What's new social security and Medicare tax for 2017?

15-A, such as legislation enacted after it was published, go to IRS.gov/pub15a. What's New Social security and Medicare tax for 2017. The social security tax rate is 6.2% each for the employee and em- ployer, unchanged from 2016.

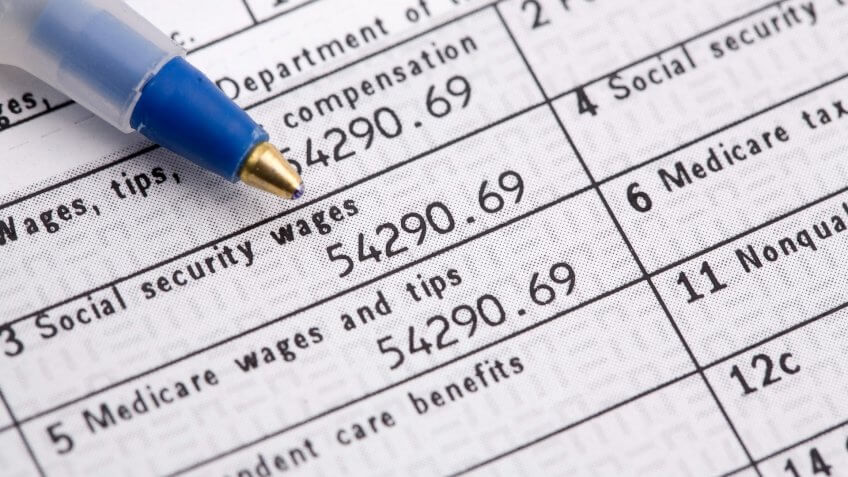

What are the Social Security and Medicare withholding rates?

Social Security and Medicare Withholding Rates. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers.

What is the wage base for Medicare tax?

Because there is no Medicare tax wage base, this exception doesn't apply to Medicare tax. For 2017, the social security tax wage base is $127,200 and the FUTA tax wage base is $7,000. Example.

What is 751 Social Security and Medicare withholding rates?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes.

What is the withholding rate for Medicare?

1.45%The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How do I calculate Medicare tax?

For example, if an employee's taxable wages are $700 for the week, their social security contribution would be: $700.00 x 6.2% = $43.40. Their Medicare contribution would be: $700.00 x 1.45%= $10.15.

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee's paycheck or paid as a self-employment tax. 1.

Why is Medicare taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the maximum Social Security benefit for 2017?

The maximum Social Security benefit for workers retiring at full retirement age in 2017 will be $2,687 per month, up from $2,639 per month in 2016. The SSA estimates that the average monthly Social Security benefits payable in January 2017 for all retired workers will be $1,360, up only $5 from the 2016 average payment of $1,355.

What is the maximum income for 2017?

The earnings limit for these individuals in 2017 will be $44,880 per year ($3,740 per month), up from $41,880 per year ($3,490 per month) in 2016. There is no limit on earnings beginning the month an individual attains full retirement age. 2017 Income Tax Brackets.

What is the tax rate for self employed?

Those who are self-employed must pay both the employer and employee portions of FICA taxes. Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable-maximum amount. The Medicare portion is 1.45% on all earnings.

How much is Social Security financed?

Social Security is financed by a 12.4 percent tax on wages up to the taxable-earnings cap, with half (6.2 percent) paid by workers and the other half paid by employers. This taxable wage base usually goes up each year—it rose from $117,000 in 2014 to $118,500 in 2015, but stayed put at that level for 2016.

Will Social Security increase Medicare?

For many SSI recipients, their Social Security increase is likely to be offset by higher Medicare premiums, which could be even steeper for those covered by Medicare Part B if they have delayed taking Social Security because they are still working, for instance. Increases in Retirement Earnings Limit.

Should compensation budgets take into account the increased taxes that employers will pay for affected positions?

Consequently, compensation budgets should take into account the increased taxes that employers will pay for affected positions. At the same time, expect some pushback from employees who may want to be "made whole" for their share of the extended tax hit.

Is FICA tax set by law?

Social Security and Medicare payroll taxes are collected together as the Federal Insurance Contributions Act (FICA) tax. FICA tax rates are statutorily set and therefore require new tax legislation to be changed.

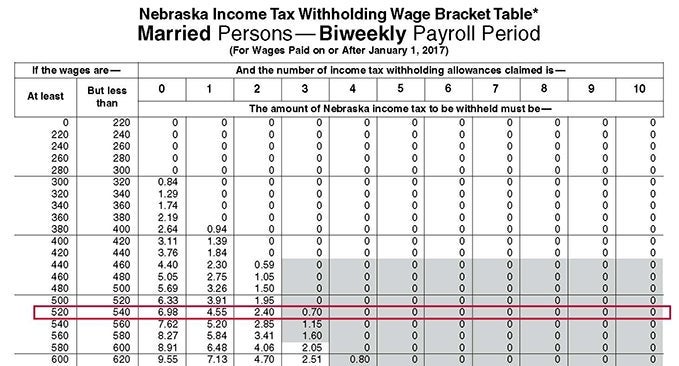

Tables for Percentage Method of Withholding

The following payroll tax rates tables are from IRS Notice 1036. The tables include federal withholding for year 2017 (income tax), FICA tax, Medicare tax and FUTA taxes.

How to Calculate 2017 Federal Income Tax by Using Federal Withholding Tax Table

1. Find your pay period: weekly, biweekly, semi-monthly, monthly or daily

How much is FICA tax?

How much are the current FICA tax rates? 1 The Social Security tax rate is 6.2% of earned income up to a certain cap. For 2017, the maximum amount of income that can be subject to Social Security tax is $127,200. No Social Security tax is assessed on income in excess of this amount. 2 The Medicare tax rate is much lower, at 1.45% of earned income. However, there is no wage cap -- every dollar of earned income is subject to Medicare taxes, even if the income is in the millions. High-income individuals pay an additional Medicare tax as part of the Affordable Care Act as well.

What is FICA payroll tax?

FICA is the U.S. federal payroll tax, designed to help fund the Social Security and Medicare programs. As of 2017, about 171 million people work and contribute FICA taxes. Image source: Getty Images. The basic idea behind FICA is that the current generation of workers is funding these programs for today's retirees, ...

What is FICA tax?

FICA, which stands for Federal Insurance Contribution Act, is a tax that is paid by employees as well as their employers, and is often referred to as the payroll tax. The purpose of the FICA tax is to fund the Social Security and Medicare programs, which provide benefits to American retirees.

Who is responsible for paying self employed taxes?

Self-employed individuals are considered to be both the employer and employee, and are therefore responsible for paying both parts of the tax, which is collectively known as the self-employment tax.

Is Medicare taxed on income?

The Medicare tax rate is much lower, at 1.45% of earned income. However, there is no wage cap -- every dollar of earned income is subject to Medicare taxes, even if the income is in the millions. High-income individuals pay an additional Medicare tax as part of the Affordable Care Act as well. For both of these taxes, employers match their ...