How much does Medicare Part B cost?

Costs for Part B (Medical Insurance) Part B costs: What you pay 2021: Premium $148.50 each month (or higher depending ... Deductible You’ll pay $203, before Original Medicar ... Costs for services (coinsurance) You’ll usually pay 20% of the cost for e ...

How much does Medicare Part C cost in each state?

How much does Medicare Part C cost in each state in 2021? State Average Weighted Premium Average Drug Deductible Alabama $24.28 $137.50 Arizona $16.35 $138.71 Arkansas $22.35 $207.36 California $20.32 $141.34 45 more rows ...

How much does Medicare Part D cost in my state?

The lowest average Part D premiums were for plans in Mississippi, Kentucky and Delaware, with average premiums around $35 or $36 per month. West Virginia, Florida, South Carolina and Florida had Part D plans with the highest average premiums, around $46 per month. Learn more about Medicare Part D plans in your state.

Will CMS reduce Medicare Part B premiums by $10?

Medicare beneficiaries were hoping that CMS would reduce the 2022 Part B premium by $10 per month after its assessment. “To some, this is going to be disappointing news, especially in the age where today you've got $5 a gallon for gasoline striking many people in a difficult time,” said Oh.

How much does Medicare Part B cost in Georgia?

$170.10 per monthPart B, most people pay the standard premium of $170.10 per month. The deductible for Part B is $233. Medicare Advantage Plans: The average cost of a Georgia Medicare Advantage Plan is $13.55 in 2022. Some plans start as low as a zero premium.

How much does Medicare Part B normally cost?

$170.10 each monthCosts for Part B (Medical Insurance) $170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

How much is Medicare Part B monthly?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

How much does Medicare cost in Georgia?

Medicare in Georgia by the NumbersPeople enrolled in Original MedicareAverage plan costAnnual state spending per beneficiary1,003,307Plan A: $0 to $499 per month* Plan B: $170.10 per month**$10,328

What is the cost of Medicare Part B in 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Is Medicare Part B worth the cost?

Is Part B Worth it? Part B covers expensive outpatient surgeries, so it is very necessary if you don't have other coverage coordinating with your Medicare benefits.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Why is Medicare Part B so expensive?

Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Which Medicare plan is best in Georgia?

10 highly rated Medicare Advantage plans in GeorgiaPlan nameStar ratingMonthly premiumSenior Advantage Medicare Medicaid SNP5$0UnitedHealthcare Nursing Home Plan 2 SNP5$29.80Humana Choice PPO4$48Aetna Medicare Value Plus PPO4$206 more rows•Oct 7, 2021

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Is Medicare free in Georgia?

Original Medicare costs (Part A and B) in Georgia are the same nationwide. The Medicare Part A premium can cost you $0, $274, or $499, depending on how long you or your spouse worked and paid Medicare taxes. For Part A hospital inpatient deductibles and coinsurance, you pay: $1,556 deductible for each benefit period.

How Much Does Medicare Part B Cost?

You pay the Part B premium each month (in 2018 the standard premium is $134). Most people will pay the standard premium amount. However, if your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you may pay more.

Common Medicare Questions

Which plan is right for me? Medicare Advantage or original Medicare and a supplement plan? How much should I expect to pay for a GOOD Medigap plan?

Which states have the lowest Medicare premiums?

Florida, South Carolina, Nevada, Georgia and Arizona had the lowest weighted average monthly premiums, with all five states having weighted average plan premiums of $17 or less per month. The highest average monthly premiums were for Medicare Advantage plans in Massachusetts, North Dakota and South Dakota. *Medicare Advantage plans are not sold in ...

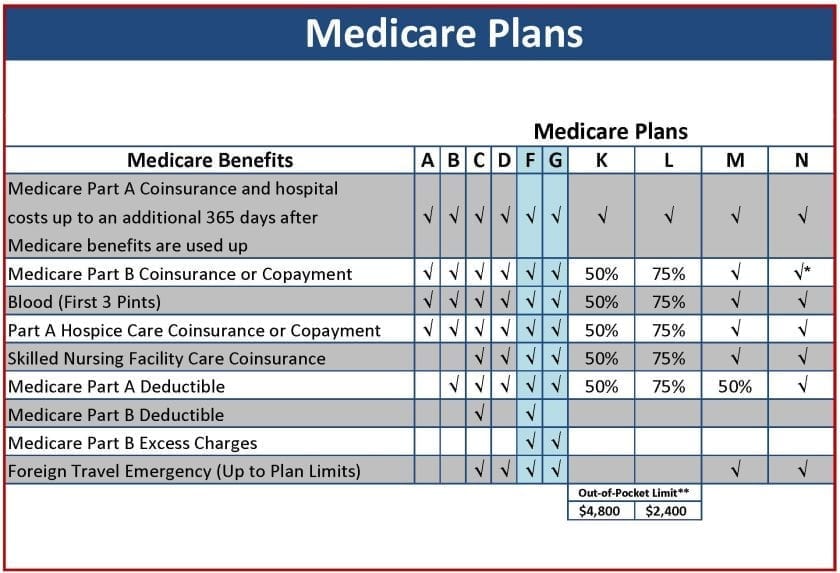

What is the second most popular Medicare plan?

Medigap Plan G is, in fact, the second-most popular Medigap plan. 17 percent of all Medigap beneficiaries are enrolled in Plan G. 2. The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018. 3.

How to contact Medicare Advantage 2021?

New to Medicare? Compare Medicare plan costs in your area. Compare Plans. Or call. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much can a spouse of a Medicaid patient have in Georgia in 2020?

In Georgia in 2020, spousal impoverishment rules allow spouses of Medicaid enrollees to keep an allowance of between $2,155 and $3,216 per month. Applicants for Medicaid nursing home care or HCBS can’t have more than $595,000 in home equity. There is an asset transfer penalty for nursing home care and HCBS in Georgia.

What is the income limit for Medicare?

Qualified Medicare Beneficiary (QMB): The income limit is $1,064 a month if single or $1,437 a month if married. QMB pays for Part A and B cost sharing, Part B premiums, and – if an enrollee owes them – it also pays for their Part A premiums.

What is Medicare Savings Program?

Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). In Washington, D.C., this program pays for Medicare Part B premiums, Medicare Part A and B cost-sharing, and – in some cases – Part A premiums. Qualified Medicare Beneficiary (QMB): The income limit is ...

What is Medicaid spend down?

When an applicant is approved for the spend-down, Medicaid calculates the portion of their monthly income above the income limit (known as “excess income”). Enrollees activate their spend-down coverage by showing they have medical bills equal to this excess income.

How much can a spouse keep on Medicaid?

If only one spouse needs Medicaid, the other spouse is allowed to keep up to $128,640. Certain assets are never counted, including many household effects, family heirlooms, certain prepaid burial arrangements, and one car. Nursing home enrollees cannot have more than $595,000 in home equity. Back to top.

What is the maximum home equity for Medicaid?

In 2020, states set their home equity limits based on a federal minimum home equity interest of $595,000 and a maximum of $893,000.

How to contact the Ombudsman for Georgia?

Contact the Ombudsman Program by calling (866) 552-4464. More information is available on the program’s website.