Original Medicare is a fee-for-service plan that allows you to go to any doctor or hospital that accepts Medicare. It only pays for 80% of services received, which may not be cost effective if you need a lot of healthcare. In this case, you may choose to supplement your Original Medicare with a Medigap plan.

Full Answer

What are the pros and cons of fee for service?

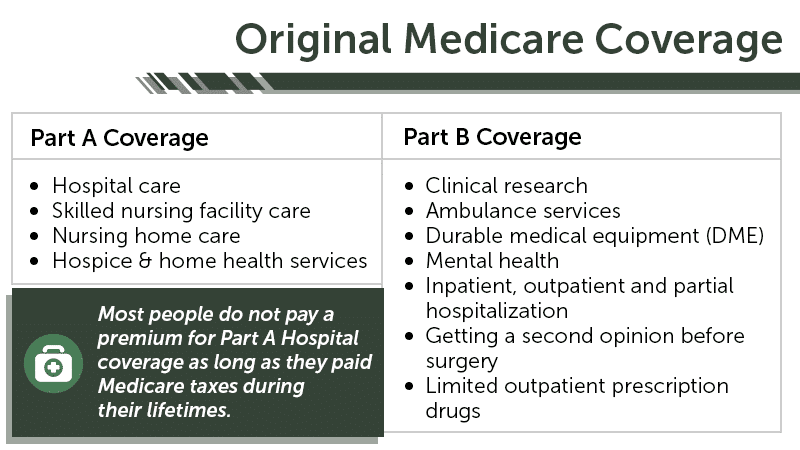

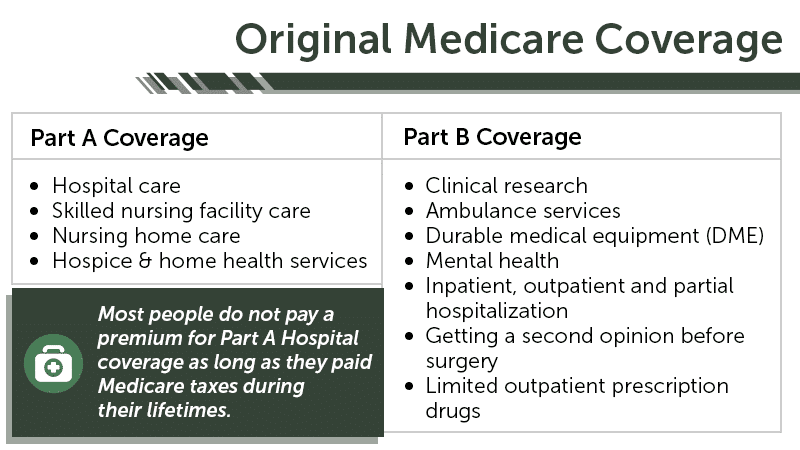

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or Medigap.

What services can you get for free from Medicare?

Apr 08, 2022 · Original Medicare is a fee-for-service plan that allows you to go to any doctor or hospital that accepts Medicare. It only pays for 80% of services received, which may not be cost effective if you need a lot of healthcare. In this case, you may choose to supplement your Original Medicare with a Medigap plan.

What is considered Original Medicare?

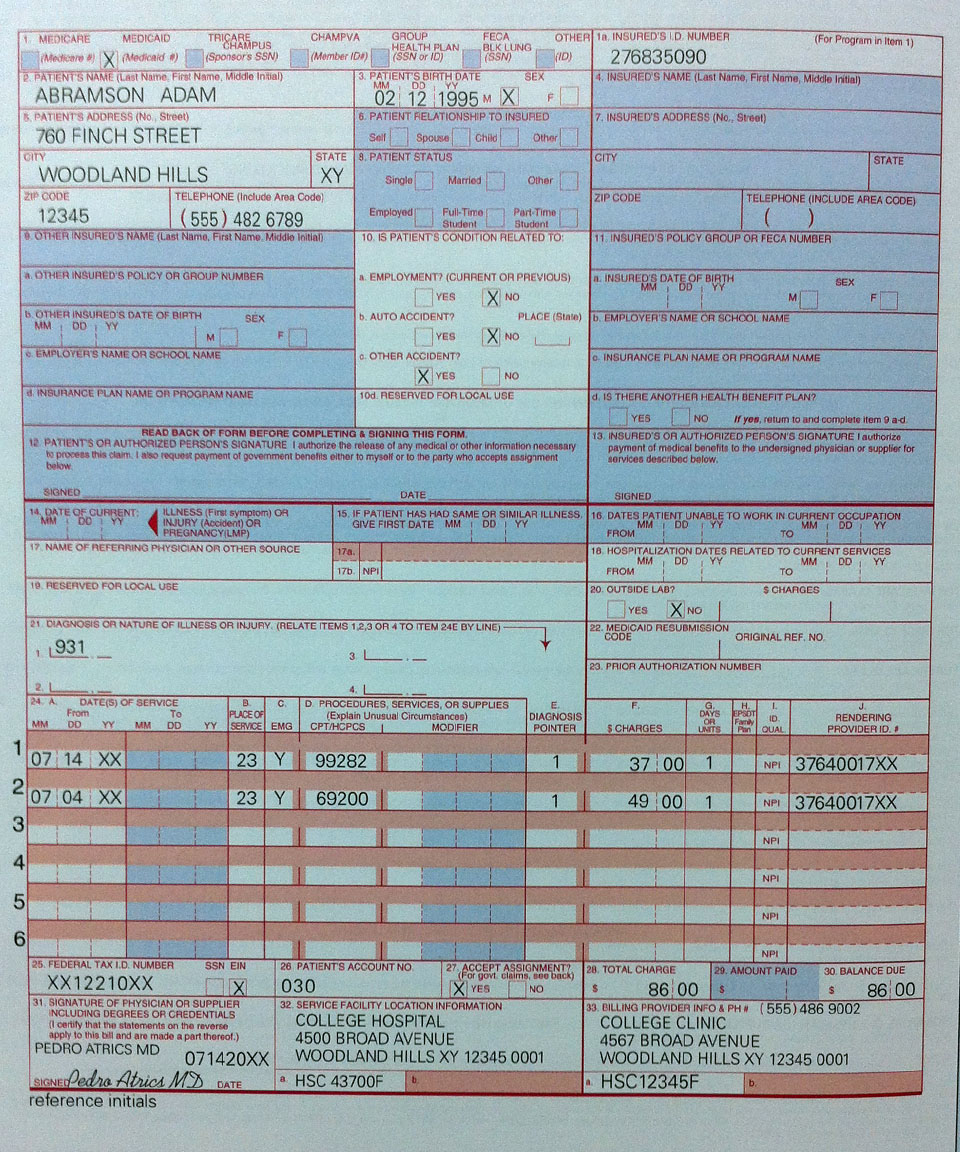

Medicare’s approved amount for the service is $100. A doctor who does not accept assignment can charge you more than $100, but not more than $115 for that service. The doctor may ask you to pay the $115 at the time you receive the service. Even though the doctor does not accept assignment, he/she is required by law to file a claim with Medicare.

What is the current cost of Medicare Part B?

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and …

Is Original Medicare fee-for-service?

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or Medigap.

What is original fee-for-service?

Fee-for-service is a system of health care payment in which a provider is paid separately for each particular service rendered. Original Medicare is an example of fee-for-service coverage, and there are Medicare Advantage plans that also operate on a fee-for-service basis.

What is the difference between Medicare Advantage and Medicare fee-for-service?

While fee-for-service Medicare covers 83 percent of costs in Part A hospital services and Part B provider services, Medicare Advantage covers 89 percent of these costs along with supplemental benefits ranging from Part D prescription drug coverage to out-of-pocket healthcare spending caps.Jan 21, 2020

What is the difference between the Medicare-approved amount for a service and the actual charge?

BILLED CHARGE The amount of money a physician or supplier charges for a specific medical service or supply. Since Medicare and insurance companies usually negotiate lower rates for members, the actual charge is often greater than the "approved amount" that you and Medicare actually pay.Feb 10, 2022

What is an example of fee-for-service?

A method in which doctors and other health care providers are paid for each service performed. Examples of services include tests and office visits.

Which program added prescription medication coverage to the original Medicare plan?

Part D adds prescription drug coverage to: Original Medicare. Some Medicare Cost Plans. Some Medicare Private-Fee-for-Service Plans.

Can I switch from original Medicare to Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

Can you have Original Medicare and a Medicare Advantage plan?

If you're in a Medicare Advantage Plan (with or without drug coverage), you can switch to another Medicare Advantage Plan (with or without drug coverage). You can drop your Medicare Advantage Plan and return to Original Medicare. You'll also be able to join a Medicare drug plan.

What does Original Medicare mean?

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

Does Medicare ever pay more than 80%?

A. In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

What percent of the allowable fee does Medicare pay the healthcare provider?

80 percentMedicare pays the physician or supplier 80 percent of the Medicare-approved fee schedule (less any unmet deductible). The doctor or supplier can charge the beneficiary only for the coinsurance, which is the remaining 20 percent of the approved amount.Jan 1, 2021

What does non par using Medicare Limited fee Schedule mean?

Amounts listed under “nonpar fee” represent the potential Medicare allowance for a physician or nonphysician practitioner who has NOT signed a participation agreement; these allowances are generally 95 percent of the amount for a participating provider in the same area.

How much is Medicare Part B premium 2020?

There is a monthly premium fee you will have to pay with Medicare Part B. In 2020, the monthly premium cost is $144.60. However, the exact monthly fee you will pay is based on your income. If your yearly gross income exceeds a certain amount, you will be required to pay both the monthly premium and an Income Related Monthly Adjustment Amount ...

What is Medicare Part B?

Medicare Part B refers to the “medical insurance” portion of Medicare, so it covers doctor’s visits, certain outpatient care like X-rays and lab tests, outpatient surgery, emergency services, some medical supplies, and preventative care, like a yearly wellness check.

Does Medicare Advantage cover dental?

Medicare Advantage plans (also known as Part C) are set up like an HMO or PPO with yearly maximum out-of-pocket costs, and may also provide coverage for dental, vision, and hearing needs, which Original Medicare doesn’t cover. Part D plans cover prescription drugs.

What is Medigap insurance?

Medigap insurance is supplemental private health insurance that is specifically offered to cover the “gaps” in Original Medicare coverage. For example, it can help cover the costs of deductibles (except your deductible for Part B for those born after January 1, 2020), copayments, and coinsurance.

Who is Caren Lampitoc?

Caren Lampitoc is an educator and Medicare consultant for Medicare Risk Adjustments and has over 25 years of experience working in the field of Medicine as a surgical coder, educator and consultant.

Does Medicare cover long term care?

Additionally, Original Medicare will not cover the following health-related needs: Long-term care, also called custodial care. Custodial care is considered care for normal activities of daily life, such as getting dressed, using the restroom, or getting dressed.

Is dental care covered by Medicare?

Because most nursing homes are considered custodial care, they are not usually covered by Medicare insurance. Dental. Most dental care, as well as dentures, are not covered through Medicare. Vision.

How many levels of appeals are there for Medicare?

There are five levels in the Medicare Part A and Part B appeals process. The levels are: First Level of Appeal: Redetermination by a Medicare Administrative Contractor (MAC) Second Level of Appeal: Reconsideration by a Qualified Independent Contractor (QIC)

Who has the right to appeal a Medicare claim?

Once an initial claim determination is made , any party to that initial determination, such as beneficiaries, providers, and suppliers – or their respective appointed representatives – has the right to appeal the Medicare coverage and payment decision. For more information on who is a party, see 42 CFR 405.906.

Who can be appointed as a representative in a claim?

Appointment of Representative. A party may appoint any individual, including an attorney, to act as his or her representative during the processing of a claim (s) and /or any claim appeals. A representative may be appointed at any time during the appeals process.

How much can a doctor charge for Medicare?

Doctors and other providers who do not accept assignment can charge you more than the Medicare-approved amount, but they cannot charge you more than 115% of Medicare’s approved amount. This additional 15% is called an excess charge or limiting charge.

How much does Medicare pay for a doctor?

Example : A doctor charges $120 for a service. The Medicare-approved amount for the service is $100. A doctor who accepts assignment agrees to the $100 as full payment for that service. The doctor bills Medicare, which pays him/her 80% or $80, and you are responsible for the 20% coinsurance or $20 ...

What is Medicare assignment?

Medicare Assignment for Original Fee-for-Service Medicare. Many doctors and health care providers agree to accept the Medicare-approved amount (the combination of what you and Medicare pay) as the total payment for their services. This is known as accepting assignment. Assignment applies if you are in the Original fee-for-service Medicare program.

What is advance beneficiary notice?

Advance Beneficiary Notice. 1. Providers Who Accept Assignment. Doctors and other providers who participate in Medicare accept assignment for all of their Medicare patients. Doctors and other providers who do not participate in Medicare can also accept assignment for some Medicare patients on a case-by-case basis.

Can you opt out of Medicare?

Doctors and certain other providers may “opt out” of Medicare, which means they can set their own rates; the limiting charge does not apply. If you want to see a doctor who has opted out and agrees to treatment, you and the doctor must enter into a private contract for services normally covered by Medicare.

What is the purpose of ABN?

The purpose of the ABN is to help you make an informed decision about the service or item. If you sign it, you agree to pay the doctor for the service if Medicare denies payment. If you do not sign it, the service will not be provided. Other providers, such as labs and suppliers may also use an ABN.

Does Medicare cover medically necessary services?

Medicare only covers services and items it considers “reasonable and medically necessary.” If your doctor (one that has NOT opted out of Medicare) believes that Medicare will deny payment for a particular service, he/she is required to tell you before providing the service and give you an Advance Beneficiary Notice (ABN). The doctor must use an approved ABN form ( Form CMS-R-131) to:

O

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

Note

This glossary explains terms in the Medicare program, but it isn't a legal document. The official Medicare program provisions are found in the relevant laws, regulations, and rulings.