Does Medicare have a standard "out-of-pocket maximum"?

May 16, 2020 · The out-of-pocket maximum is also known as the out-of-pocket limit. This is the maximum amount that the policy holder will be expected to pay out-of-pocket each year. Once a person meets their maximum, your Medicare Advantage provider is responsible for paying 100 percent of the total medical expenses. Having an out-of-pocket maximum offers protection for …

Does Medicare have an out-of-pocket spending limit?

This means there is an automatic limit on the amount of money you will spend for covered healthcare during any given year. For in-network services in 2021, the highest Medicare out-of-pocket maximum a Part C plan could allow was $7,550. Many Part C plans also offer lower out-of-pocket limits of $6,000 or less.

Is there a cap on out of pocket for Medicare?

Sep 22, 2021 · There isn’t a maximum out-of-pocket on Medicare. Because of this, there is no limit to the amount you can pay in medical bills. You can contribute 20% of any number of costs after meeting the deductible. Don’t worry, though; we have a few solutions to help you. Below we discuss Medicare plans that have a maximum limit and some that don’t.

What is an out of pocket maximum in health insurance?

Jul 20, 2021 · There is no out-of-pocket maximum when it comes to how much you may pay for services you receive through Part B. Here is an overview at the different out-of-pocket costs with Part B: Monthly...

What is the maximum out-of-pocket for Medicare in 2020?

The maximum limits will increase to $7,550 for in-network and $11,300 for in- and out-of-network combined. Once the limit is reached, the plan covers any costs for the remainder of the year.Jul 14, 2020

How much do Medicare patients pay out-of-pocket?

A: According to a Kaiser Family Foundation (KFF) analysis of Medicare Current Beneficiary Survey (MCBS), the average Medicare beneficiary paid $5,460 out-of-pocket for their care in 2016, including premiums as well as out-of-pocket costs when health care was needed.

What is the Medicare out-of-pocket for 2021?

$7,550Since 2011, federal regulation has required Medicare Advantage plans to provide an out-of-pocket limit for services covered under Parts A and B. In 2021, the out-of-pocket limit may not exceed $7,550 for in-network services and $11,300 for in-network and out-of-network services combined.Jun 21, 2021

What counts towards the out-of-pocket maximum on a Medicare Advantage Plan?

For both in and out-of-network care, the Medicare advantage out-of-pocket (OOP) limit is $11,300 in 2022. This yearly cap does not include monthly premiums, but annual deductibles, coinsurance, and copayments may all count towards this maximum limit.Dec 18, 2021

How much is healthcare out-of-pocket?

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the right health insurance for you.Jan 21, 2022

What is the cost of Medicare Part D for 2021?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What counts towards out-of-pocket maximum?

The out-of-pocket maximum is the most you could pay for covered medical services and/or prescriptions each year. The out-of-pocket maximum does not include your monthly premiums. It typically includes your deductible, coinsurance and copays, but this can vary by plan.

Do Part B drugs go towards MOOP?

Beneficiaries using Part B drugs are more likely to reach the MOOP than other beneficiaries.

What is the difference between overall deductible and out-of-pocket limit?

Essentially, a deductible is the cost a policyholder pays on health care before the insurance plan starts covering any expenses, whereas an out-of-pocket maximum is the amount a policyholder must spend on eligible healthcare expenses through copays, coinsurance, or deductibles before the insurance starts covering all ...May 7, 2020

What is the coverage gap for 2022?

In 2022, the coverage gap ends once you have spent $7,050 in total out-of-pocket drug costs. Once you've reached that amount, you'll pay the greater of $3.95 or 5% coinsurance for generic drugs, and the greater of $9.85 or 5% coinsurance for all other drugs. There is no upper limit in this stage.

What is the Maximum Medicare Out-of-Pocket Limit for in 2022?

Many people are surprised to learn that Original Medicare doesn’t have out-of-pocket maximums. Original Medicare consists of two parts — Part A and...

What is the Medicare out-of-pocket maximum ?

Let’s face it, higher-than-expected medical bills can happen to anyone, even those in perfect health. That’s a scary reality we hope won’t happen t...

How Much do Medicare Patients Pay Out-of-Pocket?

To summarize, Medicare beneficiaries pay varying out-of-pocket amounts, based upon the type of coverage they have.

What’s included in the out-of-pocket maximum for Medicare Part C plans?

The costs you pay for covered healthcare services all go towards your Part C out-of-pocket maximum. These include:

What happens if a doctor doesn't accept my insurance?

And, if the doctor doesn’t accept the policy, you don’t have coverage. Any expense you incur that doesn’t have coverage won’t apply to your maximum out of pocket. Further, that service will be 100% your bill. Some choose PPO plans to have some coverage outside the plan.

Does Medigap have a maximum out of pocket?

Medigap plans don’t have a maximum out of pocket because they don’t need one. The coverage is so good you’ll never spend $5,000 a year on medical bills. Sure, the premium is a little higher, but the benefits are more significant. If high medical bills are your concern, consider choosing Medigap.

Is there a limit on Medicare 2021?

Updated on July 13, 2021. There isn’t a maximum out of pocket on Medicare. Because of this, there is no limit to the amount you can pay in medical bills. You can contribute 20% of any number of costs after meeting the deductible. Don’t worry, though; we have a few solutions to help you.

Can you pay Medicare out of pocket?

No, with Medicare you can pay any amount out of pocket on medical bills. So, those with chronic health conditions can expect to pay endlessly on coinsurances with Medicare. There is no Part A or Part B maximum out of pocket.

Does Medicare cover surgery?

Medicare doesn’t have a limit on the amount you can spend on healthcare. But, they do cover a portion of most medical bills. Yes, there is some help, but 20% of $100,000+ surgery or accident could be bank-breaking. But, there are options to supplement your Medicare. Some options have a maximum limit. Yet, some options don’t.

What is Medicare out of pocket?

Medicare out-of-pocket costs are the amount you are responsible to pay after Medicare pays its share of your medical benefits. In Medicare Part A, there is no out-of-pocket maximum. Most people do not pay a premium for Part A, but there are deductibles and limits to what is covered.

How much of Medicare is spent on out of pocket?

More than a quarter of all Medicare recipients spend about 20 percent of their annual income on out-of-pocket costs after Medicare reimbursements. People lower income or complex health conditions are likely to pay the most.

What percentage of Medicare deductible do you pay?

After you meet your deductible, you will pay 20 percent of the Medicare-approved amount for most of your medical costs. Some services, like preventive care, are supplied without a coinsurance cost. Out-of-pocket maximum. There is no out-of-pocket maximum for your share of Medicare Part B costs.

What is the Medicare Part A deductible for 2021?

Medicare Part A costs include your share of expenses for any inpatient treatments or care. In 2021, the Part A deductible is $1,484. Once you’ve paid this amount, your coverage will kick in and you’ll only pay a portion of your daily costs, based on how long you’ve been in the hospital.

What is Medicare Supplemental Insurance?

There are a number of private insurance products that can help cover the out-of-pocket costs of your Medicare coverage. These Medicare supplemental insurance plans are called Medigap, and they are regulated by both federal and state guidelines. Each plan is different, and out-of-pocket costs may vary by plan.

What is Medicare Part C?

Medicare Part C is a private insurance product that replaces your original Medicare coverage. These plans may also include Medicare Part D, which covers prescription drug costs.

What is the Medicare Advantage out of pocket limit for 2021?

In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket. Out-of-pocket limit levels.

What is the maximum out of pocket limit for Medicare Part B 2021?

And, unlike Medicare Advantage coverage, there is no maximum out-of-pocket limit. Fortunately, you can get a Medigap plan to cover some or all of the Part B coinsurance.

What is out of pocket medical?

Out-of-pocket costs (aka, out-of-pocket medical expenses) are costs that a beneficiary must pay because their health insurance does not cover them. Out-of-pocket costs are found in the deductibles, copayments, and coinsurance outlined in each health... , high out-of-pocket costs, or even unlimited out-of-pocket expenses.

What is coinsurance in Medicare?

Coinsurance is a percentage of the total you are required to pay for a medical service. ... costs for all Medicare-approved healthcare services. Medicare Advantage plans (Medicare Part C) have an annual maximum out-of-pocket limit (MOOP) on health care services only. Plan members pay copayments when they get medical care.

What is Medicare Part A?

Medicare Part A is hospital inpatient coverage for people with Original Medicare, whereas Part B is medical coverage for doctor visits, tests, etc.... and Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare.

How long does Medicare cover skilled nursing?

Medicare Part A covers 100 percent of the cost of skilled nursing facility care for the first 20 days so long as you had at least a three-night inpatient hospital stay prior to the skilled nursing facility stay. Supplemental Medicare coverage helps pay some or all of your Part A coinsurance.

How much does Medicare pay if you don't work 10 years?

How much you pay depends on the number of quarters you paid the Medicare tax. $263/month for beneficiaries who paid into Medicare for 7.5 to 10 years.

What is a Part A deductible?

Part A is for hospital inpatient care.... A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begin s to pay its share.... Coinsurance is a percentage of the total you are required to pay for a medical service. ...

How much can you save if you don't accept Medicare?

If you are enrolled in Original Medicare, avoiding health care providers who do not accept Medicare assignment can help you save up to 15 percent on excess charges. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

How much is Medicare Part B?

Part B. The standard Medicare Part B premium is $148.50 per month. However, the Part B premium is based on your reported taxable income from two years prior. The table below shows what Part B beneficiaries will pay for their premiums in 2021, based off their 2019 reported income. Medicare Part B IRMAA.

What is a Medigap plan?

These plans, also known as “ Medigap ,” provide coverage for some of Medicare’s out-of-pocket costs, such as deductibles, coinsurance and copayments. Some Medigap plans even include annual out-of-pocket spending limits. Sign up for a Medicare Advantage plan.

How much is the deductible for Part D in 2021?

Part D. Deductibles vary according to plan. However, Part D deductibles are not allowed to exceed $455 in 2021, and many Part D plans do not have a deductible at all. The average Part D deductible in 2021 is $342.97. 1.

How much coinsurance is required for hospice?

A 5 percent coinsurance payment is also required for inpatient respite care. For durable medical equipment used for home health care, a 20 percent coinsurance payment is required.

What is Medicare Part D based on?

Part D premiums also come with an income-based tier system that uses your reported income from two years prior, similar to how Medicare Part B premiums are calculated. Part D premiums for 2021 will be based on reported taxable income from 2019, and the breakdown is as follows: Medicare Part D IRMAA. 2019 Individual tax return.

How much is a copayment for a mental health facility?

For an extended stay in a hospital or mental health facility, a copayment of $371 per day is required for days 61-90 of your stay, and $742 per “lifetime reserve day” thereafter.

What is the maximum out of pocket for Medicare?

In 2018, the Medicare Advantage out of pocket maximum was $6,700. Some Medicare Advantage plans may have lower out of pocket maximums, for example $4,900. An out of pocket maximum can be a reassuring thing. Without one, you could end up paying tens of thousands of dollars or more on medical bills if you need a lot of care.

What is Medicare Advantage Out of Pocket?

A Medicare Advantage out of pocket maximum is a limit on the amount you will pay out of pocket before your covered medical expenses are paid for the rest of the calendar year. In 2018, the Medicare Advantage out ...

What copayments count towards out of pocket?

Other copayments that generally count towards your out of pocket maximum include emergency room copayments, coinsurance for X-rays and radiology, copayments for outpatient rehabilitation, and coinsurance for durable medical equipment. Copayments and coinsurance not listed here may count as well.

What are some examples of out of pocket expenses?

Examples of costs that generally count towards your out of pocket maximum would include for example: Other copayments that generally count towards your out of pocket maximum include emergency room copayments, coinsurance for X-rays and radiology, copayments for outpatient rehabilitation, and coinsurance for durable medical equipment.

How much does Medicare cost monthly?

Some Medicare Advantage plans have monthly premiums as low as $0. If you pay more than $0, for example $104 a month for your Medicare Advantage plan, that amount will not count towards reaching your Medicare Advantage out of pocket maximum.

What is Medicare premium?

What is a Medicare premium? A Medicare premium is amount you pay to have Medicare coverage, whether or not you use covered services. Most types of Medicare coverage may charge you a monthly premium, including Medicare Part B (Original Medicare), Medicare Part D, Medicare Supplement plans, and Medicare Advantage plans.

Does Medicare Advantage count towards out of pocket?

Medicare Advantage premiums are not the only cost that don’t count towards the out of pocket maximum. Other costs that generally don’t count could include: Any care you get out of network, including doctor visits and hospital stays. A coinsurance you pay for a prescription drug.

What is the out of pocket maximum?

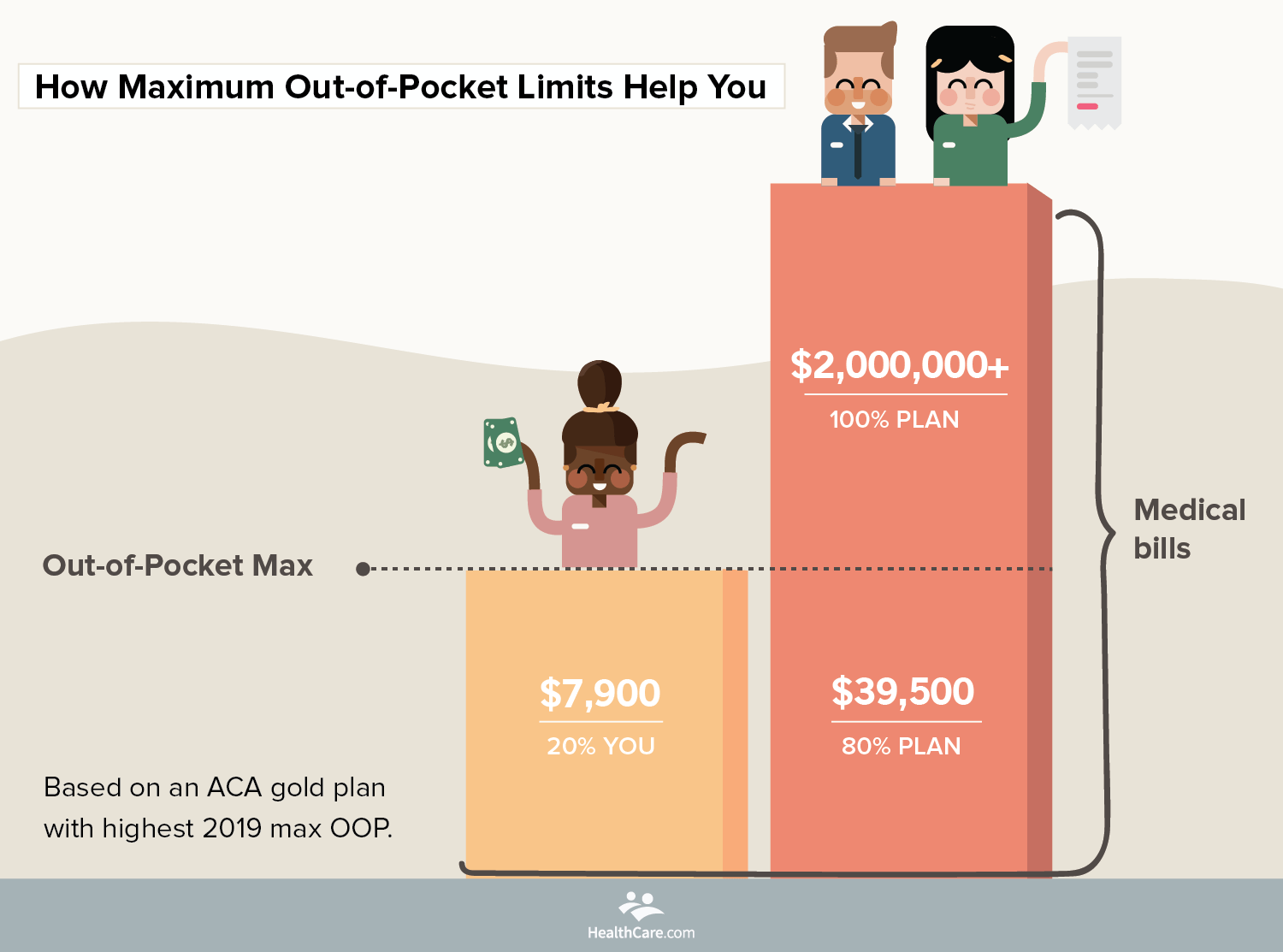

An out-of-pocket maximum is a cap, or limit, on the amount of money you have to pay for covered health care services in a plan year. If you meet that limit, your health plan will pay 100% of all covered health care costs for the rest of the plan year. Some health insurance plans call this an out-of-pocket limit.

How long is an out-of-pocket limit?

Some health insurance plans call this an out-of-pocket limit. A plan year is the 12 months between the date your coverage is effective and the date your coverage ends. If you have dependents on your plan, you could have individual out-of-pocket maximums and a family out-of-pocket maximum. This depends on the terms of the plan.

What is the most preventive care?

Most preventive care: Many health plans cover most preventive care at 100%, as part of the Affordable Care Act (ACA). This is routine care like an annual check-up, some lab tests, flu shots and some other vaccinations, and routine screenings like an annual mammogram and colonoscopy.

What happens if you charge more than the maximum amount of medical insurance?

Costs above the allowed amount: Most plans set an allowed amount for various services. If a doctor or facility charges more than that, your plan is not going to cover that cost. This means it will not be applied to your out-of-pocket maximum, either. Make sure to check the details of your plan.

How much is Jane Q's health insurance?

Jane Q. has a health plan with a $2,500 deductible, 20% coinsurance, and a $4,000 out-of-pocket maximum. At the start of her plan year she has an unexpected illness. She sees her regular doctor and a number of specialists. She goes through a lot of medical tests. She receives medical bills totaling $2,500 and pays these costs.

What happens if you have more than one person on a health plan?

Individual out-of-pocket maximum: If someone on the plan reaches their individual out-of-pocket max, the plan starts paying 100% of their covered care for the rest of the plan year.

What expenses do not count toward out of pocket?

There are a number of expenses that may not count toward the out-of-pocket maximum: Care and services that aren’t covered: Your health plan may not cover some types of services. This could include things like cosmetic treatments, weight loss surgery, and some alternative medicine.

What is the donut hole in Medicare?

In fact, it has a big hole in it. The so-called donut hole is a coverage gap that occurs after you and Medicare have spent a certain amount of money on your prescription medications.

What is the maximum deductible for 2021?

A deductible is the amount of money you spend out-of-pocket before your prescription drug benefits begin. Your plan may or may not have a deductible. The maximum deductible a plan can charge for 2021 is set at $445, 2 an increase of $10 from 2020.

What is Medicare Part D?

1 The law created what we now know of as Medicare Part D, an optional part of Medicare that provides prescription drug coverage. Part D plans are run by private insurance companies, not the government.

How much does a generic cost for Part D?

For a generic drug, you will pay $25 and your Part D plan will pay $75. In all Part D plans in 2020, after you've paid $6,550 in out-of-pocket costs for covered medications, you leave the donut hole and reach catastrophic coverage, where you will pay only $3.70 for generic drugs and $9.20 for brand-name medications each month or 5% the cost ...

What is NBBP in Medicare?

The NBBP is a value used to calculate how much you owe in Part D penalties if you sign up late for benefits. Your best bet is to avoid Part D penalties altogether, so be sure to use this handy Medicare calendar to enroll on time.

What is a Part D premium?

Part D Premiums. A premium is the amount of money you spend every month to have access to a health plan. The government sets no formal restrictions on premium rates and prices may change every year. 3 Plans with extended coverage will cost more than basic-coverage plans.

Can Medicare Part D be expensive?

A Word From Verywell. Prescription medications can be costly, but don't let that intimidate you. Know what your Medicare Part D plan covers and how much you can expect to pay. With this information in hand, you can budget for the year ahead and keep any surprises at bay.

/GettyImages-149411234-56d5feeb5f9b582ad501a289.jpg)