NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI

Social Security

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance program and is administered by the Social Security Administration. The original Social Security Act was signed into law by President Franklin D. Roosevelt in 1935, and the current version of the Act, as amended, encompasses several social welfare and social insurance programs.

What is the difference between social security and OASDI?

Nov 19, 2021 · OASDI stands for " Old Age, Survivors and Disability Insurance ." The program provides benefits to older Americans after they have paid taxes on earnings to fund the program throughout their...

Is OASDI withholding Social Security?

Yes, OASDI/EE (along with the Medicare tax, Fed Med/EE) is what is generally referred to as federal withholding tax. These taxes are funds that are remitted by a payer (usually an employer) on a payee’s behalf (usually an employee). The 6.2% OASDI/EE tax is part of that process.

How do you calculate OASDI taxable wages?

Feb 24, 2022 · OASDI is a tax that you and your employer both pay to fund Social Security. In fact, it's often called the "Social Security" tax. (Getty …

Does everyone pay OASDI tax?

May 12, 2021 · It taxes both parties to contribute to social security and medicare (aka, the OASDI tax). Employers pay matching contributions to the percentage of income that employees pay on a monthly basis, which sets the FICA tax rate at 6.2% of net earnings for social security coverage and 1.45% for medicare coverage (a total of 7.65%).

Why is Oasdi and Medicare taken out of my paycheck?

Medicare provides health insurance for people aged 65 and over, as well as some people with disabilities. Generally, employers are required to withhold Social Security and Medicare taxes from your paycheck in order to pay for these social programs.

Can I remove Oasdi from my paycheck?

If you don't have a legitimate option to opt out of paying Social Security taxes, you likely can't avoid paying this tax as an employee. Employers are required to withhold Social Security tax from your paychecks. Unlike the federal income tax, you can't tell your employer how much to withhold for Social Security taxes.Apr 5, 2022

Is Medicare and Oasdi the same thing?

FICA taxes and benefits consist of two parts: Social Security or Old Age Survivors, and Disability Insurance (OASDI), and Hospital Insurance for senior citizens and the disabled also known as Medicare (Med).

What is Oasdi and do I have to pay?

Employees and Employers Pay Into OASDI FICA taxes include OASDI, as federal law requires all wage earners to pay OASDI tax. Under federal law, employers are required to deduct 6.2 percent of an employee's wages as his or her OASDI/EE (employee) contribution and also to pay a matching amount.Dec 27, 2019

Is Oasdi mandatory?

OASDI is federally mandated, and for the most part, all workers must contribute. There are only a few exceptions to this rule. Members of some religious groups may be exempt from Social Security taxes, but must waive their rights to benefits in order to become exempt.May 12, 2021

Is Oasdi the same as Social Security tax?

FICA refers to the combined taxes withheld for Social Security and Medicare (FICA stands for the Federal Insurance Contributions Act). On your pay statement, Social Security taxes are referred to as OASDI, for Old Age Survivor and Disability Insurance.

What are Oasdi benefits?

The Old-Age, Survivors, and Disability Insurance ( OASDI ) program provides monthly benefits to qualified retired and disabled workers and their dependents and to survivors of insured workers. Eligibility and benefit amounts are determined by the worker's contributions to Social Security.

Why is Oasdi on paycheck?

If you look at the paycheck stub or statement that lists information for a payroll check, you may notice an item labeled "OASDI." This acronym stands for Old Age, Survivors and Disability Insurance.

Is Oasdi the same as 401 K?

You are required to pay OASDI taxes on the sum total of your earned income prior to any 401(k) contributions.Mar 13, 2019

Who benefits from Oasdi?

The program initially applied only to elderly people. Dependents and survivors were added by an amendment in 1939, and disabled people were added in 1956. The OASDI program is funded through payroll taxes that employees, employers, and self-employed people pay. The OASDI tax is 6.2% as of 2021.Aug 8, 2021

What exactly is Oasdi?

The Old-Age, Survivors, and Disability Insurance ( OASDI ) program provides monthly benefits to qualified retired and disabled workers and their dependents and to survivors of insured workers. Eligibility and benefit amounts are determined by the worker's contributions to Social Security.

What is the Oasdi limit for 2021?

Social Security's Old-Age, Survivors, and Disability Insurance (OASDI) program limits the amount of earnings subject to taxation for a given year....Contribution and benefit bases, 1937-2022.YearAmount2020137,7002021142,8002022147,00014 more rows

What is OASDI tax?

OASDI stands for Old Age, Survivors and Disability Insurance. It's a tax that you and your employer both pay to fund Social Security. In fact, it's often called the "Social Security" tax. Making matters more complicated, the OASDI tax is part of FICA taxes, which stands for the Federal Insurance Contributions Act.

How much is OASDI 2021?

OASDI is paid on wages up until you earn $142,800," she says. She adds that $142,800 is for 2021. It changes every year. Last year, self-employed taxpayers paid 12.4% of their income to the OASDI tax up to $137,700.

What is an OASDI?

What Is OASDI Tax? OASDI is an acronym standing for Old Age, Survivors, and Disability Insurance. The OASDI tax funds a large portion of a program you’re likely already familiar with: Social Security. The money that employers collect from employee paychecks for the purposes of the OASDI tax, goes toward funding the Social Security program.

How is OASDI tax taken?

Because the OASDI tax is taken directly from payroll contributions, how much is paid by employees, employers, and self-employed workers vary. There are two ways in which people contribute to OASDI — through FICA or SECA.

What is FICA contribution?

Employee and Employer Contributions. Employers and employees contribute through FICA, which stands for the Federal Insurance Contributions Act. It taxes both parties, employers and employees, to contribute to Social Security and Medicare (aka the FICA tax). Employers pay matching contributions to the percentage of income ...

How much is Medicare taxed?

However, the Medicare tax rate has a different limit. Employees are taxed 1.45% on their first $200,000, then 2.35% for anything beyond $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return). All wages in excess of $200, 000 will be taxed at 2.35% ( $250,000 for joint returns ;

What is the survivor benefit?

Survivors benefits. Survivors benefit amounts are based on the earnings of the deceased relative. The more the deceased relative paid into Social Security, the higher the survivors benefit would be. The monthly benefit amount is a percentage of the deceased’s basic Social Security benefit. Lump-Sum Death Payment.

What is the difference between Social Security Disability and Supplemental Security Income?

The Social Security Disability Insurance (SSDI) program provides benefits to qualifying contributors and their family members. And the Supplemental Security Income (SSI) program provides benefits to qualifying adults and their children.

Do self employed people pay FICA?

Instead of paying through FICA tax, self-employed people pay through SECA , also known as the Self-Employment Contributions Act.

What Is OASDI Tax?

OASDI stands for Old Age, Survivors, and Disability Insurance. The OASDI tax funds the social security program. Employers collect this money through employees’ paychecks which directly go to the federal government. The federal government then uses it to develop and fund social security programs.

Is OASDI Tax Mandatory?

The federal government mandates OASDI tax for almost everyone who earns an income. Also known as the Social Security tax, OASDI is mandatory for members of Congress, employees, self-employed INDIVIDUALS, and employers unless they are exempt.

Who Is Exempt From OASDI Tax?

Members of the executive and judicial branches in the federal government who were employed before 1984 were given the choice of either switching to the social security program or remaining with the old system known as the Civil Service Retirement System. Those who stayed with the latter do not have any legal obligation to pay the OASDI.

What Does OASDI Tax Cover?

When qualified contributors reach retirement age, they receive social security benefits. This means that they will receive monthly benefits as a replacement for their income in retirement.

Employees and Self-Employed Contribute Differently

OASDI tax is taken directly from paychecks. Therefore, employers, employees, and self-employed pay vary. There are two ways in which contributions are made to OASDI: FICA or SECA.

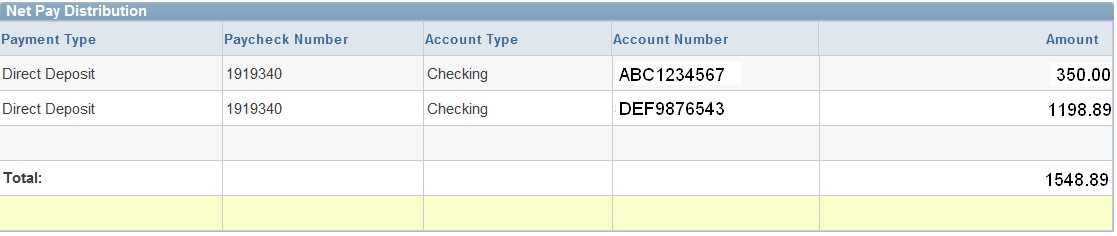

What Is OASDI on My Paycheck?

The OASDI applies to income or wages up to a certain amount and it keeps changing every year. For instance, in 2020, it was $137,700 and in 2021, it moved up to 142,800.

FICA Tax Rate

For 2021, the social security wage base is 142,800. This means that employees have to pay 6.2% of their income up to 142,800. This signifies that earning beyond this mark will not be taxed for social security.

OASDI (Social Security) and Medicare Taxes

Wages for OASDI (Social Security) and Medicare are calculated by adding all earnings (including any taxable fringe benefits) less the following qualifying pre-tax deductions: insurance, parking, and UT FLEX. OASDI and Medicare taxes are calculated as follows:

Federal Withholding Taxes

Federal Withholding Taxable Wages are calculated by adding all earnings (including any taxable fringe benefits) less all pre-tax deductions, and less any applicable 1042-S Wages. The tax rate (s) used in the calculation are specific to earnings being paid.

IRS Percentage Method

To check your Federal Withholding Tax calculation for all earnings on the payslip, use the IRS Percentage Method below:

Supplemental Wage Method

When a payslip includes recurring supplemental earnings (like a Faculty Endowed Supplement), these earnings are treated the same as regular salary and taxed based on the IRS Percentage method.

What is the OASDI tax?

One common item you might find on your paycheck is OASDI tax. OASDI stands for old age, survivors, and disability insurance tax, and the money that your employer collects goes to the federal government in order to fund the Social Security program. Even for those who earn too little to owe income tax, OASDI tax usually gets deducted from ...

What is the maximum amount of Oasdi tax?

For 2020, the maximum amount on which OASDI tax gets applied is $137,700. That means that the most that you'll pay in OASDI tax is $8,537.40, or twice that if you're self-employed.

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.