- Medigap is supplemental insurance that helps Original Medicare beneficiaries pay out-of-pocket costs.

- Medigap Plan F covers copayments, coinsurance and deductible costs.

- Medicare Supplement Plan F doesn’t cover services not covered by Original Medicare, such as eye care, dental, and hearing aids.\

- Medigap Plan F also has a high-deductible option.

Is Medigap plan F the most popular plan?

There are several reasons why consumers choose certain Medigap plan options over others. Plan F is the most popular Medicare Supplement insurance plan, and Plan C is also very popular. These are both the most benefits-rich plans in the Medicare Supplement insurance market.

How much does Medigap plan F cost?

The average cost of Plan F in 2018 was the fourth highest among the 10 Medigap plans used for analysis. Plan M ( $218.75 ), Plan A ( $192.33) and Plan C ( $189.88) all had higher average premiums than Plan F in 2018. Plan J ( $160.07) and Plan D ( $157.33) had average monthly premiums that were slightly lower than Plan F in 2018.

Is Medigap plan F the best supplement?

- Eight plans offered in many areas: F, G, A, B, C, K, L and N

- You can apply to join AARP at the same time you apply for a Medigap supplement plan

- More flexibility to change to another Medigap plan if you qualify

- Enrollment discount in many states of up to 30 percent starting at age 65 and decreasing 3 percent thereafter

Do I need Medicare to buy a Medigap policy?

Medicare Supplement Insurance (Medigap) An insurance policy you can buy to help lower your share of certain costs for Part A and Part B services (Original Medicare). policy is when you’re 65 (or older) and first get both Part A and Part B. You need both Part A and Part B to buy a Medigap policy. This is your Medigap Open Enrollment Period.

What is the difference between plan F and plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

What is the advantage of Medicare Plan F?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.

Why is Medigap plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

What is the difference between Medigap plan C and F?

Of the 10 Medigap plans, C and F currently pay that deductible, which is $233 for 2022. The difference between plans C and F is that C does not cover the 15 percent in excess charges that doctors who don't participate in Medicare are allowed to charge their patients; Plan F does.

Does Medicare Plan F cover vision?

Plan F is one of the most comprehensive Medicare supplement plans you can purchase, but it doesn't cover everything. This plan will not cover the following: Things that Medicare doesn't normally cover, like acupuncture, vision exams and dental work, are not included in Plan F coverage.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

Can I keep my plan F after 2020?

If you already have Medicare Supplement Plan F (or Plan C, which also covers the Part B deductible), you can generally keep it. If you were eligible for Medicare before January 1, 2020, you may be able to buy Medicare Supplement Plan F or Plan C.

What is the most popular Medigap plan for 2021?

Plans F and GMedigap Plans F and G are the most popular Medicare Supplement plans in 2021. Learn more about other popular plans like Plan N and compare your Medigap plan options.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

Is plan C better than plan F?

Medicare Supplement (Medigap) insurance Plan C is one of the most comprehensive of the 10 standardized Medigap insurance plans available in most states. Out of the 10, only Medigap Plan F offers more coverage. Medigap Plan C covers most Medicare-approved out-of-pocket expenses.

Can I switch from Medicare Plan F to plan G?

Switching from Plan F to Plan G If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance.

Is plan F still available in 2022?

However, as of January 1, 2020, Plan F was phased out, making it ineligible for new enrollees unless you were eligible for Medicare before January 1, 2020. The only real difference between Plan F and Plan G is that Plan F covers the deductible for Part B, which is $170.10 in 2022.

Does Medicare Plan F have a deductible?

Are Medicare Plan F premiums tax-deductible? When filing your federal tax return, Medicare Plan F premiums would be tax-deductible. Additionally, any medical expenses that you pay for out of pocket can also be deducted on your taxes.

How much does AARP plan F cost?

Below are the average AARP Medicare Supplement costs in each of these three categories....1. AARP Medigap costs in states where age doesn't affect the price.Plan nameAverage monthly cost for AARP MedigapPlan B$242Plan C$288Plan F$2567 more rows•Jan 24, 2022

Does plan F cover Medicare deductible?

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

Can I switch from Medicare Plan F to plan G?

Switching from Plan F to Plan G If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance.

What Does Medicare Supplement Plan F Cover?

Plan F is a private insurance plan that helps cover the out-of-pocket costs you would normally pay with Original Medicare. It is a Medigap plan, an...

Is it a Plan or a Part?

You may have heard it referred to as Medicare Part F, but this is incorrect. “Parts” refer to the main portions of Medicare only. Original Medicare...

How Much Does Medicare Supplement Plan F Cost?

The cost of a Medigap plan depends on the prices set by the private insurance company that is offering the plan, where you live, and what is included.

Is Medicare Supplement Plan F Being Discontinued?

If you’re shopping for Medigap plans, you may have asked the question, “Is Medicare Plan F going away?” No, Medicare Supplement Plan F has not been...

How does Medicare Advantage work?

How it works: Medicare pays its share of the approved amount for covered health care costs and services. Then, the Medigap policy pays its share. (You’ll pay a separate monthly premium for Medigap benefits.) » Learn about Medicare Advantage Plans.

How to contact Medigap insurance?

For questions about Medicare coverage, go to Medicare.gov or call 1-800-MEDICARE (1-800-633-4227).

What is Plan F insurance?

Plan F is part of Medicare Supplement Insurance, also known as Medigap. This is insurance that’s sold by private companies and fills gaps in Original Medicare coverage, such as copayments, coinsurance and deductibles. How it works: Medicare pays its share of the approved amount for covered health care costs and services.

Which states have Medigap plans?

Medigap plans are standard in every state except Massachusetts, Minnesota and Wisconsin, which have their own plans. Medigap Plan F, when it was fully available, was considered one of the most comprehensive Medigap policies on the market, since it covers all of the out-of-pocket costs of Original Medicare (Part A and Part B).

Can I buy a Medigap plan F after Jan 1 2020?

Here’s the catch for most new enrollees: If you’re newly eligible for Medicare after Jan. 1, 2020, you cannot purchase a Medigap Plan F policy. Why? After that date, new policies aren't allowed to pay a Medicare Part B deductible, one of the prime features of Plan F.

Can I keep my Medicare Part F plan?

If you already have or were covered by Part F before Jan. 1, 2020, you can keep your plan. And if you were eligible for Medicare before that date but haven't yet enrolled , you may be able to buy a Part F plan. Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up.

Who is Kate Ashford?

About the author: Kate Ashford is a personal finance writer at NerdWallet specializing in Medicare. She has more than 15 years of experience writing about personal finance. Read more. On a similar note...

What does Medicare Supplement Plan F Cover?

Plan F is a first-dollar coverage plan. This means you’ll pay zero out of pocket outside the monthly premium. No matter what your medical costs are, you’ll never pay any copays, coinsurance, or deductibles. If Medicare covers it, you won’t pay a penny out of pocket.

Medigap Plan F Cost

The cost for Plan F varies greatly depending on where you live, and how old you’re. There are several factors to consider that determine Plan F cost.

When to Enroll in Medigap Plan F

Since Plan F is a Medigap plan, you can enroll at any time as long as you’re healthy enough and eligible. Medigap does not come with annual enrollment periods like Medicare.

FAQs

Any Medicare beneficiaries that have both Parts A and B of Medicare & are not considered newly eligible.

What is Medicare Part B coinsurance?

Medicare Part B Coinsurance and Copayment. Medicare Part B usually charges a coinsurance and copayments for doctor visits and other outpatient care . Medicare Part B typically pays for 80% of the Medicare-approved amount for covered services, leaving a 20% coinsurance in most cases.

What is Medicare Supplement Insurance Plan F?

Medicare Supplement Insurance Plan F. Medigap Plan F is one of the 10 standardized Medicare Supplement Insurance plan options sold in most states. Plan F covers the most standardized Medigap benefits and is the most popular Medigap plan. In fact, 55% of Medigap beneficiaries in 2017 were enrolled in Plan F. 1.

What is Plan F?

Plan F covers the most benefits out of any of the standardized Medicare Supplement Insurance plan options. This popular plan may be suitable for you if you may need extensive medical coverage and don't want to worry about co-pays and deductibles. Although Plan F's premiums tend to be some of the highest, it offers coverage for all 9 standardized ...

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

How much is coinsurance for skilled nursing?

In 2020, the coinsurance charge is $176 per day for days 21-100 of an inpatient skilled nursing facility stay. After day 100, you are responsible for all costs.

How much is Medicare Part A deductible?

Medicare Part A Deductible. Medicare Part A comes with a deductible, which is $1,408 per benefit period in 2020. This means that you must pay $1,408 out of pocket before your Medicare Part A coverage kicks in. The Part A deductible is not annual.

How much is a high deductible plan F?

There is a regular Plan F and a high-deductible Plan F. If you choose the high-deductible Plan F, you must meet a yearly deductible of $2,340 (in 2020) before the plan covers anything. The high-deductible version of Plan F may have lower premiums than the regular Plan F, but it also comes with much higher out-of-pocket costs.

What is a Medigap Plan F?

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage.

What does Medicare Supplement Insurance Plan F cover?

Medicare Supplement Plan F covers costs that Medicare doesn’t cover, says Laura Decker, co-founder and president of the Employee Benefits Division at SSGI, a Maryland-based employee benefits insurance agency.

What doesn't Medicare Supplement Plan F cover?

Medicare Plan F won't cover any services not covered under Original Medicare.

How much does Medicare Part F cost?

The cost of Medicare Plan F depends on a few factors, including your age.

Medicare supplement plans comparison

Medicare Plan F is no longer available for purchase. However, several other Medigap supplement plans can help cover the out-of-pocket costs associated with Original Medicare.

Frequently Asked Questions

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium.

What Is Medicare Supplement Insurance?

Medicare Supplement insurance is private health insurance that can supplement Original Medicare (Parts A and B). While Medicare covers most of your health care expenses, you could still be responsible for some sizable costs such as deductibles, co-payments and coinsurance.

What Does Medigap Plan F Cover?

Medigap Plan F is the most comprehensive type of Medicare Supplement insurance plan, because it covers every cost on the Medicare benefits list. This includes:

Who Is Eligible for Medigap Plan F?

You can only purchase a Medigap Plan F if you qualified for Medicare before 2020. Most people qualify for Medicare when they turn 65 — so, if you aren't yet 65 or you turned 65 after January 1, 2020, then you cannot buy Plan F under the current rules.

How Does Plan F Compare to Other Medigap Plans?

Plan F offers more c overage than any other Medigap plan — exactly how much more depends on which plan you compare it against. Plan G is very similar, covering the same Medicare out-of-pocket costs with the exception of the Medicare Part B deductible of $203 per year.

How Does It Compare With Medicare Advantage?

Apart from Medicare Supplement insurance, another way to cover your health care expenses is through a Medicare Advantage plan. Rather than combining with Original Medicare, Medicare Advantage is a separate program also known as Medicare Part C.

Is Medigap Plan F the Right Choice?

Before deciding if Plan F makes sense for you, determine whether you can buy one in the first place. If you aren't 65 yet or turned 65 only after January 1, 2020, you wouldn't be able to buy this plan under the current federal rules. In this case, Medigap Plan G may be similar enough to serve your needs.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

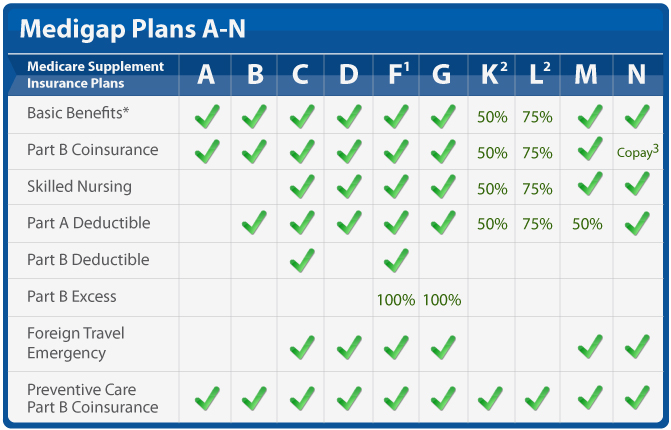

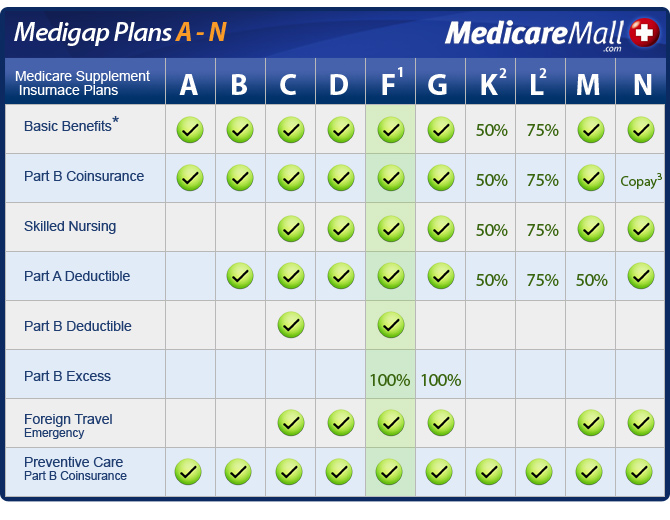

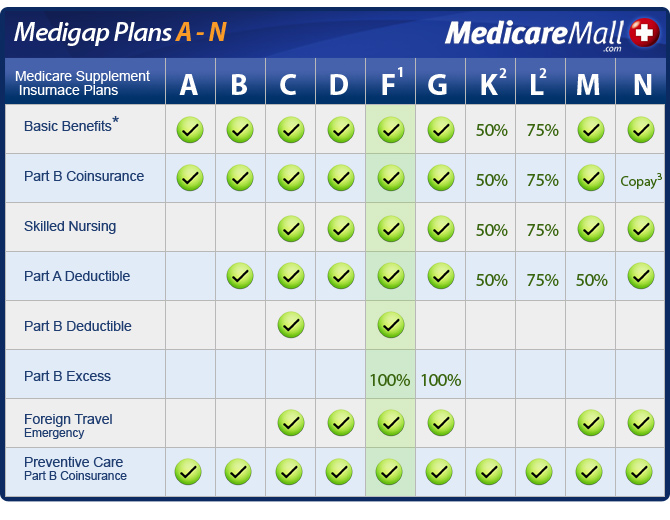

What is the benefit of choosing Plan F?

One potential benefit of choosing Plan F is that it covers many out-of-pocket Medicare costs. The chart below shows how Plan F compares with of other types of Medigap plans. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020.

How much is the 2021 F deductible?

In 2021, high-deductible Plan F offers an annual deductible of $2,370, meaning you are responsible for paying the first $2,370 worth of covered expenses before the plan’s coverage begins.

Does Medicare Supplement Insurance have a higher monthly premium?

Benefits. Because Plan F provides more benefits than any other type of Medigap plan, Plan F may have higher monthly premiums than other types of Medigap plans in some areas.

When will Medicare plan F be available?

Because of a recent federal law, Plan F and Plan C are no longer available for Medicare beneficiaries who became eligible on or after January 1, 2020. If you already had Plan C or Plan F before 2020, you will be able to keep your plan.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.