What Medicare plan is the most popular?

There are 10 different Medicare Supplement plans approved by Medicare, each with a different level of provided benefits. Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold).Sep 25, 2021

What is the most popular Medigap plan for 2021?

Medigap Plans F and G are the most popular Medicare Supplement plans in 2021.Oct 6, 2021

What is the difference between Medicare A and B and Medicare Advantage?

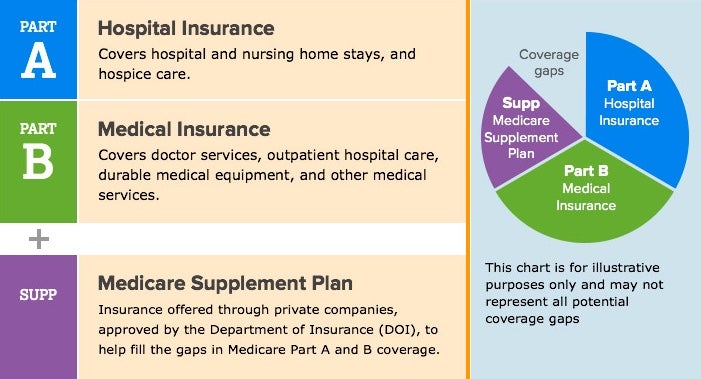

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Why does zip code affect Medicare?

Because Medicare Advantage networks of care are dependent upon the private insurer supplying each individual plan, the availability of Medicare Advantage Plans will vary according to region. This is where your zip code matters in terms of Medicare eligibility.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Popular Medigap Plans: Plan F vs. Plan G vs. Plan N vs. Plan C

While Plan F is the most popular plan, Medigap Plan C, Plan G and Plan N are the next most popular Medicare Supplement Insurance plans.

Is Medigap Plan F the Best?

There are several reasons why consumers choose certain Medigap plan options over others.

Plan G and Plan N Likely to be the Most Popular Plan Going Forward

Because Plan F and Plan C are no longer available to new Medicare beneficiaries who became eligible for Medicare after January 2020, Plan G is now the Medigap plan option that covers more Medicare costs than any other Medigap plan available to new Medicare beneficiaries.

What Do the Most Medicare Supplement Plans Cover?

The chart below shows which benefits are covered by each of the 10 standardized Medicare Supplement Insurance plans available in most states. Take note of how Plan F and Plan G coverage compares to other plans, particularly plans like Plan A and Plan B.

What Do the Most Popular Medicare Supplement Plans Cost?

Although first-dollar coverage Medigap plans are the most popular, some beneficiaries may choose other plans based on their premiums and costs that they cover.

How Do Medicare Supplement Companies Determine Plan Costs?

Medicare Supplement Insurance companies can charge different premiums for policies depending on a number of factors, including age and location.

Why Should I Compare Medicare Supplement Plans?

Comparison shopping is important because two different insurance companies could charge you a different price for a plan with the same benefits.

What do the most popular Medigap plans cover?

Medicare Supplement Insurance provides coverage in areas where Original Medicare (Part A and Part B) requires some out-of-pocket spending in the form of deductibles, copayments and coinsurance. There are nine such out-of-pocket costs that a Medigap plan can cover in part or in full, if at all.

Plan F: Traditionally the most popular Medigap plan

Plan F has been the most popular Medicare Supplement Insurance plan over recent years. Plan F offers the most comprehensive coverage, for which its popularity may be attributed. Plan F beneficiaries typically face little to no out-of-pocket costs when seeking Medicare-covered services or items.

Plan G: Becoming the new most popular plan

There’s no doubt that Plan F has been the most popular Medicare Supplement Insurance plan for years. Even going back to 2012, Plan F accounted for 53% of the Medigap market share with no other plan garnering more than 13%.

Plan N and other popular Medicare Supplement plans

Any discussion of the most popular Medigap plans deserves a mention of Plan N. Plan N has maintained about a 10% share of the Medigap market over the years, making it the clear-cut favorite after Plan F and Plan G.

Enrolling in the Most Popular Plan

The most popular Medigap plan may not always be the best plan for you. Each plan is designed with different health care needs and budgets in mind, so it’s important to examine each plan carefully to determine how it may fit your own needs.

How much is Medicare Part B deductible in 2021?

That aside, you would have a out of pocket max. The Medicare Part B annual deductible is $203 in 2021. This may seem small compared to the Part A deductible. It is, but the real cost under B is the coinsurance which is where coverage matters. Part B coinsurance is different than the deductible.

How much is Medicare Part A 2021?

The annual deductible for Medicare Part A in 2021 is $1,484. This your out of pocket expense for the first 60 days of hospitalization.

What are the different Medicare Supplement plans?

Medicare Supplement plans offer different coverage to close the Medicare gaps. They are Plans A, B, C, D, F, G, K, L, M and N.

Why is Medicare Supplement Plan important?

That is why a Medicare supplement plan is so important because it provides you generally speaking with an out of pocket max. Yes, if you were in the hospital for more than 365 consecutive days you would then have exceeded both your Medicare and supplement insurance coverage and you would have to pay all the costs.

Why is it important to take a high deductible?

By taking a high deductible plan, you significantly reduce your premiums, and potentially save all or most of the deductible costs in the premium savings. This may be a good option if you have low medical expenses and if you are looking to save on premium costs.

What is the most comprehensive plan?

Plan F. Plan F provides the most comprehensive coverage. Policyholders get the following benefits under Plan F: Part A benefits. Part A Deductible. Part A hospital and co-insurance costs up to an additional 365 days after Medicare benefits are exhausted. Part A hospice care co-payment or co-insurance. Part B benefits.

How much is coinsurance in Medicare?

There is a 20% coinsurance under Medicare Part B. For example, if you are sent to a specialist for care, you would pay the first 20% of the charges, and Medicare would pick up the other 80%. This is different than a co-payment, where you would pay a fixed amount for service.

Plan F

Plan F is the most comprehensive Medicare supplement plan. It covers the Part B deductible and everything covered by Plan G. After Medicare pays its share, Medicare supplement Plan F pays the rest.

Plan G

Plan G is like Plan F. However, with Plan G, beneficiaries are responsible for the Part B deductible.

Plan N

Plan N is one of the most popular Medicare Supplement plans for all beneficiaries.

Don't Leave Your Health to Chance

You've worked hard your whole life by thinking ahead. Now do the same for your health. Get FREE Medicare help to plan your future.

Medicare Supplement Plan G

The most popular Medicare supplement plan available now is Medicare supplement Plan G. Plan G offers great coverage with only one small deductible you have to pay each year.

Medicare Supplement Plan N

Now, coming in to close second is Medicare Supplement Plan N, which I happen to love.

The Top Medicare Supplement Companies

While there are many companies out there that offer Medicare supplement plans, not all of them have competitive premiums.

Best of the Blues: Highmark

Service area: Available in Delaware, New York, Pennsylvania and West Virginia.

How to shop for Medicare Advantage plans

The right Medicare Advantage plan for you will depend on your health history, prescription medications and where you live, among other things. Here are some strategies for selecting the best plan:

What is the best Medicare plan for 2021?

This makes Plan G the most popular Medigap plan for those people who turned 65 after January 1, 2020. If you are new to Medicare in 2021 here are our recommendations: Medigap Plan G: In most cases, this is the best option. It covers the most benefits possible at usually the most competitive prices.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

Has Medigap changed?

As you may know Medigap underwent some changes in 2020, which means that the Medigap plans worth considering also changed.

Is Innovative G better than regular G?

Note : In some states Innovative G will be a better deal than regular G. Medigap Plan N: Plan N is a good plan as long as you live in a state that doesn’t allow for Medicare’s excess charges. Plan N is the third most popular plan in terms of total enrollment after Plan F and Plan G.