What is Plan E?

- Plan E is a Medicare supplement (Medigap) plan that has not been available to new Medicare subscribers since 2009.

- Unless you had Plan E before January 1, 2010, you may not purchase it, but if you have Plan E, you can keep it.

- Since so few people have Plan E, it may be more expensive than other similar Medigap plans. ...

What are the best Medicare plans?

Apr 19, 2021 · Medigap Plan E, also known as Medicare Supplement Plan E, is an original Medicare add-on that helps cover your Medicare costs. Medicare Plan E was no longer offered to new Medicare beneficiaries ...

Which Medicare plan is best for You?

Dec 08, 2021 · Medicare Supplement Insurance, also called Medigap, is a type of private insurance that is used alongside your Original Medicare coverage (Medicare Part A and Part B) to help cover certain Medicare out-of-pocket expenses, such as copays and deductibles. Medigap Plan E was discontinued for new enrollees in 2010.

What are the top 5 Medicare supplement plans?

Feb 28, 2022 · A Medicare supplement is an insurance policy that helps pay for health care costs not covered by Original Medicare Part A and Part B. These are also called Medigap policies. Currently, there are ten different Medigap policies to choose from. Medigap Plan E was the most popular of these in the recent past, but it was discontinued at the end of 2009.

Which Medicare Prescription Plan is best?

Medicare Supplement Plan E is one of the four Medicare Supplement Plans that was eliminated on June 1st, 2010 due to the Medicare Modernization Act. The Centers for Medicare and Medicaid Services (CMS) constantly monitors Medicare Supplement Plans, current economic situations, and maintains the needs of senior citizens.

Does AARP Plan E cover Medicare deductible?

Plan E pays the 20% remainder of Medicare Approved Amounts. Foreign Travel Emergency benefits are included in this plan. The Basic Benefits, the Part A deductible of 1100.00 is paid by the plan and Skilled Nursing Coinsurance is included in this plan. The plan pays the Part A Deductible of $ 1100.00 per benefit period.

What are the 2 types of Medicare plans?

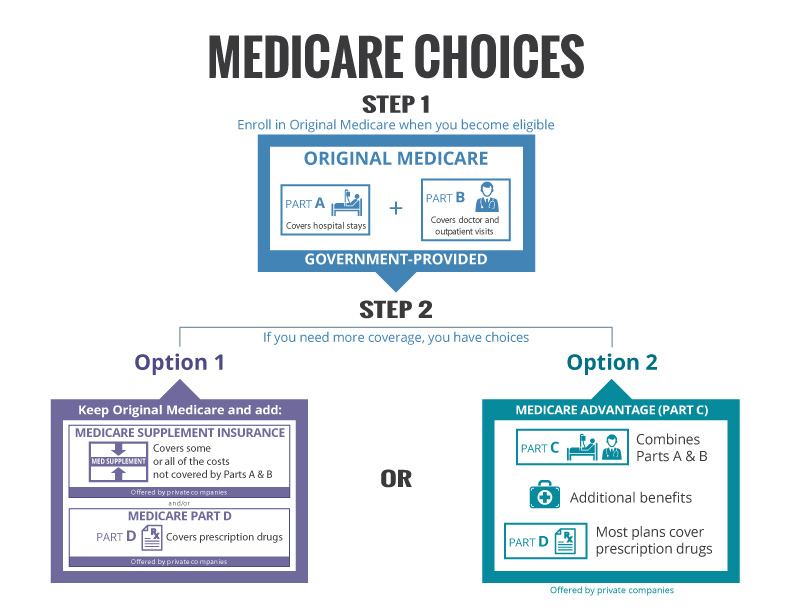

What's a Medicare health plan? Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

What are the straight Medicare plan types?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Is Medicare discontinuing Plan F?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.Nov 23, 2021

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Which Medicare Supplement plan is the most popular?

Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible — $233 for 2022 — before insurance benefits will begin to pay for your health care. Plan G is the most popular Medicare Supplement for new enrollees.Mar 16, 2022

Can you switch from plan F to plan G in 2021?

Can't I just move from a Medigap Plan F to a Plan G with the same insurance plan? Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch.Jan 14, 2022

What is the difference between AARP plan F and plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Should I switch from plan F to plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What happened to Medicare Supplement Insurance Plan E?

In 2003, Congress passed the Medicare Prescription Drug, Improvement and Modernization Act, which expanded certain Original Medicare benefits. This...

What does Medicare Supplement Plan E cost?

Medigap plan costs may vary based on factors such as age, gender, health, how your insurance company rates (prices) its plans, and where you live.

Does Medicare Supplement Plan E cover prescriptions?

Medigap Plan E does not cover prescription drugs. Medigap plans can only help cover certain out-of-pocket Medicare costs, such as deductibles and c...

Should I switch from my Medigap Plan E to another Medigap plan?

The first thing to consider is the plan cost. Because no new members are being accepted into Plan E, the overall plan risk pool can only increase i...

What is Medigap Plan E?

At the time, certain Medigap plans – such as Medigap Plan E – covered some of these services and devices for people who joined those plans. But in 2003, Congress passed the Medicare Prescription Drug, Improvement and Modernization Act, which expanded certain Original Medicare benefits.

When did Medicare Supplement Insurance stop selling plan E?

Therefore, Medicare Supplement Insurance companies were no longer allowed to sell Medigap Plan E to new enrollees as of June 1, 2010.

What is the most popular Medicare plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is the most popular Medigap plan currently available. 53 percent of all Medicare Supplement Insurance beneficiaries are enrolled in Plan F. 1. Plan G is the second-most popular Medigap plan currently available. 17 percent of all Medigap beneficiaries are enrolled in Plan G.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap, is a type of private insurance that is used alongside your Original Medicare coverage (Medicare Part A and Part B) to help cover certain Medicare out-of-pocket expenses, such as copays and deductibles. Medigap Plan E was discontinued for new enrollees in 2010.

What is Medicare Advantage?

You can enroll in a Medicare Advantage Prescription Drug plan (MAPD). These plans cover all of the same hospital and medical insurance benefits that are covered by Original Medicare, as well as prescription drug costs. Many plans also offer benefits such as routine hearing, vision and dental.

How many Medigap plans are there?

There are 10 Medigap plans that are currently available in most states, however. These plans include Plan A, B, C, D, F, G, K, L, M and N. Each type of Medigap plan offers a different combination of standardized benefits, which are outlined below. Massachusetts, Minnesota, and Wisconsin have different Medigap standards and plan options.

Does Medigap Plan E cover prescription drugs?

Medigap Plan E does not cover prescription drugs. Medigap plans can only help cover certain out-of-pocket Medicare costs, such as deductibles and copayments. If you want to get Medicare prescription drug coverage, you have two options: You can enroll in a Medicare Advantage Prescription Drug plan (MAPD).

When did Medicare Supplement Plan E end?

Overview of Medicare Supplement Plan E. Medicare Supplement Plan E is one of the four Medicare Supplement Plans that was eliminated on June 1st, 2010 due to the Medicare Modernization Act.

Is it ok to have an old Medicare supplement?

With an increase in these types of standard Medicare coverage, it does not make sense to have one of the "old" Medicare supplement plans, because you will simply be paying for additional benefits on your Medicare Supplement Policy that you get for free by just having Medicare.

Is Medicare Supplement Plan J a duplication?

With this upgrade in Medicare coverage, some of the "old" Medicare Supplement Plans were eliminated due to the duplication of benefits.

Is it a good idea to purchase a Medicare Supplement Plan?

It is a good idea to consider purchasing a more current "Modernized" Medicare Supplement Plan that will cover the gaps left by Medicare, but one that will not duplicate benefits already provided as standard coverage.

What is Medicare Plan E?

Medicare Plan E is a Medicare supplement (Medigap) plan that is no longer available to new enrollees in Medicare. However, some of the people who purchased this plan before its discontinuation still have it.

What is Medicare Supplement Plan E?

Summary. Medicare Supplement Plan E is a former Medicare supplement insurance (Medigap) plan that has not been available to new enrollees since 2010. However, if a person already has Plan E, they may keep it. Original Medicare pays for most, but not all, healthcare costs. Medigap plans help cover some of the remaining costs ...

Why do people choose Medigap?

A person may choose a Medigap plan to help with costs that original Medicare does not cover. Medicare-approved private health insurance companies administer Medigap plans, which help fill any gaps that original Medicare has in its coverage. These coverage gaps include: Medigap plans do not help with Medicare premium costs.

What are the benefits of Plan E?

The benefits of Plan E include coverage of: Part A copayment. Part B coinsurance. the first 3 pints of blood that a person may need. Part A deductible. SNF daily copayment. 80% of emergency care costs outside the U.S. up to $120 per year for extra preventive care that original Medicare does not cover.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

Does Medicare cover DME?

Before 2003, original Medicare did not cover certain types of durable medical equipment (DME) or some home healthcare, and Medigap Plan E helped cover some of these costs. In 2003, Congress passed the Medicare Prescription Drug, Improvement, and Modernization Act, which saw an increase in original Medicare coverage.

Does Medicare cover all medical expenses?

Original Medicare pays for most, but not all, healthcare costs. Medigap plans help cover some of the remaining costs that a person may otherwise have to pay for out of pocket. Since 2010, those new to Medicare have been unable to enroll in Plan E. If a person enrolled in Plan E before 2010, they may keep their Plan E policy.

What is not included in Plan E?

Not included in Plan E are the Medicare Part B deductible, the Medicare Part B Excess Charges, and recovery care at home, Medicare excess charges which aren’t covered and don’t count toward the out of pocket limit. You are obligated to pay these excess charges.

Why is preventive care being removed from Medicare?

Preventive Care and At Home Recovery are being removed due to a lack of use, making Plan D and Plan E identical .

Will there be more Medicare Supplement plans after June 2010?

There will simply be no more Plan E coverage sold after June 1, 2010. It can be difficult to determine which plan is right for you, and not all providers offer every single Medicare Supplement Plans. Our trained specialists can help you find the plan that best fits your needs and budget.

Is Plan E still a Medigap?

Effective Ju ne 1, 2010 Plan E will no longer be offered as a Medigap supplementary insurance policy. Policyholders can take note, however, that current Plan E enrollees will not lose their current Plan E coverage. One of the main changes in Medicare’s effort to modernize their plan offerings is the elimination of certain benefit options.

Is Plan E the same as Plan D?

Overall Plan E is very similar to Plan D. It however does not offer the At Home Recovery benefits that Plan D has, and Plan D does not offer the Preventative Care Coverage that Plan E offers. It does not offer the overall comprehensive benefits of some of the other plans, but it also offers lower premiums.

Does Medicare Supplement Plan E lose coverage?

Current policyholders should note that current Plan E enrollees will not lose their current Plan E coverage. Medicare Supplement Plan E is one of the few Supplement Plans that has offered enrollees Preventive Care Coverage. Overall Plan E is very similar to Plan D.

How long do you have to be in a hospital to be eligible for Medicare?

You must meet Medicare's requirements, including having been in a hospital for at least 3 days and entered a Medicare-approved facility within 30 days after leaving the hospital: First 20 days. All approved amounts. $0. $0. 21st through 100th day. All but $137.50 a day. Up to $137.50 a day. $0.

How much is the Part A deductible for nursing?

The Basic Benefits, the Part A deductible of 1100.00 is paid by the plan and Skilled Nursing Coinsurance is included in this plan. The plan pays the Part A Deductible of $ 1100.00 per benefit period. The Plan pays up to $ 120.00 for preventative not paid by Medicare per year. Click here to start your free quote.

Is Plan E still available?

Plan E is no longer available for sale. If you currently have a plan E you will be grandfathered in and can keep the plan. If you would like to look at the 2019 Modernized plans click here. You pay the Part B excess when you see a provider that does not accept Medicare Assignment.

Is a dipstick urinalysis covered by Medicare?

BENEFIT- NOT COVERED BY MEDICARE. Some annual physical and preventative tests and services such as: digital rectal exam, hearing screening, dipstick urinalysis, diabetes screening, thyroid function test, tetanus and diphtheria booster and education, administered or ordered by your doctor when not covered by Medicare:

Why was Medicare Supplement Plan I so popular?

Medicare Supplement Plan I: Medicare Supplement Plan I used to be very popular because it covered many of the main high risk gaps left by original Medicare Part A and Part B, while covering most of the main Medicare-approved health care expenses. Relative to the array of benefits, Plan I was also very affordable.

What is the CMS?

The Centers for Medicare and Medicaid Services (also known as “CMS”) constantly monitors Medicare Supplement plans, current economic situations, and maintains the needs of senior citizens. Recently, original Medicare has upgraded some of the benefits that people receive by just having original Medicare Part A and/or Part B. ...

What is a benefit advisor?

A Benefit Advisor will review the plan you current have an compare to the more modern ized Medicare Supplement plans that were established in June, 2010. A Benefit Advisor will do a rate comparison, as well, to determine if there is a more affordable plan available that will cover the gaps in original Medicare similarly to your current plan.

Does Medicare cover Plan H?

Plan H is only limited to medical charges that are Medicare-approved. If the charges are in excess of what original Medicare Part A and Part B covers ( i.e., Part B excess) then the Medicare beneficiary will have to pay any additional costs.

Does Plan H cover hospice?

Aside from the basic coverage, Plan H also covered skilled nursing co-insurance and Part A deductible, as well as emergency coverage for foreign travel. Plan H also covered a maximum of 80% of emergencies that might be incurred overseas, hospice care and original Medicare Part B.

Is Plan E the same as Plan D?

When original Medicare eliminated preventive care from its line of supplemental benefits, Plan E became identical to Plan D.

Do you have to review Medicare Supplement Plan E?

If you have a Medicare Supplement Plan E, H, I or J you may want to review your options for other Medicare Supplement plans because it is highly probably that you will find a plan that offers very similar coverage at a much more affordable premium. A Medicare Pathways Benefit Advisor will be able to assist you in finding a more affordable and a more appropriate Medicare Supplement plan from the list of Medicare Supplement plans now available.

How many Medicare Supplement Plans are there?

There are 12 standardized Medicare Supplement plans “A” through “L”. The benefits of each plan are different, with the exception that all plans are required to cover the “Basic Benefits” which are identified below.

What does it mean when a column lists a percentage?

If a column lists a percentage, this means the MediGap policy covers that benefit at that percentage rate of the Medicare-approved amount. If no percentage appears or if the column is blank, this means the MediGap policy doesn't cover that benefit .

Is Medicare Supplement the same as Medigap?

The words "Medicare supplement" and MediGap plans are interchangeable and mean exactly the same thing . The descriptions of benefits of each of these plans are in the table below. How to read the chart: If a check mark appears in the column, this means that the MediGap policy covers that benefit up to 100% of the Medicare-approved amount.