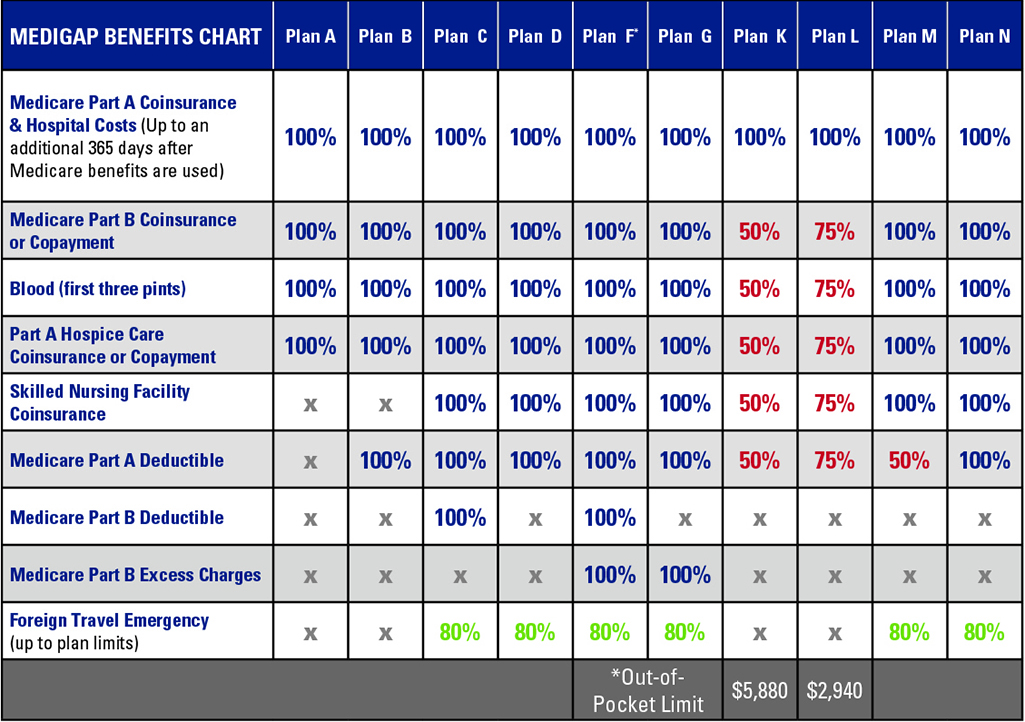

As you can see, there’s actually only one difference in coverage for Medicare Part F vs. G. That is that Medicare Part F covers the Part B deductible, whereas Part G does not. Medicare is phasing out plans that cover the Part B deductible, so anyone newly eligible for Medicare from January 1, 2020 and onward, cannot buy a Part F plan.

Full Answer

What is Medicare Plan G and F?

Apr 07, 2021 · Plan G Medicare Rates are Lower You see, most savvy seniors have already figured out that Plan G Medicare premiums are lower than Plan F, and that cost difference adds up to more than the Part B deductible (in most areas). So, for these seniors, a Medigap Plan G policy is better than Plan F because they save money.

How much does Medicare Part F cost?

As you can see, there’s actually only one difference in coverage for Medicare Part F vs. G. That is that Medicare Part F covers the Part B deductible, whereas Part G does not. Medicare is phasing out plans that cover the Part B deductible, so anyone newly eligible for Medicare from January 1, 2020 and onward, cannot buy a Part F plan.

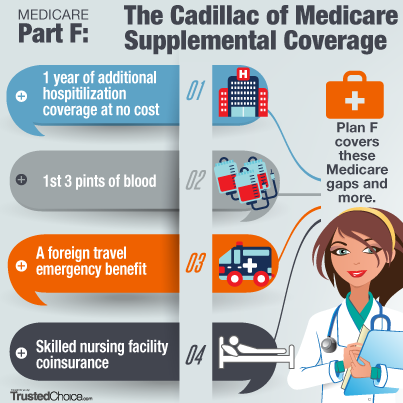

What are the benefits of Medicare Part F?

Nov 18, 2021 · Plan F covers more than Plan G, as it includes the Medicare Plan B deductible. Plan F prices have also jumped substantially since the introduction of the act that discontinued their availability to new Medicare beneficiaries. However, Plan G is also a comprehensive plan.

Who is eligible for Medicare Plan F?

Feb 03, 2022 · If you have Medicare Plan F and you haven’t yet met your Medicare Part B deductible, it would cover the $203 deductible plus the 20% of the Medicare-approved coinsurance amount. If you have Medicare Plan G, you’ll need to pay the $233 Medicare Part B deductible first. Then your Medicare Supplement plan would cover the 20% coinsurance.

What Is The Difference Between Plan F and G

This part is easy to answer because there is only one benefit difference between Medigap plan G and F. Plan F covers the Medicare Part B deductible...

Medigap Plan G vs F Benefit Details

Below is a chart we put together with the main benefits covered by Medicare Supplement Plans G and F. As you will see, they mirror each other in al...

Who Should Choose Medigap F?

Everyone looking into Medigap policies should consider Plan F since it offers the most benefits. But who should pick F over G? 1. Anyone who can fi...

Who Should Choose Medigap G?

Everyone consider enrolling in Medicare Supplement Insurance who does not fall under the three bullets above should consider Plan G. Basically if y...

What About Plan F Going away?

First of all, Plan F is not going away. Anyone who is Medicare eligible before 2020 can purchase it at any time in the future and those currently o...

What is Medicare Supplement Plan F?

Medicare Supplement Plan F provides coverage for two areas that Plan N does not: Medicare Part B deductible. Part B excess charges. Doctors who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for services and items they provide.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

Who is Zia Sherrell?

Zia Sherrell is a digital health journalist with over a decade of healthcare experience, a bachelor’s degree in science from the University of Leeds and a master’s degree in public health from the University of Manchester. Her work has appeared in Netdoctor, Medical News Today, Healthline, Business Insider, Cosmopolitan, Yahoo, Harper's Bazaar, Men's Health and more. .. Read full bio

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

Is Medigap Plan F deductible?

While the deductibles mean you must pay a certain amount of money out of pocket before the plan coverage kicks in, the monthly premiums are typically much lower than the premiums for other Medigap plans or for the standard non-deductible versions of Plan F and Plan G.

Is Medigap Plan F the same as Plan G?

As you can see , Medigap Plan F and Plan G are very similar. There are several points to consider when deciding which Medigap plan suits your need, especially if you already have Plan F coverage. Plan F covers more than Plan G, as it includes the Medicare Plan B deductible.

Does Plan G cover Part B?

Even though Plan G doesn’t cover the Part B deductible, some Plan F options could have high enough premiums that the cost difference between Plan F vs. Plan G would be higher than the Part B deductible itself.

What is the difference between Medicare Plan F and Plan G?

Another big difference between Medicare Plan F and Plan G is who is eligible to enroll. Both plans require you to first have Original Medicare, but the enrollment guidelines for Plan F changed at the beginning of 2020. If you first became eligible for Medicare on or after January 1, 2020, you cannot enroll in Medicare Plan F.

What are the benefits of Medicare?

More specifically, Medicare Plan G and Medicare Plan F cover: 1 Part A coinsurance and hospital costs 2 Part B coinsurance or copayments 3 First three pints of blood (for surgeries that require blood transfusions) 4 Part A hospice care coinsurance 5 Skilled nursing facility care coinsurance 6 Medicare Part A deductible 7 Up to 80% of the cost of medically necessary care while you’re traveling in a foreign country

What is the deductible for Medicare 2021?

If you became eligible for Medicare. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

Who is Lisa Eramo?

Lisa Eramo is an independent health care writer whose work appears in the Journal of the American Health Information Management Association, Healthcare Financial Management Association, For The Record Magazine, Medical Economics, Medscape and more.

How much is the Part B deductible?

The Part B deductible is a one time deductible you must play each year when you see the doctor for non-preventive visits. The current part B deductible cost is $203. This means Medigap Plan F pays the $203 while Plan G does not. The other difference is price, and it is a considerable one.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

Is there a charge for Senior65?

Compare prices for yourself. If you need assistance or are ready to enroll, give us a call. There is never a charge or hidden fee to work with Senior65.com. Since Medicare Insurance prices are regulated, no one can sell you the same plan for less than we can.

What is a Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dollar coverage means that both your Part A and Part B deductibles are covered by the plan, so you pay nothing before your Medicare benefits kick in.

Which is the most comprehensive Medicare plan?

The most comprehensive plan currently available is Medigap Plan F. It covers all of the gaps in Medicare. The next most comprehensive plan is Plan G, which covers nearly as much, with the Part B deductible being the only difference. Finally, Plan N is probably the third most popular plan because it operates similar to Plan G except ...

What happens if you don't have Medicare?

When you see a provider that doesn’t participate with Medicare, he can charge up to 15% more than the standard Medicare rate for your services. You will pay this money out of pocket unless you have Medigap Plan F or Plan G. It’s definitely something to consider if provider choice is important to you.

Is Medigap Plan G the same as Plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deduct ible, which is $203 in 2021. Medigap Plan G is now the most popular plan among beneficiaries new to Medicare.

How many Medigap plans are there?

There are currently 10 different Medigap plans that are standard across most states. (Massachusetts, Minnesota, and Wisconsin have their own plan standards.) What this means for consumers, however, is that Plan A offered by Company X in Anaheim is exactly the same as Plan A offered by Company Y in Boise.

Does Medigap Plan N cover Part B?

Under Medigap Plan N, you have all the same coverage as Plan F except: No coverage for Part B deductible. No coverage for Part B excess charges. You may have a copay of up to $20 for doctor visits and $50 for hospital visits that don’t result in admission. This is one of the newer plans, rolled out in 2010.

Is Medigap a smart choice?

If you’re concerned about out-of-pocket health care costs, enrolling in any Medigap is a smart decision. The average 66-year-old couple spends about 57% of their Social Security benefits on health care, according to a 2016 study. Learn Medicare for Free: Enroll in 6-Day Medicare Mini Course.

What is Medigap Plan F?

Medigap Plan F provides a person with coverage for some parts of healthcare that original Medicare does not cover. However, there are some restrictions on enrollment: A person newly enrolled in Medicare can no longer get Plan F.

How much is the deductible for Medicare 2021?

In addition to the basic Plan F, there is a high deductible version of Plan F available. In 2021, this has a deductible of $2,370. A person must reach the deductible before the plan starts to cover costs.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

How many Medigap policies are there?

There are 10 Medigap policies: A, B, C, D, F, G, K, L, M, and N. The plans offer standardized benefits to Medicare recipients and help pay coinsurance, deductibles, and copays that original Medicare may not cover. Medigap plans may also cover emergency healthcare if a person needs treatment while they are away from the United States.

Does Medigap cover Part B?

Each Medigap plan must offer the same benefits as all other plans with the same letter, though plan premiums may be different. However, eligibility rules changed in January 2020, and Plan F is no longer available to new enrollees in Medicare. Plan G coverage is similar to that of Plan F but does not cover the Medicare Part B deductible.

Does Medigap Plan G cover Medicare Part B?

Medigap Plan G provides a person with coverage for some parts of healthcare that original Medicare does not cover. However, Plan G does not cover the Medicare Part B deductible, which is $148.50 in 2021. In 2021, the high deductible version of Plan G has a $2,370 deductible before the plan will start coverage.

Which is better, Medicare Supplement Plan F or G?

Medicare Supplement Plan F and Plan G are nearly identical. Technically, Plan F is better because it offers first-dollar coverage. However, the one cost that Plan G does not cover, the Part B deductible, is often less than the annualized premium difference between the two plans.

How much does Medicare Plan F cost?

The price of a Medicare Plan F policy is determined based on your age, location, gender, and use of tobacco. National averages are around $300 per month, but in many areas, rates start as low as $125 per month. For the high deductible version, you may pay as little as $68.

What are the benefits of Medicare Supplement?

Important Facts About Medicare Plan F: 1 It’s important to note that Medicare supplements are not standalone policies. You must have both Medicare Parts A and B to qualify. 2 You pay for your Medicare Part B and Medigap separately. If you or your spouse did not work the full 40 quarters (10 years) required, you will also pay for your Part A coverage. 3 Each person needs their own Medicare supplement policy. These policies only cover one person. However, many companies offer a household discount. 4 Medicare Plan F is offered through private insurance companies and only those authorized to sell in your state can provide this policy. 5 Health problems do not disqualify you from a Medigap policy if you enroll during your 6-month individual enrollment period. During this period, you have guaranteed issue rights and cannot be turned down. You may continue to renew these indefinitely if you pay the monthly premium. 6 If you have a Medicare Advantage plan it is illegal for an insurance company to sell you a Medigap plan. The only exception is if you are going back to Original Medicare.

What is Medicare Plan F?

Medicare Plan F provides the same healthcare coverage from state to state. In general, you can use it to cover the copayment for all medical costs (e.g., doctor visits, specialists, lab tests, diagnostics, etc.) and even the Medicare Part B deductible.

When will Medicare Supplement Plan F be available?

As a result, anybody who becomes eligible for Medicare on or after 1 January 2020 will not be able to purchase a Medicare Supplement Plan F policy.

What is Medicare Part B excess charge?

A Medicare Part B excess charge is the difference between a health care provider’s actual charge and Medicare’s approved amount for payment. ... . These occur when your doctor or specialist does not accept the standard Medicare payment for a service.

Which states do not follow Medicare standardized plans?

There are three states that do not follow the standardized plans organized by Medicare, Massachusetts, Minnesota, and Wisconsin. These three states have their own standardized plans, which start with a base plan and additional riders to cover different gaps.

Is Plan G the same as Plan F?

Ultimately, Plan G has the same benefits as the Plan F, except for coverage for the Part B deductible ($203 for 2021). Once you pay the Part B deductible, the coverage is the same for both plans.

Is Medigap Plan G cheaper than Plan F?

Even though it has similar coverage, Medigap Plan G’s monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

Is Medicare Supplement Plan G the same as Plan F?

Medicare Supplement Plan G is almost identical to Plan F, except for the Part B deductible. If you select Plan G, you’ll need to pay your Part B deductible ($203 for 2021), yourself. After you pay your deductible, you have no other out-of-pocket costs, just like the Plan F.

What is the difference between Medicare Supplement Plan G and Plan F?

The main difference between Medicare Supplement Plan G and Plan F is that MedSup Plan F covers your Medicare Part B deductible. Plan G doesn’t cover that cost. Of course, the Part B deductible is just $198 this year, but a buck is a buck, right? However, MedSup Plan G premiums tend to be cheaper than Plan F premiums.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G is a popular and comprehensive MedSup plan. Here's why it may be the best MedSup plan for you. Medicare Part G — or Plan G — is one of the most popular Medicare Supplement plans available. Plan G sits just behind Plan F in terms of popularity among American Medicare enrollees who want a bit more coverage.

How much does Medicare Supplement Plan G cover?

Up to three pints of blood for medical procedures each year. Medicare Supplement Plan G also covers 80% of medical care you receive while traveling outside the U.S., up to your plan’s limits.

What is the deductible for Medicare Part B 2020?

For 2020, the Medicare Part B deductible is $198 per year. After your out-of-pocket costs hit that limit, you’ll pay 20% of the Medicare-approved amount for most of the services Part B covers. That includes care like doctor visits and outpatient therapy. Also, Plan G usually doesn’t cover prescription drugs.

Do you pay Medicare Part B premium?

You pay your monthly Medicare Part B premium. If you receive benefits from Social Security, the Railroad Retirement Board or the Office of Personnel Management, your premium will be automatically deducted from your benefit payment. You also pay the monthly premium for your Plan G policy.

Does Medicare Supplement Plan G cover prescriptions?

Also, Plan G usually doesn’t cover prescription drugs. Some MedSup policies used to, but that’s no longer the case. For that, you need to enroll in Medicare Part D. Finally, Medicare Supplement Plan G also won’t cover any of these costs: Dental care. Eye care, including glasses. Hearing aids.