What does troop mean in Medicare?

· When you have a standalone Medicare Part D prescription drug plan or a Medicare Advantage (Medicare Part C) plan that includes Part D drug coverage, you also have what’s called a true out-of-pocket limit (otherwise known as TrOOP). TrOOP is important because it regulates the amount you’ll spend through your drug plan each year.

What exactly is troop or total out-of-pocket costs?

· If you’re a Medicare beneficiary with prescription drug coverage, the chances are that you’ve heard of the True out-of-pocket (TrOOP) costs. Medicare TrOOP is the maximum amount you’ll have to pay for your prescription drug plan expenses each year before you reach catastrophic coverage. In 2021, the TrOOP amount is $6,550 for the year and will be $7,050 in …

What is troop or true out-of-pocket costs?

TrOOP is the annual "Total out-of-pocket costs" and was also known before as "True out-pf-pocket costs". In general, TrOOP includes all payments for Medications listed on your plan's formulary and purchased at a Network or participating Pharmacy. This includes payments that you made and payments that were made by others on your behalf.

What are the stages of Medicare?

· TrOOP stands for True Out-Of-Pocket costs. While it may sound similar to MOOP, it is not the same thing. While MOOP applies to Original Medicare-covered services with Medicare Advantage Plans, TrOOP applies to prescription drug coverage, whether that’s from Medicare Advantage Prescription Drug plans or stand-alone Medicare Part D plans.

What does Medicare TrOOP mean?

True out-of-pocketTrue out-of-pocket (TrOOP) costs refer to your Medicare Prescription Drug Plan's maximum out-of-pocket amount. This is the maximum amount you would need to spend each year on medications covered by your prescription drug plan before you reach the “catastrophic” level of coverage.

What is the difference between MOOP and TrOOP?

No. TrOOP and MOOP are two different measures of out-of-pocket (OOP) costs - and TrOOP and MOOP are not related, aside from both defining OOP costs - and your TrOOP does not count toward your MOOP.

What counts toward TrOOP in Part D?

The TrOOP includes the annual deductible amount you pay before your Part D drug plan coverage begins. It also covers your formulary drug cost-sharing. To illustrate, let's say you have a prescription for a medication with a retail cost of $100.

How do I avoid the Medicare donut hole?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.

Do manufacturer discounts count towards TrOOP?

Your plan pays 5% for brand-name drugs and the drug manufacturer pays 70%. Your 25% + the manufacturer's discount of 70% = 95%. This 95% counts toward your TrOOP.

Does MOOP include premium?

The MOOP limit for each Medicare Advantage plan is the maximum amount you will spend on healthcare in a given year. Once your out-of-pocket costs reach this amount, the plan will pay 100% for your healthcare benefits until the start of the next plan year. Your MOOP limit does not apply to your monthly premium.

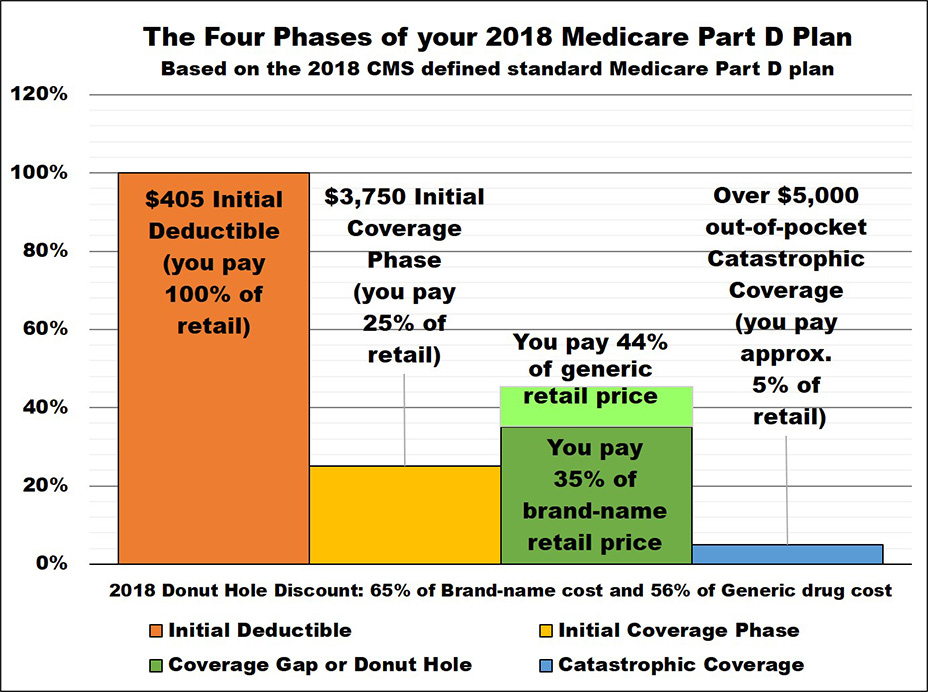

What are the 4 phases of Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

What is the 2022 true out-of-pocket TrOOP threshold?

$7,050The Medicare Part D total out-of-pocket threshold will bump up to $7,050 in 2022, a $500 increase from the previous year. The true (or total) out-of-pocket (TrOOP) marks the point at which Medicare Part D Catastrophic Coverage begins.

What is the 2021 Medicare Part D deductible?

Summary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year. You probably know that being covered by insurance doesn't mean you can always get services and benefits for free.

What is the Doughnut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

What happens when you hit the donut hole?

You enter the donut hole once your Medicare Part D plan has paid a certain amount toward your prescription drugs in 1 coverage year. Once you fall into the donut hole, you'll pay more out of pocket (OOP) for the cost of your prescriptions until you reach the yearly limit.

Can you use GoodRx If you are on Medicare?

While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge. Here's how it works.

What is the coverage gap for Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,130 on ...

How much will Medicare cover in 2021?

Once you and your plan have spent $4,130 on covered drugs in 2021, you're in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs won’t enter the coverage gap.

How much does Medicare pay for generic drugs?

Generic drugs. Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , coinsurance, and copayments. The discount you get on brand-name drugs in the coverage gap. What you pay in the coverage gap.

What is out of pocket cost?

out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance. to help you get out of the coverage gap. What you pay and what the manufacturer pays (95% of the cost of the drug) will count toward your out-out-pocket spending.