What is the current Medicare tax rate?

Dec 20, 2021 · The Federal Insurance Contributions Act, or FICA, tax rate for earned income is 7.65% in 2021, which consists of the Social Security tax (6.2%) and the Medicare tax (1.45%). What percentage is Medicare tax? The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total.

How much Medicare is withheld from paycheck?

Jul 06, 2021 · The Medicare tax rate in 2021 is 2.9%. That amount is split evenly between employers and employees, with each side paying 1.45% respectively. The Medicare tax rate has gradually increased over the years since debuting at 0.7% (0.35% for both employer and employee) in 1966.

What is the tax rate for FICA and Medicare?

Dec 07, 2021 · The Medicare tax rate is determined by the IRS and is subject to change. The Federal Insurance Contributions Act, or FICA, tax rate for earned income is 7.65% in 2021, which consists of the Social Security tax (6.2%) and the Medicare tax (1.45%). What income is subject to the 3.8 Medicare tax? How does the 3.8% Medicare surtax work?

What percentage of your paycheck is Medicare?

In 2021, What Will the Medicare Tax Rate Be? The Medicare tax rate for 2021 is 2.9%. In most cases, you are responsible for half of the entire Medicare tax amount (1.45%), and your employer is responsible for the remaining 1.45%. Your Medicare tax is a part of your paycheck automatically. Is This a Tax That Everyone on Medicare Has to Pay?

Does Everyone Pay Medicare Tax?

If your income is reported for tax filing purposes, then you will typically pay the Medicare tax.

Is There a Limit on Medicare Tax?

Unlike Social Security taxes, there is no limit on how much of your income is subject to Medicare taxes. The Medicare tax rate applies to all earned income and taxable wages, and there is no minimum income required to be subject to Medicare taxes.

How Is Medicare Tax Calculated?

The Medicare tax rate is determined by the IRS and is subject to change. To calculate the Medicare tax, multiply your earnings by 0.0145. So if your biweekly pay is $2,000, your Medicare tax will be $29 (2,000 x 0.0145 = 29).

How much Medicare tax do I pay in 2021?

What is the Medicare Tax Rate for 2021? The Medicare tax rate is 1.45%. But the Federal Insurance Contributions Act tax combines two rates. FICA taxes include both the Social Security Administration tax rate of 6.2% and the Medicare tax rate.

Did Medicare taxes go up for 2021?

The Medicare tax rate is determined by the IRS and is subject to change. The Federal Insurance Contributions Act, or FICA, tax rate for earned income is 7.65% in 2021, which consists of the Social Security tax (6.2%) and the Medicare tax (1.45%).

What income is subject to the 3.8 Medicare tax?

How does the 3.8% Medicare surtax work? Who is affected by the tax? Individual taxpayers with more than $200,000 in modified adjusted gross income (MAGI) or couples with more than $250,000 in MAGI. For trusts and estates, the income threshold is $13,050.

How do you calculate FICA and Medicare tax 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

Who pays the 3.8 investment tax?

The net investment income tax (NIIT) is a 3.8% tax on investment income such as capital gains, dividends, and rental property income. This tax only applies to high-income taxpayers, such as single filers who make more than $200,000 and married couples who make more than $250,000, as well as certain estates and trusts.

What is the Social Security cap for 2021?

The amount liable to Social Security tax is capped at $142,800 in 2021 but will rise to $147,000 in 2022. The change to the taxable maximum, called the contribution and benefit base, is based on the National Average Wage Index. The increase for 2022, at 2.9 percent, is less than the 3.7 percent increase for 2021.

At what income level does Medicare tax increase?

The regulation has been in place since 2013. Everyone who earns income pays some of that income back into Medicare. The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

What Is Medicare Tax?

The Medicare tax, often known as the “hospital insurance tax,” is a federal employment tax that helps to support a portion of the Medicare healthcare program. Moreover, Medicare tax is a deduction from an employee’s paycheck or paid as a self-employment tax, similar to Social Security tax.

What is FICA?

The Federal Insurance Contributions Act, or FICA, was first enacted in 1935. It is a payroll tax that both employees and employers must pay to the IRS, and it consists of two taxes:

Social Security

The Social Security tax rate is a percentage of your pay used to fund the program. This rate will be 6.20% in 2021. Self-employed people will have to pay twice as much. You may be able to pay half of that with proper deductions. You will settle into the program while working, and the program will repay you when you retire.

In 2021, What Will the Medicare Tax Rate Be?

The Medicare tax rate for 2021 is 2.9%. In most cases, you are responsible for half of the entire Medicare tax amount (1.45%), and your employer is responsible for the remaining 1.45%. Your Medicare tax is a part of your paycheck automatically.

Is This a Tax That Everyone on Medicare Has to Pay?

While everyone pays some Medicare taxes, you’ll only pay the additional tax if your income is at or over the threshold. If your income falls below a specific point, you will not be obliged to pay any other taxes.

What Is the Purpose of the Medicare Tax?

The Medicare tax supports Medicare Part A, which provides health insurance to adults 65 and older. Part A of Medicare, generally known as hospital insurance, pays for inpatient hospital stays, skilled nursing care, hospice, and home health services.

When Will I Be Able to Quit Paying Medicare Tax?

FICA taxes will continue to be paid to Social Security and Medicare as long as you have earned income. If you have no source of income, you stop paying Medicare taxes.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is Part B for 2021?

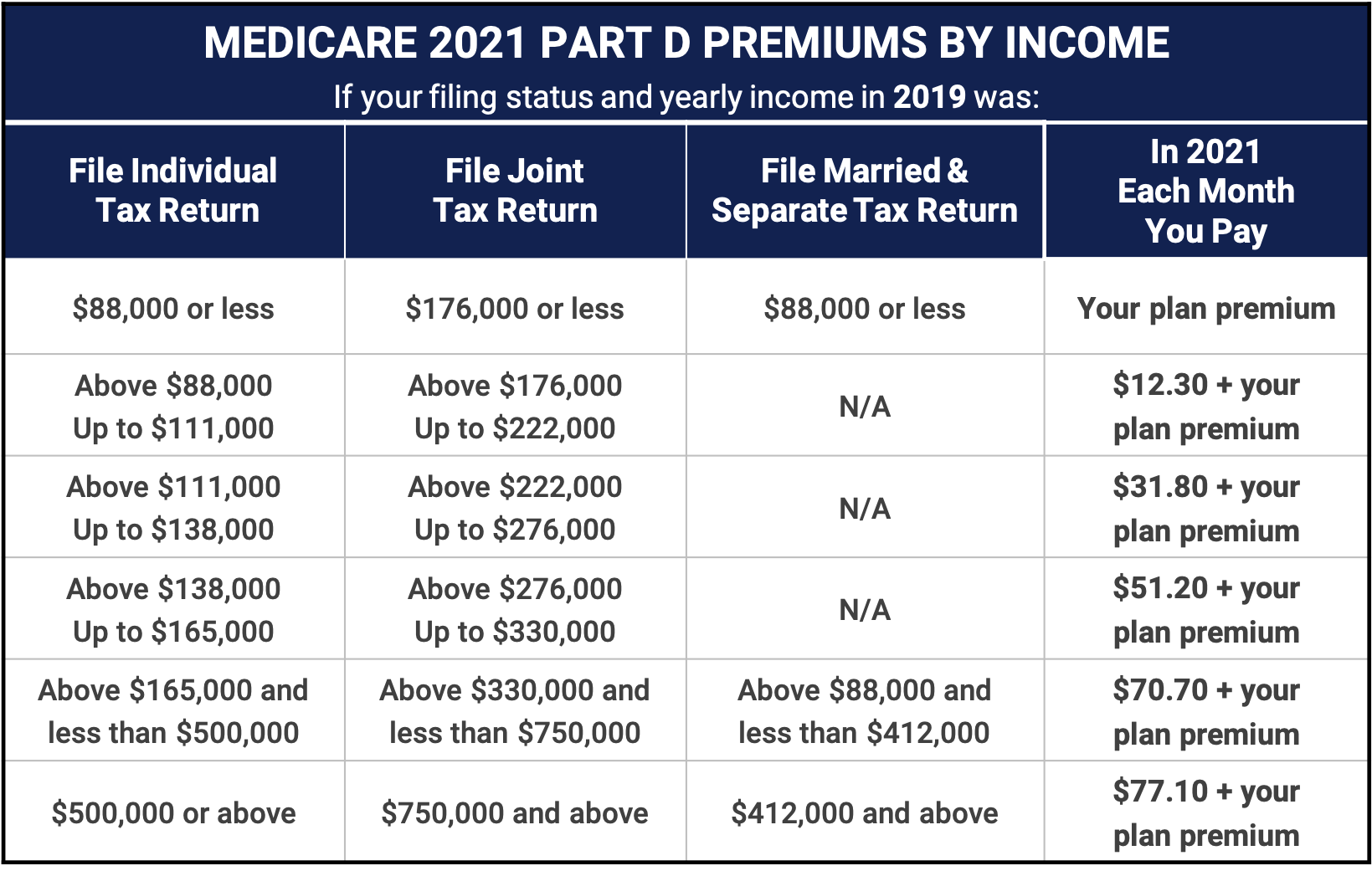

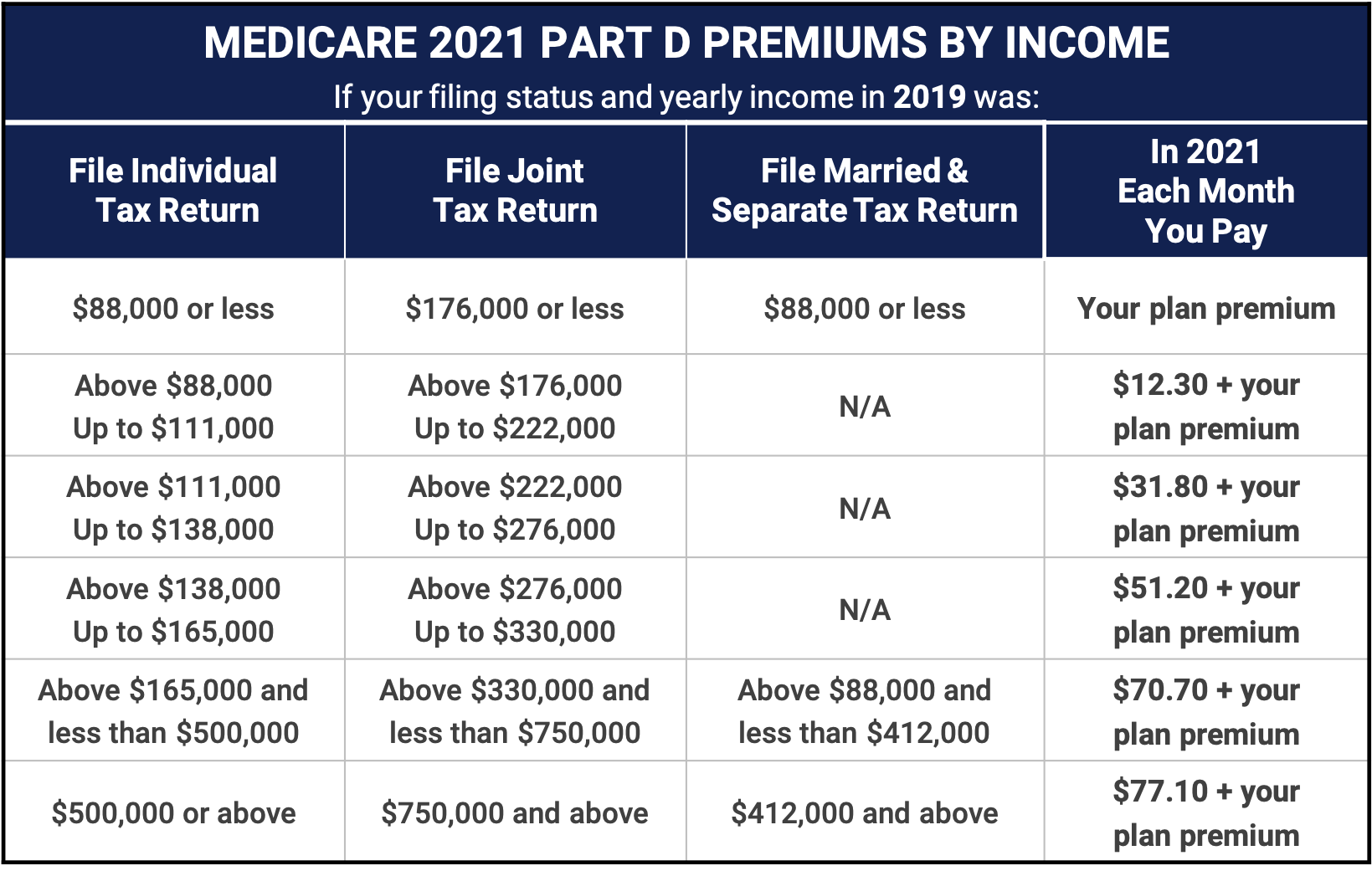

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

What is the Medicare tax rate for a person earning $225,000 a year?

However, the additional 0.9% only applies to the income above the taxpayer’s threshold limit. 8 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45% and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

Where are Medicare and Social Security taxes put?

Medicare taxes and Social Security taxes are put into trust funds held by the U.S. Treasury . Medicare tax is kept in the Hospital Insurance Trust Fund and is used to pay for Medicare Part A. Costs of Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage) are covered by the Supplemental Medical Insurance Trust Fund, ...

Is Medicare income taxable?

An individual’s Medicare wages are subject to Medicare tax. This generally includes earned income such as wages, tips, vacation allowances, bonuses, commissions, and other taxable benefits up to $200,000.

Do employers have to pay Medicare taxes?

Under the Federal Insurance Contributions Act (FICA ), employers are required to withhold Medicare tax and Social Security tax from employees’ paychecks. Likewise, the Self-Employed Contributions Act (SECA) mandates that self-employed workers pay Medicare tax and Social Security tax as part of their self-employment tax. 1. ...

Will the Hospital Insurance Trust Fund be exhausted?

However, the Hospital Insurance Trust Fund has been facing solvency and budget pressures and is expected to be exhausted by 2026, according to the 2019 Trustees Report. 5 If this happens, then Medicare services may be cut, or lawmakers may find other ways to finance these benefits.

Is Medicare surtax withheld from paycheck?

Like the initial Medicare tax, the surtax is withheld from an employee’s paycheck or paid with self-employment taxes. However, there is no employer-paid portion of the additional Medicare tax. The employee is responsible for paying the full 0.9%. 8.

How to calculate Medicare taxes?

If you receive both Medicare wages and self-employment income, calculate the Additional Medicare Tax by: 1 Calculating the Additional Medicare Tax on any Medicare wages in excess of the applicable threshold for the taxpayer's filing status, without regard to whether any tax was withheld; 2 Reducing the applicable threshold for the filing status by the total amount of Medicare wages received (but not below zero); and 3 Calculating the Additional Medicare Tax on any self-employment income in excess of the reduced threshold.

What is the responsibility of an employer for Medicare?

Employer Responsibilities. An employer is responsible for withholding the Additional Medicare Tax from wages or railroad retirement (RRTA) compensation it pays to an employee in excess of $200,000 in a calendar year, without regard to filing status. An employer must begin withholding Additional Medicare Tax in the pay period in which ...

Can non-resident aliens file Medicare?

There are no special rules for nonresident aliens or U.S. citizens and resident aliens living abroad for purposes of this provision. Medicare wages, railroad retirement (RRTA) compensation, and self-employment income earned by such individuals will also be subject to Additional Medicare Tax, if in excess of the applicable threshold for their filing status.

Is railroad retirement subject to Medicare?

All Medicare wages, railroad retirement (RRTA) compensation, and self-employment income subject to Medicare Tax are subject to Additional Medicare Tax, if paid in excess of the applicable threshold for the taxpayer's filing status. For more information on ...

How much Medicare do self employed people pay in 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

What is the Medicare tax rate?

The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

How much tax do you pay on income above the threshold?

For example, if you’re a single tax filer with an employment income of $250,000, you’d pay the standard 1.45 percent on $200,000 of your income, and then 2.35 percent on the remaining $50,000.

Do self employed people have to include Medicare in their estimated taxes?

Self-employed taxpayers who are at or over the limits need to include this calculation in their estimated tax payments for the year. When you file taxes, you’ll calculate your Additional Medicare Tax liability for the year. In some cases, you might owe more, and in other cases, you might have paid too much.