You must be enrolled in either Medicare Part A or Part B to be eligible. Medicare Part D coverage is optional and is sold by private insurance companies. You must enroll in Part D between October 15 and December 7. Coverage is not automatic and late enrollment penalties may apply.

How much does Medicare Part C and D cost?

You pay your portion of the monthly premium if you receive Part D coverage as part of Medicare. The cost varies, but the nationwide base is about $33 per month in 2022. Each plan will also have a copayment and coinsurance amount. You can add Part D coverage to Medicare Parts A and/or B.

What does Medicare Part D really cost?

The moving parts of Medicare Part D costs. The Part D premium is certainly a major determinant of annual cost but not the only factor that can contribute to overall costs. The average monthly premium for Part D is approximately $34.00 per month. The lowest premium nationwide for 2017 is the Humana Walmart RX plan at $17.00 per month. Some Part D plans have monthly premiums well over $100.

How much does it cost for Medicare Part D?

As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state. What affects Medicare Part D costs each year?

What is covered under Medicare Part D?

Other common symptoms of the condition include:

- Burning

- Rash

- Itching

- Fever

- Headaches

- Fatigue

- Light sensitivity

What's the difference between Medicare Part C and D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

What is the purpose of Part C Medicare?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is Medicare Part C and how does it work?

Medicare Part C plans, also known as Medicare Advantage plans, are optional insurance plans that offer the benefits of both original and additional Medicare coverage. Medicare Part C is a great option for people interested in coverage for prescription drugs, vision and dental services, and more.

What is the average cost for Medicare Part C?

Currently insured? For 2022, a Medicare Part C plan costs an average of $33 per month. These bundled plans combine benefits for hospital care, medical treatment, doctor visits, prescription drugs and frequently, add-on coverage for dental, vision and hearing.

Is Medicare Part C deducted from Social Security?

Beneficiaries may elect deduction of Medicare Part C (Medicare Advantage) from their Social Security benefit. Some Medicare Advantage plans include a reduction in the Part B premium. Social Security takes that reduction into account, as soon as we are notified of the reduction by CMS.

Does Medicare Part C replace A and B?

Part C (Medicare Advantage) Under Medicare Part C, you are covered for all Medicare parts A and B services. Most Medicare Advantage plans also cover you for prescription drugs, dental, vision, hearing services, and more.

Does Medicare Part D cover prescriptions?

Medicare Part D, the prescription drug benefit, is the part of Medicare that covers most outpatient prescription drugs. Part D is offered through private companies either as a stand-alone plan, for those enrolled in Original Medicare, or as a set of benefits included with your Medicare Advantage Plan.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Is Medicare Part C the same as supplemental insurance?

These are also called Part C plans. Medicare Supplement insurance policies, also called Medigap, help pay the out-of-pocket expenses not covered by Original Medicare (Part A and B). It is not part of the government's Medicare program, but provides coverage in addition to it.

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Is there a penalty for Medicare Part C?

Medicare Part C (Medicare Advantage) doesn't have a late enrollment penalty. You can switch over to this type of plan during certain enrollment periods. Medicare supplement insurance (Medigap) also does not have a set penalty. However, rates may go up drastically if you don't sign up when you're first eligible.

What is the deductible for Medicare Part D in 2022?

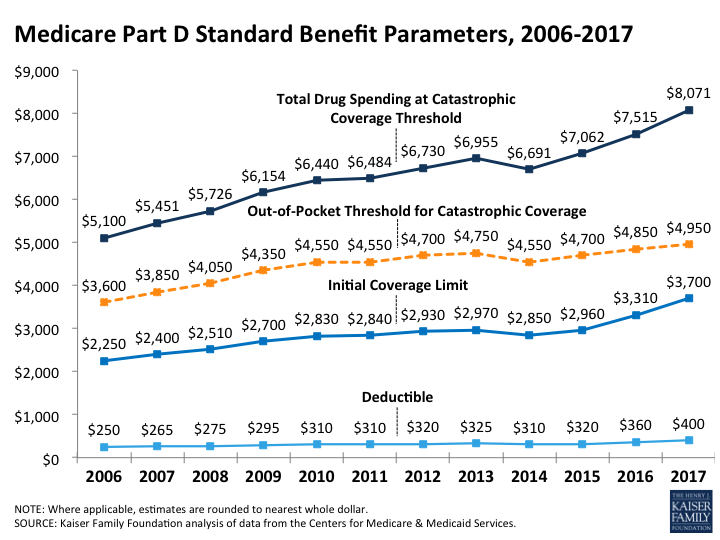

$480The initial deductible will increase by $35 to $480 in 2022. After you meet the deductible, you pay 25% of covered costs up to the initial coverage limit. Some plans may offer a $0 deductible for lower cost (Tier 1 and Tier 2) drugs.

How many enrollment periods are there for Medicare Advantage?

There are 2 separate enrollment periods each year. See the chart below for specific dates.

What is the late enrollment penalty for Medicare?

The late enrollment penalty is an amount that’s permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there’s a period of 63 or more days in a row when you don’t have Medicare drug coverage or other creditable prescription drug coverage. Creditable prescription drug coverage is coverage (for example, from an employer or union) that’s expected to pay, on average, at least as much as Medicare’s standard prescription drug coverage. If you have a penalty, you’ll generally have to pay it for as long as you have Medicare drug coverage. For more information about the late enrollment penalty, visit Medicare.gov, or call 1‑800‑MEDICARE (1‑800‑633‑4227). TTY users can call 1‑877‑486‑2048.

What are the special enrollment periods?

When certain events happen in your life, like if you move or lose other insurance coverage, you may be able to make changes to your Medicare health and drug coverage. These chances to make changes are called Special Enrollment Periods. Rules about when you can make changes and the type of changes you can make are different for each Special Enrollment Period.

What is Medicare Part C and Part D?

Medicare Part C and Part D offer different benefits to people eligible for Medicare. It is important that people consider the benefits they may need to cover their medical expenses.

What is the difference between Medicare Part C and Medicare Part D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

What are the requirements to be eligible for Medicare Part C?

In general, a person must meet two requirements to be eligible for Medicare Part C: They must be enrolled in original Medicare, and they must live in an area where an insurance company offers Medicare Part C. During a person’s IEP, they are eligible for Medicare Part C.

How much does Medicare Part D pay?

The individual pays approximately 25% of the cost of prescriptions, and Medicare Part D pays the remaining 75%. If a person reaches the “ catastrophic coverage ” amount, they pay 5% of the cost of prescriptions. This feature of the plan helps individuals with high out-of-pocket prescription expenses.

When is Medicare Part D available?

However, these changes are possible during the annual OEP that runs from October 15 to December 7. Medicare Part D is available for everyone during their IEP for original Medicare. Private insurance companies sell Medicare Part C and Part D.

How long can you be without Medicare Part D?

The company can charge a penalty when a person is without Medicare Part D for 63 continuous days or longer after the initial enrollment period (IEP) ends.

Who pays Medicare Part C premium?

The premium for Medicare Part C is paid to the private insurance company , which then pays the premium for Medicare Part B to Medicare. Medicare Advantage plans have a yearly out-of-pocket spending limit. If a person reaches the limit in a calendar year, the plan pays all medical expenses for the rest of the year.

What are the benefits of Medicare Part D?

Medicare Part D is an optional benefit for all people who have Medicare. It adds drug coverage to: 1 original Medicare 2 some Medicare cost plans 3 some Medicare Private Fee-for-Service plans 4 Medicare savings accounts

What happens if you don't sign up for Medicare?

If you didn’t sign up for Medicare Part D when you were first eligible, you may be required to pay a late enrollment penalty for the entire time you continue with Part D. You can also avoid it if you qualify for Medicare’s Extra Help program by meeting certain income and resource limits.

Do Medicare Advantage plans have monthly premiums?

When considering Medicare Part C, along with comparing benefits, compare costs, too. Typically, you’ll pay a separate monthly premium, but not all Medicare Advantage plans have monthly premiums.

Can you have both Part C and D?

You can’t have both parts C and D. If you have a Medicare Advantage plan (Part C) that includes prescription drug coverage and you join a Medicare prescription drug plan (Part D), you’ll be unenrolled from Part C and sent back to original Medicare.

How many parts are there in Medicare?

There are four different parts of Medicare: Part A, Part B, Part C, and Part D — each part covering different services. Understanding how these parts and services work (together and separately) is the key to determining which ones fit your unique health care needs and budget. There are two main paths for Medicare coverage — enrolling in Original ...

What is Medicare Advantage?

Medicare Advantage (Part C) is an alternative to Original Medicare. It allows you to receive Part A and Part B benefits — and in many cases, other benefits — from a private health insurance plan. At the very least, your Medicare Advantage plan must offer the same benefits as Original Medicare. The only exception is hospice care, which is still ...

What are the benefits of Medicare Advantage Plan?

Additional benefits that many Medicare Advantage plans include are: Vision coverage. Hearing coverage. Dental coverage. Medicare Part D prescription drug coverage. If you’re eligible for Medicare Part A and Part B, and do not have ESRD, you can join a Medicare Advantage Plan. Medicare beneficiaries have the option of receiving health care benefits ...

How long do you have to be on Medicare if you are 65?

For those younger than 65, you are only eligible to receive Medicare benefits if you: Have received Social Security or Railroad Retirement Board (RRB) disability benefits for 24 months.

When do you get Medicare for ALS?

If you’re under 65, it’s the 25th month you receive disability benefits. ALS patients are automatically enrolled in Medicare coverage when their Social Security disability benefits begin, regardless of age. If you have end-stage renal disease (ESRD), you must manually enroll.

Does Medicare Advantage include Part D?

Many Medicare Advantage plans also include Part D coverage. If you're looking for Medicare prescription drug coverage, you can consider enrolling in a Medicare Advantage plan that includes drug coverage, or you can consider enrolling in a Medicare Part D plan. You can compare Part D plans available where you live and enroll in a Medicare ...

What are the parts of Medicare?

There are four parts of Medicare. Each one helps pay for different health care costs. Part A helps pay for hospital and facility costs . This includes things like a shared hospital room, meals and nurse care. It can also help cover the cost of hospice, home health care and skilled nursing facilities. Part B helps pay for medical costs.

What does Part B cover?

It can also help cover the cost of hospice, home health care and skilled nursing facilities. Part B helps pay for medical costs. This is care that happens outside of a hospital. It includes things like doctor visits and outpatient procedures. It also covers some preventive care, like flu shots.

Does Medicare cover dental?

Some of these plans cover preventive dental, vision and hearing costs. Original Medicare doesn’t. You can see a list of the Medicare Advantage plans we offer and what they cover. Part D helps pay for prescription drugs. Part D plans are only available through private health insurance companies. They’re called prescription drug plans.

Does Medicare Advantage cover generic drugs?

You can read about our prescription drug plans and what they cover. Many Medicare Advantage plans include Part D prescription drug plans built right into them.

What is Medicare Advantage?

Medicare Advantage is the private health insurance alternative to the federally run original Medicare. Think of Advantage as a kind of one-stop shopping choice that combines various parts of Medicare into one plan.

How much is Medicare deductible for 2021?

Medicare charges a hefty deductible each time you are admitted to the hospital. It changes every year, but for 2021 the deductible is $1,484. You can buy a supplemental or Medigap policy to cover that deductible and some out-of-pocket costs for the other parts of Medicare.

How much is Part B insurance for 2021?

The federal government sets the Part B monthly premium, which is $148.50 for 2021. It may be higher if your income is more than $88,000. You’ll also be subject to an annual deductible, set at $203 for 2021. And you’ll have to pay 20 percent of the bills for doctor visits and other outpatient services.

When is open enrollment for Medicare 2021?

The next open enrollment will be from Oct. 15 to Dec. 7 , 2021, and any changes you make will take effect in January 2022. Editor’s note: This article has been updated with new information for 2021.

Does Medicare cover wheelchair ramps?

In addition, in recent years the Centers for Medicare and Medicaid Services, which sets the rules for Medicare, has allowed Medicare Advantage plans to cover such extras as wheelchair ramps and shower grips for your home, meal delivery and transportation to and from doctors’ offices.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage plans also fold in prescription drug coverage. Not all of these plans cover the same extra benefits, so make sure to read the plan descriptions carefully. Medicare Advantage plans generally are either health maintenance organizations (HMOs) or preferred provider organizations (PPOs).