What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

Does Medicaid pay for Part B premium?

Does Medicaid pay for Medicare premiums? Medicaid pays Part A (if any) and Part B premiums. Medicaid pays Medicare deductibles, coinsurance, and copayments for services furnished by Medicare providers for Medicare-covered items and services (even if the Medicaid State Plan payment does not fully pay these charges, the QMB is not liable for them).

Is Medicare Part B cost based on income?

The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium. Once you exceed $87,000 yearly income if you file an individual tax return, or $174,000 if you file a joint tax return, the cost goes up to $202.40.

How high will the Medicare Part B deductible get?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the cost of Medicare Part B for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How much is Medicare Part B monthly?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

What is the Medicare Part B monthly premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Does everyone have to pay Part B of Medicare?

Does everyone pay the same for Medicare Part B? No, each beneficiary will pay a Medicare Part B premium that is based on their income. Do you pay the Medicare Part B premium with Medicare Advantage? You must still pay your Medicare Part B premium, even when you enroll in a Medicare Advantage plan.

How much does Social Security take out for Medicare each month?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

What is the average cost of supplemental insurance for Medicare?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Does Medicare Part B pay for prescriptions?

Medicare Part B (Medical Insurance) includes limited drug coverage. It doesn't cover most drugs you get at the pharmacy. You'll need to join a Medicare drug plan or health plan with drug coverage to get Medicare coverage for prescription drugs for most chronic conditions, like high blood pressure.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

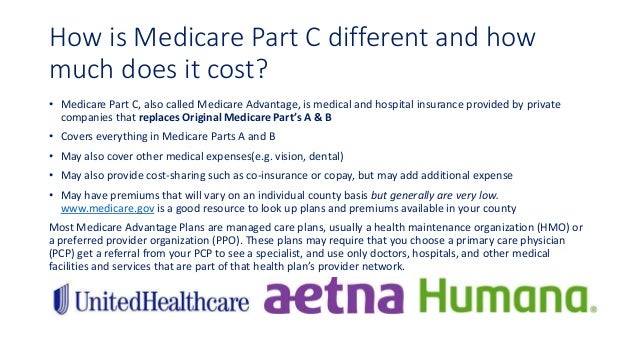

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much income is required to pay Part B?

Since 2007, people who earn more than $85,000 ($170,000 for a couple) have paid higher Part B premiums (and higher Part D premiums) based on their income. For the first time, the threshold for what counts as “high income” was adjusted for inflation as of 2020, increasing it to $87,000 for a single individual and $174,000 for a couple.

How much is the standard Part B premium in 2020?

The standard Part B premium increased by about $9/month in 2020. But the 1.6 percent Social Security COLA for 2020 increased the average beneficiary’s Social Security benefit by $24/month. Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees have been paying the standard premium in 2020.

What is the Medicare deductible for 2021?

Part B deductible also increased for 2021. Medicare B also has a deductible, which has increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20 percent of the Medicare-approved cost for Part B services.

How much is the Social Security Cola for 2021?

The high-income threshold (where premiums increase based on income) grew to $88,000 for a single person for 2021. The Part B deductible increased to $203 for 2021. Q: How much does Medicare Part B cost the insured? ...

How much is the 2020 Medicare premium?

Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month). But that’s in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium.

What is the income threshold for Part B?

For people with income above $87,000 ($174,000 for a couple) in 2020, Part B premiums for 2020 ranged from $202.40/month to $491.60/month. As explained by the math above, the high-income threshold has increased to $88,000 for a single individual and $176,000 for a couple in 2021.

How much is Part B insurance in 2021?

In 2021, most enrollees will be paying $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month).

How does Medicare Part B work?

How it Works Premiums & Deductibles Coverage & Enrollment FAQs. Medicare Part B provides the medical portion of your Medicare coverage . Part B has costs, including a premium, deductible and coinsurance. Together, they make up the overall cost of Medicare Part B. But the costs aren’t the same for everyone.

What is Medicare premium?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. A deductible is the amount you pay out of pocket before your insurance company covers its ...

What is premium insurance?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. and annual deductible. A deductible is the amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs ...

Does Medicare Supplement Insurance cover Part B?

Medicare Supplement Insurance (Medigap) has several policies that will help cover your Part B costs, including premiums, deductibles and out-of-pocket costs.

Is Medicare Part B based on income?

Unlike the Part B premium, this amount isn’t based on income. Everyone enrolled in Original Medicare pays the same Part B deductible. That means no matter how high your income is, you’ll pay the standard Medicare Part B deductible amount.

Is Medicare Part B the same as Medicare Advantage?

But Part B coverage isn’t exclusive to Original Medicare; you’ll receive at least the same benefits with Medicare Advantage (Part C).

Does Medicare cover wheelchairs?

Medically necessary: Your doctor must deem your treatment is required to improve or maintain your health. Preventive services: Medicare-approved screenings and other preventive services are covered and generally at no-cost. Part B can also cover wheelchairs and other medically necessary equipment.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).