How much do you pay for Medicare Part B?

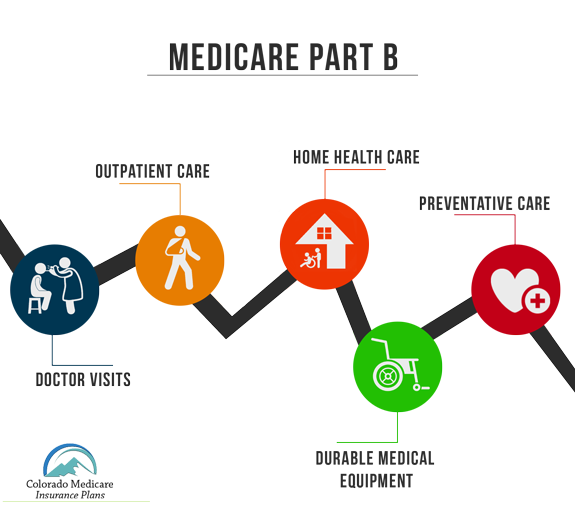

Sep 16, 2014 · Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage …

What is the difference between Medicare Part an and Part B?

Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, you may have to pay a late enrollment penalty.

What is Medicare Part B and what does it cover?

Apr 16, 2021 · Medicare Part B is medical insurance. Along with Medicare Part A (hospital insurance), it makes up Original Medicare, the federal health insurance program. Here’s something important to know about Medicare Part B: you need this coverage if you decide to sign up for a Medicare Advantage plan, or buy a Medicare Supplement insurance plan.

How does Medicare Part A differ from Part B?

Mar 20, 2020 · What is Medicare Part B and What Does it Cover? Medicare Part A and Part B are designed to cover inpatient and outpatient expenses. Part A is designed specifically for inpatient stays in hospitals, skilled nursing facilities, and hospice care.

See more

Apr 12, 2022 · Medicare Part B (medical insurance) is part of Original Medicare and covers medical services and supplies that are medically necessary to treat your health condition. This can include outpatient care, preventive services, ambulance services, and durable medical equipment. It also covers part-time or intermittent home health and rehabilitative services, …

What is the purpose of Medicare Part B?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.Sep 11, 2014

What is the difference between part and Part B Medicare?

Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care.

Is Medicare Part B required?

Medicare Part B isn't a legal requirement, and you don't need it in some situations. In general, if you're eligible for Medicare and have creditable coverage, you can postpone Part B penalty-free. Creditable coverage includes the insurance provided to you or your spouse through work.

What happens if I don't want Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

Does Medicare Part B pay for prescriptions?

Medicare Part B (Medical Insurance) includes limited drug coverage. It doesn't cover most drugs you get at the pharmacy. You'll need to join a Medicare drug plan or health plan with drug coverage to get Medicare coverage for prescription drugs for most chronic conditions, like high blood pressure.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How do you pay for Medicare Part B if you are not collecting Social Security?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

What parts of Medicare are mandatory?

There are four parts to Medicare: A, B, C, and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse.

Can you drop Medicare Part B anytime?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.Nov 24, 2021

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

What does Medicare Part B cover?

Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, ...

What is Part B insurance?

Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is Medicare Part B?

Medicare Part B is medical insurance. Along with Medicare Part A (hospital insurance), it makes up Original Medicare, the federal health insurance program. Here’s something important to know about Medicare Part B: you need this coverage if you decide to sign up for a Medicare Advantage plan, or buy a Medicare Supplement insurance plan.

How much is Medicare Part B 2021?

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services.

What happens if you don't sign up for Medicare Part B?

However, when that coverage ends, be aware that if you don’t sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty. Here’s one reason you might want to sign up for Medicare Part B. Suppose you decide you’d like to buy a Medicare Supplement insurance plan.

How much is the Part B deductible for 2021?

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021. After you pay your deductible, you generally pay a 20% coinsurance (as mentioned above) for most covered services.

Does Medicare cover long term care?

If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it .

Is a hospital inpatient covered by Medicare?

Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B. Some tests and services that your doctor might order or recommend for you.

Do you have to pay Medicare Part B premium?

Please note that even if you decide to get your Original Medicare benefits through a Medicare Advantage plan, you still have to pay our monthly Medicare Part B premium. Of course, if the Medicare Advantage plan charges a premium, you’ll need to pay that as well. Some Medicare Advantage premiums are as low as $0.

What is Medicare Part A and Part B?

Medicare Part A and Part B are designed to cover inpatient and outpatient expenses. Part A is designed specifically for inpatient stays in hospitals, skilled nursing facilities, and hospice care.

What is covered under Part B?

Injections, physical therapy, or other modalities are also often covered under Part B as they are used to treat a condition. Durable medical equipment required after an injury, procedure, or diagnosis is also covered.

How much is Medicare Part B 2020?

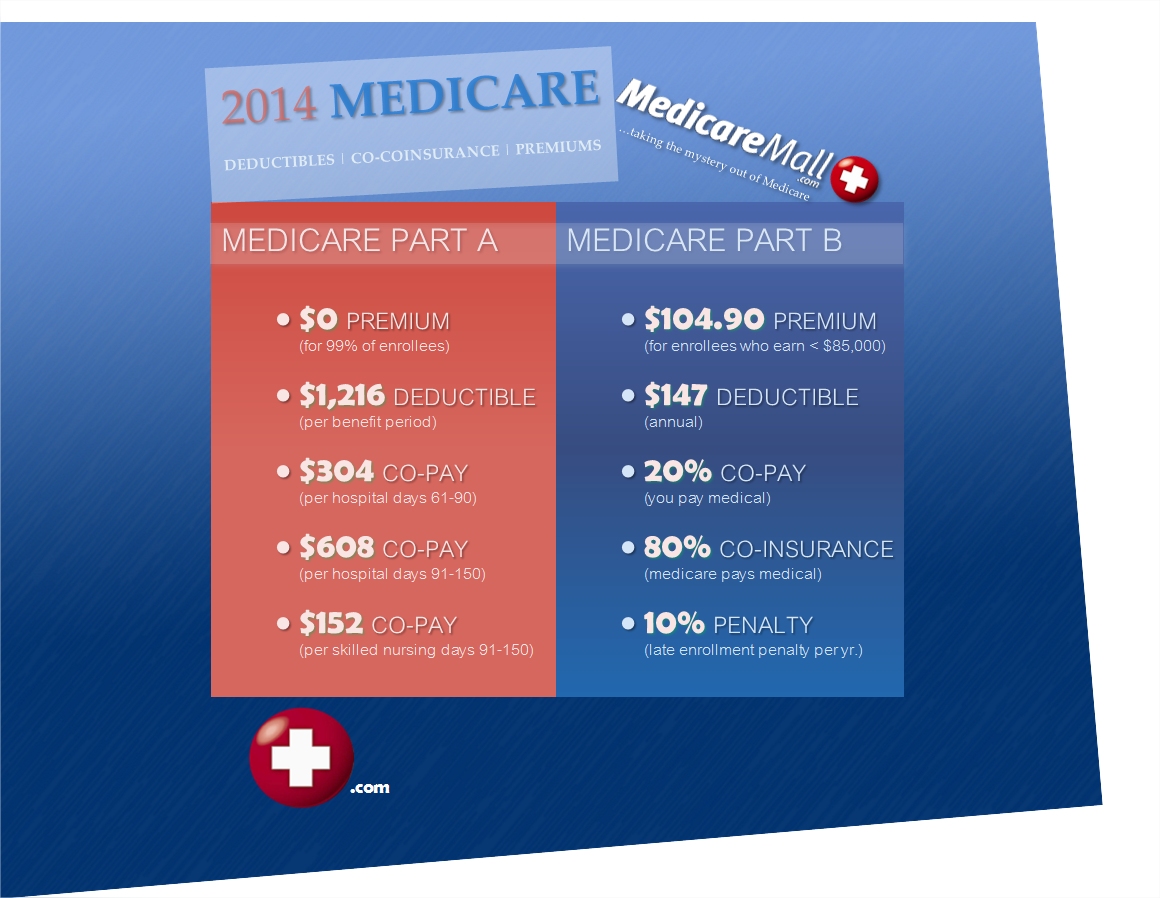

In addition to the premium payments, Medicare Part B also requires an annual deductible to be met. In 2020, the deductible is set to $198. You will need to pay this amount completely out of pocket before Medicare will begin covering your services.

How much is Part B medical insurance?

Part B medical insurance is associated with monthly premium payments, an annual deductible, and coinsurance payments for services. In 2020, the base monthly premium payment is $144.60. This amount applies to anyone making less than $87,000 annually as an individual or $174,000 for those filing jointly. If you exceed these numbers, your premium ...

How much coinsurance do you pay for Medicare?

Once you have met your deductible, you will then pay a coinsurance of 20 percent of the Medicare-approved amount. This amount is pre-set by Medicare and sets a limit as to the maximum amount they will pay for a service.

Does Part B cover hearing aids?

Part B does not provide any coverage related to vision, dental, or hearing care. This means that you will not receive any reimbursement for routine dental checkups, fillings, or dentures; routine vision care, including eye exams, glasses, or contacts; or hearing appointments and hearing aids. Part B also does not cover elective procedures, massage ...

What is Medicare Part B?

Medicare Part B (medical insurance) is part of Original Medicare and covers medical services and supplies that are medically necessary to treat your health condition. This can include outpatient care, preventive services, ambulance services, and durable medical equipment. It also covers part-time or intermittent ...

How often is Medicare Part B deducted?

See below for more details about the Medicare Part B premium. If you are receiving Social Security, Railroad Retirement Board, or federal retirement benefits, your Part B premium will be deducted directly from your monthly benefit. If not, you will be sent a bill every three months.

What is the late enrollment penalty for Medicare?

A late enrollment penalty may be applicable if you did not sign up for Medicare Part B when you were first eligible. Your monthly premium may be 10% higher for each 12-month period that you were eligible, but didn’t enroll in Part B.

What is the deductible for Medicare Part B 2021?

The annual deductible for Medicare Part B is $203 in 2021. You will also be responsible for a 20% coinsurance for many covered services. If your doctor or health care provider accepts assignment for a covered service, you would pay the Part B deductible along with 20% of the Medicare-approved amount for services rendered. Accepting assignment means that your doctor will not charge you more than the Medicare-approved amount for the covered service. You would still be responsible for cost-sharing.

How long do you have to enroll in Medicare Part B?

You can enroll in Medicare Part B at any time that you are still covered by a group plan based on current employment. After your employer health coverage ends or your employment ends (whichever comes first), you have an eight-month special enrollment period to sign up for Part B without a late penalty.

How old do you have to be to qualify for Medicare?

You must be 65 years or older. You must be a U.S. citizen, or a permanent resident lawfully residing in the U.S for at least five continuous years. You may also qualify for automatic Medicare Part B enrollment through disability. If you are under 65 and receiving Social Security or Railroad Retirement Board (RRB) disability benefits, ...

How long does it take to get Medicare Part A and Part B?

If you are under 65 and receiving Social Security or Railroad Retirement Board (RRB) disability benefits, you will automatically be enrolled in Medicare Part A and Part B after 24 months of disability benefits.

What does Medicare Part B cover?

Part B also covers preventive services, including diagnostic tests and a host of screenings.

What is covered by Part B?

In addition, Part B covers diagnostic tests (s uch as MRIs, CT scans, EKGs and x-rays) and a host of preventive medical services , such as pap tests, HIV screening, glaucoma tests, hearing tests, diabetes screening, and colorectal cancer screenings. Part B also pays the costs of durable medical equipment such as wheelchairs, hospital beds, ...

What income bracket did Medicare change?

The income levels for the various brackets changed in 2018, which means that people with unchanged income might have found themselves in a higher Part B premium bracket in 2018, and the adjustment resulted in more enrollees paying the highest premiums. The bracket changes only affected Medicare beneficiaries with income above $107,000 ($214,000 for a married couple), but the premium increases were substantial for people who were bumped into a higher bracket as a result of the changes.

What percentage of Medicare deductible is paid in 2021?

After the deductible, enrollees also pay 20 percent of the Medicare-approved amount for care that’s covered under Part B. (The Part B deductible will increase to $203 in 2021.) But most enrollees have supplemental coverage — from an employer plan, Medicaid, or Medigap — that covers some or all of the out-of-pocket costs ...

How much is the 2020 Medicare Part B deductible?

Enrollees who receive treatment during the year must also pay a Part B deductible, which is $198 in 2020 (and will be $203 in 2021). Failing to enroll in Medicare Part B during your open enrollment could raise your Part B premium later on. If you have health insurance through your employer, or through your spouse’s employer, ...

What is the income limit for Medicare Part B?

Medicare Part B enrollees with income above $87,000 (single) / $174,000 (married) pay higher premiums than the rest of the Medicare population (this threshold was $85,000/$170,000 prior to 2020, but it was adjusted for inflation starting in 2020; it will be $88,000/$176,000 in 2021). The 2020 Part B premiums for high-income beneficiaries range ...

What is the highest income bracket for Medicare?

In 2018, the highest income bracket was $160,000 and up ($320,000 and up for a married couple). But a new bracket was created as of 2019 for the highest-income Medicare Part B (and D) enrollees.

What age does Medicare cover outpatient?

Medicare coverage becomes available to individuals once they reach the age of 65 or under the age of 65 when they qualify due ...

How long does Medicare coverage last?

This marks the beginning of the Initial Enrollment Period, which lasts for seven months.

How much is the 2020 Medicare premium?

The base premium payment for 2020 is $144.60 for everyone with an annual income of less than $87,000 or joint filers with an income less than $174,000. If you are above this income threshold, your premium payment may increase to up to $376 per month if you file as an individual and up to $491.60 if you file jointly.

Does Medicare Part B cover secondary insurance?

If the employer has fewer than 20 employees, they have the option of requiring you to sign up for Medicare Part B during your Initial Enrollment Period, causing Medicare to serve as your primary insurance and your employer’s insurance to serve as secondary insurance. What Does Part B Cover?

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is a 504.90?

504.90. Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follow s: Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses:

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...