Full Answer

What is the maximum penalty for not having health insurance?

There is no federal penalty for not having health insurance since 2019, however, certain states and jurisdictions have enacted their own health insurance mandates. The federal tax penalty for not being enrolled in health insurance was eliminated in 2019 because of changes made by the Trump Administration. The prior tax penalty for not having health insurance in 2018 was $695 for adults and $347.50 for children or 2% of your yearly income, whichever amount is more.

Can you be penalized for not enrolling in Medicare?

Yes, you read that right! There are penalties for not signing up for Medicare. If you incur penalties from enrolling in Medicare at the wrong time, they can stick around for a lifetime. Understanding when to enroll in Medicare and how to navigate the process, will help you keep your hard-earned money where it belongs. Updated for 2022.

Why is there a penalty for not having health insurance?

Some places where a health insurance penalty is still assessed:

- New Jersey. This state has a health insurance penalty that went into effect in 2019. ...

- Massachusetts has had a health insurance penalty since instituting a state health insurance program in 2006. ...

- Vermont has instituted a health insurance penalty for uninsured individuals in that state. ...

- District of Columbia. ...

Is there a penalty for not signing up for Medicare?

Summary: Some people don’t realize that there may be penalties for not signing up for Medicare when they’re first eligible for Medicare. Most people don’t pay a late-enrollment penalty for Medicare Part A. If you delay enrollment in Medicare Part B and/or Medicare Part D, you might face penalties.

Is Medicare Part D optional or mandatory?

Medicare drug coverage helps pay for prescription drugs you need. Even if you don't take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare.

How can I avoid Medicare Part D Penalty?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

When did Medicare Part D become mandatory?

The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

What happens if you opt out of Medicare Part D?

In 2020, the average Part D premium is $32.74, so the monthly penalty would be about 33 cents multiplied by the number of months you have been without drug coverage. For a more detailed explanation of how this penalty is calculated, see “Paying for the Part D Late Penalty.”

Does the Part D penalty ever go away?

Since the monthly penalty is always rounded to the nearest $0.10, she will pay $9.70 each month in addition to her plan's monthly premium. Generally, once Medicare determines a person's penalty amount, the person will continue to owe a penalty for as long as they're enrolled in Medicare drug coverage.

Can I delay Medicare Part D?

For each month you delay enrollment in Medicare Part D, you will have to pay a 1% Part D late enrollment penalty (LEP), unless you: Have creditable drug coverage. Qualify for the Extra Help program. Prove that you received inadequate information about whether your drug coverage was creditable.

What is the Part D penalty?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $. 10 and added to your monthly Part D premium.

Are you required to have a Medicare supplement?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Can you use GoodRx with Medicare?

GoodRx can't be used in combination with Medicare, but it can be used in place of Medicare. You may want to consider using GoodRx instead of Medicare when Medicare doesn't cover your medication, when you won't reach your annual deductible, or when you're in the coverage gap phase (“donut hole”) of your Medicare plan.

Is plan D necessary?

En español | Part D drug coverage is a voluntary benefit; you are not obliged to sign up. You may not need it anyway if you have drug coverage from elsewhere that is “creditable” — meaning Medicare considers it to be the same or better value than Part D.

Do I have to pay Medicare Part D?

You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums. If you don't pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back.

How much is the 2020 Medicare penalty?

In 2020, that would equal a total of $7.90. The monthly penalty is always rounded to the nearest $0.10. This means that you’d pay an extra $7.90 per month (in addition to your regular Part D monthly premium) for the rest of your life.

How long can you go without a drug plan?

Don’t go over 60 days without a drug plan – this could be Part D or some other type of creditable drug plan (through your employer, for example). If you need help with your drug plan, feel free to use the DIY Part D tutorial, or you can contact us to get help from one of our trusted advisors.

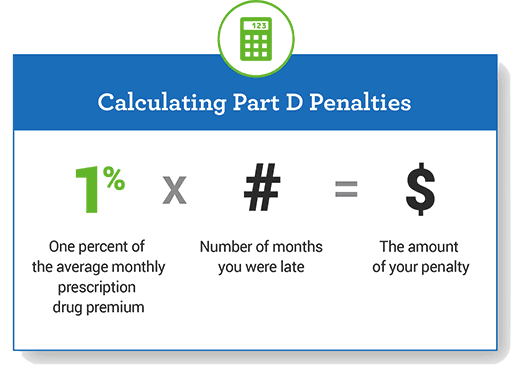

How to calculate Part D penalty?

In order to calculate your Part D penalty, you need to know two things: 1 How many months you’ve gone without coverage, and 2 The national base beneficiary premium for the current year.

How long have you had prescription drug coverage?

You haven’t had prescription drug coverage since December of 2018. That means you haven’t had drug coverage for a total of 16 months. It’s 2020, and the national base beneficiary premium is $32.74. So, here’s your Part D penalty calculation:

What is the national base beneficiary premium for 2020?

The national base beneficiary premium for 2020 is $32.74. This figure can change every year, although for the past two years, it has actually decreased! Each month you don’t have drug coverage, you’re penalized 1% of that national base beneficiary premium. The final sum is then added on to your monthly Part D premium.

What is Medicare Part D?

What Is the Medicare Part D Penalty? For starters, Medicare Part D, also called your prescription drug plan, is a health insurance plan that helps pay for prescriptions.

Does Part D go up?

The Part D penalty continues to go up over time; however, you will not receive the penalty in the form of a bill in the mail – you receive the penalty in the form of a higher premium later on.

What happens if you don't tell Medicare about your prescription?

If you don’t tell your Medicare plan about your previous creditable prescription drug coverage, you may have to pay a penalty for as long as you have Medicare drug coverage.

How long can you go without Medicare?

Your plan must tell you each year if your non-Medicare drug coverage is creditable coverage. If you go 63 days or more in a row without Medicare drug coverage or other creditable prescription drug coverage, you may have to pay a penalty if you sign up for Medicare drug coverage later. 3. Keep records showing when you had other creditable drug ...

How to avoid Part D late enrollment penalty?

3 ways to avoid the Part D late enrollment penalty. 1. Enroll in Medicare drug coverage when you're first eligible. Even if you don’t take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little ...

What is creditable prescription drug coverage?

Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage.

What happens if you don't sign up for Medicare?

If you don’t sign up for Medicare when you first become eligible, you may face a late enrollment penalty. Learn how much these penalties are and how you can avoid them.

What is the penalty for late enrollment in Medicare?

There are special circumstances that could exempt beneficiaries from a penalty. The Medicare Part A late enrollment penalty is 10 percent of the Part A premium, which must be paid for twice the number of years for which you were eligible for Part A but did not sign up. For example, if you were eligible for Part A for two years before finally ...

How much is Medicare Part A 2021?

In 2021, Medicare Part A premiums are either $259 or $471 per month, depending on the amount of Medicare taxes you paid during your lifetime. The 2021 Part A late enrollment penalty can be as high as $26 or $47 per month, depending on your Medicare Part A premium cost.

How long does Medicare enrollment last?

When you first become eligible for Medicare, you have an Initial Enrollment Period. This is a seven-month period that begins three months before you turn 65 years old, includes the month of your birthday, and then continues for three more months thereafter.

What happens if you wait too long to enroll in Medicare?

If you wait too long after your Initial Enrollment Period to sign up for Medicare Part A (hospital insurance), Part B (medical insurance) or Part D (Medicare prescription drug plans), you could be subject to a Medicare late enrollment penalty.

How much is Part D late enrollment?

The Part D late enrollment fee is calculated by multiplying 1 percent of the “national base beneficiary premium” (which is $33.06 in 2021) by the number of months you were eligible for but did not enroll in a Part D plan or other creditable coverage.

How long does it take to enroll in Medigap?

During your Medigap Open Enrollment Period (which is a six-month period that begins the day you are 65 years old and enrolled in Medicare Part B), insurance companies are not allowed to use medical underwriting to determine your Medigap plan rates.

What happens if you don't sign up for Medicare?

If you’re not automatically enrolled and don’t sign up for Medicare Part A during your initial enrollment period, you’ll incur a late enrollment penalty when you do sign up. The late enrollment penalty amount is 10 percent of the cost of the monthly premium. You’ll have to pay this additional cost each month for twice the number ...

What happens if you delay Medicare enrollment?

Delaying enrollment in Medicare can subject you to long-lasting financial penalties added to your premiums each month. A late enrollment penalty can significantly increase the amount of money you’re required to pay for each part of Medicare for years. Share on Pinterest.

How long does it take to enroll in Medicare Part D?

You can enroll in Medicare Part D without incurring a late enrollment penalty during the 3-month period that begins when your Medicare parts A and B become active. If you wait past this window to enroll, a late enrollment penalty for Medicare Part D will be added to your monthly premium. This fee is 1 percent of the average monthly prescription ...

How long does Medigap last?

This period starts on the first day of the month you turn 65 and lasts for 6 months from that date. If you miss open enrollment, you may pay a much higher premium for Medigap.

Why is Medicare charging late fees?

Charging late fees helps to reduce these costs overall and encourage people to enroll on time.

How long does Medicare Part B take to enroll?

Part B late enrollment penalty. You’re eligible for Medicare Part B starting 3 months before your 65th birthday until 3 months after it occurs. This period of time is known as the initial enrollment period.

How long do you have to enroll in Medicare?

make sure to enroll during the 8-month period when your current coverage ends, known as a special enrollment period.

How long do you have to be on Medicare if you are not on Social Security?

If you wish to do so, contact the SSA . If you are not yet on Social Security, you have an initial window of seven months , sandwiched around your 65th birthday, to enroll in Medicare. Updated December 28, 2020.

What is the Medicare rate for 2021?

Medicare Part A, which covers hospitalization, comes at no cost for most recipients, but Part B carries premiums. The base rate in 2021 is $148.50 a month.

How long can you delay Part B?

In this case, you can delay signing up for Part B until your employment ends. When that happens, you have eight months to sign up without incurring the penalty.

What happens if you don't sign up for Medicare Part D?

Penalties For Not Signing Up For Medicare Part D: What Is the Part D Penalty? Medicare Part D, or your prescription drug coverage, isn’t mandatory to have, but if you choose not to sign up for Part D, you’ll face a penalty. In all honesty, the Part D penalty is slightly confusing.

How is Medicare Part D penalty calculated?

The Medicare Part D penalty is calculated using two different factors: How long you’ve gone without creditable drug coverage. The national base beneficiary premium for that year. For each month that you don’t have creditable drug coverage, you’re penalized 1% of that national base beneficiary premium, and the final sum is added to your monthly Part ...

What is the penalty for refusing Part D?

The Part D penalty is a fee that continues to go up over time; however, you will not receive a bill in the mail for refusing drug coverage. The penalty comes in the form of an added fee when you finally sign up for Part D drug coverage. This just means that the longer you go without Part D drug coverage, the more expensive your drug coverage will ...

Do you owe a penalty for Part D?

If you’re not sure whether you had creditable drug coverage, you might not know whether you actually will owe a Part D penalty. However, when you do sign up for a Part D plan, that plan will tell you if you owe a penalty. You will know what your total monthly premium will be.

Can you avoid the Part D penalty?

Avoiding the Part D penalty is pretty simple: don’t go without drug coverage. Here are some tips to make sure you don’t get stuck with that Part D penalty for the rest of your life: Join a Part D plan when you’re first eligible. For most people, this is when they turn 65.

Do you have to have Medicare if you don't have a prescription?

Medicare wants everyone to have prescription drug coverage in some form, and if you don’ t, you’re penalized in the form of a fee. If you’re still on your employer’s health plan, and it has drug coverage, you don’t need Part D. You are only vulnerable to the Medicare Part D penalty when you’re over 65 and do not have any other form ...

How long do you have to sign up for Part D?

But you must still sign up with a Part D plan within two months of enrolling in Part A and/or Part B to avoid penalties.) In all other situations, you are liable for Part D late penalties.

Is Part D late penalty permanent?

En español | Part D late penalties are permanent and are calculated according to how many months you had delayed Part D enrollment. But whether you’re liable for penalties depends on your situation.

Can you be penalized for late enrollment in Medicare?

If you delayed enrolling in both Part A and Part B at age 65, you were not eligible for Part D during that time — because Part D requires enrollment in either Part A or Part B — and therefore you cannot be penalized for late enrollment.

Is Part D coverage creditable?

Before the Part D drug benefit came into effect in 2006, many people had Medigap supplemental insurance policies (labeled H, I or J) that included limited drug coverage. This coverage is not considered creditable.

Can you be liable for Part D late penalties?

You will not be liable for Part D late penalties in the following circumstances: If you’ve had “creditable” prescription drug coverage from elsewhere since enrolling in Medicare Part A and/or Part B, and you sign up with a Part D drug plan within two months of losing this coverage, you’ll avoid late penalties.