Who qualifies for premium-free Medicare Part A?

If you are over 65 and qualify for Medicare, you are eligible for premium-free Part A if you or your spouse have at least 40 calendar quarters of work in a job where you paid payroll taxes to Social Security, or are eligible for Railroad Retirement benefits.

Which part of Medicare requires premium payment?

- Social Security

- Railroad Retirement Board

- Office of Personnel Management

What is the difference between Medicare Part an and Part B?

Summary:

- Both Medicare Part A and B are federally funded plans that come with different coverages.

- Part A is free, and the patients need not pay a premium for the coverage. People have to pay some premium for availing themselves of the Part B coverage.

- Part A can be called hospital insurance whereas Part B can be termed as medical insurance.

Do I pay for part a Medicare?

Part A premiums. If you don't qualify for premium-free Part A, you can buy Part A. People who buy Part A will pay a premium of either $274 or $499 each month in 2022 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also:

Do patients usually pay premiums for Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Is Medicare Part A considered health insurance?

If you have Medicare Part A (Hospital Insurance), you're considered covered under the health care law and don't need a Marketplace plan.

What does Medicare Part A include?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

Who pays for Medicare Part A?

Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums. If you or your spouse haven't worked at least 40 quarters, you'll pay a monthly premium for Part A.

What is Part A insurance?

Medicare Part A is hospital insurance. Part A generally covers inpatient hospital stays, skilled nursing care, hospice care, and limited home health-care services. You typically pay a deductible and coinsurance and/or copayments. Additionally, this includes inpatient care that received through: Acute care hospitals.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What is not covered by Medicare Part A?

A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care. A television or telephone in your room, and personal items like razors or slipper socks, unless the hospital or skilled nursing facility provides these to all patients at no additional charge.

What is the difference between Medicare Part A and Part B?

Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care. These plans aren't competitors, but instead are intended to complement each other to provide health coverage at a doctor's office and hospital.

What are benefits of Medicare Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Is Medicare Part A free for everyone?

Medicare Part A (Hospital Insurance) Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Is Medicare Part A automatically deducted from Social Security?

No, Medicare Part A premiums may not be deducted directly from your Social Security check. However, most beneficiaries do not need to pay a premium for Part A. If you or your spouse have worked and paid Medicare taxes for at least 40 quarters (10 years), you will likely qualify for premium-free Part A.

How do I sign up for Medicare Part B if I already have Part A?

If you already have Medicare Part A but need Medicare Part B, there are forms you and your employer (if applicable) need to complete to enroll in P...

How do I sign up for Medicare Part A only?

To enroll in Medicare Part A, you can visit the Social Security website or do so during the general enrollment period each year. You can also wait...

What are the differences between Medicare Part A and Part B?

Medicare Part A covers inpatient care in a hospital, skilled nursing facility care, nursing home care (inpatient care in a skilled nursing facility...

Is Medicare Part A free?

You won’t have to pay a monthly premium for Medicare Part A if you or your spouse worked 40 or more quarters — 10 years or more — over your career....

What is a Medicare Advantage plan?

Medicare Advantage, also called Part C, is offered by private health insurance companies as an alternative to Original Medicare. When you become el...

Does Medicare Part A provide prescription drug coverage?

Part A doesn’t include Medicare prescription drug coverage. Instead, beneficiaries with Original Medicare must get a Medicare Part D prescription d...

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Medicare Part A eligibility

If you’re age 65 or older or have certain disabilities, you’re likely eligible for Medicare, a form of government-sponsored medical insurance. Part A is paid via Medicare payroll taxes withheld from your paychecks over your working life.

How much is Medicare Part A?

The good news is that you typically don’t have to pay a monthly premium for Part A. That’s true so long as you or your spouse paid sufficient Medicare taxes over your lifetime.

Medicare Part A deductible

Aside from premiums, Medicare Part A recipients may also pay out-of-pocket costs, including a deductible and coinsurance .

How to sign up for Medicare Part A

Most people eligible for Medicare Part A and B are enrolled automatically.

Medicare Part A vs. Part B

Part A and Part B are both components of Original Medicare, but they cover different health care services.

Frequently Asked Questions

If you already have Medicare Part A but need Medicare Part B, there are forms you and your employer (if applicable) need to complete to enroll in Part B without having to pay penalties, according to Reese. If you missed your qualifying window, there’s a general enrollment period between Oct. 15 and Dec. 7.

How much is Medicare Part A monthly?

Part A monthly premium. 40 quarters or more. $0. 30–39 quarters. $259. fewer than 30 quarters. $471. Of course, a free premium doesn’t mean you won’t pay anything for hospital care. There are other costs involved with Medicare Part A, several of which have increased for 2021.

How long does it take to get Medicare Part A?

For the most part, signing up for Medicare Part A depends on when you turn age 65. You have a 7-month time period during which you can enroll. You can enroll as early as 3 months before your birth month, during your birth month, and up to 3 months after your 65th birthday.

How long does Medicare cover inpatient hospital care?

After 90 days of inpatient hospital care, you enter what Medicare calls lifetime reserve days. Medicare covers 60 lifetime reserve days in total over your lifetime. After you meet your lifetime reserve days, you’re expected to pay all costs.

How much is a deductible for Medicare 2021?

A deductible is the amount you pay out of pocket before Part A starts covering the costs of your care. In 2021, you’ll pay $1,484 for each benefit period. A benefit period starts the day you’re admitted as an inpatient to a hospital, skilled nursing facility, or any other inpatient facility.

How old do you have to be to get Medicare?

Typically, you must be age 65 to enroll in Medicare. To receive Medicare Part A free of charge, you must meet the following criteria: You’ve worked and paid Medicare taxes at least 40 quarters or roughly 10 years. If your spouse worked, but you did not, you can still qualify.

What is Medicare Part A 2021?

What You Need to Know About Medicare Part A in 2021. Medicare Part A is the hospital coverage portion of Medicare. For many people who worked and paid Medicare taxes, Medicare Part A is free of charge, starting when you reach age 65.

Do all people on Medicare have to be enrolled in Medicare?

While the Social Security Administration automatically enrolls many beneficiaries in Medicare parts A and B, not all people are automatically enrolled. There are several ways to accomplish this if you or a loved one is approaching age 65 when your open enrollment period occurs.

What is Medicare Part A?

Medicare Part A – Hospital Insurance. Medicare Part A, often referred to as hospital insurance, is Medicare coverage for hospital care , skilled nursing facility care, hospice care, and home health services. It is usually available premium-free if you or your spouse paid Medicare taxes for a certain amount of time while you worked, ...

How long does Medicare cover nursing?

Original Medicare measures your coverage for hospital or skilled nursing care in terms of a benefit period. Beginning the day you are admitted into a hospital or skilled nursing facility, the benefit period will end when you go 60 consecutive days without care in a hospital or skilled nursing facility. A deductible applies for each benefit period.

How long does Medicare deductible last?

A deductible applies for each benefit period. Your benefit period with Medicare does not end until 60 days after discharge from the hospital or the skilled nursing facility. Therefore, if you are readmitted within those 60 days, you are considered to be in the same benefit period.

How many days can a skilled nursing facility be covered by Medicare?

The facility must be Medicare-approved to provide skilled nursing care. Coverage is limited to a maximum of 100 days per benefit period, with coinsurance requirements of $164.50 per day in 2017 for Days 21 through 100. Coverage includes: A semiprivate room.

How much does Medicare pay for Grandpa's stay?

Grandpa is admitted to the hospital September 1, 2017. After he pays the deductible of $1,316, Medicare will pay for the cost of his stay for 60 days. If he stays in the hospital beyond 60 days, he will be responsible for paying $329 per day, with Medicare paying the balance.

How much is my grandpa's deductible?

If Grandpa has supplemental insurance, he can submit a claim for the $1,316 deductible and the $329 per day he paid. If he stays longer than 90 days, he may choose to use some of his lifetime reserve days to continue his Medicare coverage.

What is home health care?

Home health care is care provided to you at home, typically by a visiting nurse or home health care aide. Medicare Part A covers medically necessary home health care offered by a provider certified by Medicare to provide home health care. Medicare pays the lower of:

What is Medicare Part A?

While Part B generally covers doctor's appointments and preventive care, Medicare Part A is hospital insurance and generally covers:

What happens after Medicare coverage ends?

After your coverage ends, you’ll get a special enrollment period, at which time you can enroll in Medicare and choose plans without late penalties. (If you were to enroll and keep your employer coverage, your Medicare would be secondary and your employer coverage would be primary.)

What is inpatient hospital care?

This covers hospital services you get when you’re admitted to a hospital on doctor’s orders, including semiprivate rooms, meals, general nursing and drugs for inpatient treatments. The hospital must accept Medicare. Medicare Part A covers inpatient hospital care in a variety of facilities, including: Acute care hospitals.

How much is the deductible for hospital care in 2021?

In 2021, that deductible for hospital care is $1,484 per benefit period, which starts on the day you’re admitted and ends when you haven’t received inpatient hospital care or care in a skilled nursing facility for 60 days. If your hospital stay exceeds 60 days, you'll have to start paying coinsurance.

How long do you have to wait to get Medicare?

So, for example, if you were to realize on April 1 that you needed to sign up for Medicare during the general enrollment period, you'd have to wait over a year to actually get that coverage — even if you signed up as soon as possible during the general enrollment period the following January.

How old do you have to be to qualify for Medicare?

Generally, you're eligible for Medicare Part A if you meet one of the following requirements, according to Medicare: You are age 65 or older. You've gotten disability benefits from Social Security or the Railroad Retirement Board for at least 25 months.

What is hospice care?

Hospice is the end-of-life care you receive if you're terminally ill, for example. Covered services include care from doctors, nurses and aides; medical equipment (such as wheelchairs); certain prescription drugs; occupational therapy; physical therapy; and grief and loss counseling for you and your family.

What is health insurance premium?

A health insurance premium is the amount – typically billed monthly – that policyholders pay for health coverage. Policyholders must pay their premiums each month regardless of whether they visit a doctor or use any other healthcare service. Health insurance through Medicare, the health insurance marketplace, or an employer will almost always ...

How much is the average premium for health insurance in 2020?

For people who buy their own coverage in the marketplace, the average full-price premium (ie, before subsidies are applied) in 2020 was $575/month, although it varies considerably depending on the metal level of the plan, the insurer that’s offering the policy, the geographical area, and the age of the enrollee.

What is the ACA subsidy?

The premium subsidies are a direct result of the ACA, and they’re the primary means of keeping premiums affordable. But the ACA also ensures that state insurance regulators and the federal government conduct thorough reviews to ensure that premiums are actuarially justified before they’re implemented for the coming year.

What affects the amount of premiums that people pay?

But the biggest factor that affects the premium amounts that people actually pay is income. Premium subsidies are based on income, and they can offset a large portion (or even all) of the premium that a person would otherwise have to pay.

How does the American Rescue Plan (2021) help lower premiums?

How does the American Rescue Plan (2021 COVID relief) help lower premiums? The American Rescue Plan eliminates the “subsidy cliff” by ensuring that nobody has to pay more than 8.5% of their income for the benchmark marketplace plan.

How much does Kaiser pay in 2020?

According to the Kaiser Family Foundation (KFF), the 2020 average total premium for employer-provided coverage for a single employee was $623/month. Of that amount, the average worker paid $124/month and the average employer paid $519/month. For family coverage, the total average premium was $1,779/month, but again, ...

Does employer insurance count as family coverage?

And although large employers are required to ensure that coverage is affordable (to avoid a financial penalty), that only applies to coverage for the employee; it does not count the cost of coverage for family members.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

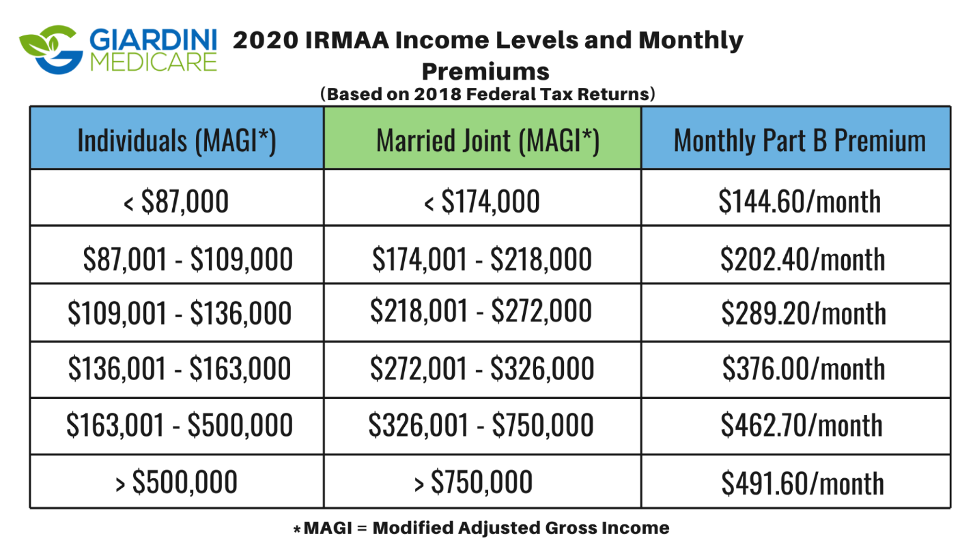

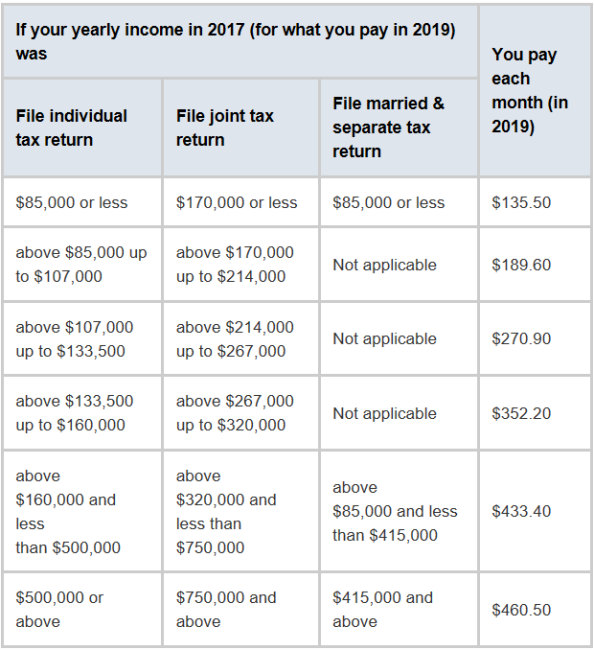

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).