have a high income, you will notice that the Social Security tax stops getting collected once you hit that year’s threshold, which is set at $142,800 for 2021.

How much is the Medicare surtax?

Jan 11, 2019 · What is the Medicare surtax rate for 2021? 2.9% In 2021, the Medicare tax rate is 2.9%, which is split between an employee and their employer. Self-employed individuals are responsible for both portions of Medicare tax but only on 92.35% of business earnings. There are two additional Medicare surtaxes that apply to certain high earners.

What is the current tax rate for Medicare?

Dec 01, 2021 · 3.8% Obamacare Medicare Surtax and How to Avoid It. December 1, 2021 Financial Planning, Investing, Retirement Planning, Smart Spending, Social Security, Stock Market, Taxes The 3.8% Obamacare Surtax and how to avoid it. This Medicare surtax can be avoided or minimized with a little proactive tax planning.

When does Medicare surtax apply?

Nov 09, 2021 · There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of...

What is the Medicare surtax on my paycheck?

Some taxpayers are required to pay an additional 0.9% tax over and above the "regular" Medicare tax.

What is the Medicare surcharge tax for 2021?

0.9%A 0.9% Additional Medicare Tax applies to Medicare wages, self-employment income, and railroad retirement (RRTA) compensation that exceed the following threshold amounts based on filing status: $250,000 for married filing jointly; $125,000 for married filing separately; and. $200,000 for all other taxpayers.Feb 18, 2022

How do I avoid Medicare surtax?

Despite the complexity of this 3.8% surtax, there are two basic ways to “burp” income to reduce or avoid this tax: 1) reduce income (MAGI) below the threshold, or 2) reduce the amount of NII that is subject to the tax.Aug 28, 2013

Who pays the Medicare surtax?

An employer must withhold Additional Medicare Tax from wages it pays to an individual in excess of $200,000 in a calendar year, without regard to the individual's filing status or wages paid by another employer.Jan 18, 2022

What is 3.8 Medicare surtax?

What's the Medicare surtax? The Affordable Care Act of 2010 included a provision for a 3.8% "net investment income tax," also known as the Medicare surtax, to fund Medicare expansion.

What do you mean by surtax?

Definition of surtax 1 : an extra tax or charge. 2 : a graduated income tax in addition to the normal income tax imposed on the amount by which one's net income exceeds a specified sum.

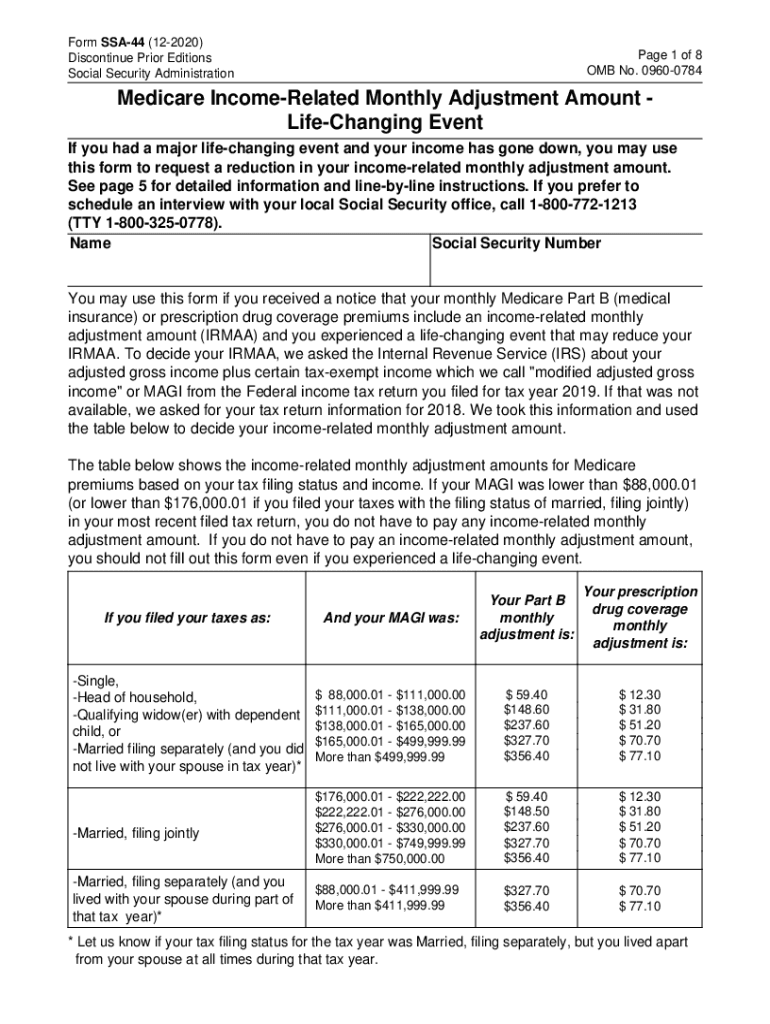

What will Irmaa be in 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $111,000 but less than or equal to $138,000$297.00More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.9012 more rows•Dec 6, 2021

At what income level does the 3.8 surtax kick in?

There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI.Nov 9, 2021

What are the 2021 tax brackets?

There are seven tax brackets for most ordinary income for the 2021 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.6 days ago

What is the 2021 standard deduction?

$12,550Standard Deduction $12,550 for married couples filing separately. $18,800 for heads of households. $25,100 for married couples filing jointly.

What is the surtax on Medicare?

The 3.8% medicare surtax on higher incomes seems to be the tax that surprise and annoy many people who find themselves getting hit with it for the first time. The only good news about paying this surtax is that it means you are making more money than 90% plus of Americans.

Who is David Rae?

DAVID RAE, CFP®, AIF® is a Los Angeles-based retirement planner with DRM Wealth Management. He has been helping friends of the LGBT community reach their financial goals for over a decade. He is a regular contributor to the Advocate Magazine, Forbes.com, Huffington Post as well as the author of the Financial Planner Los Angeles Blog. Follow him on Facebook, or via his website www.davidraefp.com

Do you pay capital gains tax if you pass away?

So, if you hold investments up until the time of your passing, there won’t be capital gains taxes or the ACA surtax on the earning prior to your passing. Of course, you have to die, so not always a great option.

Does Roth 401(k) raise taxes?

ROTH IRA to the rescue. Payment from a ROTH IRA or ROTH 401 (k) comes out tax-free and doesn’t raise taxable income. This can also help minimize the burden of the 3.8% surtax. This is where diversification of your retirement account taxation can really pay off.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

What is the Medicare tax rate?

The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

How to calculate Medicare taxes?

If you receive both Medicare wages and self-employment income, calculate the Additional Medicare Tax by: 1 Calculating the Additional Medicare Tax on any Medicare wages in excess of the applicable threshold for the taxpayer's filing status, without regard to whether any tax was withheld; 2 Reducing the applicable threshold for the filing status by the total amount of Medicare wages received (but not below zero); and 3 Calculating the Additional Medicare Tax on any self-employment income in excess of the reduced threshold.

Can non-resident aliens file Medicare?

There are no special rules for nonresident aliens or U.S. citizens and resident aliens living abroad for purposes of this provision. Medicare wages, railroad retirement (RRTA) compensation, and self-employment income earned by such individuals will also be subject to Additional Medicare Tax, if in excess of the applicable threshold for their filing status.

What is additional Medicare tax?

The requirement is based on the amount of Medicare wages and net self-employment income a taxpayer earns that exceeds a threshold based on filing status.

How to calculate Medicare tax?

Step 1: Calculate the Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2: Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

How much does Barney earn?

Barney earned $75,000 in wages, which is below the $125,000 threshold for a married person filing separately, so he doesn't have wages in excess of the threshold amount. He doesn't have to pay any Additional Medicare Tax. But Betty's wages are $200,000.

Who is William Perez?

William Perez is a tax expert with 20 years of experience who has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income. He previously worked for the IRS and holds an enrolled agent certification.

What is the Medicare tax threshold?

The Additional Medicare Tax applies when a taxpayer's wages from all jobs exceed the threshold amount, and employers are required to withhold Additional Medicare Tax on Medicare wages in excess of $200,000 that they pay to an employee. The same threshold applies to everyone regardless of filing status.

What line is Medicare adjustment on 8959?

An adjustment can be made on Form 8959 beginning at line 10, if you're calculating the AMT on both self-employment income and wages. This adjustment functions to ensure that the Additional Medicare Tax is calculated only once on wages and only once on self-employment income when they're combined and exceed the threshold amount.

What is the threshold for self employment?

The threshold amounts for self-employment income are the same as for wages earned by employees. Net self-employment income is the total of all self-employment income after deductions for business expenses are taken on Schedule C, Schedule F, or Schedule E, which reports self-employment income from partnerships.