Providers can elect to request “immediate offset” to avoid making payment by check and/or avoid the assessment of interest. The request may be for: A one-time request for a specific demanded overpayment (the total amount of the demanded overpayment); or

Full Answer

What is offset offset in Medicare?

Offset causes withholding of overpayment amounts on future Medicare payments. This is done in one of two ways: Contractor initiated when the money is not returned within the appropriate time frame after the initial notice of overpayment (see below) Provider requests immediate recoupment

How do I offset a Medicare provider overpayment?

The Medicare provider voucher has an "Offset Details" field. This field can be used for three different reasons: If a provider requests immediate recoupment on an overpayment, or if an overpayment is not satisfied within 40 days of the initial refund letter, offset of the debt will occur by withholding payments of future claims.

What is a Medicare special election?

Disaster declarations in states due to weather and other events can create a Medicare special election. The special election can allow clients and prospects to make a plan change outside of the normal Medicare elections periods.

Can I remove offset provisions from my disability insurance policy?

If you have an employer-sponsored disability insurance plan, you will not be able to remove the offset provisions from your policy. This is because the terms of your disability benefit plan have already been negotiated between your employer and the insurance company.

How much will Medicare premiums increase in 2022?

California Health Advocates > Prescription Drugs - Blog > Why Did Medicare's Part B Premium Rise 14.5% in 2022? If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022.

What does reassignment of benefits mean?

A reassignment of benefits is a mechanism by which Medicare practitioners allow third parties to bill and receive payment for services that they rendered. Practitioners submit to Medicare contractors Form CMS-855I (855I) to enroll in Medicare and Form CMS-855R (855R) to reassign benefits.

What is a Medicare election period?

It starts 3 months before you turn 65 and ends 3 months after you turn 65. If you're not already collecting Social Security benefits before your Initial Enrollment Period starts, you'll need to sign up for Medicare online or contact Social Security.

How does a Medicare set aside annuity work?

A Medicare Set-Aside is a trust or trust-like arrangement that is set up to hold settlement proceeds for future medical expenses. A specialized company evaluates your future medical needs, recommends an amount that should be set aside for future medical care, and the government approves the amount.

How do I reassign my Medicare provider?

Providers and suppliers are able to submit their reassignment certifications either by signing section 6A and 6B of the paper CMS-855R application or, if completing the reassignment via Internet-based PECOS, by submitting signatures electronically or via downloaded paper certification statements (downloaded from www. ...

How do I reassign Medicare benefits in Pecos?

1. The User will go to the PECOS web site at https://pecos.cms.hhs.gov, enter their I&A User ID and Password, and select "Log In." Page 2 Page 3 2. The User selects "My Associates." Page 4 Page 5 3. The User selects "View Enrollments" beside the application where they need to add or remove a reassignment of benefits.

What is an election period?

(1) Election period The term “election period” means the period which— (A) begins not later than the date on which coverage terminates under the plan by reason of a qualifying event, (B) is of at least 60 days' duration, and (C) ends not earlier than 60 days after the later of— (i) the date described in subparagraph (A ...

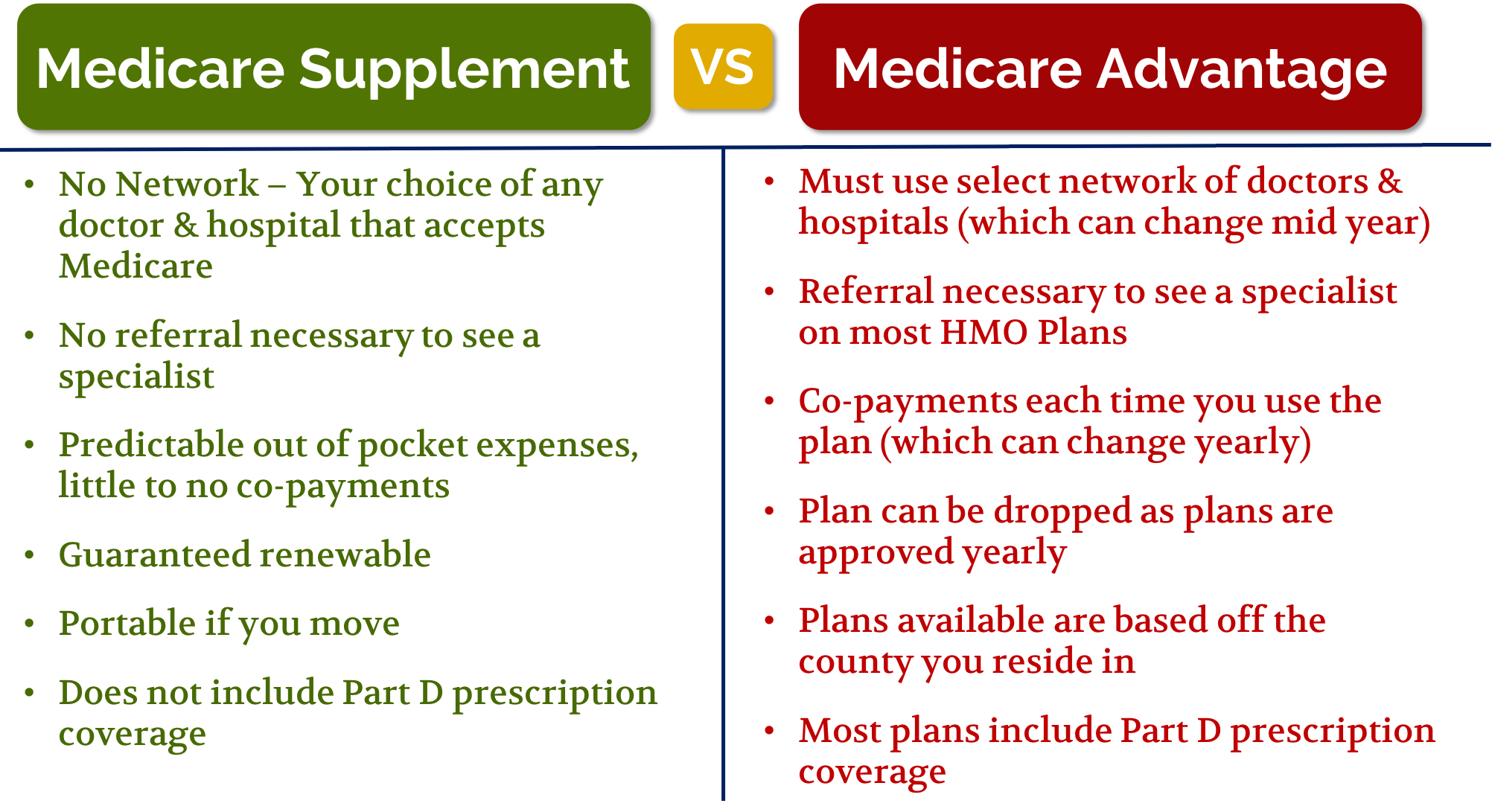

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Can you lose Medicare benefits?

Summary: In most cases, you won't lose your Medicare eligibility. But if you move out of the country, or if you qualify for Medicare by disability or health problem, you could lose your Medicare eligibility.

Can I manage my own Medicare set aside?

Medicare beneficiaries may choose to self-administer their CMS-approved WCMSA or have it professionally administered on their behalf.

What happens to unused Medicare set aside?

Medicare set aside proceeds are to be used to pay for a beneficiary's future injury-related care otherwise covered by Medicare. Should the beneficiary pass away prior to those proceeds being exhausted, they would pass to the named beneficiary on the MSA account.

How is a Medicare Set Aside calculated?

The professional hired to perform the allocation determines how much of the injury victim's future medical care is covered by Medicare and then multiplies that by the remaining life expectancy to determine the suggested amount of the set aside.

What is offset in Medicare?

Offset causes withholding of overpayment amounts on future Medicare payments.

Where is offset information on a provider remittance?

On page two of the provider remittance, information concerning offset is in the second and third columns. See illustration below. Offset information in bold.

How long does it take for an overpayment to be offset?

If a provider requests immediate recoupment on an overpayment, or if an overpayment is not satisfied within 40 days of the initial refund letter, offset of the debt will occur by withholding payments of future claims. These payments may include services performed for other beneficiaries. The Offset Details field will show 'WO'.

What is it called when an insurance company makes a wrong payment to its provider?

When an insurance company makes a wrong or excess payment to its provider, it would adjust the amount in its subsequent claims and this is called as offset in medical billing.

What to do if there is no valid EOB/ERA?

If there is no valid EOB/ERA, check website to download the EOB/ERA.

How to change Noridian DME election?

A supplier may change their election by submitting the following information to the Noridian DME Recoupment team via fax, Email, or postal mail.

What is an overpayment request letter?

A supplier is sent an overpayment request letter that includes the Medicare processed claim (s) detail which led to the overpayment. It is the supplier's responsibility to refund overpayments. Suppliers should respond to the request for refund according to the instructions provided in the letter.

How long does it take for Medicare to refund overpayments?

Providers are sent a letter specifying information regarding the overpayment and are given 30 days to refund the overpaid amount.

What is the difference between write off and adjustment?

The main difference between an adjustment and write-off is that Adjustment may be recovered whereas write-off cannot be recovered at all. For Example:-. If the billed amount is $100.00 and the insurance allowed amount is $80.00. The payment amount is $80.00 then the remaining $20.00 is the write-off amount.

What is an adjustment in insurance?

An adjustment is an amount which had been adjusted for some reason and may be recoverable. It can be an additional payment or correction of records on a previously processed claim. Adjustments are done based on the client instructions. One specific type of adjustment is the write-off.

Is an immediate offset voluntary?

An immediate offset is considered a voluntary repayment. Keep in mind a request for an immediate offset will occur only as funds become available. Providers who choose immediate recoupment must do so in writing. However, a provider can terminate the immediate recoupment process at any time.

Does BCBSKS have offset?

BCBSKS will, through auto deduction processes, exercise the right of offset for claims previously paid. This right includes offset against any subsequent claim (s) submitted by the provider, including those involving other members. To accomplish this, BCBSKS will supply providers detailed individual claims information on the remittance advice so amounts can be reconciled efficiently.

Can you request immediate offset of overpayment?

A. Yes. When you receive an overpayment demand letter indicating a refund is due, you can request immediate offset of the debt in writing.#N#The immediate recoupment process allows providers to request that recoupment begin prior to day 41. Providers who elect this option may avoid paying interest if the overpayment is recouped in full prior to day 31. The immediate recoupment process does not terminate appeal rights.#N#An immediate offset is considered a voluntary repayment. Keep in mind a request for an immediate offset will occur only as funds become available. Providers who choose immediate recoupment must do so in writing. However, a provider can terminate the immediate recoupment process at any time.

What is the initial coverage election period?

Initial Coverage Election Period is when you are first time eligible to enroll in Medicare Advantage Plan.

When is the Medicare enrollment period?

Oct 15 to Dec 07 is the Annual Enrollment Period, that time of year, when you can make any change in your Medicare Plan. The coverage will start from 1st January next year. To know more about Annual Enrollment Period, click on the below link;- https://medicareadvantage.home.blog/2019/10/06/annual-enrollment-period-aep/.

What is the OEP code for MA?

MA OEP – Election Type Code ‘M’. Jan 1 – March 31 is the open enrollment period for the beneficiaries who already had Medicare, Or from the month of entitlement date (Part A and Part B) to the last day of the 3rd month of entitlement, for the newly MA eligible members.

What is OEPI election type code?

OEPI – Election Type Code ‘T’. Open Enrollment Period for Institutionalized individual election period is for beneficiaries who move-in, reside or discharge from long term care facilities. It’s a continuous eligibility period unless the person moved out, in that case OEPI ends two months after the person moves out.

How to get Medicare Advantage Plan approved?

To get an Enrollment/or disenrollment application approved by CMS, Medicare Advantage Plan organization has to assess applications, determine correct election period/assign Election Type Code and send transactions to CMS.

What is MA health insurance?

MA health plans (Private Health Insurance Companies) can define its own set of process (such as defining attestation statement etc.) to get relevant information from beneficiaries so that organization can determine the correct election period for each application. If the information is incomplete, then Plan has to contact beneficiary ...

What is offset insurance?

Offsets are policy provisions that permit your insurer to deduct other sources of income you are receiving or are eligible to receive due to your disability. These provisions may only amount to a few sentences in your policy that indicate your insurer is authorized to deduct “other benefits” from your monthly sum.

What is SSDI offset?

Social Security disability insurance (SS DI) and Supplement Security Income (SSI) benefits are some of the most common types of offsets. SSDI pays monthly benefits to you if you become disabled before you reach retirement age and cannot work.

What to do if your insurance company is requesting an overpayment be refunded?

If your insurance company is requesting an overpayment be refunded, contact an expert long-term disability attorney to ensure the backpay and overpayment amounts are correct.

How does offset affect disability?

How Offsets Can Affect Your Disability Benefits. Individuals who are eligible to receive long term disability insurance should be aware that any benefits received from other income sources could seriously reduce their monthly disability benefits. Offsets are policy provisions that permit your insurer to deduct other sources ...

How does offset work?

How offsets work. If you are disabled and receiving – or are eligible to receive – benefits from more than one source, offsets essentially make sure these benefits are not stacked on top of one another and creating overinsurance. Instead, the total amount your LTD insurance company is supposed to pay each month will be reduced by ...

What happens if a third party causes a disability claim?

If a third party caused the injury that resulted in your disability and you get any sort of settlement, insurers will also consider that settlement an offset to your monthly disability benefit.

Why do disability policies have offsets?

Disability policies have language about offsets to ensure you will receive a percentage of your pre-disability earnings from all sources. This allows the insurance company to pay less money if you are receiving payments from other income sources.