Medicare wages are employee earnings subject to the Medicare levy in the United States. This tax is similar to Social Security, which is a US payroll tax. It pays for the government’s Medicare program, which helps pay for health and hospital insurance for people who are 65 or older and have disabilities.

What wages are subject to Medicare tax?

What wages are taxable for Medicare?

- Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee’s wages.

- Employers also pay 1.45%.

- The Medicare tax for self-employed individuals is 2.9% to cover both the employee’s and employer’s portions.

What percent of wages goes to Medicare?

There was an increase of 2 percent in health care spending. This increase of 9% to $186 is justified by economic growth. Twenty-three percent of that revenue came from sales of $5 billion. Approximately 4% of total government expenditures are allocated to defense. How Much Of My Tax Goes To Benefits Uk?

Why are Medicare wages higher than wages?

The most common reason why medicare wages are higher is due to 401(k) contributions (W2, Box 12, Code D) or other pre-tax retirement plan contributions. They are subject to medicare tax but not to federal or state income tax.

How do you calculate Medicare taxable wages?

Information you need for this calculator

- Your taxable income.

- Your spouse's taxable income.

- Whether you were eligible for a Medicare levy exemption and the number of days you were eligible.

What is difference between wages and Medicare wages?

Box 1 (Wages, Tips and Other Compensation) represents the amount of compensation taxable for federal income tax purposes while box 3 (Social Security Wages) represents the portion taxable for social security purposes and box 5 (Medicare Wages) represents the portion taxable for Medicare tax purposes.

What is included in Medicare wages?

' These include medical, vision, and dental insurance premiums, Flexible Spending Account Health Care, and Flexible Spending Account Dependent Care. Employers are required to withhold Medicare tax on employees' Medicare wages. This is a flat rate of 1.45%, with employers contributing a matching amount.

What is Medicare wages on my w2?

What Are Medicare Wages and Tips on a W-2? The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding. The number included in this box will usually be identical to the “wages, tips, other compensation” section on the W-2 form.

Why is Medicare wages more than wages?

How is that possible? Certain amounts that are taken out of your pay are not subject to federal income tax, so they are not included in box 1, but they are subject to Social Security and Medicare taxes, so they are included in boxes 3 and 5.

Is Medicare wages and tips gross income?

Wages, tips, other compensation: Your total federal taxable gross pay. This can include: Wages, bonuses, and other cash compensation (including prizes or awards)

Does everyone pay Medicare tax?

There is no minimum income limit, and all individuals who work in the United States must pay the Medicare tax on their earnings.

Do Medicare wages include 401k?

Contributions to a 401k are subject to social security and medicare tax, but not to ordinary income tax.

Does my W-2 show how much I paid for health insurance?

Your health insurance premiums paid will be listed in box 12 of Form W2 with code DD.

Is Medicare deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

How is Medicare calculated on paycheck?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Why do I pay for Medicare tax?

The Medicare tax helps fund the Hospital Insurance (HI) Trust Fund. It's one of two trust funds that pay for Medicare. The HI Trust Fund pays for Medicare Part A benefits, including inpatient hospital care, skilled nursing facility care, home health care and hospice care.

What is the Medicare tax for?

Medicare taxes fund hospital, hospice, and nursing home expenses for elderly and disabled individuals. There are two additional Medicare surtaxes that apply to certain high earners.

Should medicare wages be the same as my salary? - Intuit

The medicare wages and tips box of your W-2 is supposed to be the same your wages, tips, other compensation box. All this means is that your medicare tax is based on 100% of your earnings.

What are Medicare Wages and Tips (W-2)? | BambooHR

How to Calculate Medicare Wages | Bizfluent

Medicare and Medicare Taxable Wage | Program Details & More

What Income Is Subject To Medicare Tax? - TAX TWERK

What is Medicare tax?

Medicare taxes go toward the Medicare program—a federal health insurance program for Americans who are older than 65 or have certain disabilities and diseases. The funds taken from Medicare taxes cover three areas.

How much do employers have to match for Medicare?

An employer is also required to match 1.45% of an employee’s withholding for Medicare wages and tips. For example, if an employee makes $2,000 during their pay period, that employee would have $29 withheld from their paycheck, and their employer would match that contribution with an additional $29 paid toward Medicare.

What is Medicare tips on W-2?

What Are Medicare Wages and Tips on a W-2? The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding.

What is the Medicare tax rate for 2020?

If you are self-employed, the 2020 Medicare tax rate is 2.9% on the first $137,700 of your yearly earnings.

Is Medicare taxed on wages?

Almost all wages earned by an employee in the United States are subject to the Medicare tax. How much an individual is taxed will depend on their yearly earnings. However, certain pretax deductions are exempt from the FICA tax, which includes Social Security and Medicare taxes.

What is Medicare tax?

The Medicare Program. The Medicare tax deducted from employee wages goes towards the Medicare program provided to Americans over 65 years of age. A line item in an employee pay stub, Medicare tax is implemented under FICA (Federal Insurance Contributions Act) and calculated on the employee’s Medicare taxable wage.

What is the Medicare tax rate on W-2?

Employers are required to withhold Medicare tax on employees’ Medicare wages. This is a flat rate of 1.45%, with employers contributing a matching amount. Medicare tax is reported in Box 5 of the W-2 ...

What are the gross earnings?

Gross earnings are made up of the following: Regular earnings . Overtime earnings. Paid time-off earnings. Payouts of time-off earnings (Sick, holiday, and vacation payouts) Non-work time for paid administrative leave, military leave, bereavement, and jury duty. Bonus pay.

When was Medicare enacted?

In 1965 , Medicare was enacted into law, with Medicare coverage intending to be an important source of post-retirement health care. Medicare is divided into four parts: Part A, Hospital Insurance: This helps pay for hospice care, in-patient hospital care, and nursing care.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is Medicare tax?

Medicare tax by definition goes to fund the federal insurance program for elderly and disabled people. It's deducted from your paychecks along with Social Security tax, which pays for that federal program, as well as ordinary federal and state income tax.

How much is pretax for Medicare?

Also, amounts you receive for educational assistance under your employer’s program earn you a pretax deduction; up to $5,250 annually is exempt from Medicare tax. If a pretax deduction is excluded from Medicare tax, subtract it from your gross wages before subtracting the tax. For example, if you earn $2,000 semi-monthly ...

What is the Social Security tax rate?

The Social Security tax rate is 6.2 percent payable by the employee and 6.2 percent payable by the employer. Self-employed people must pay what is called self-employment tax, which includes the employee and employer portions of Social Security and Medicare taxes, so they pay a 15.3 percent tax rate.

Where is Medicare tax withheld on W-2?

Your employer puts your annual Medicare wages in Box 5 of your W-2 and Medicare tax withheld for the year in Box 6. The amount shown in Box 5 does not include pretax deductions which are exempt from Medicare tax. Your last pay stub for the year may show a different year-to-date amount for Medicare wages than your W-2.

Is Medicare tax exempt from Social Security?

Pretax deductions that are excluded from Medicare tax are typically exempt from Social Security tax as well. Your Medicare wages are usually the same as your Social Security wages except that Social Security tax has an annual wage limit and Medicare tax has none. If you have multiple jobs that collectively put you over the wage limit, you may get a refund for over-withheld Social Security tax

Is pretax income tax exempt from Medicare?

Deductions from your wages used to pay for your employer-sponsored benefits reduce your income and are excluded from taxes. In many cases, pretax deductions are exempt from Medicare tax; however, this isn’t always the case.

Is Medicare tax law changing?

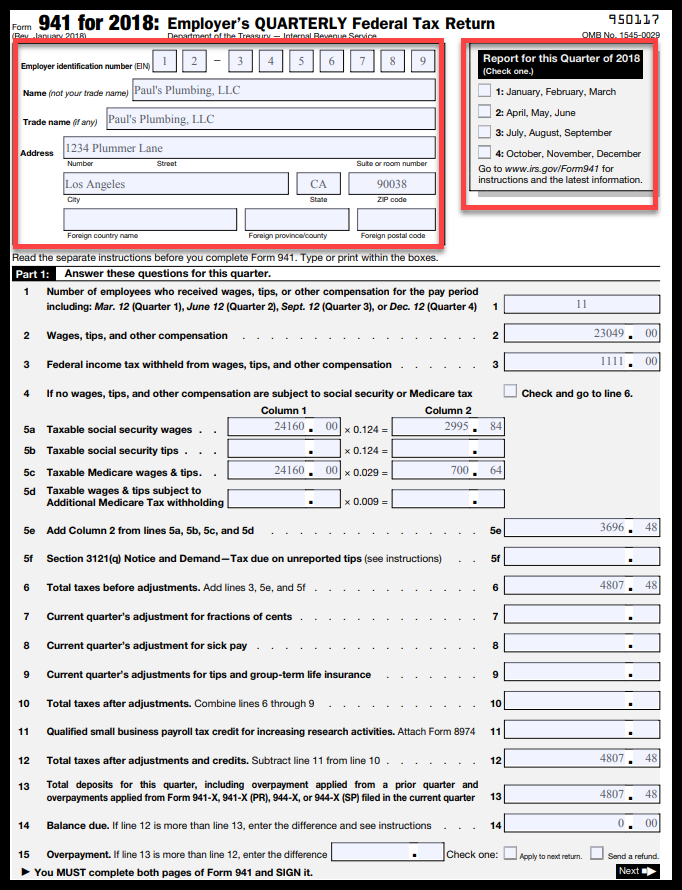

2018 Tax Law. Social Security and Medicare taxes aren't substantially impacted by the 2018 tax law changes. The other benefits of some deductions will change, since tax rates are generally going down. meaning deductions will deliver less tax saving to many taxpayers. Social Security taxes apply to wages up to $128,400 as of the 2018 tax year.