What Does Medicare Supplement Plan J Cover?

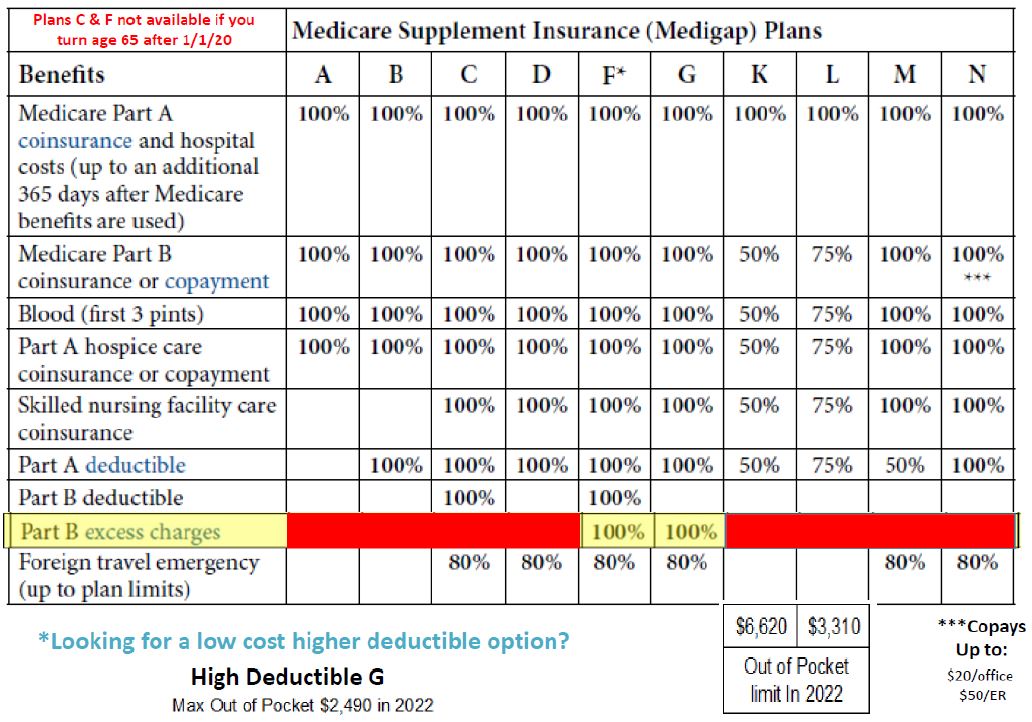

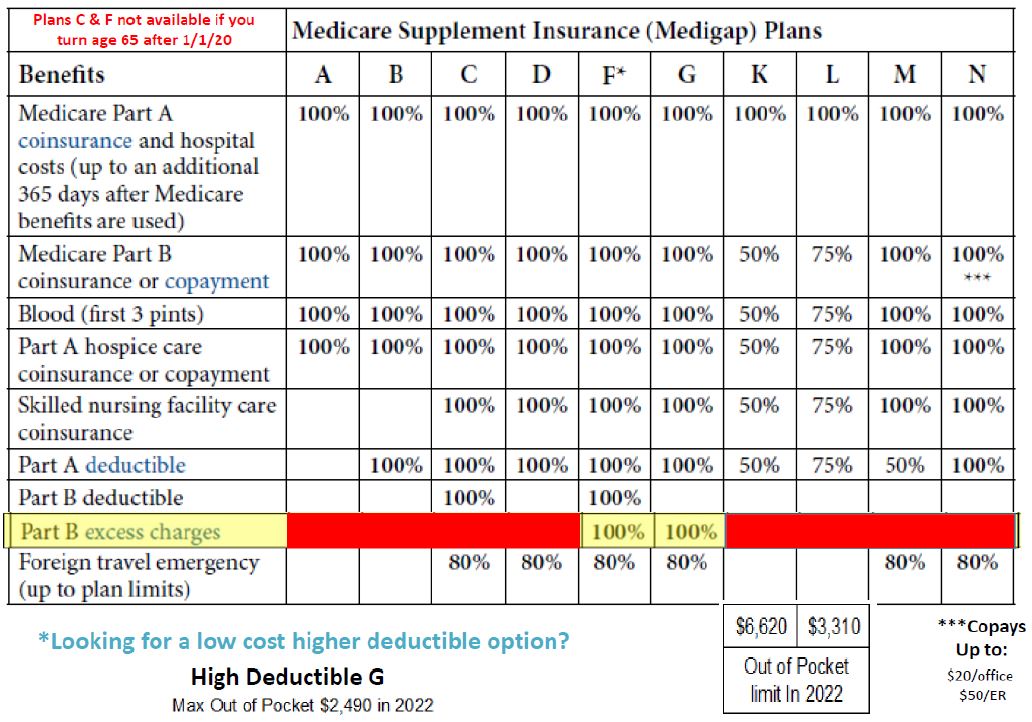

- Options to Minimize Out-of-Pocket Costs. Original Medicare leaves a shortfall that impacts beneficiaries in terms of coinsurance, copayments, blood, deductibles, drugs, foreign travel emergencies and out-of-pocket limits.

- Medigap Plans Available. ...

- Medicare Supplement Plan J. ...

- Changes to Plan J. ...

- Medicare Supplement Plan Enrollment. ...

Full Answer

How to pick the best Medicare supplement plan?

Nov 03, 2019 · Plan J added coinsurance for a skilled nursing facility, Parts A and B deductibles, Part B excess charges, foreign travel emergencies up to plan limits, preventive care up to $120 per year, recovery at home up to $1600 per year and prescription drugs up to $3,000 per year. Changes to Plan J Changes in Original Medicare caused the demise of Plan J.

What is the best and cheapest Medicare supplement insurance?

Jan 14, 2022 · Plan J and Plan F each provide coverage for foreign travel emergency care as well. While Plan F allots for coverage of 80% of costs, Plan J provides 100% coverage. Medicare Supplement Insurance Plan J coverage also provides two additional benefits that are not found in Plan F: At-home recovery care (up to $1600 a year)

What happened to Medigap plan J?

Dec 08, 2021 · Medicare Supplement Insurance, also called Medigap, is a type of private insurance that is used alongside your Original Medicare coverage (Medicare Part A and Part B) to help cover certain Medicare out-of-pocket expenses, such as copays and deductibles. Medigap Plan J was discontinued for new enrollees in 2010.

How much does a Medicare supplement insurance plan cost?

Medicare Supplement Plan J was one of several Medigap plan options. Medigap plans help pay for things that original Medicare (parts A and B) doesn’t, like …

What is a supplement plan J?

Medicare Supplement Plan J is a policy that helps pay out-of-pocket expenses. Medicare has discontinued this plan for new enrollees. Medicare supplement insurance plans, also known as Medigap, help pay for the costs that people with original Medicare incur, such as coinsurance, deductibles, and copayments.

When was plan J discontinued?

June 1, 2010Medicare Supplement Plan J (also known as Medigap Plan J) was discontinued for new enrollees after June 1, 2010. Anybody who already had the plan can keep it and still receive its benefits.

Why was Medigap plan J discontinued?

As of June 1, 2010, the implementation of rules originating from the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 prevented new sales of Medigap Plan J due to the inclusion of additional benefits in original Medicare. After this date, no new beneficiaries could enroll.

Does plan J cover prescriptions?

What is Medicare Supplement Plan J? Medicare Supplement Plan J used to be considered the plan that offered the highest level of coverage because it included preventative care ($120 per year), at-home recovery ($1600/year), and foreign travel benefits, as well as prescription drug coverage.

What Medicare plan is no longer available?

Apparently so, for some people. According to congress.gov, starting in 2020, Medicare Supplement plans that pay the Medicare Part B deductible will no longer be sold to those newly eligible. This change is part of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA).

Why is Medicare Plan F being phased out?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

What is the most comprehensive Medicare Supplement plan?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Are Medigap plans going away?

It's been big news this year that as of Jan. 1, 2020, Medigap plans C and F will be discontinued. This change came about as a part of the Medicare Access and CHIP Reauthorization legislation in 2015, which prohibits the sale of Medigap plans that cover Medicare's Part B deductible.Oct 15, 2019

Is Medigap plan G being phased out?

Medicare Plan G is not going away. There is a lot of confusion surrounding which Medigap plans are going away and which are still available. Rest assured that Plan G isn't going away. You can keep your plan.Feb 11, 2020

Does plan G cover Medicare deductible?

Get online quotes for affordable health insurance Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

What is Medicare plan F?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but it's no longer available to most new Medicare enrollees.Feb 1, 2022

Why is Medigap Plan J so popular?

Medigap Plan J benefits were popular among Medicare beneficiaries because of the comprehensive coverage of Medicare’s out-of-pocket costs. Fortunately, the option for a wide range of health care cost coverage still exists in the form of Medigap Plan F.

What are the benefits of Medicare Supplement?

Medicare Supplement Insurance Plan J coverage also provides two additional benefits that are not found in Plan F: 1 At-home recovery care (up to $1600 a year) 2 Preventive care (up to $120 a year)

When did Medicare change?

Medicare experienced a change in 2003, when the Medicare Prescription Drug, Improvement and Modernization Act was passed. This benefits change introduced prescription drug coverage to Medicare (Medicare Part D), something that was previously only available through Medigap Plan J.1 Because Medigap plans can no longer offer prescription drug ...

Is Medigap Plan J the same as Plan F?

Without these benefits, Medigap Plan J’s coverage became too similar to Plan F to warrant keeping both options.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap, is a type of private insurance that is used alongside your Original Medicare coverage (Medicare Part A and Part B) to help cover certain Medicare out-of-pocket expenses, such as copays and deductibles . Medigap Plan J was discontinued for new enrollees in 2010.

How many Medigap plans are there?

Anyone who enrolled in Medicare Supplement Insurance Plan J prior to 2010 was allowed to keep the plan. There are 10 Medigap plans that are currently available in most states, however. These plans include Plan A, B, C, D, F, G, K, L, M and N. Each type of Medigap plan offers a different combination of standardized benefits, which are outlined below.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is Medicare Advantage?

You can enroll in a Medicare Advantage Prescription Drug plan (MAPD). These plans cover all of the same hospital and medical insurance benefits that are covered by Original Medicare, as well as prescription drug costs. Many plans also offer benefits such as routine hearing, vision and dental.

How much is Medicare Part B deductible in 2021?

The Medicare Part B deductible is $203 per year in 2021. If you can find a Plan G option that only costs $203 more per year (or less) than your current Plan J, you could save money in the long run by switching to Plan G (provided you don’t need the extra foreign emergency care coverage).

Does Medicare Part C cover prescriptions?

Due to this law, Medicare Advantage plans (Medicare Part C) can also offer prescription drug coverage. The 2003 legislation also expanded certain Original Medicare benefits. This included adding coverage for at-home recovery care and preventive care, which were previously covered by Medigap Plan J.

What is the most popular Medigap plan?

But if you do not have plans to travel outside the U.S., the extra coverage for this benefit area may not serve much of a purpose for you. Plan F is the most popular Medigap plan currently available. 53 percent of all Medicare Supplement Insurance beneficiaries are enrolled in Plan F. 2.

What is Medicare Supplement Plan J?

Medicare Supplement Plan J. Medicare Supplement Plan J was one of several Medigap plan options. Medigap plans help pay for things that original Medicare (parts A and B) doesn’t, like copays from doctors’ visits. Medicare Supplement Plan J (also known as Medigap Plan J) was discontinued for new enrollees after June 1, 2010.

When did Medigap Plan J come out?

Medigap Plan J has not been available since June 1, 2010. People who opted for Medigap Plan J and its comprehensive coverage before this time are able to keep it. It might be worth exploring other Medigap plans offered each year, as your needs and budget may change over time.

How much is the deductible for Medigap 2021?

In 2021, the annual deductible to pay for Medigap Plan J is $2,370. If your plan covers prescription drugs, it also has a separate prescription drug deductible of $250 to cover each year. Your Medigap policy also has a monthly premium. The exact amount can vary by individual policy.

What is a Medigap plan?

Medigap plans help pay for things that original Medicare (parts A and B) doesn’t, like copays from doctors’ visits. Medicare Supplement Plan J (also known as Medigap Plan J) was discontinued for new enrollees after June 1, 2010. Anybody who already had the plan can keep it and still receive its benefits. Keep reading to learn about Medigap Plan J ...

What is yearly deductible?

yearly deductibles (the amount youhave to pay before the coverage starts) copayments/coinsurance (your shareof the price, if any, after your plan pays its share) You must have original Medicare (parts A and B) to qualify for Medicare prescription drug coverage.

Is foreign travel covered by Medicare?

foreign travel (up to plan limits) preventive care. prescription drug benefits (with some plans) With changes to Medicare over the years, some of this coverage is now redundant. Hospice and preventive care are now covered by Part A and Part B, respectively .