The four Medicare Savings Programs include:

| MSP | Income Limits * | Benefit |

| Qualified Medicare Beneficiary ( QMB) Pr ... | 100% of FPL | QMB pays Medicare Part A and Part B prem ... |

| Qualified Medicare Beneficiary Plus ( QM ... | 100% of FPL** | QMB+ (QMB Plus) has full Medicaid benefi ... |

| Specified Low-Income Medicare Beneficiar ... | 100-120% of FPL | SLMB pays Medicare Part B premiums CMS: ... |

| Specified Low-Income Medicare Beneficiar ... | 100-120% of FPL** | SLMB+ (SLMB Plus) has full Medicaid bene ... |

Full Answer

How do I apply for Medicare savings program?

To qualify for the QI program, you must meet the following:

- Individual monthly income limit of $1,469 (limits may be higher in Alaska or Hawaii)

- Married couple monthly income limit of $1,890 (limits may be higher in Alaska or Hawaii)

- Individual resource limit of $7,970

- Married couple resource limit of $11,960

What is the slmb Medicare savings program?

- Qualified Medicare Beneficiary (QMB) program, which helps with Part A and Part B premiums, as well as deductibles, copayments, coinsurance, and prescription drugs

- Qualified Individual (QI) program, which helps with Part B premiums

- Qualified Disabled and Working Individuals (QDWI) programs, which help with Part A premiums

Is Medicaid a Medicare savings program?

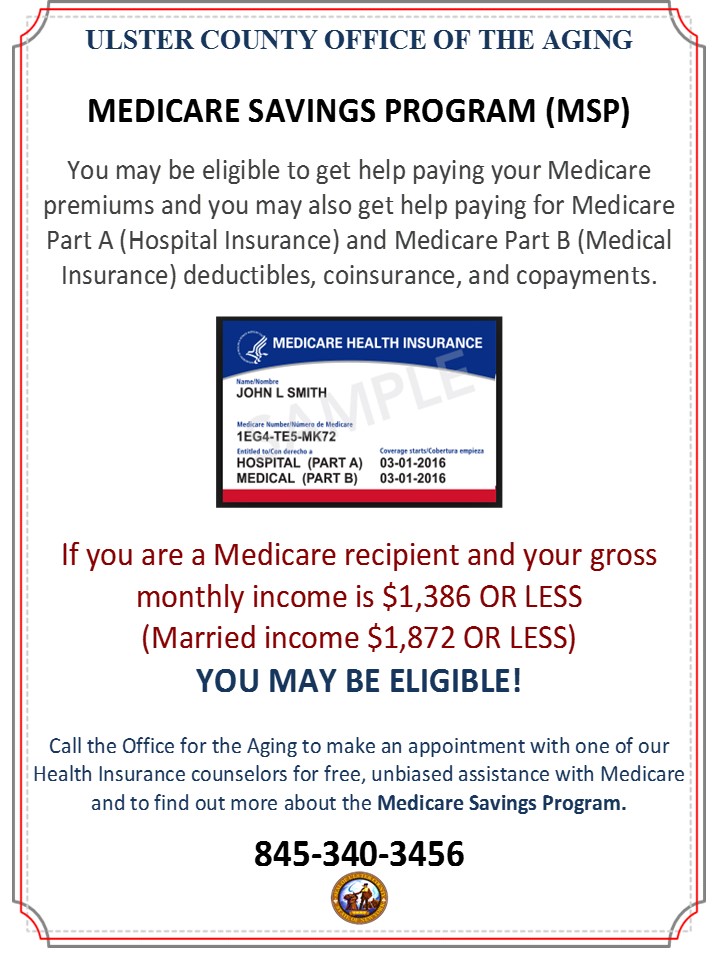

The Medicare Savings Program (MSP) is a Medicaid-administered program that can assist people with limited income in paying for their Medicare premiums. Depending on your income, the MSP may also pay for other cost-sharing expenses.

What is the Qi Medicare savings program?

- The Qualified Medicare Beneficiary (QMB) Program. ...

- The Special Low-Income Medicare Beneficiary (SLMB) Program. ...

- Qualifying Individuals (QI). ...

- Qualified Disabled and Working Individuals (QDWI). ...

What do Medicare savings programs MSP provide?

Medicare Savings Programs (MSP) are federally funded programs administered by each individual state. These programs are for people with limited income and resources to help pay some or all of their Medicare premiums, deductibles, copayments, and coinsurance.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Is MSP the same as Medicaid?

MSP and Medicaid are two separate programs. You can have both at the same time. The medical coverage is different for both programs. QMB only covers medical benefits that Medicare covers.

What is income limit for MSP?

Medicare Savings Program (MSP)Income Requirements for MSP ProgramsFamily SizeQMB 100% FPLQI-1 135% FPL1$1,133$1,5302$1,526$2,0613$1,920$2,5928 more rows

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

Is MSP the same as Medicare?

The MSP provisions have protected Medicare Trust Funds by ensuring that Medicare does not pay for items and services that certain health insurance or coverage is primarily responsible for paying. The MSP provisions apply to situations when Medicare is not the beneficiary's primary health insurance coverage.

What is Medicaid MSP?

The Medicare Savings Program (MSP) is a Medicaid-administered program that can assist people with limited income in paying for their Medicare premiums. Depending on your income, the MSP may also pay for other cost-sharing expenses.

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

Does Medicare look at your bank account?

Medicare will usually check your bank accounts, as well as your other assets when you apply for financial assistance with Medicare costs. However, eligibility requirements and verification methods vary depending on what state you live in. Some states don't have asset limits for Medicare savings programs.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the MSP program?

Medicare Savings Program (MSP) The Medicare Savings Program (MSP) is a Medicaid-administered program that can assist people with limited income in paying for their Medicare premiums. Depending on your income, the MSP may also pay for other cost-sharing expenses.

What is a QMB on Social Security?

If qualified, you will no longer have this premium amount deducted from your Social Security benefit. Qualified Medicare Beneficiary ( QMB): Pays for Medicare Part A premium for people who do not have enough work history to get premium free Part A. QMB also pays the Part B premium, deductibles and coinsurances.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) is designed to cover all or part of Medicare out-of-pocket expenses that encumber Medicare recipients who live within limited financial means.

What is a Medicare summary notice?

You will also receive a Medicare Summary Notice (MSN), which is proof of being in the program and shows the healthcare provider you should not be billed for services, deductibles, coinsurance or copayments. An exception is outpatient prescriptions.

Is Medicare cost prohibitive?

The cost of Medicare benefits in the form of premiums, coinsurance, copayments and deductibles can raise concerns about affordability, especially when you are on a limited income. For Medicare recipients under a certain income and asset level, Medicare benefits can be cost prohibitive.

Who Qualifies for a Medicare Savings Program?

To qualify for an MSP, you first need to be eligible for Part A. For those who don’t qualify for full Medicaid benefits, your monthly income must also be below the limits in the following chart.

Does Medicare savers have a penalty?

Also, those that qualify for a Medicare Savings Program may not be subject to a Part D or Part B penalty. Although, this depends on your level of extra help and the state you reside in. Call the number above today to get rate quotes for your area.

How much is Medicare Part B in 2021?

Medicare Part B premium ($148.50 per month in 2021) Deductibles for both Part A ($1,484 per benefit period in 2021) and Part B ($203 annually in 2021) Coinsurance under both Part A and Part B. For example, under Part A, QMB pays the $371 per day for hospital days 61-90, and the $742 per day for the 60 hospital lifetime reserve days in 2021. ...

How much does it cost to get free Medi-Cal?

If eligible, you may be able to receive Medi-Cal coverage by paying a small monthly premium, ranging from $20-$250 per month for an individual or from $30-$375 for a couple.

What does it mean to have a conditional Medicare plan?

This means you only want to receive Medicare on the condition that an MSP will pay for your Medicare premiums.

What is the 250% disability program in California?

California also offers the 250% California Working Disabled (CWD) program. You must meet certain income and asset limits to qualify for these programs, which are administered by Medi-Cal (the California health program known as Medicaid in other states). This section provides information on eligibility and how to apply.

Does QMB pay for outpatient medical services?

Under Part B, QMB pays the remaining 20% coinsurance after Medicare pays 80% of the covered outpatient medical services such as physician visits, as long as you see doctors and other providers who accept Medi-Cal. Note: This is because Medi-Cal administers the MSPs and will only pay providers who accept Medi-Cal.

How many types of Medicare are there?

There are four types of Medicare Savings Programs and each one comes with its own benefits. Learn about how you could save on some of your Medicare Part D costs. Medicare coverage can include out-of-pocket expenses. Many people may struggle to close the gap on some of these costs.

Does SLMB pay for Part B?

This savings program pays for the Part B premium but unlike the QMB, it does not pay for Part A premiums or for any cost-sharing expenses. The SLMB program uses the same income and asset qualifying criteria as the QMB, with qualifying numbers that may change from year to year.

How much is Medicare Part B in 2021?

All deductibles and coinsurance that Medicare does not pay. Medicare Part B premium: $148.50/month for most people in 2021. Medicaid Eligibility.

What is Medicaid application?

The Medicaid application determines eligibility to receive benefits from any of the programs listed on this brochure.