Does Medicare really contribute to a MSA?

Does Medicare contribute to MSA? Medicare MSA plans cover the Medicare services that all Medicare Advantage Plans must cover. In addition, some Medicare MSA plans may cover extra Benefits for an extra cost, like: Dental. Vision.

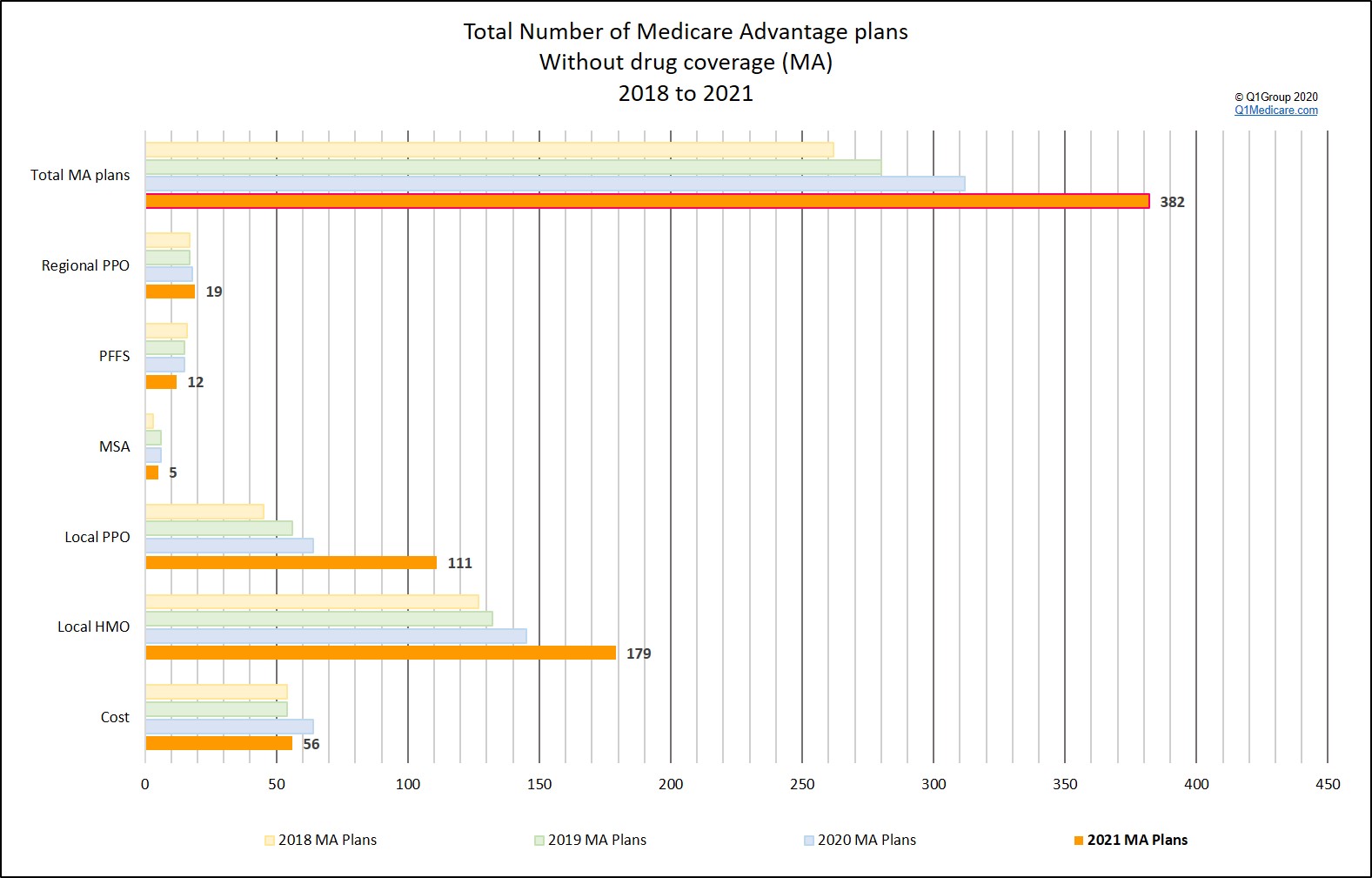

Do MSA plans have drug coverage?

MSA plans do not offer drug coverage. You must enroll in a standalone drug plan if you want drug coverage. Copays and Out of Pocket Limits. Premiums for Medicare Advantage plans are typically lower than Medicare Supplement premiums, but they may have higher maximum out of pocket limits.

What is the best health plan for Medicare?

- Standard Medicare benefits for people 65+ and older who meet certain other requirements such as disabilities.

- Covers Medicare-eligible costs, and you pay the rest out-of-pocket, which may include premiums, deductibles and coinsurance.

- You can use your coverage with any doctor or hospital that accepts Medicare in the U.S.

What is the Medicare Advantage of security health plan?

Advantage Plan. In all types of Medicare Advantage Plans, you’re always covered for emergency and urgent care. Medicare Advantage Plans must offer emergency coverage outside of the plan’s service area (but not outside the U.S.). Many Medicare Advantage Plans also offer extra benefits such as dental care, eyeglasses, or wellness programs ...

What is an MSA Medicare plan?

– A Medicare Medical Savings Account (MSA) plan is a type of Medicare Advantage plan that combines a high- deductible health plan with a medical savings account.

How is an MSA different than other plans?

Some MSAs offer additional benefits, such as vision and hearing care. Unlike other Medicare Advantage Plans, MSA plans include both a high deductible health plan (HDHP) and a bank account to help pay your medical costs. HDHPs have large deductibles that you must meet before receiving coverage.

What is MSA and how does it work?

The Medicare MSA Plan deposits money in a special savings account for you to use to pay health care expenses. The amount of the deposit varies by plan. You can use this money to pay your Medicare-covered costs before you meet the deductible.

Who is eligible for an MSA?

MSAs were limited to the self-employed or employer groups with 50 or fewer employees, and they were subject to requirements relating to eligibility, contributions, and use of funds. Participants had to be enrolled in a high-deductible health insurance plan (HDHP).

What is the disadvantage of a MSA?

A person has the option of withdrawing their money from an MSA. However, if they do take it out, they must pay a 50% tax penalty as well as income taxes on the withdrawal. If a person does not use the money in the MSA by the end of the year, the remaining money rolls over into an account for the following year.

What are the advantages of an MSA?

This type of plan combines a high-deductible health insurance plan with a medical savings account that you can use to pay for your health care costs. Medicare MSA Plans give you freedom to control your health care dollars and provide you with important coverage against high health care costs.

What is MSA example?

It can be either in manufacturing or service industries. Some of the examples are automobiles, pharmaceuticals, garment, healthcare, airlines, banks, consulting firms, etc. MSA helps us to find variation due to measurement system itself and guide us to improve the system for measurement.

What is an MSA payment?

An MSA is a financial arrangement that allocates a portion of a settlement, judgment, award, or other payment to pay for future medical services. The law mandates protection of the Medicare trust funds but does not mandate an MSA as the vehicle used for that purpose.

How is MSA calculated?

Bias AssessmentSubtract the reference value from x̄ to yield the Bias: Bias = x̄ - Reference Value. ... Calculate the Bias percentage: Bias Percentage = Bias / Process Variation.Analyze the results. If there is a relatively high value, examine the following potential root causes:

What happens if you spend your MSA?

Simple answer: When MSA funds are exhausted, Medicare will begin to pay for all covered items related to your injury, only if you have properly managed your MSA funds and reported your spending to Medicare, and if you are enrolled as a beneficiary on Medicare.

What is the deductible for MSA plans?

The plan's yearly deductible is $3,000. The plan pays for all Medicare-covered services once Mr.

What is the maximum amount that can be contributed to an MSA?

How much can I contribute to an MSA? The annual limit to contributions are 65% of your insurance deductible if you have single coverage, or 75% if you have family coverage.

What is MSA plan?

An MSA plan is a type of Medicare Advantage plan. However, MSA plans are different from most other Medicare Advantage plans. MSA plans don’t typically include dental, vision, or prescription drug coverage, as some Medicare Advantage plans do. MSAs have more restrictions than Medicare Advantage plans when it comes to who can join in the first place.

What is MSA insurance?

An MSA plan is a type of Medicare Advantage plan. Medicare Advantage plans give you health coverage through a private insurance company that has contracted with Medicare. MSA plans have two parts: A high-deductible health plan (HDHP). With this type of plan, you are responsible for paying your health costs up to a certain dollar amount, ...

How to choose MSA?

Why choose an MSA plan? 1 They have a $0 premium. You pay no premium with an MSA plan. You do still have to pay your Part B premium (typically it’s withheld from your Social Security check) and the premiums for any Part D prescription drug plan you choose. 2 They are simple. If you enroll in an MSA, you can have $0 premiums, and no required copays or coinsurance. 3 They have tax benefits. Money deposited in the MSA account is not taxed as income, and any interest it earns is tax-free too. 4 Your out-of-pocket costs are predictable. Worst-case scenario: the most you’d have to spend is the difference between the annual deposit and your deductible. 5 Your savings can build if you stay healthy. If you spend less money on health care than the yearly deposit, the difference will roll over. If the balance grows high enough to cover your full deductible, you might not need to pay anything out of pocket in some years. 6 You can move the funds to any financial institution you choose. The plan will open your account at a bank they choose, but you can move the money if you like. Keep in mind that you will be responsible for tracking your spending if you move the funds.

How much is MSA premium?

The premium for an MSA is $0, but that doesn’t mean your total costs are always zero. It’s best to set some money aside in case you have health care costs above what is in the savings account. Until you meet your deductible, you’re responsible for paying 100% of the Medicare-approved amount for your care. You can use the money from your medical ...

How many people have MSA plans in 2019?

You’re not alone. Only about 5,600 Medicare enrollees have MSA plans in 2019. 1 That’s miniscule compared to the 64 million total people on Medicare. 2. However, things may be changing, as MSA plans are about to become available to more people in more states. That’s a good thing, because this type of plan offers substantial benefits for some people.

What is Medicare deductible?

With this type of plan, you are responsible for paying your health costs up to a certain dollar amount, called your deductible. Once you reach the deductible, the plan pays all your medical costs. A medical savings account. Medicare puts money into this account for you each year, and you can use it to pay for your health care costs ...

When is Medicare enrollment period?

Specifically, the initial enrollment period occurs during a seven-month window around your 65th birthday. It includes the month you turn 65, plus the three months before and after. The Annual Election Period, when anyone can change Medicare plans, runs from October 15 to December 7.

What is a Medicare MSA plan?

A Medicare MSA plan is one of the six types of Medicare Advantage — also called Part C — plans offered to consumers by private insurance companies in partnership with Medicare. As with all Medicare Advantage plans, you can enroll in an MSA plan when you become eligible for Medicare Parts A and B.

MSA deductibles, deposits and costs

There are typically no premiums for MSA plans, but you must pay Part B premiums, which, for most people, are $148.50 per month in 2021 (high-income participants pay a surcharge on these premiums).

Who are MSA plans good for?

MSA plans tend to work best for people who are relatively healthy and who don’t take expensive medications or use many health services. Only about 5,600 Medicare beneficiaries chose MSA plans in 2019 — down from 6,040 in 2018, according to the Kaiser Family Foundation .

Take our quiz

Navigating Medicare can be challenging, especially since different types of coverage won’t necessarily cover all of your expenses. Choosing to purchase additional coverage may help. Find out which supplemental coverage option is best for you, Medicare Advantage or Original Medicare with Medigap.

The bottom line

Medicare MSA plans combine a high-deductible health plan with a medical savings account that’s funded by the government. While they’re not widely used, they may appeal to Medicare beneficiaries who want a flexible approach to their healthcare spending and who expect to need few healthcare services.

What is MSA in Medicare?

A Medicare MSA is meant to help enrollees control their medical expenses. Beneficiaries have the risk of paying more out-of-pocket for healthcare services than do those in other Medicare Advantage plans, but those who do not anticipate having significant medical expenses may find the plans economically attractive.

What is MSA plan?

Medicare Medical Savings Account (MSA) Plans are a type of Medicare Advantage plan that offers enrollees a combination of a high-deductible health insurance plan and a Medical Savings Account from which qualified medical expenses can be paid . Once the MSA funds are exhausted, medical expenses are paid out-of-pocket until ...

What is MSA insurance?

Medicare MSAs combine a medical savings account with a high deductible health insurance plan. The plans are offered by private insurers, and cover any medical expense that Original Medicare covers once the deductible has been met. The Medical Savings Account portion of the MSA plan is funded by Medicare, which pays the private insurer to set up ...

What happens to MSA funds after they are exhausted?

Once the MSA funds are exhausted, medical expenses are paid out-of-pocket until the maximum out-of-pocket deductible is met. These plans resemble the Health Savings Accounts that many employees receive from their employers if they choose a high-deductible health insurance plan, though in the case of Medicare MSAs, ...

How to determine what a Medicare plan will cost?

The best way to determine what a plan will cost is by asking plan representatives about these details. You will need to continue paying your Medicare Part B premium but will not need to pay a monthly premium for the Medicare MSA plan itself.

What are the advantages of MSA?

Advantages of a Medicare MSA Plan. Medicare MSA plans offer the advantage of flexibility and control. Enrollees are able to choose their own medical providers and pay a good portion of their qualified medical expenses with funds that are provided by Medicare through the private insurer that provides their high deductible Medicare Advantage health ...

When do you have to pay deductible for MSA?

Unlike other Medicare Advantage plans, if you join an MSA plan after January 1, your yearly deductible will be prorated to the number of months left in the year. Though some of these plans have a network of providers that charge lower contracted fees, not all do, and MSA enrollees can seek care from any provider that accepts Medicare.

When is the MSA window open?

If you’re enrolled in Original Medicare or a regular Medicare Advantage plan and you’d like to consider an MSA plan instead for 2020, your window of opportunity continues until December 7, 2019.

How many MSAs are there in 2020?

In total, MSAs are available in 1,883 counties across 29 states in 2020, up from 1,262 counties in 19 states in 2019. You can see if any MSAs are available in your area by using Medicare’s plan finder tool or by reaching out to a health insurance broker who is certified to offer Medicare Advantage plans.

What is the maximum deductible for Medicare Advantage 2020?

In 2020, the maximum allowable deductible for an MSA is $13,400, although many plans have deductibles well below this limit.

How many people are in Medicare Advantage 2019?

Very few enrollees, but that might start to change. Although there are 22 million people enrolled in Medicare Advantage plans in 2019, only about 5,600 of them are enrolled in MSA plans.

What is a medical savings account?

What is a Medicare Medical Savings Account Plan? A Medicare Medical Savings Account Plan is a type of Medicare Advantage plan that combines a high-deductible health insurance policy with a medical savings account (MSA). MSAs differ from regular Medicare Advantage plans in several key ways, which are detailed below.

Can you use MSA money for medical expenses?

The person enrolled in the Medicare MSA plan can then use the money in the MSA if and when they have medical expenses during the year ( see examples here of how this works). MSA withdrawals are not taxed as long as they’re used for qualified medical expenses (including out-of-pocket costs for Medicare-covered services as well as services ...

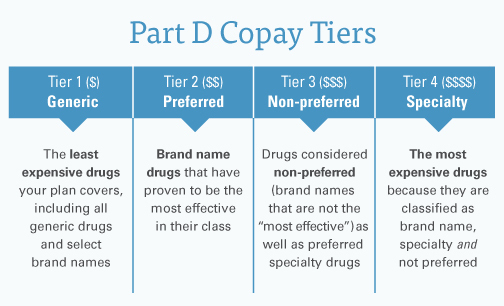

Does MSA have prescription coverage?

No integrated prescription coverage. Unlike most Medicare Advantage plans, MSA plans do not include Part D prescription drug coverage. But beneficiaries can purchase a separate stand-alone Part D plan in addition to the MSA plan.

What Is a Medicare Advantage MSA?

A Medicare Medical Savings Account (MSA) Plan is a plan available to most people eligible for Medicare who live where these plans are offered. An MSA has two separate components: a medical savings account and a high-deductible Medicare Advantage plan (“Part C”).

How a Medicare Advantage MSA Plan Works

The first step to getting an MSA plan is to select a high-deductible MSA plan. You can do this when you first sign up for Medicare or during the annual open enrollment period between October 15 and December 7. You won't pay a monthly premium for your Medicare Advantage MSA, however, you must continue to pay your monthly Medicare Part B premium. 1

The Bottom Line

A Medicare Medical Savings Account (MSA) plan isn’t right for everyone. But it might be a good fit if you appreciate the flexibility of choosing any Medicare-approved provider, and if you can afford to pay a high deductible before your coverage kicks in.

What is Medicare MSA?

Medicare MSA Plans (offered by private companies) are Medicare Advantage Plan options . Medicare MSA Plans are similar to Health Savings Account plans available outside of Medicare. If you choose a Medicare MSA Plan, you’re still in Medicare and you will still have Medicare rights and protections.

How does Medicare work?

Medicare works with private insurance companies to offer you ways to get your health care coverage. These companies can choose to offer a consumer-directed Medicare Advantage Plan, called a Medicare Medical Savings Account (MSA) Plan. This type of plan combines a high-deductible health insurance plan with a medical savings account that you can use to pay for your health care costs. Medicare MSA Plans give you freedom to control your health care dollars and provide you with important coverage against high health care costs.

What is assignment in Medicare?

Assignment—An agreement by your doctor or other supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance.

What rights do you have with Medicare?

As a person with Medicare, you have certain rights. One of these is the right to a fair process to appeal decisions about your health care payment of services.