Is there a grace period for Medicare Part D?

How long does the Part D late enrollment penalty last?

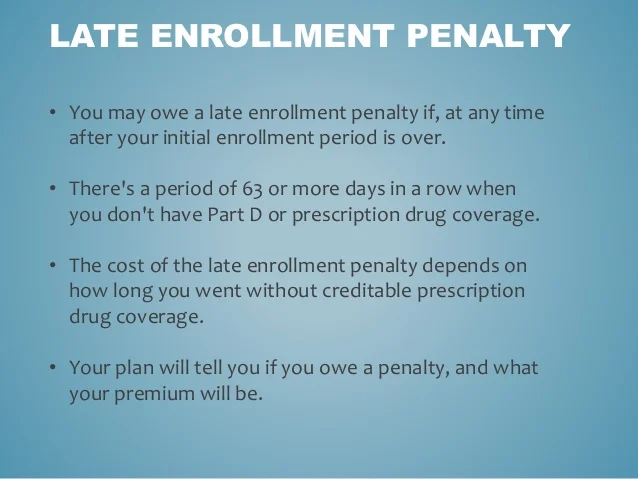

How do I avoid late enrollment penalty for Part D?

- Sign up for a Medicare Part D plan within 63 days of becoming eligible. ...

- If your existing prescription medication coverage is creditable, stick with it. ...

- Qualify for Medicare's low-income subsidy program, also known as Extra Help.

Is it too late to change Medicare Part D plan?

Is there a max Part D Penalty?

How is Part D penalty calculated?

How do I get rid of Medicare late enrollment penalty?

- Enroll in Medicare drug coverage when you're first eligible. ...

- Enroll in Medicare drug coverage if you lose other creditable coverage. ...

- Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

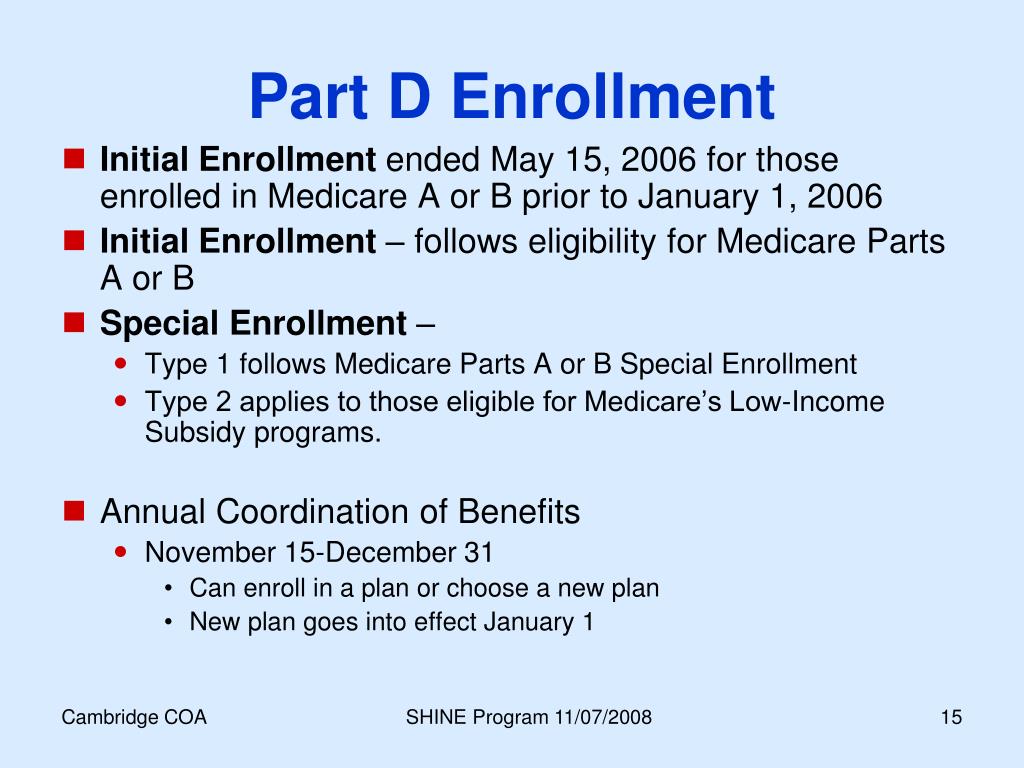

When did Part D become mandatory?

The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.Dec 1, 2021

When did the Part D Penalty start?

| Deadline for joining Part D without penalty | Date Part D coverage begins | Late penalty calculation for 2016 |

|---|---|---|

| March 2015 | January 2016 | 9 x 34 cents |

| August 2014 | January 2016 | 16 x 34 cents |

| November 2010 | January 2016 | 61 x 34 cents |

| May 2006 | January 2016 | 115 x 34 cents |

Who has the best Medicare Part D plan?

- Best in Ease of Use: Humana.

- Best in Broad Information: Blue Cross Blue Shield.

- Best for Simplicity: Aetna.

- Best in Number of Medications Covered: Cigna.

- Best in Education: AARP.

What happens if I don't want Medicare Part D?

Can I opt out of Medicare Part D?

What is Medicare Part D?

Summary: Medicare Part D is prescription drug coverage. It’s optional, but if you delay enrolling in a Medicare Part D Prescription Drug Plan, you may be charged a late-enrollment penalty if you decide to enroll later. Here is how that penalty is calculated and assessed: When you enroll in a Medicare Part D Prescription Drug Plan, ...

How much is Medicare Part D 2021?

This amount is added to your Medicare Part D Prescription Drug Plan monthly premium. The national base premium ($33.06 in 2021) may change each year, so your Medicare Part D late-enrollment penalty may vary from year to year.

What happens if you turn 65 on Medicare?

And, if he or she is still enrolled in the Part D Prescription Drug Plan, the late-enrollment penalty would be eliminated going forward. Individuals who qualify for Medicare’s Low-Income Subsidy, also known as the Extra Help program, ...

Is there a late enrollment penalty for Medicare Part D?

If you’re enrolling in Medicare, you may question whether you really need Part D prescription drug coverage. Beneficiaries pay a monthly premium for Part D, it may feel like an unnecessary expense if you don’t take any prescriptions. You may have other prescription benefits and wonder if you need Part D.

What is the penalty for Part D late enrollment?

The amount is 1% for every month you went without coverage when first eligible. The penalty is in place to encourage beneficiaries to enroll in a Part D plan when first eligible if they don’t already have creditable coverage.

What is Medicare Part D?

A Part D plan. Prescription coverage through a Medicare Advantage plan. Any other Medicare plan that includes Medicare PDP coverage. Another healthcare plan that includes prescription drug coverage that is at least as good as the coverage provided by Medicare.

How much is Medicare Part D 2021?

For 2021, the average beneficiary premium is $33.06. This is not a one-time penalty.

What happens if you don't enroll in Part D?

If you don’t enroll in Part D when you’re first eligible, even if you’re eligibility comes from disability, you’re going to incur a penalty . To avoid the penalty, keep up with your Medicare eligibility, know your Part B effective date, and sign up for Part D as soon as possible.

Can you delay Medicare Part B enrollment?

Just because you’re not 65, doesn’t mean the penalty doesn’t apply; the penalty DOES apply to anyone with Medicare Part B. So, don’t delay your enrollment.

Can you appeal Medicare Part D penalty?

If you’re penalized by Medicare, you can appeal it. All you must do is complete a reconsideration request form that’s available on CMS.gov. If you qualify for extra help, you may qualify for assistance paying the Part D penalty. Some lower-income beneficiaries have the penalty waived altogether.

Do you have to enroll in a Part D plan if you have Medicare?

If you have prescription drug coverage through the VA , it’s considered creditable, so you don’t have to enroll in a Part D plan (no penalty). However, some Medicare beneficiaries still purchase a Part D prescription drug plan in the event the VA doesn’ t cover a particular medication, or if they just want the flexibility to pick up certain drugs ...

Is Medicare Part D creditable?

Creditable prescription drug coverage is drug coverage that meets or exceeds Medicare Part D minimum standards. If you have prescription drug coverage through the VA , it’s considered creditable, so you don’t have to enroll in a Part D plan (no penalty). However, some Medicare beneficiaries still purchase a Part D prescription drug plan in ...

Does Medicare cover Part D?

However, some Medicare beneficiaries still purchase a Part D prescription drug plan in the event the VA doesn’t cover a particular medication, or if they just want the flexibility to pick up certain drugs at a local pharmacy, rather than the VA.

Is group health coverage creditable?

Each group health plan needs to confirm whether the drug coverage is creditable or non-creditable each year from the insurance carrier. Some plans are creditable, and some are non-creditable. Your employer is required to communicate this to you at least annually when the group renews health coverage, and at your request.

Do you pay late enrollment penalty for Part B?

And, the penalty increases the longer you go without Part B coverage. Usually, you don't pay a late enrollment penalty if you meet certain conditions that allow you to sign up for Part B during a Special Enrollment Period.

What happens if you don't get Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

When does Part B start?

You waited to sign up for Part B until March 2019 during the General Enrollment Period. Your coverage starts July 1, 2019. Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B.