Full Answer

How much does PBM pay?

The average PBM salary is $33,850. Find out the highest paying jobs at PBM and salaries by location, department, and level. PBM employees earn an average salary of $33,850 in 2020, with a range from $16,000 to $70,000.

What do PBM pharmacists do?

What Does a PBM Pharmacist Do. As a PBM pharmacist, you fill prescriptions on behalf of a pharmacy benefit manager, which is a person or company that helps manage a program to provide a group of people—typically employees at one company—with prescription drugs.

What is a PBM insurance?

Traditionally a health insurance company contracts with a Prescription Benefit Manager (PBM) to handle the drug related benefit for the health insurer. Historically Health Insurers were not in a position to process large numbers of prescription claims and determine coverage and benefits efficiently.

What is PBM in medical?

Policymakers have considered three principal reforms to regulate PBMS:

- Require greater transparency around rebates. Federal and state policymakers likely need more data on the rebates PBMs receive to gain a more complete understanding of pharmaceutical spending and where reforms ...

- Ban spread pricing. ...

- Require PBMs to pass through rebates to payers or to patients. ...

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How much money can you have in the bank if your on Medicare?

You may have up to $2,000 in assets as an individual or $3,000 in assets as a couple. As of July 1, 2022 the asset limit for some Medi-Cal programs will go up to $130,000 for an individual and $195,000 for a couple. These programs include all the ones listed below except Supplemental Security Income (SSI).

Is the Medicare savings program legitimate?

Medicare Savings Programs (MSP) are federally funded programs administered by each individual state. These programs are for people with limited income and resources to help pay some or all of their Medicare premiums, deductibles, copayments, and coinsurance.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

Can Medicare look at your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

What assets are exempt from Medicare?

Other exempt assets include pre-paid burial and funeral expenses, an automobile, term life insurance, life insurance policies with a combined cash value limited to $1,500, household furnishings / appliances, and personal items, such as clothing and engagement / wedding rings.

Does Social Security count as income for QMB?

An individual making $1,000 per month from Social Security is under the income limit. However, if that individual has $10,000 in savings, they are over the QMB asset limit of $8,400.

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

What will Irmaa be in 2021?

The maximum IRMAA in 2021 will be $356.40, bringing the total monthly cost for Part B to $504.90 for those in that bracket. The top IRMAA bracket applies to married couples with adjusted gross incomes of $750,000 or more and singles with $500,000 or more of income.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How does the Part B reimbursement work?

The Medicare Part B Reimbursement program reimburses the cost of eligible retirees' Medicare Part B premiums using funds from the retiree's Sick Leave Bank. The Medicare Part B reimbursement payments are not taxable to the retiree.

Can you deduct Medicare Part B premiums from your taxes?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

What is Medicare Savings Program?

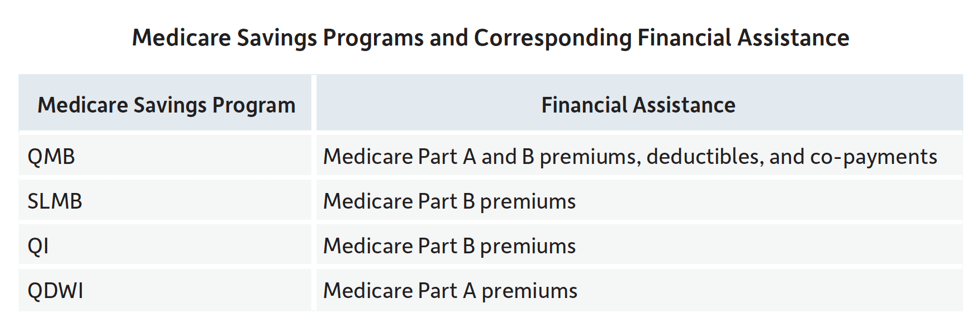

A Medicare Savings Program (MSP) is designed to cover all or part of Medicare out-of-pocket expenses that encumber Medicare recipients who live within limited financial means.

What is a Medicare summary notice?

You will also receive a Medicare Summary Notice (MSN), which is proof of being in the program and shows the healthcare provider you should not be billed for services, deductibles, coinsurance or copayments. An exception is outpatient prescriptions.

What is QDWI in Medicare?

Qualified Disabled and Working Individuals (QDWI) Program for Part A premiums. If your application for the QMB Program is accepted, you will receive a QMB card. Be sure to show this card along with your Medicare or Medicaid card every time you receive healthcare services. You will also receive a Medicare Summary Notice (MSN), ...

Is Medicare cost prohibitive?

The cost of Medicare benefits in the form of premiums, coinsurance, copayments and deductibles can raise concerns about affordability, especially when you are on a limited income. For Medicare recipients under a certain income and asset level, Medicare benefits can be cost prohibitive.

What is a PBM plan?

After the plan is designed, the employer relies on the PBM to correctly administer their prescription benefits, and to educate their employees about their coverage. PBMs typically offer call centers for member support and can answer questions about the in-network pharmacies or different co-payments for different drugs.

What does a PBM do?

PBMs negotiate with pharmaceutical companies to determine the level of rebates the company will offer for certain drugs — rebates are paid to the PBM. Depending on the contract between the PBM and employer, or plan sponsor, the PBM will pass all, some, or none of the rebate to the employer or plan sponsor.

Why are PBMs important?

It’s not always about money — PBMs play an important safety role within prescription benefits plans, too. Drug Utilization Review is a life-saving program that calls for the review of a drug to determine effectiveness, potential dangers, potential drug interactions, and mitigate other safety concerns. Since PBMs oversee their own pharmacy networks, they have access to a patient’s prescription history and can alert patients or physicians to potential negative drug interactions that could occur by mixing different prescriptions.

How do PBMs increase access to medications?

PBMs increase a patient’s access to medications by negotiating directly with drug manufacturers or wholesalers. PBMs negotiate discounts from Wholesale Acquisition Cost (WAC) for quantity discounts that they are able to pass on to their clients. They also negotiate payments based on adherence programs.

What is a PBM in pharmacy?

What is a Pharmacy Benefit Manager (PBM) and how Does a PBM Impact the Pharmacy Benefits Ecosystem? Pharmacy Benefits Managers, also referred to as PBMs, are, in essence, the intermediaries of almost every aspect of the pharmacy benefits marketplace. Many people assume that pharmacy benefits come directly from the health insurance provider when, ...

Why is it important to have a pharmacy benefit plan?

Having an effective pharmacy benefit strategy, and selecting the right PBM to meet an employer’s needs, is critical to ensuring the success of a benefits plan, optimizing spend, and protecting the well-being of employees.

For Accountable Care Organizations

Find information about the Shared Savings Program application process, program participation, financial benchmarking, quality reporting, and more. Learn more >

For Providers

Find information about eligibility requirements, locating Accountable Care Organizations (ACOs) in your area, and coordinating care as an ACO provider. Learn more >

Program Data

Find publicly available datasets related to ACO participation and performance. Learn more >

Program Guidance & Specifications

Find guidance and specification documents relevant to the application process and program participation. Learn more >

Program Statutes & Regulations

Find final rules, program statutes, and other regulatory documents for the Shared Savings Program. Learn more >

What is a PBM?

Pharmacy Benefit Managers (PBMs) now implement prescription drug benefits for some 266 million Americans who have health insurance from a variety of sponsors: commercial health plans, self-insured employer plans, union plans, Medicare Part D plans, the Federal Employees Health Benefits Program, state government employee plans, managed Medicaid plans, and others. Working under contract to these plan sponsors, PBMs use advanced tools to manage drug benefit programs that give consumers more efficient and affordable access to medications. Visante was commissioned by the Pharmaceutical Care Management Association (PCMA) to estimate the savings that these PBM tools generate for plan sponsors and consumers.

How much can PBM save?

Savings can range from 20% to 30%, from limited use to high/incentivized use of PBM tools consistent with best practices. At current/average use, PBM tools will save $1 trillion compared to low or limited use over the next decade. In addition to these expected savings, an additional $1 trillion could be saved if all plan sponsors adopted high use of PBM tools best practices. Likewise, $1 trillion could be lost if PBM tools are limited by government policies or other factors.

What are PA and ST used for?

PA and ST are often used as UM tools, but PBMs offer their clients other UM tools as well, including drug utilization review (DUR), refill-too-soon checks, and quantity limits. PBMs use DUR and other utilization management programs to reduce over-utilization and waste, as well as reducing adverse drug events associated with polypharmacy.

Why is Medicaid different from Medicare?

Medicaid is different from Private/Commercial insurance and Medicare Part D for many reasons, including different populations, different age mix, different disease and drug mix, problems with patients accessing care, etc. But most important for this analysis, two important PBM tools are essentially removed from our savings model:

Why do PBMs use complex contractual verbiage?

PBMs use complex contractual verbiage to limit the scope and extent of rebate sharing in order to maximize their profit. Therefore, unless demanded by and through strong contractual terms, PBMs are not obligated to disclose the rebates retrieved they receive from rebate aggregators, even those that the PBM wholly owns.

What is NPRM in drug law?

The current administration withdrew a notice of proposed rulemaking (NPRM) in 2019 that would have altered the drug marketplace. The NPRM sought to eliminate the “safe harbor” that permits PBMs to legally extract billions of dollars in manufacturer rebates with little or no transparency.

What is rebate administration?

Rebate administration is one of the main services that PBMs offer to governmental entities, self-funded employers, insurers, and managed health care organizations (collectively, “plan sponsors”). PBMs receive two types of rebates: manufacturer rebates and pharmacy rebates. Manufacturer rebates are cash payments made by pharmaceutical manufacturers ...

What is manufacturer rebate?

Manufacturer rebates are cash payments made by pharmaceutical manufacturers to PBMs that are theoretically designed to act as drug discounts. Pharmacy rebates are point-of-sale fees or post-sale chargeback (e.g., audit recoupment) that PBMs retain from their member pharmacies. Unfortunately, rebates became a lucrative revenue source ...

Can PEHP verify rebates?

In other words, PEHP was prohibited from verifying the total rebates that ESI procured on behalf of PEHP. Plan sponsors are cautioned to negotiate robust auditing provisions in PBM contracts to prevent such schemes.

Does OptumRx pay for caps?

OptumRx purported that it paid Broward County all rebate funds it received, through CAPS, from the drug manufacturers. However, the rebate funds received by Broward County do not account for the funds retained by CAPS. OptumRx and CAPS are both subsidiaries of UnitedHealth Group. All plan sponsors should take the opportunity to exercise their right ...

Do PBMs pass through rebates?

Most PBMs market themselves as “transparent” and purport to “pass thru” all rebates to plan sponsors. However, recent litigation has brought that into question for some of them. We have seen instances where PBMs secretly use little-known rebate aggregators that are often PBM-owned or affiliated in the manufacturer rebates arena.

_1.jpg)