There are actually two different rate components, broken out as follows:

- The Social Security withholding rate is gross pay times 6.2% up to the maximum pay level for that year. This is the employee’s portion of the Social Security payment. ...

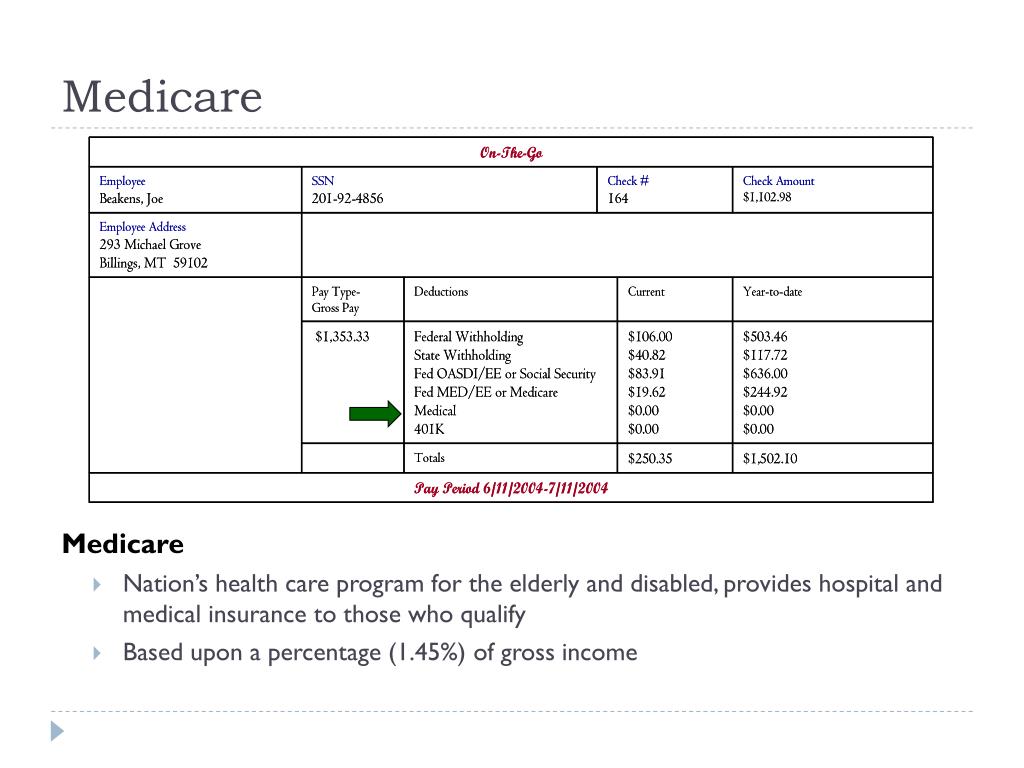

- The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. ...

- For a total of 7.65% withheld, based on the employee’s gross pay.

How much does Medicare take out of your paycheck?

Apr 02, 2020 · The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income. Your employer also pays a matching Medicare tax based on your paycheck. There are two ways that you may see the Medicare payroll …

What year did Medicare start being deducted from the Paycheck?

Mar 18, 2021 · The Medicare tax is an automatic payroll deduction that your employer collects from every paycheck you receive. The tax is applied to regular earnings, tips, and bonuses. The current tax rate for Medicare, which is subject to change, is …

How much does health insurance take out of paycheck?

Feb 24, 2022 · We'll also discuss whether these Medicare expenses come out of your Social Security check, or if you can pay for this coverage in a different way. Key Takeaways Medicare is a federally funded health insurance program that helps cover the medical costs of Americans ages 65 and older, as well as some younger Americans with disabilities.

Does Medicare come out of my paycheck?

Dec 23, 2008 · What percent of your paycheck is taken out for Medicare and Medicaid? 20 year old single male: 1.5% Employer's match the 1.5% for a total of 3% (.03)

Why is Medicare being taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.Mar 28, 2022

What is Medicare tax used for?

Medicare taxes fund hospital, hospice, and nursing home expenses for elderly and disabled individuals. There are two additional Medicare surtaxes that apply to certain high earners.

Can I opt out of paying Medicare tax?

There is no legal way to stop paying Social Security taxes without applying and receiving approval or becoming a member of a group that is already exempt.

Do I have to pay Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.Mar 3, 2022

How is Medicare tax calculated on paycheck?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.Nov 7, 2019

Why did my employee Medicare tax go up?

The Affordable Care Act expanded the Medicare payroll tax to include the Additional Medicare Tax. This new Medicare tax increase requires higher wage earners to pay an additional tax (0.9%) on earned income. All types of wages currently subject to the Medicare tax may also be subject to the Additional Medicare Tax.Feb 18, 2022

Do I get a refund on Medicare tax withheld?

Ask your employer to refund the erroneously withheld FICA taxes and if a W-2 was already issued, to give you a corrected Form W-2c for that year. If your employer refuses to refund the taxes, you can file Form 843 (for instructions see here) and the IRS will refund the money to you.

Do you still pay Medicare tax after 65?

Medicare Withholding after 65 As long as you have earned income, even after retirement, you continue to contribute to Social Security and Medicare with FICA taxes at the same rate as before you retired. If you have no earned income, you do not pay Social Security or Medicare taxes.

At what age do you stop paying Medicare tax?

65Your age doesn't change whether or not you pay Medicare taxes. If you retire from your career at the age of 65 and decide to start working part-time, your income is subject to Medicare taxation.Mar 29, 2021

Why is Medicare taken out of paycheck?

As part of your overall payroll taxes, the federal government requires employers to collect the FICA (Federal Insurance Contributions Act) tax. Social Security taxes fund Social Security benefits and the Medicare tax goes to pay for the Medicare Hospital Insurance (HI) that you’ll get when you’re a senior.

How is Medicare deducted from paycheck?

The Medicare tax is an automatic payroll deduction that your employer collects from every paycheck you receive. The tax is applied to regular earnings, tips, and bonuses. The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What does Medicare withholding mean?

Medicare tax is a payroll tax. It is an employee and employer tax, meaning you must withhold a certain amount from an employee’s wages and make a matching contribution. You must do this for each one of your employees. This includes regular wages, tips, commissions, bonuses, overtime, and some fringe benefits.

Do I have to pay Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

Is it better to claim 1 or 0 on your taxes?

By placing a “ ” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. If your income exceeds $1000 you could end up paying taxes at the end of the tax year.

Do you get back Medicare tax withheld?

If your withholding is more than the tax you owe, then you can claim a refund for the difference. Employees pay 6.2% of their wages in Social Security taxes and 1.45% in Medicare taxes.

At what age is Social Security not taxable?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free. However, if you’re still working, part of your benefits might be subject to taxation.

Not everyone pays for Medicare with their Social Security check

Lorraine Roberte is an insurance writer for The Balance. As a personal finance writer, her expertise includes money management and insurance-related topics. She has written hundreds of reviews of insurance products.

Who Is Eligible for Medicare?

Medicare is a social insurance program available to U.S. citizens and permanent residents 65 years of age or older. It’s also available to some younger Americans who are disabled or diagnosed with End-Stage Renal Disease (ESRD).

When Do You Have To Pay for Medicare?

If you don’t qualify for premium-free Part A coverage, you’ll need to pay a monthly premium. You’ll also have to pay a premium if you sign up for Part B, which is optional.

Medicare Costs You Can Deduct From Social Security

Most people who receive Social Security benefits will have their Medicare premiums automatically deducted. Here’s a closer look at what costs you can expect to see taken out of your checks.

Can You Change How You Pay for Medicare?

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you don’t qualify for Social Security benefits, you’ll get a bill from Medicare that you’ll need to pay via:

What does Medicare pay for?

Medicare pays for many different types of medical expenses. Part A covers inpatient hospital care, surgery, and home health care, among other items. Part B covers things such as preventive care, doctors’ visits, and durable medical equipment. Part D covers prescription drugs.

How much will I pay for Medicare?

The amount you’ll pay for Medicare depends on several factors, including your sign-up date, income, work history, prescription drug coverage, and whether you sign up for extra coverage with an Advantage or Medigap plan. The Medicare Plan Finder can help you compare costs between different plans.

What is Medicare tax?

Medicare tax is a payroll tax that funds the Medicare Hospital Insurance program. Employers and employees each pay Medicare tax at a rate of 1.45% with... Menu burger. Close thin.

What is the Medicare surtax rate?

It is not split between the employer and the employee. If your income means you’re subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000.

What is the Social Security tax for 2017?

As of 2017, the employee share of Social Security and Medicare taxes is 7.65%. If you make over $200,000, remember to account for the Additional Medicare Tax. It may seem like a lot of trouble now, but all this tax withholding is designed to give you a safety net when you reach retirement.

When did Medicare HI start?

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though it’s still below the Social Security tax rate.

Is NIIT the same as Medicare?

According to the IRS, a taxpayer may be subject to both the Additional Medicare Tax and the NIIT, but not necessarily on the same types of income .

Is there a limit on Medicare taxes?

Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes. Medicare Taxes and the Affordable Care Act. The Affordable Care Act (ACA) added an extra Medicare tax for high earners.

How much can you give to a couple without reporting?

Married couples, as two individuals, may give a total of $20,000 to as many people as they want every year without reporting it to the IRS.

What is a gift tax law?

The gift tax law allows this. What form these gifts take is an entirely separate issue. In most cases, these gifts are made in the form of stock, some other tangible asset--or, if it’s a cash gift, by check.

Do you have to register bonds when a co-owner dies?

L. A: You don’t necessarily have to register your bonds when one of the co-owners dies, say officials from the Federal Reserve Bank in Los Angeles. However, bank officials highly recommend it and promise that it is quite easy. Advertisement.

Does Medicare tax continue after Social Security?

But for wage earners in higher income brackets, the Medicare tax will continue long after the Social Security tax is satisfied. There Are Ways to Give Without Reporting It.

What is the difference between Medicare and Social Security?

Social Security benefits include survivor benefits. If the immediate beneficiary passes away, eligible family members may receive the benefits in their place. Medicare is the federal health insurance program for people who are 65 or older.

How much tax do you pay on income of $9,875?

For a single filer, the first $9,875 you earn is taxed at 10%. The next $30,249 you earn--the amount from $9,876 to $40,125--is taxed at 15% . Only the very last $1,475 you earned would be taxed at the 22% rate. This IRS Tax Table can help you figure out how much federal income tax you owe.

How much is Social Security wage cap 2021?

You pay 6.2% of your salary up to the Social Security wage cap, which is $142,800 for 2021, and 1.45% in taxes for Medicare (note that there is no wage cap for Medicare tax).

What is the largest social security program?

It includes many federal aid programs: unemployment assistance, disability assistance, Medicaid, and so on. One of the largest Social Security programs is retirement benefits. For many Americans, retirement benefits are a crucial piece of their retirement income.

Does Uncle Sam take your paycheck?

In fact, Uncle Sam takes a decent-sized chunk of your paycheck before it even hits your bank account. Before you sign a lease or nail down your budget, you’ll need to figure out your "take-home pay," or the amount of your hard-earned money that will actually end up in your pocket.

What percentage of your paycheck goes to FICA?

Social Security tax is 6.2%, and Medicare is 1.45%, totaling 7.65% of your paycheck going to FICA.

What is the other half of FICA?

The other half of FICA funds programs like Medicare, Medicaid, and CHIP. Medicare provides health coverage to around 57 million people who are over the age of 65 or have a disability. Medicaid is a separate program that provides health coverage to low-income people.

How much of your taxes are taken out to fund food stamps?

Contrary to popular belief, the amount of taxes taken out to fund safety net programs (such as food stamps and low-income housing assistance) account for less than 10% of your total tax.

Does Texas have state income tax?

Texas does not have state income tax, and we also do not pay any local income tax, besides the regular sales tax. If you move to another state to work, you might see other taxes taken out you might have not seen in Texas.

Is there federal tax taken out of your taxable income?

Federal Taxes. The first thing you notice is the fact that there is federal income tax taken out of your taxable income (after exemptions, and other deductions like contributing to retirement, and health insurance).

Why do couples file taxes separately?

Some reasons a couple may choose to file separately include: Only one spouse wants to file taxes. One spouse suspects that the information on the joint return might not be correct. One spouse doesn't want to be liable for the payment of tax due on the joint return. One spouse owes taxes, and the other is due a refund.

What is the FICA tax rate for 2021?

These amounts are paid by both employees and employers. For 2021, employees will pay 6.2% in Social Security on the first $142,800 of wages. The Medicare tax rate is 1.45%.

What is the head of household status?

Head of Household Filing Status: If you are unmarried, paid more than half the costs of keeping up a home, and have a Qualifying Person, you may qualify for Head of Household filing status. This filing status provides a higher standard deduction and lower tax rate than the Single filing status.

What is the maximum amount of pre-tax contributions for 2021?

It’s important to note that there are limits to the pre-tax contribution amounts. For 2021 the limit is $19,500.

Can you handle payroll on your own?

To handle payroll on your own, make sure that you’re getting Form W-4 from employees during onboarding. Additionally, you’ll want employees to verify their personal information is correct at the end of the year as you’re preparing Form W-2 for tax season. From there, payroll calculators will be your friend.

Is married on the last day of the year?

The filing status you use largely depends on the answer to one question: Were you considered married on the last day of the year? If yes, you are considered married for tax filing that year and if not you are not considered married. There are some special circumstances under which married persons may be viewed as not married. As an example, if they are qualifying for Head of Household status even if not legally separated or divorced. Types of filing statuses include:

Is married filing separately a tax benefit?

Married Filing Separately Status: Married Filing Separately filers receive the least tax benefit but realize separate tax liabilities. It is important to consult an accountant or tax professional to determine which married filing status will provide the best benefit for your specific financial situation.