What parts of Medicare do I Need?

Medicare Supplement Plan K includes the following coverage for Medicare Part A (hospital insurance) and Medicare Part B (outpatient medical insurance) costs, as well as some extras.

Do I have to pay for Medicare Part?

Medicare Supplement insurance Plan K out-of-pocket limit. Medigap Plan K is one of two Medigap plans that includes a yearly out-of-pocket limit, which is $6,220 in 2021. After your out-of-pocket costs have reached this limit (which includes the yearly Part B deductible), Medigap Plan K may cover 100% of your Medicare-covered costs for the rest of the year.

How to qualify for Medicare Part?

Jun 18, 2020 · Medicare Supplement Plan K is one of 10 different Medigap plans and one of the two Medigap plans that has a yearly out-of-pocket limit. Medigap plans are offered in most states to help pay for some of the healthcare costs not covered by original Medicare (Part A and Part B). If you live in Massachusetts, Minnesota, or Wisconsin, Medigap policies have slightly different …

What are the top 5 Medicare supplement plans?

Jan 29, 2020 · Medicare supplemental insurance, or a Medigap, helps cover some of the healthcare costs that are often leftover from Medicare parts A and B.. Medicare Supplement Plan K is one of two Medicare supplement plans that offer a yearly out-of-pocket limit. Keep reading to learn more about this plan, what it covers, and who might benefit from it.

What is Medicare type K?

Medicare Supplement Plan K coverage is one of 10 different Medigap plans to pay for some of the healthcare costs leftover from original Medicare coverage. Along with Medicare Supplement Plan L, it is one of the two Medigap plans that include a cap on how much you will spend on Medicare-approved treatments.Jun 18, 2020

What is Supplement plan K?

Medigap Plan K is a Medicare Supplement Insurance plan that covers certain out-of-pocket expenses associated with Medicare Part A and Part B coverage.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is Part F of Medicare coverage?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

What is Plan G Medicare?

Medicare Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.Jan 24, 2022

Does Medigap cover drugs?

Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D).

What are Medicare Parts A & B?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers. Outpatient care.

Whats the difference between Medicare Part A and B?

Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care.

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

What is the difference between Medicare Part F and Part G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Should I switch from plan F to plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Why was plan F discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

Medicare Supplement Insurance Plan K Out-Of-Pocket Limit

Medigap Plan K is one of two Medigap insurance plans that includes a yearly out-of-pocket limit, which is $5,240 in 2018. After your out-of-pocket...

Medicare Supplement Insurance Plan K Benefits

As mentioned, Medigap Plan K offers partial coverage for a variety of Original Medicare costs that you’d normally have to pay out of pocket. This p...

Medicare Supplement Insurance Plan K Costs

One factor to keep in mind with Medigap Plan K is that you may have higher out-of-pocket costs with this Medigap policy. Because the plan only cove...

What is Medigap Plan K?

As mentioned, Medigap Plan K offers partial coverage for a variety of Original Medicare costs that you’d normally have to pay out of pocket. This plan covers 50% of the cost for the following benefits: Medicare Part A hospice care coinsurance or copayment.

What is the out-of-pocket limit for Medicare Supplement?

Medicare Supplement insurance Plan K out-of-pocket limit. Medigap Plan K is one of two Medigap plans that includes a yearly out-of-pocket limit, which is $6,220 in 2021. After your out-of-pocket costs have reached this limit (which includes the yearly Part B deductible), Medigap Plan K may cover 100% of your Medicare-covered costs for the rest ...

How many pints of blood are covered by Medicare?

First three pints of blood for a covered medical procedure (yearly) With Medigap Plan K, beneficiaries must pay the Medicare Part B deductible and Part B excess charges out of pocket. Part B excess charges are the difference between what Medicare covers for a service and what your health-care provider may charge you.

How much does Medicare pay for outpatient services?

As an example, you’ll usually pay 20% of the Medicare-approved cost for outpatient services, while Medicare pays the remaining 80% . Let’s say the approved amount set by Medicare is $100 for a doctor appointment.

Does Medigap Plan K cover hospital costs?

As mentioned, while Medigap Plan K offers partial coverage for most of its benefits, the plan completely covers the following benefit: Medicare Part A coinsurance hospital costs up to an additional 365 days after Medicare benefits are exhausted.

Does Medigap Plan K work?

Compare Plans within Seconds. If you’re looking for some help with certain Original Medicare costs and want a lower-cost Medigap plan with very basic coverage, then Medigap Plan K may work for your situation. Medicare Supplement insurance Plan K pays a percentage of most of its covered benefits, with the exception of Medicare Part A coinsurance ...

What is Medicare Part C?

Medicare Part C. Part C is also known as Medicare Advantage. Private health insurance companies offer these plans. When you join a Medicare Advantage plan, you still have Medicare. The difference is the plan covers and pays for your services instead of Original Medicare.

Is Medicaid part of Medicare?

Medicare and Medicaid (called Medical Assistance in Minnesota) are different programs. Medicaid is not part of Medicare. Here’s how Medicaid works for people who are age 65 and older: It’s a federal and state program that helps pay for health care for people with limited income and assets.

Does Medicare cover assisted living?

Medicare doesn’t cover costs to live in an assisted living facility or a nursing home. Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

Does Medicare cover chiropractic care?

Medicare has some coverage for chiropractic care if it’s medically necessary. Part B covers a chiropractor’s manual alignment of the spine when one or more bones are out of position. Medicare doesn’t cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Does Medicare cover colonoscopy?

If you had a different screening for colorectal cancer called a flexible sigmoidoscopy, Medicare covers a screening colonoscopy if it is 48 months or longer after that test. Eye exams. Medicare doesn’t cover routine eye exams to check your vision if you wear eyeglasses or contacts.

Does Medicare cover hearing aids?

Hearing aids. Medicare doesn’t cover hearing aids or pay for exams to fit hearing aids. Some Medicare Advantage plans have benefits that help pay for hearing aids and fitting exams.

Does Medicare cover acupuncture?

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesn’t cover costs to live in an assisted living facility or a nursing home.

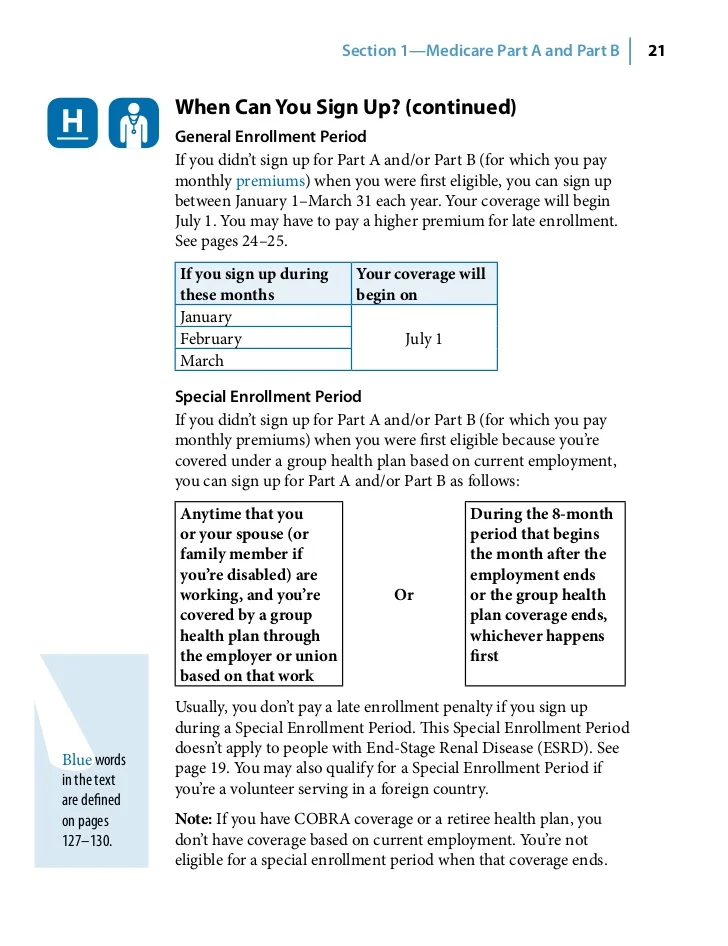

What happens if you don't sign up for Medicare Part B?

If you don’t sign up for Medicare Part B at 65 and later decide you need it, you’ll likely pay a penalty of 10% of the premium for each 12-month period that you delayed. You will pay this penalty for life, basically, since few people drop Medicare Part B once they have it.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is a type of health plan offered by private insurance companies that provides the benefits of Parts A and Part B and often Part D (prescription drug coverage) as well. These bundled plans may have additional coverage, such as vision, hearing and dental care.

How much is Medicare Part A in 2021?

Medicare Part A has a deductible ($1,484 in 2021) and coinsurance, which means patients pay a portion of the bill. There is no coinsurance for the first 60 days of inpatient hospital care, for example, but patients typically pay $371 per day for the 61st through 90th day of the hospitalization, and more after that.

Is Medicare the same as Medicaid?

No. Medicare is an insurance program, primarily serving people over 65 no matter their income level. Medicare is a federal program, and it’s the same everywhere in the United States. Medicaid is an assistance program, serving low-income people of all ages, and patient financial responsibility is typically small or nonexistent.

Does Medicare cover eye exams?

Medicare also doesn’t cover eye exams for eyeglasses or contact lenses. Some Medicare Advantage Plans (Medicare Part C) offer additional benefits such as vision, dental and hearing coverage. To find plans with coverage in your area, visit Medicare’s Plan Finder.

Does Medicare Part A cover hospice?

Part A also helps pay for hospice care and some home health care. Medicare Part A has a deductible ($1,484 in 2021) and coinsurance, which means patients pay a portion of the bill. There is no coinsurance for the first 60 days of inpatient hospital care, for example, but patients typically pay $371 per day for the 61st through 90th day ...