Comparison of Plan F and Plan G

| Medigap Plan F | Medigap Plan G | |

| Medicare Part A coinsurance and copays | 100% | 100% |

| Medicare Part A deductible | 100% | 100% |

| Medicare Part B coinsurance and copays | 100% | 100% |

| Medicare Part B deductible | 100% | No |

Full Answer

Will plan F premiums increase?

Those who are already enrolled in a Plan F will have no problem as this will be allowed to continue. Thus, Medigap Plan G is at present the most popular among the Medigap plans since it offers almost the same coverage as Plan F, except for the Part B deductible, which costs $233 in 2022.

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

How much does a Medicare plan cost?

- Medicare Part A is free for many people

- Premiums and deductibles vary across different parts of Medicare

- If you delay signing up for Medicare parts A, B, or D you might have to pay a late penalty for as long as you’re enrolled in Medicare

- Private health insurers offer Medicare Part C, Medicare Part D, and Medigap, so plans vary in price

What is Medicare Plan F coverage?

What is a Medigap Plan F?

- Medigap is supplemental insurance that helps Original Medicare beneficiaries pay out-of-pocket costs.

- Medigap Plan F covers copayments, coinsurance and deductible costs.

- Medicare Supplement Plan F doesn’t cover services not covered by Original Medicare, such as eye care, dental, and hearing aids.\

- Medigap Plan F also has a high-deductible option.

What is the difference between F and G Medicare plans?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

What is the difference between Unitedhealthcare Plan F and Plan G?

Medicare Supplement Plan G is almost identical to Plan F, except for the Part B deductible. If you select Plan G, you'll need to pay your Part B deductible ($233 for 2022), yourself. After you pay your deductible, you have no other out-of-pocket costs, just like the Plan F.

What is a Medicare G plan?

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

How much cheaper is Plan G than Plan F?

Insurance companies are currently pricing Medigap Plan G $30 to $60 less each month than Medigap F. Most times you can save $500 or more a year in lower premiums on Plan G. Yes, you still have to pay $233 if you go to the doctor for a non preventive visit on plan G but when you save over $500, it is worth it.

Should I switch from F to G?

When it comes to coverage, Medicare Supplement Plan F will give you the most coverage since it's a first-dollar coverage plan and leaves you with zero out-of-pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Medicare Supplement Plan G may be better for you.

Why is plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

What is the difference between high deductible Plan F and Plan G?

High-deductible Plan F and Plan G each have a $2,370 deductible in 2021. Both plans include more coverage than the other lettered plans. The difference in benefits between Plan F and Plan G is that Plan G doesn't cover the Medicare Part B deductible ($203 in 2021).

What is the deductible for Medicare Plan G?

$233 deductiblePlan G covers nearly all out-of-pocket costs for services and treatment once you pay the Medicare Part B $233 deductible. This means you pay no copays or coinsurance. If you don't need that level of coverage, though, you might want a plan with less coverage.

Does Medicare Plan G have a deductible?

However, Plan G does not have its own deductible separate from the Part B deductible. There is also a High Deductible Plan G which has a deductible of $2,490 in 2022.

Is Medicare Plan F expensive?

Medicare Supplement Plan F premiums may be more expensive than those for other Medicare Supplement plans. However, the reason is that this plan provides the most benefit to enrollees. The plan's average cost is around $230.00 per month.

Has plan F been discontinued?

Medicare Supplement Plan F is being phased out as a result of “The Medicare Access and CHIP Reauthorization Act of 2015”, also known as MACRA. As a result of MACRA, anybody who becomes eligible for Medicare in 2020 will not be able to purchase Plan F.

Can I switch from plan G to plan F?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F provides coverage for two areas that Plan N does not: Medicare Part B deductible. Part B excess charges. Doctors who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for services and items they provide.

What percent of private insurance companies sell Plan F?

85 percent of private insurance companies sell Plan F, and 66 percent sell Plan G policies. While new Plan F policies are no longer sold to new Medicare beneficiaries, existing policies still provide ongoing coverage in many states. Residents in most states can purchase and use Plan G policies, though Massachusetts, Minnesota, ...

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What percentage of Medicare beneficiaries are enrolled in a Medigap plan?

Close to 34 percent of all Medicare beneficiaries are enrolled in a Medicare supplement insurance (Medigap) plan. These optional plans, issued by private insurance companies, help pay for some of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Plan F has long been the most popular Medigap plan.

Is Medigap Plan F deductible?

While the deductibles mean you must pay a certain amount of money out of pocket before the plan coverage kicks in, the monthly premiums are typically much lower than the premiums for other Medigap plans or for the standard non-deductible versions of Plan F and Plan G.

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

Can I sell my Medicare Part B policy?

As part of that act, from January 1, 2020, insurers couldn't sell a policy that covers the annual Medicare Part B deductible to new Medicare beneficiaries. This ruling effectively meant insurers couldn't offer Plan F or Medigap Plan C ...

What is Medigap Plan F?

Medigap Plan F provides a person with coverage for some parts of healthcare that original Medicare does not cover. However, there are some restrictions on enrollment: A person newly enrolled in Medicare can no longer get Plan F.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How many Medigap policies are there?

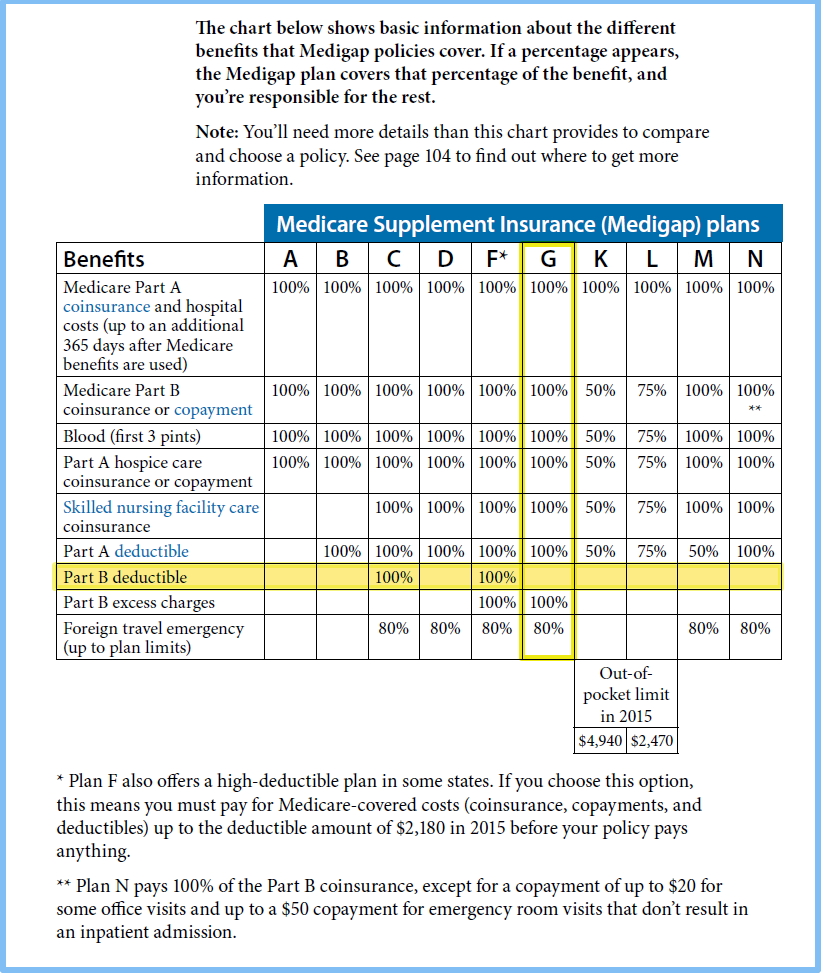

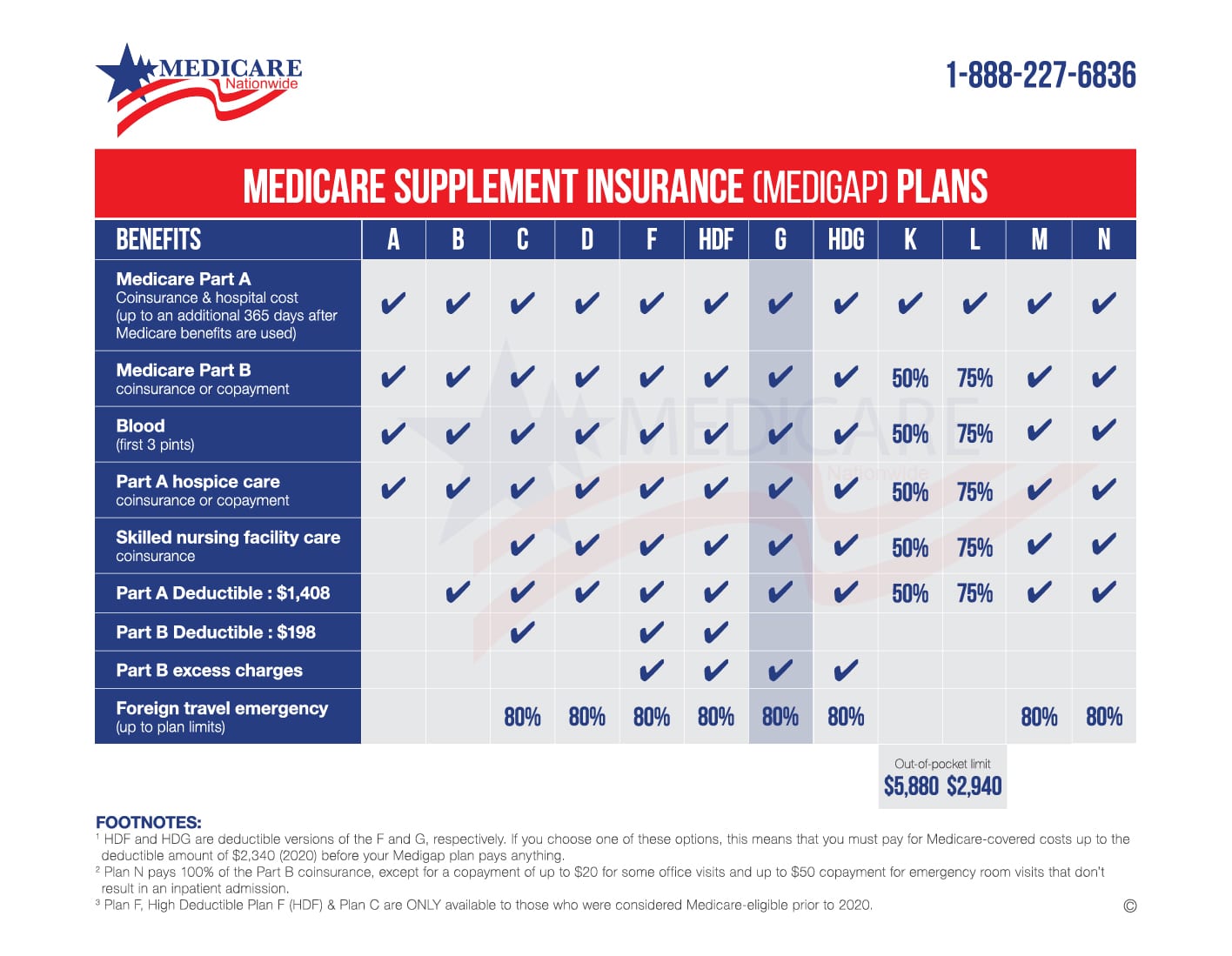

There are 10 Medigap policies: A, B, C, D, F, G, K, L, M, and N. The plans offer standardized benefits to Medicare recipients and help pay coinsurance, deductibles, and copays that original Medicare may not cover. Medigap plans may also cover emergency healthcare if a person needs treatment while they are away from the United States.

How much is the deductible for Medicare 2021?

In addition to the basic Plan F, there is a high deductible version of Plan F available. In 2021, this has a deductible of $2,370. A person must reach the deductible before the plan starts to cover costs.

Can you have a Medigap plan if you are enrolled in Medicare Advantage?

In addition, if a person is enrolled in a Medicare Advantage plan, they cannot also have a Medigap plan.

Does Medigap work with original Medicare?

Comparing the plans. Costs. Summary. Medicare supplemental health insurance plans, also called Medigap, work with original Medicare. Medigap Plan F provides many of the same benefits as Plan G, with some differences. Medigap plans help a person pay their out-of-pocket Medicare expenses. A person can get a Medigap plan, ...

Can you cancel a Medigap policy?

Medigap plans are renewable, which means that the company offering them cannot cancel a person’s Medigap policy as long as they pay the premiums — even if they have health problems.

What is the difference between a plan F and a plan G?

The main difference is that Plan F covers the Medicare Part Bdeductible while Plan G doesn’t. Both plans also have a high-deductible option. In 2021, this deductible is set at $2,370, which must be paid before either policy begins paying for benefits. Another big difference between Plan F and Plan G is who can enroll.

What is a Medigap plan?

Medigap is supplemental insurance that helps cover costs that aren’t covered by original Medicare. Medigap Plan F and Plan G are two of the 10 different Medigap plans that you can choose from.

How many different Medigap plans are there?

Medigap is made up of 10 different plans, each designated with a letter: A, B, C, D, F, G, K, L, M, and N. Each plan includes a specific set of basic benefits, no matter what company sells the plan.

How long does it take to get Medicare Part B?

This is a 6-month period that begins the month you turn age 65 and you’ve enrolled in Medicare Part B. Some people are eligible for Medicare before age 65. However, federal law doesn’t require companies to sell Medigap policies to people under age 65.

Do you have to pay for Medigap?

You’ll have to pay a monthly premium for your Medigap plan. This is in addition to the monthly premium that you pay for Medicare Part B if you have Plan G. Your monthly premium amount can depend on your specific policy, plan provider, and location. Compare Medigap policy prices in your area before deciding on one.

Does Medigap cover Part B?

Similar to Plan F, Medigap Plan G covers a wide variety of costs; however, it does not cover your Medicare Part B deductible. You have a monthly premium with Plan G, and what you pay can vary depending on the policy you choose. You can compare Plan G policies in your area using Medicare’s search tool.

Can you enroll in Medicare Part B in 2020?

The enrollment rules for Plan F changed in 2020. As of January 1, 2020, Medigap plans are no longer allowed to cover the Medicare Part B premium. If you were enrolled in Medigap Plan F before 2020, you are able to keep your plan and benefits will be honored. However, those new to Medicare are not eligible to enroll in Plan F.

What is Medicare Plan F and G?

Medicare Plan F and Plan G are two of the 10 different types of standardized Medicare supplemental health insurance plans available in most states. You pay a premium for both types of plans, but both plans help pay for out-of-pocket expenses that Original Medicare doesn’t cover. The following chart provides a side-by-side look at all 10 ...

What is the difference between Medicare Plan F and Plan G?

Another big difference between Medicare Plan F and Plan G is who is eligible to enroll. Both plans require you to first have Original Medicare, but the enrollment guidelines for Plan F changed at the beginning of 2020. If you first became eligible for Medicare on or after January 1, 2020, you cannot enroll in Medicare Plan F.

Why switch to Medicare Plan G?

Switching to a Medicare Plan G might be a good idea because you’ll pay lower premiums, and you might also never pay the $203 Medicare Part B deductible.

How much does Medicare cover if you have a plan F?

If you have Medicare Plan F and you haven’t yet met your Medicare Part B deductible, it would cover the $203 deductible plus the 20% of the Medicare-approved coinsurance amount. If you have Medicare Plan G, you’ll need to pay the $203 Medicare Part B deductible first. Then your Medicare Supplement plan would cover the 20% coinsurance.

What is the deductible for Medicare 2021?

If you became eligible for Medicare. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When will Medicare change to Plan F?

Both plans require you to first have Original Medicare, but the enrollment guidelines for Plan F changed at the beginning of 2020. If you first became eligible for Medicare on or after January 1, 2020, you cannot enroll in Medicare Plan F.

Is everyone eligible for Medicare Plan F and Plan G?

Medicare Plan F and Plan G can help you save money on your Medicare costs. However, as of January 1, 2020, not everyone is eligible for both plans, and you need to understand the new requirements.

What is the difference between Medicare Supplements Plan F and Plan G?

The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise they function just the same. There is one important feature that Medicare Supplements Plan F and G have over all the other Medigap plans.

What is a Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dollar coverage means that both your Part A and Part B deductibles are covered by the plan, so you pay nothing before your Medicare benefits kick in.

How many Medigap plans are there?

There are currently 10 different Medigap plans that are standard across most states. (Massachusetts, Minnesota, and Wisconsin have their own plan standards.) What this means for consumers, however, is that Plan A offered by Company X in Anaheim is exactly the same as Plan A offered by Company Y in Boise.

Which is the most comprehensive Medicare plan?

The most comprehensive plan currently available is Medigap Plan F. It covers all of the gaps in Medicare. The next most comprehensive plan is Plan G, which covers nearly as much, with the Part B deductible being the only difference. Finally, Plan N is probably the third most popular plan because it operates similar to Plan G except ...

How much does a 66 year old spend on Medicare?

The average 66-year-old couple spends about 57% of their Social Security benefits on health care, according to a 2016 study. Learn Medicare for Free: Enroll in 6-Day Medicare Mini Course.

Is Medigap Plan G the same as Plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deduct ible, which is $203 in 2021. Medigap Plan G is now the most popular plan among beneficiaries new to Medicare.

Does Medigap have to offer all 10 plans?

Medigap is offered by private insurance companies. These companies do not have to offer all 10 plans. However, any company that offers Medigap coverage must offer Plan A. Also, if it wishes to offer more than one plan, it must also offer either Medigap Plan C or Plan F in addition to any other plans it offers.