Medicare supplement plans comparison

| Standard Plan F | High-deductible Plan F | Standard Plan G | High-deductible Plan G | |

| Part B deductible | Yes | Yes | No | No |

| Part B excess charge | Yes | Yes | Yes | Yes |

| Foreign travel exchange (up to plan limi ... | 80% | 80% | 80% | 80% |

| Deductible | N/A | $2,340 | N/A | $2,340 |

How much is plan F Medicare?

In terms of popularity, Plan F is the most popular, with approximately 55 percent of all Medigap plans currently active being Plan F. Plan C is in second place but there is a huge gap as Plan C only accounts for about 9 percent of all Medigap plans.

Who is eligible for Medicare Plan F?

People who became eligible for Medicare before 2020: You can still enroll in Plan F, even if you've never had this particular plan before. John is 73, and he has end-stage renal disease (ESRD). He’s choosing Plan F because he needs regular kidney dialysis, as well as physical therapy for an old shoulder injury.

How much does a Medicare supplement insurance plan cost?

Medicare Supplement Insurance Cost Factors

- Plan Coverage. One big factor in the cost of a Medicare Supplement Insurance plan is the level of coverage provided.

- Carrier. Medicare Supplement Insurance is sold by private insurance companies that set their own plan prices.

- Location. ...

- Enrollment Time. ...

- Pricing Structure. ...

- Discounts. ...

- Gender. ...

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

What is Medicare Part F used for?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

What is the average cost of Medicare Plan F?

How much does it cost for Medigap Plan F? The average premium for Medicare Supplement Insurance Plan F in 2022 is $172.75 per month, or $2,073 per year.

Who qualifies for Medicare Plan F?

Who Can Enroll in Plan F? Any Medicare beneficiary who was Medicare-eligible prior to January 1, 2020, can enroll in Plan F. If you are within the first six months of having enrolled in Medicare Part B, you are able to enroll in Plan F under the guarantee issue period.

What is the difference between Supplemental plan F and plan G?

The main difference between the two plans is how Plan G interacts with the Part B deductible. With Plan F, the Medicare Supplement plan pays for the Part B deductible. Under Plan G, you are responsible for the Part B deductible only. Otherwise, all Part A deductibles, copays, and coinsurance are covered.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

Does Medicare Plan F have a deductible?

As with other health insurance policies, premiums for Plan F are tax-deductible. However, people who became eligible for Medicare after January 2020 will be unable to purchase a Plan F policy.

Does Medicare Plan F cover vision?

Plan F is one of the most comprehensive Medicare supplement plans you can purchase, but it doesn't cover everything. This plan will not cover the following: Things that Medicare doesn't normally cover, like acupuncture, vision exams and dental work, are not included in Plan F coverage.

Does Medicare Plan F cover prescriptions?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.

Can I switch back to plan F?

You pay for Medicare-covered costs up to the $2,490 deductible (as of 2022) before the plan begins to pay for anything. If you currently have Medicare Supplement Plan F, you can switch to high-deductible Plan F by contacting your insurance provider.

Should I switch from F to G?

When it comes to coverage, Medicare Supplement Plan F will give you the most coverage since it's a first-dollar coverage plan and leaves you with zero out-of-pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Medicare Supplement Plan G may be better for you.

Does Plan F have copays?

Remember that the monthly premium for Medicare Supplement Plan F is the only cost you will be paying for your Medigap coverage. You will not be required to pay any copays, coinsurance, or deductible for your service. So, paying a higher premium may save you money in the long run.

Can I change from Medicare Supplement Plan F to Plan G?

If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance. However, every state has different rules worth considering before making the switch.

What is the difference between Plan F and Plan F high deductible?

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium. As a reminder, your...

Does Plan F cover dental?

Original Medicare doesn’t cover routine dental care, like cleanings or extractions, and there are no supplement plans that fill the gap. If you wan...

Is there an alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers,...

What Is Plan F Medicare Supplement?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and...

Is Medicare Plan F Supplement still available?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1...

Why Is Medigap Plan F being discontinued?

Plan F is going away due to new legislation that no longer allows Medicare Supplement plans to cover Medicare Part B deductibles. Since Plan F (and...

What is a plan F?

Plan F is a very comprehensive plan, helping cover expenses that original Medicare doesn’t. This includes your deductibles, coinsurance, and copays when receiving medical care. It even covers a portion of your medical expenses during foreign travel.

Which Medicare supplement plan is the most comprehensive?

The various Medicare supplement plans each offer different benefits. Some plans offer more benefits than others. Plan F is generally considered to be the most comprehensive.

What are the disadvantages of Medigap Plan F?

Disadvantages of Medigap Plan F. On the downside of this plan option, its large amount of coverage can be costly and have high monthly premiums. Also, if you’re newly eligible for Medicare as of January 1, 2020, or later, you will not be eligible to buy this plan, as it is being phased out for new enrollees.

How much is the deductible for Plan F in 2021?

While monthly premiums for this option may be lower, you must pay a deductible before Plan F begins paying for benefits. For 2021, this deductible is set at $2,370.

What is standardized plan?

Each of these different plans is standardized, meaning the same set of basic benefits needs to be offered. For example, a Plan F policy offered by Company A must include the same basic benefits as a Plan F policy offered by Company B.

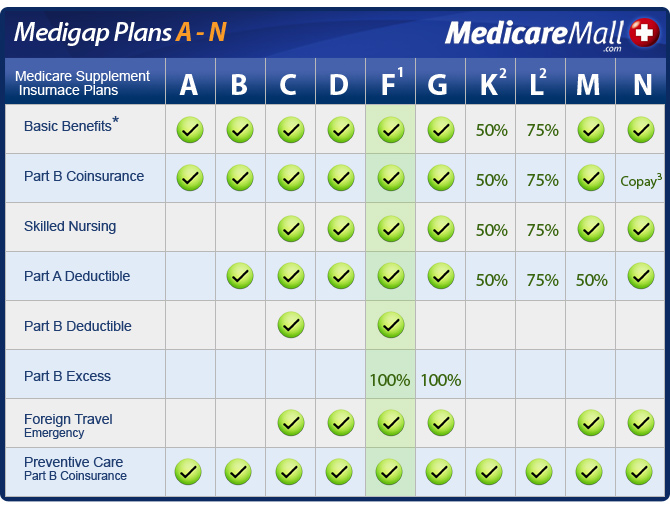

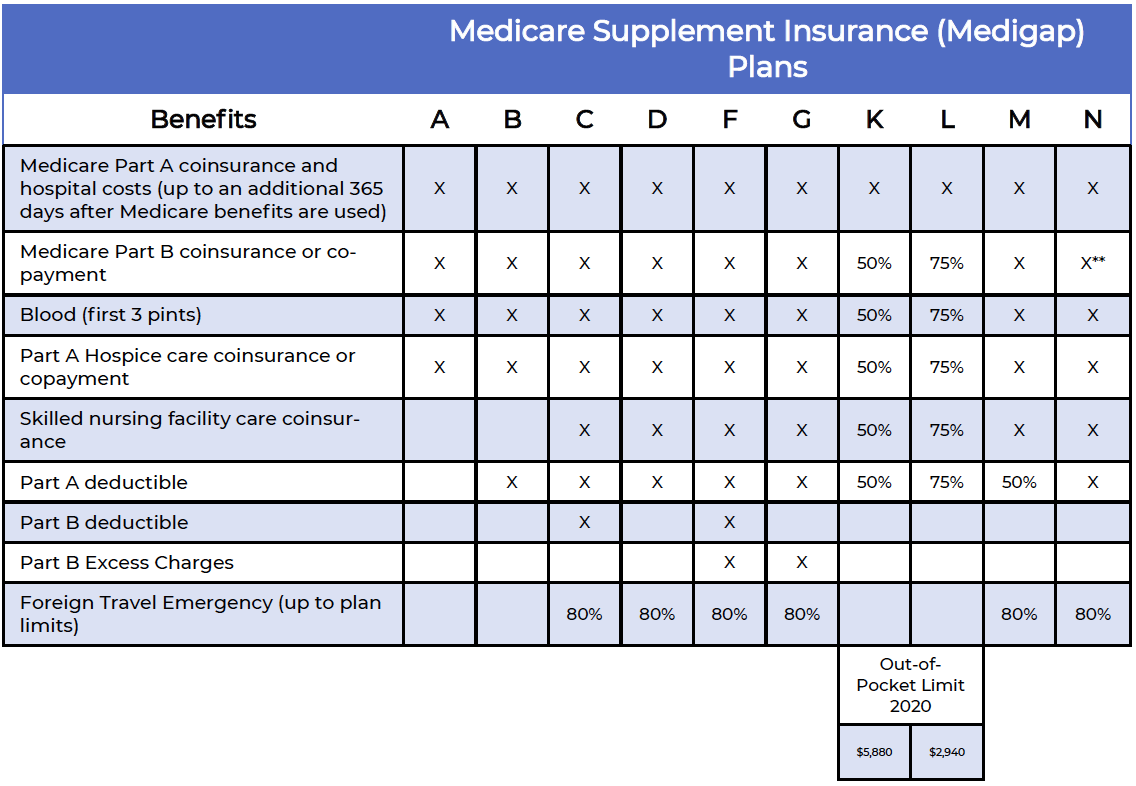

Does Medicare Supplement cover healthcare?

Medicare supplement insurance can help pay for healthcare costs that original Medicare doesn’t cover. About 25 percent. Trusted Source. of people who have original Medicare are also enrolled in a Medicare supplement plan. Private companies sell Medicare supplement plans. There are 10 different Medicare supplement plans.

Is Medicare Supplement Plan F a part of Medicare?

You may have also heard of something called Medicare Supplement Plan F. Medicare Plan F isn’t a “part” of Medicare. It’s actually one of several Medicare supplement insurance ( Medigap) plans.

What Other Medicare Supplement Plans Are Similar to Plan F?

People newly eligible for Medicare can’t sign up for Plan F, but they still have options when it comes to other Medigap plans. Here’s a look at what some experts say are the two best alternatives to Plan F.

Which Medicare plan provides the most benefits?

Historically, Medicare Plan F provided the most benefits of all the supplemental Medicare plans, says Price. It addresses some of the coverage gaps in Medicare parts A and B, which is why many people thought it was worth the extra premium, he notes.

What is Medicare Part A?

Medicare is the federal health insurance program for older U.S. adults, available starting at age 65. It consists of two main plan options: Medicare Part A covers hospitalization without a premium, and Medicare Part B covers doctor and outpatient care for a monthly premium.

Is Medicare a complicated plan?

Medicare can be a complicated subject—especially when you dive into all its variations. “A lot of people hear ‘Part A,’ ‘Part B,’ ‘Plan F’ and all these different letters flying around, and they definitely get a little confused,” says Sterling Price, a senior research analyst at ValuePenguin who specializes in health and life insurance.

Is Medicare Supplement Plan G the best option?

Medicare Supplement Plan G is generally the best option for people who are no longer eligible for Plan F, says Price. “It’s very similar to Plan F,” he notes.

Is Medicare Plan F a supplement?

Meanwhile, Medicare Plan F is an example of Medicare Supplement Insurance (Medigap). As its name suggests, Medigap helps fill the gaps that Medicare doesn’t cover. About 25% of people enrolled in Medicare parts A and B are also enrolled in a Medigap policy, research suggests [1].

What Is Medicare Supplement Plan F?

This is due to new legislation that no longer allows Medicare Supplement Insurance plans to cover your Part B deductible ($203 in 2021).

What is a Medigap Plan F?

Medigap Plan F is one of the most popular Medicare supplement policies on the market. It covers a wide range of medical expenses and is offered by many health insurance providers.

How many days does Medicare cover inpatient hospital care?

For inpatient hospital care, you pay nothing for days 0-90. The following 60 days you use are counted against your Medicare Part B lifetime reserve days under. Finally, if you exhaust these, your Plan F coverage will cover the next 365 days.

Why is Plan F going away?

Plan F is going away due to new legislation that no longer allows Medicare Supplement plans to cover Medicare Part B deductibles. Since Plan F (and Plan C) pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

How many Medigap plans are there in 2021?

There are a variety of Medigap plans. As of 2021, there are ten different plans (and in some states, high-deductible versions of Plan F and Plan G).

When is Plan F available?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020, or you qualified for Medicare due to a disability before this date).

Does Medicare cover hospice care?

They cover, among other items, the coinsurance and deductibles for hospitalization, hospice care, or skilled nursing services that Medicare does not cover.

What is Medicare Supplement Insurance Plan F?

Medicare Supplement Insurance Plan F. Medigap Plan F is one of the 10 standardized Medicare Supplement Insurance plan options sold in most states. Plan F covers the most standardized Medigap benefits and is the most popular Medigap plan. In fact, 55% of Medigap beneficiaries in 2017 were enrolled in Plan F. 1.

What Does Medigap Plan F Cover?

Medigap Plan F covers all 9 of the available Medicare Supplement Insurance benefits.

How Much Does Medigap Plan F Cost?

It's important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

What Happened to Medigap Plan F in 2020?

Medigap Plan F and Plan C (the only two plans that cover the Part B deductible) are no longer available for sale to Medicare beneficiaries who became eligible for Medicare after January 1, 2020.

When Is the Best Time to Sign Up for Plan F?

A great time to enroll in Medigap is during your Medigap Open Enrollment Period (OEP).

How Do I Sign up for Plan F?

You may have Plan F options available in your area. A licensed insurance agent can help you compare Medigap plans available near you and help you find a plan that fits your coverage and budget needs.

What is the 80% deductible for Medigap Plan F?

Medigap Plan F pays for 80% of your foreign travel emergency care costs. Coverage is provided after a $250 deductible has been met for the year in 2020.

What is Medicare Plan F?

Medicare Plan F covers all of the gaps in Original Medicare. It is considered to be the “Cadillac” coverage among the available Medicare supplements today. Plan F gives you first-dollar coverage for all Medicare-approved services. Whether you have a hospital stay, or a diagnostic exam or a doctor’s visit, you will simply present your Medicare card ...

What is Plan F insurance?

Plan F coverage also includes your other doctor visits for illnesses and injuries. Medicare Part B first pays 80%. Then your Plan F supplement pays your deductible and the other 20%. Some doctors charge a 15% excess charge beyond what Medicare pays. Plan F covers that for you.

What Does Plan F Cover at my Doctor’s Office?

All of your preventive care is covered 100% by Medicare Part B. This includes items like:

Does Plan F cover long term care?

No Medicare does not cover any long-term care, and therefore Medicare supplements also cannot supplement the cost of long-term care.

Do Different Insurance Companies Have Different Plan F Benefits?

Fortunately NO. We get questions all the time about this – for instance a caller may ask us whether an AARP Plan F is the same as a Mutual of Omaha Plan F or Aetna Plan F. Rest assured that Medigap plans are standardized by the government. The benefits for a standard Plan F are the same whether you buy that policy from one insurance company or another. This allows you to shop based on price and a few other factors.

What does Plan F cover?

Plan F covers that for you. Plan F also pays the 20% for a long list of other Part B services. This includes durable medical equipment, lab work, tests, mental health care, home health, chiropractic adjustments and much more. There is no overall cap on what Plan F will cover, although Medicare itself does impose some caps on certain things like ...

How much is Plan F for 2021?

Here’s a list view of your Plan F coverage at the hospital: Hospital deductible ($1,484 in 2021) and coinsurance. 365 days of additional hospital coverage after Medicare’s coverage is exhausted. Hospice care at any hospice facility. Blood (if needed in a transfusion)

What are the different pricing models for Medicare Supplement?

There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates. Each type of cost model can affect the average price of a given plan. Community-rated.

What are the factors that affect Medicare Supplement?

As you compare Medicare Supplement quotes, keep in mind that other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

What factors affect the cost of a Medigap plan?

Location is another factor that can affect the cost of a Medigap plan, as market competition and the local cost-of-living can affect Medigap premiums. The chart below shows the average cost of Medicare Supplement Insurance Plan F by state in 2018. State.

How long is the Medigap Open Enrollment Period?

Your Medigap Open Enrollment Period (OEP) is a 6-month period that starts as soon as you are at least 65 years old and enrolled in Medicare Part B. During your Medigap OEP, Medicare Supplement Insurance companies cannot use medical underwriting to determine your Medigap plan costs.

What is the lowest Medicare premium?

Based on our analysis, Medicare Supplement Insurance Plan F premiums in 2018 were lowest were lowest for beneficiaries at age 64 ( $146.55 per month ) and highest for beneficiaries at age 82 ( $236.53 per month).

Why are Medicare premiums so high?

Medicare Supplement Insurance plan premiums could be more expensive for older beneficiaries for a few reasons, such as: 1 If you wait until after your Medigap Open Enrollment Period to sign up for a Medigap plan, insurance companies can charge you a higher premium based on your health.#N#Your Medigap Open Enrollment Period (OEP) is a 6-month period that starts as soon as you are at least 65 years old and enrolled in Medicare Part B.#N#During your Medigap OEP, Medicare Supplement Insurance companies cannot use medical underwriting to determine your Medigap plan costs. 2 There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates. Each type of cost model can affect the average price of a given plan.#N#Community-rated#N#With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.#N#For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market.#N#Issue-age-rated#N#With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.#N#You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age.#N#Attained-age-rate#N#Attained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

Does Medicare Supplement Insurance Plan F have a high deductible?

Medicare Supplement Insurance Plan F also offers a high-deductible option (and is the only Medigap plan to do so).