In 2019, the Part A premium for those individuals with less than 30 quarters will be $437/month. Individuals who worked at least 30 to 39 quarters will pay a prorated premium of $240. Unlike Medicare Part A, Part B requires monthly premiums from the Medicare beneficiary.

How much will my Medicare premium be in 2019?

If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. The 2019 Part A premiums increased a little over 3 percent from 2018. Medicare Part B provides coverage for doctor’s office visits and other types of outpatient care, along with durable medical equipment (DME).

How much does Medicare Part a cost per quarter?

If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $252. The standard Part B premium amount is $144.60 (or higher depending on your income). $198.

What is the Medicare Part B premium for 2019?

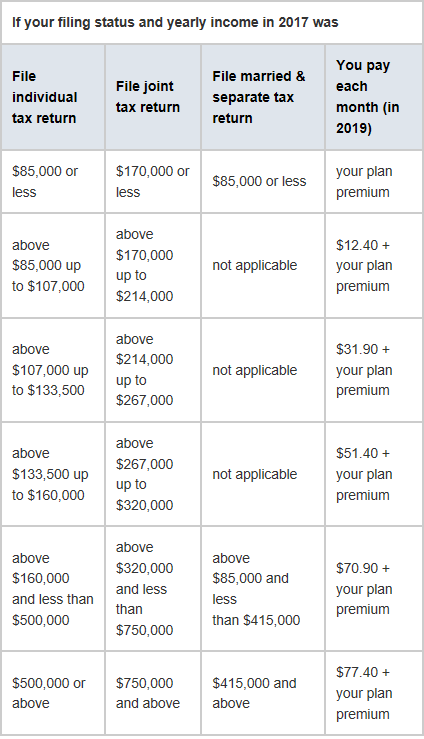

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium. This higher Part B premium is called the Income-Related Monthly Adjusted Amount (IRMAA).

How much is the average Medicare premium for 2020?

Monthly Medicare premiums for 2020 The standard Part B premium for 2020 is $144.60. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

How do you find out what my Medicare premium is?

You can use your online MyMedicare account to view your Medicare premium bills, check your payment history and set up Medicare Easy Pay for auto payments.

What are the annual premiums for Part B coverage in 2019 and 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019.

Are Medicare premiums quarterly?

So, it's known as a quarterly bill. If you have original Medicare (parts A and B), you'll continue to receive bills directly from Medicare until you start collecting either Social Security or RRB benefits. Once your benefits begin, your premiums will be taken directly out of your monthly payments.

How is Medicare Part B premium calculated 2019?

The 2019 Medicare premiums and deductibles The standard Medicare Part B monthly premium for 2019 will be $135.50, a modest increase of just $1.50 per month over 2018's standard premium. In addition, the annual Medicare Part B deductible will increase, but by just $2, to $185.

How much did Medicare cost in 2019?

$135.50On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

Can you write off Medicare Part B premiums from your taxes?

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums (including premiums for Medicare Part B – and Part A, for people who have to pay a premium for it – Medigap, Medicare Advantage plans, and Part D) from their federal taxes, and this includes Medicare premiums for their spouse.

How often are Medicare Part B premiums paid?

Part B premiums You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

Can I pay Medicare Part B monthly instead of quarterly?

Part B: If you receive retirement benefits from Social Security, the Railroad Retirement Board or the civil service, your Part B premiums are automatically deducted from your monthly payments—there's no other option. But if you don't get any of those benefits, Medicare will send quarterly bills.

Why is my Medicare bill for 5 months?

You have been charged for 5 months of Medicare Part B premiums because you are not receiving a Social Security check to have your Medicare premiums deducted.

Why is my Medicare Part B premium so high?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

What is the Medicare Part B premium for 2022?

$170.10In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022.

What is the Medicare Part B premium for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How much is Medicare premium for 2019?

If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. The 2019 Part A premiums increased ...

What is the Medicare Part B premium?

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

How much is Medicare Part C?

Plan premiums will vary by provider, plan and location. The Centers for Medicare and Medicaid Services (CMS) reports that the average Medicare Advantage plan premium in 2019 will be $28.00 per month.

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

Is Medicare Part B optional?

Medicare Part B is optional. You will likely be automatically enrolled in Part B (with the option to drop it) if you are automatically enrolled in Medicare Part A.

Will Medicare IRMAA increase in 2020?

It’s expected that the income thresholds that determine when someone pays a Medicare IRMAA will rise slightly in 2020. This means that fewer people may have to pay the IRMAA, and the adjustment will delay when other beneficiaries are required to pay more for their 2020 Part B premiums.

How much is Medicare Part B?

Medicare Part B requires a monthly premium. The standard premium for Part B in 2019 is $135.50 per month, although some people will pay more than that amount and others may pay less.

How long does it take to pay coinsurance for a hospital stay?

You pay no coinsurance during the first 60 days of an inpatient hospital stay during each benefit period. This means that your hospital costs are covered at 100% (after you meet your Part A deductible).

What happens if you don't accept Medicare?

If you visit a health care provider who does not accept Medicare assignment (which means they don't accept Medicare reimbursement as payment in full for their services), the provider reserves the right to charge you up to 15% more than the Medicare-approved amount.

How much will Social Security increase in 2019?

The Social Security Administration recently announced a 2.9% cost-of-living adjustment for 2019. The SSA estimated that benefits for the average retired worker will rise by around $39 per month, making this one of the largest cost of living increases since 2012.

Does Medicare have cost sharing?

Just like insurance that you’ve participated in during your working years, Medicare has cost-sharing that you pay as you use your benefits. These come in the form of deductibles, copays and coinsurance.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What is the standard Part B premium for 2021?

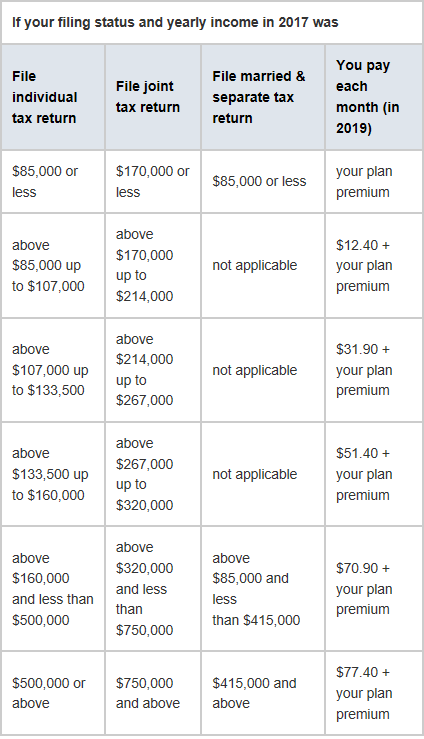

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

Does Medicare pay for prescription drugs?

Medicare prescription drug coverage helps pay for your prescription drugs. For most beneficiaries, the government pays a major portion of the total costs for this coverage, and the beneficiary pays the rest.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much will Medicare premiums be in 2021?

There are six income tiers for Medicare premiums in 2021. As stated earlier, the standard Part B premium amount that most people are expected to pay is $148.50 month. But, if your MAGI exceeds an income bracket — even by just $1 — you are moved to the next tier and will have to pay the higher premium.

Why did Medicare Part B premiums increase in 2021?

That’s because 2021 Medicare Part B premiums increased across the board due to rising healthcare costs. Exactly how much your premiums increased though, isn’t based on your current health or Medicare plan or your income. Rather, it’s the soaring prices of overall healthcare.

What is Medicare Advantage?

Essentially: Medicare Advantage – Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A.

How much of Medicare Part B is paid?

But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

Why are Social Security beneficiaries paying less than the full amount?

In 2016, 2017, and 2018, the Social Security COLA amount for most beneficiaries wasn’t enough to cover the full cost of the Part B premium increases, so most enrollees were paying less than the full amount, because they were protected by the hold harmless rule.

How much is Part B 2021?

So most beneficiaries are paying the standard $148.50/month for Part B in 2021. The hold harmless provision does NOT protect you if you are new to Medicare and/or Social Security, not receiving Social Security benefits, or are in a high-income bracket.

Is Medicare Part D tax deductible?

Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A. However, you are charged monthly premiums for Part B and Part D, and can also be charged for Part C, depending on the plan you select. These premiums are tax-deductible but very few ...

How often do you get Medicare premiums?

If you only have Medicare Part B and don’t get your Part B premiums deducted from your benefits, you’ll receive a premium bill every three months . If you have to buy Part A or owe Part D income-related monthly adjustment amounts (IRMAA), you’ll get a monthly premium bill.

When is Medicare payment due?

You’ll have your payment due on the 25th of the month, so pay early to allow processing time. Whether you prefer making individual payments or enjoy the convenience of automated payment options, Medicare's online portal has you covered.

What to do if you don't receive Medicare?

If you don’t receive these benefits, you’ll need to decide how to pay your Medicare premium bill (in which case, you may need to use Form CMS-500 ). There are several payment options, including sending a check or money order, mailing your credit card information or using your bank’s payment service.

Can you save on Medicare Supplement?

Learn How to Save on Medicare. Medicare Supplement Insurance plans (also called Medigap) can’t cover your Medicare premiums, but they can help make your Medicare spending more predictable by paying for some of your other out-of-pocket costs such as Medicare deductibles, copayments, coinsurance and more.

Does Medicare Easy Pay work?

Medicare Easy Pay is another payment option available to MyMedicare members. This program costs nothing to use, and it automatically deducts premiums from your checking or savings account when they’re due, ensuring you maintain continuous coverage. You’re also able to view your premium payment history online with Easy Pay.

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is a 504.90?

504.90. Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follow s: Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses:

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...