What does PFFS mean for Medicare?

A Medicare PFFS Plan is a type of Medicare Advantage Plan (Part C) offered by a private insurance company. PFFS plans aren’t the same as Original Medicare or Medigap. The plan determines how much it will pay doctors, other health care providers, and hospitals, and how much you must pay when you get care.

Do PFFS plans offer drug coverage?

Dec 01, 2021 · A Private Fee-For-Service (PFFS) plan is a Medicare Advantage (MA) health plan, offered by a State licensed risk bearing entity, which has a yearly contract with the Centers for Medicare & Medicaid Services (CMS) to provide beneficiaries with all their Medicare benefits, plus any additional benefits the company decides to provide.

What's the best Medicare plan?

Sep 15, 2018 · A Medicare Private Fee-For-Service (PFFS) plan is a type of Medicare Advantage health plan offered by a private insurance company under contract to the Medicare program. The PFFS plan, rather than Medicare, largely determines how much it will pay for covered health-care services and how much members of the plan will pay.

What is a Medicare private-fee-for-service plan?

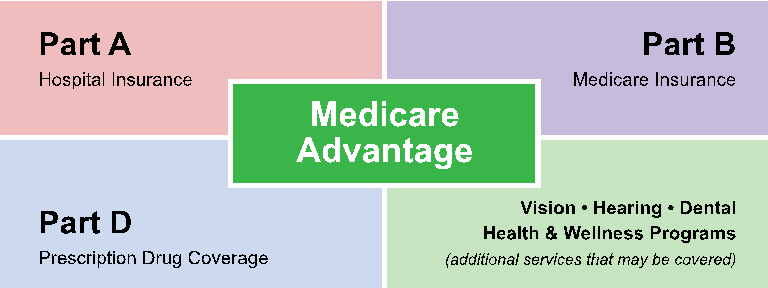

Nov 26, 2020 · What Is a Medicare PFFS Plan? Medicare Advantage plans are private health insurance plans available to seniors who qualify for Medicare. These plans cover Parts A and B of Medicare insurance and typically also include prescription drug coverage and other services such as hearing and dental that Original Medicare does not cover.

What is Pffs healthcare?

Medicare Private Fee for Service (PFFS) plans are a type of Medicare Advantage plan. Medicare PFFS plans are offered by private insurance companies. Medicare PFFS plans are fixed rate-based for individual medical services, and doctors may accept that rate for some services and not for others.

What is the difference between original Medicare and PFFS plans?

Like all Medicare Advantage Plans, PFFS plans must provide you with the same benefits, rights, and protections as Original Medicare, but they may do so with different rules, restrictions, and costs. Some PFFS plans offer additional benefits, such as vision and hearing care.

What type of plan is a PFFS?

Medicare Private Fee-For-Service Plans. A Medicare Private Fee-for-Service plan is a type of Medicare Advantage plan (Part C) administered by a private insurance company. The plan determines how much you must pay when you get care. Doctors decide whether to accept patients with PFFS plans.

What does Pffs stand for in Medicare?

Private Fee-for-Service (PFFS) Plans | Medicare.

How do Pffs work?

Under a Medicare Advantage PFFS plan, besides premium costs, you pay any cost-sharing expenses set by your plan (for example, copayments and coinsurance) at the time you receive the service. After that, the provider bills your plan for the remaining amount.

Which defines private fee-for-service?

What is a private fee-for-service Medicare plan? Private fee-for-service plans are a type of Medicare Advantage plan. Some have provider networks, while others will allow you to receive care from any hospital or doctor that accepts the plan's coverage.

What are the 4 phases of Medicare Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.Oct 1, 2021

How many number of plans does Medicare have?

There are four types of Medicare: A, B, C, and D. Part A covers payments for treatment in a medical facility. Part B covers medical services including doctor's visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatments.

What is the difference between Medicare Advantage and Medicare fee-for-service?

While fee-for-service Medicare covers 83 percent of costs in Part A hospital services and Part B provider services, Medicare Advantage covers 89 percent of these costs along with supplemental benefits ranging from Part D prescription drug coverage to out-of-pocket healthcare spending caps.Jan 21, 2020

What is PPO good for?

A PPO is generally a good option if you want more control over your choices and don't mind paying more for that ability. It would be especially helpful if you travel a lot, since you would not need to see a primary care physician.Oct 1, 2017

Which program includes managed care and private fee-for-service plans that provide contracted care?

Medicare Advantage (Medicare Part C), formerly called Medicare+Choice, includes managed care and private fee-for-service plans that provide contracted care to Medicare patients.

What is Medicare fee-for-service vs managed care?

Under the FFS model, the state pays providers directly for each covered service received by a Medicaid beneficiary. Under managed care, the state pays a fee to a managed care plan for each person enrolled in the plan.

What Is A Medicare Private Fee-For-Service (PFFS) Health Plan?

Did you know that Medicare Private Fee-For-Service (PFFS) plans may give you the freedom to choose any doctor you want, as long as he or she accept...

How Does A Medicare PFFS Plan Work?

You may generally enroll in a PFFS plan if you have Medicare Part A and Part B and you live in the area where the PFFS plan provides coverage. (PFF...

How Do I Get Care If I Am Enrolled in A PFFS Plan?

Unless the PFFS plan you select has a network of participating providers, you will need to verify in advance of receiving services if a particular...

What is PFFS plan?

Chapter 16a (PFFS Plan) of the Medicare Managed Care Manual. On May 27, 2011, CMS released a new Chapter 16a of the Medicare Managed Care Manual, "Private Fee-for-Service (PFFS) Plans.".

What is a private fee for service plan?

A Private Fee-For-Service (PFFS) plan is a Medicare Advantage (MA) health plan, offered by a State licensed risk bearing entity, which has a yearly contract with the Centers for Medicare & Medicaid Services (CMS) to provide beneficiaries with all their Medicare benefits, plus any additional benefits ...

What is a PFFS plan?

A Medicare Private Fee-For-Service (PFFS) plan is a type of Medicare Advantage health plan offered by a private insurance company under contract to the Medicare program. The PFFS plan, rather than Medicare, largely determines how much it will pay for covered health-care services ...

What is the main feature of a PFFS plan that distinguishes it from other types of Medicare Advantage plans

The main feature of a PFFS plan that distinguishes it from other types of Medicare Advantage plans is the latitude it may give Medicare beneficiaries and health-care providers.

What to do if you don't know if your PFFS plan will pay for a service?

If you don’t know whether your PFFS plan will pay for a service, you can call your plan and ask for confirmation that the plan will cover the service. Note: You have the right to receive medically necessary emergency care anytime and anywhere in the United States without any prior approval from your PFFS plan.

How much does a PFFS plan charge?

Some PFFS plans may allow doctors and hospitals to charge you up to 15% over the plan’s payment amount for services. The plan will inform you if this is the case. Health-care providers: PFFS plans do not require you to select a primary care physician (PCP) to coordinate your care or to use a network of hospitals and doctors contracted with ...

Does PFFS charge a premium?

Costs: PFFS plans may charge you a premium amount above the Medicare Part B premium. (You typically pay your Part B premium no matter what type of Medicare Advantage plan you may have, as well as any plan premium.) PFFS plans may charge deductible, copayment and/or coinsurance amounts. PFFS plans may charge a premium for extra benefits like ...

Does PFFS cover dental?

Some PFFS plans may have extra benefits – for example, prescription drug coverage, routine dental care and/or routine vision care coverage. If you choose to enroll in a PFFS plan that does not offer Medicare Part D prescription drug coverage, you may be able to enroll in a stand-alone Medicare Part D Prescription Drug Plan offered ...

Does Medicare have a provider network?

Some Medicare PFFS plans have provider networks. Before enrolling in a PFFS plan, you may want to consider carefully the following features of this type of Medicare Advantage plan. Benefits: PFFS plans provides all medically necessary health care services covered by Medicare Part A (hospital care) and Part B (medical care).

Medicare Advantage PFFS Plans

Because managed care plans offer lower costs by using networks of care, all Medicare Advantage plans will have some sort of restriction on what doctors you can see and what facilities you can use. However, with PFFS plans, you have the freedom to see any doctor you’d like that is in your plan’s network, including specialists.

Get started now

Interested in learning more about Medicare, Medigap, and Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.

What is a private fee for service plan?

The plan determines how much it will pay health care providers, and how much you must pay when you get care.

What is Medicare Advantage Plan?

A Medicare Private Fee-for-Service plan is a type of Medicare Advantage plan (Part C) administered by a private insurance company. The plan determines how much you must pay when you get care. Doctors decide whether to accept patients with PFFS plans.

Does PFFS include prescription drug coverage?

Some PFFS plans include prescription drug coverage. If it doesn’t, you still have options. PFFS are one of the few Medicare Advantage plans that allow you to purchase stand-alone Medicare Part D plan separately if your plan does not already include prescription drug coverage.

Can you have a PFFS plan if you have end stage renal disease?

Typically, you cannot have a PFFS plan if you have end-stage renal disease, though there are a few exceptions. Costs of a PFFS plan usually include your Medicare Part B premium as well as any premiums charged by your PFFS plan. Some PFFS plans include prescription drug coverage. If it doesn’t, you still have options.

Can out of network providers accept Medicare?

There is no guarantee that out-of-network providers will accept the plan’s payment terms. In an emergency, doctors, hospitals and urgent care centers must treat you. You will pay your Medicare Part B premium and a separate premium for your Medicare Advantage PFFS plan. PFFS plans are much less common than other types of Medicare Advantage plans.

Can I see outside of my PFFS?

These doctors and health care facilities have agreed to always treat plan members. You can still see doctors outside your plan’s network as long as they accept the plan’s terms. However, out-of-network care often costs more. Basics of PFFS Plans.

Does Medicare require a primary care physician?

Unlike some other Medicare Advantage plans — such as HMOs — a PFFS plan does not require you to choose a primary care physician.

What is the benefit of PFFS?

The other good thing about PFFS plans is that beneficiaries have the freedom to choose their healthcare provider, just like with Original Medicare. Some PFFS plans will have contracts with a network of providers who have agreed to always treat PFFS patients, even new patients to their office.

What is fee for service Medicare?

Medicare Fee-for-Service. A fee-for-service plan is an insurance plan in which the insurer pays healthcare providers on a per-service basis. With a traditional fee-for-service pla n, you can visit the provider of your choice and the insurer will either pay your healthcare provider directly or reimburse you after you’ve filed a claim ...

Is PFFS a drawback?

However, there are also drawbacks to PFFS plans. “Except for emergencies, PFFS plan members must show healthcare providers that they are PFFS plan members before receiving services,” Haig says. “If the provider agrees to accept the plan’s terms and conditions, the member can receive Medicare covered services from them.”

What is PFFS plan?

PFFS plans are another type of Medicare Advantage plan. A person who joins this plan can see a specialist without referrals, and they do not need to select a primary care physician (PCP). Individuals can visit any healthcare provider who agrees to accept the PFFS plan’s conditions and payment terms.

How much does Medicare charge for PFFS?

Medicare allows “ balance billing ,” which means that the PFFS plan providers can charge up to 15% of the total cost of deductibles, copayments, and other services. In addition to a monthly premium that may be payable for a PFFS plan, a person will usually have to pay the Medicare Part B monthly premium.

What is PFFS insurance?

Private Fee-for-Service (PFFS) plans are one of four main types of Medicare Advantage policy that private insurance companies administer. The plans have specific rules relating to costs paid to healthcare providers. Private insurance companies offer Medicare Advantage plans to those who are eligible for Medicare benefits.

Why do people prefer PFFS?

Some individuals may prefer a PFFS plan because they do not have to choose a PCP, and they can see a specialist without a referral.

How to enroll in Medicare?

After deciding on a plan, a person should enroll by directly contacting the private insurance company they choose. Individuals can join in several ways, including: online, by signing up through the Medicare search tool. by paper enrollment form, usually obtained by calling the insurer.

What is a preferred provider organization?

Preferred Provider Organization plans. Members typically use a network of health care providers, but they do not need to select a PCP to coordinate their care . A Preferred Provider Organization (PPO) plan usually provides benefits outside of the network with higher coinsurance or copayments.

Is PFFS a Medicare Advantage Plan?

People eligible for Medicare may be interested in PFFS plans, which are a type of Medicare Advantage plan. Medicare is health insurance run by the federal government for individuals aged 65 or older. Coverage is also available to those younger than 65 with specific health conditions. A person can choose to receive their Medicare benefits by having ...

What is PFFS insurance?

PFFS stands for “Private Fee for Service,” and it is one type of Medicare Advantage plan. These plans, like all Medicare Advantage plans, are offered by private insurance companies contracted with Medicare, so the insurance company can determine what they will pay and what you will pay for your medical care.

What is a PPO plan?

A Preferred Provider Organization, or PPO plan, is a type of Medicare Advantage plan that uses a network of doctors, hospitals, and other health care facilities to help keep costs lower for their members. While you can usually get your care from any provider, you pay less if you use those in your plan’s network.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is an alternate way to get your health care benefits under Original Medicare (Part A and Part B). Here’s a look at the difference between a Medicare Advantage PFFS vs PPO plan.

When is open enrollment for Medicare Advantage?

If you don’t like your PFFS or PPO Medicare Advantage plan, you have the opportunity to enroll in a different one each year during the Open Enrollment Period for Medicare Advantage and Prescription drug coverage, which runs from October 15 to December 7.

Do you pay more if you are out of network with Medicare?

However, if you choose an out-of-network specialist or facility, you will likely pay more (and in some cases, significantly more) than if you stayed within your plan network. Again, because Medicare Advantage plans are offered by private insurance companies, the amount you’ll pay in deductibles, coinsurance, and copayment amounts will vary ...

Do you have to pay a deductible for PFFS?

Depending on the plan you choose, you may also have to meet a deductible each year.

Do you have to choose a primary care doctor for a PPO?

In most cases, similar to PFFS plans, you aren’t required to choose a primary care doctor or get referrals for specialist care in a PPO plan.